FTX announces plan to repay customers as Fidelity reveals tokenized fund

Weekly Market Update #45

Before diving into this week’s overview, be sure to check out some of our recently released content:

Major developments for the week:

FTX announced a plan to repay crypto customers in cash with interest

The US government indicated that Bitfinex might be the sole victim eligible for restitution of the BTC seized from the 2016 hack

Fidelity revealed plans for its first tokenized fund

VanEck entered the crypto venture capital space

EIP-7781 proposal suggested reducing Ethereum's slot time from 12 to 8 seconds

Vitalik Buterin sold memecoins and addressed his followers

Scroll released its tokenomics

Puffer Finance introduced its token, $PUFFER

Google officially integrated Ethereum Name Service (ENS)

Uniswap launched Unichain, its Layer 2 solution

ArkhamIntel announced plans to launch a derivatives exchange next month

Avalanche Foundation committed to repurchasing AVAX tokens sold to the Luna Foundation

Ethena Labs submitted a proposal to include SOL as a backing asset for USDe

Unisat Wallet unveiled its Q4 roadmap

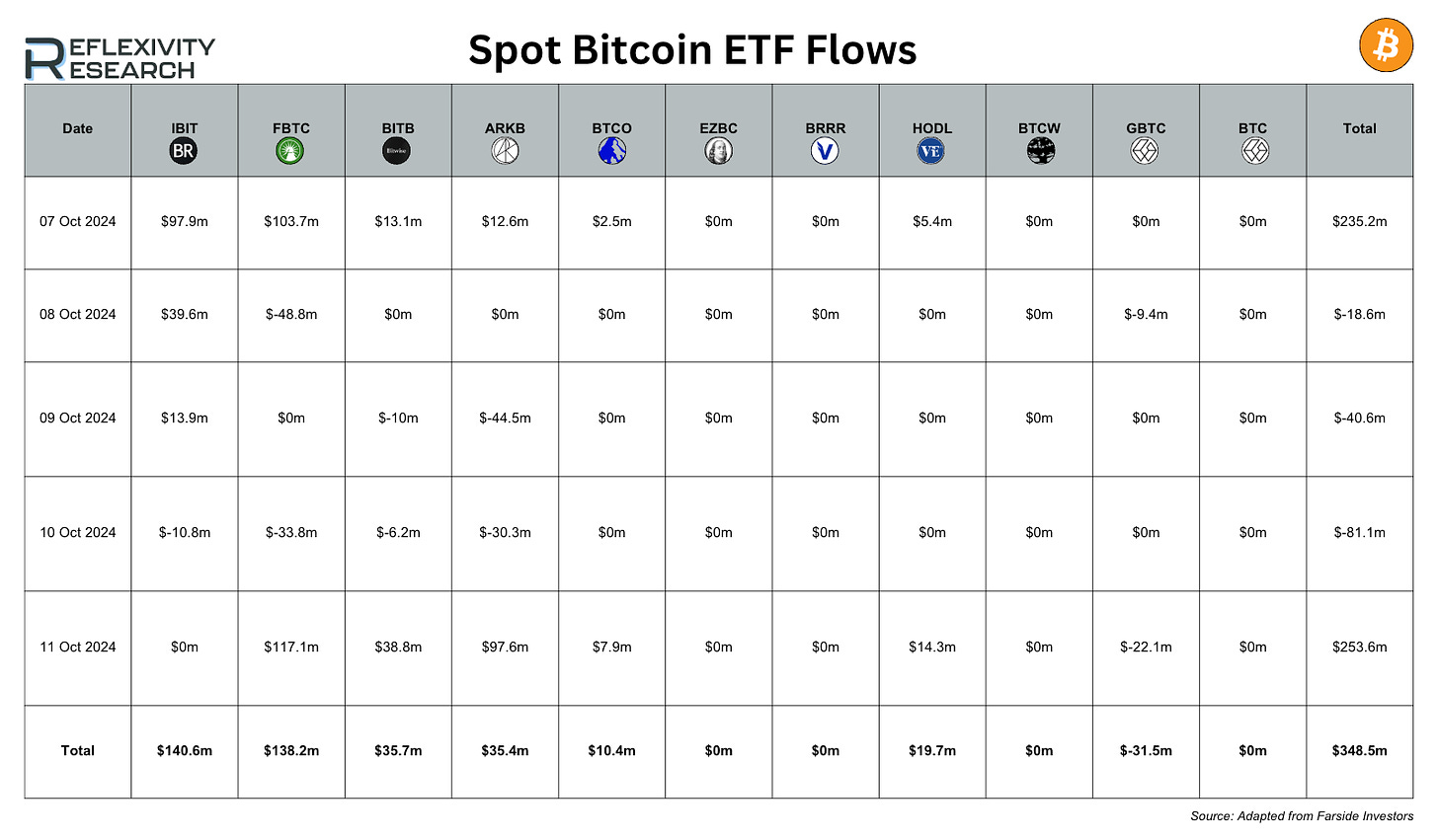

Between October 7 and 11, 2024, Bitcoin ETF flows saw significant movements. The week started with strong inflows, particularly on October 7 with $235.2 million. However, from October 8 to 10, there were notable outflows, especially in FBTC, ARKB, and GBTC, leading to a cumulative outflow of $140.3 million during those days. The trend reversed on October 11, with a substantial recovery, driven by inflows into FBTC, IBIT, and ARKB, bringing the total net flow for the week to a positive $348.5 million.

Ethereum ETF flows from October 7 to 11, 2024, showed mixed activity. There were no notable flows early in the week, but on October 8, there were outflows of $8.1 million, mainly from FETH (-$3.6 million) and ETHW (-$4.5 million). On October 10, inflows resumed, with $17.8 million into ETHA offsetting smaller outflows from FETH (-$3.5 million) and ETHW (-$4.2 million), resulting in a net inflow of $10.1 million for the day. In total, net inflows amounted to $1.9 million for the week.

Fidelity revealed plans for its first tokenized fund

Fidelity Investments is preparing to launch its first blockchain-based money market fund, with the goal of improving transaction speed and efficiency through blockchain technology. This new fund will compete with similar offerings from BlackRock and Franklin Templeton, both of which have already garnered substantial investments. On September 26, 2024, Fidelity submitted the required documents to the U.S. Securities and Exchange Commission. This initiative builds on Fidelity’s previous efforts to tokenize money market fund shares using JPMorgan’s Ethereum-based Onyx Digital Assets platform.

In other institutional developments, VanECK has entered the venture capital space with the launch of VanEck Ventures, a $30 million fund aimed at fintech, crypto, and AI startups. Like Fidelity's push into blockchain, VanEck is focusing on early-stage innovation, specifically targeting pre-seed and seed rounds. Led by former Circle Ventures executives Wyatt Lonergan and Juan Lopez, the fund plans to invest in 25-35 startups, with individual investments ranging from $500,000 to $1 million. VanEck Ventures places particular emphasis on opportunities related to tokenization and stablecoin platforms, aligning with the broader industry trend toward blockchain technology and digital assets.

Scroll announces $SCR Token Launch

In other news last week, Scroll announced their token $SCR.

About the $SCR Token Launch

Token Name: Scroll (SCR)

Total Supply: 1 billion SCR

Airdrop Snapshot Date: October 19, 2024

Token Launch & Airdrop Claim Date: October 22, 2024

Why a token, and why now?

The introduction of the SCR token is intended to support the next phase of Scroll’s development, focusing on building scalable, secure infrastructure and promoting global adoption. SCR is designed to support the protocol’s long-term sustainability and core design.

SCR will enable the decentralization of Scroll’s governance, provers, and sequencers in line with the development roadmap, playing a significant role in the future of the protocol.

SCR utility and purpose

SCR will be used as a governance mechanism for the protocol and will evolve into a utility token as Scroll decentralizes further.

The token is relevant to three key areas in the rollup protocol design:

Governance rights

Proving rights

Sequencing rights

SCR also introduces new design possibilities aimed at improving the user experience, while giving users a role in maintaining and managing the protocol.

Ethena Labs discusses adding Solana as a collateral asset for USDe’s treasury

Ethena Labs, the team behind the synthetic stablecoin USDe, has proposed adding Solana as a collateral asset for USDe’s treasury.

Unlike traditional stablecoins like USDT or USDC, USDe is not backed by fiat currency in a 1:1 ratio. Instead, it maintains its $1 peg by collateralizing other stablecoins and using a hedged cash-and-carry trade strategy, involving futures positions with high open interest to stabilize its value. A reserve fund is also in place to manage risk in volatile markets.

If approved by Ethena’s independent Risk Committee, SOL will be gradually introduced as collateral for USDe, with an initial target of $100-200 million in SOL positions. This allocation would account for approximately 5-10% of SOL’s open interest, comparable to USDe's current holdings of 3% of BTC's open interest and 9% of ETH’s.

The proposal also suggests incorporating liquid staking tokens (LSTs) like BNSOL and bbSOL, similar to how Ethena currently uses ETH LSTs, which make up about one-third of its ETH collateral.

Puffer announces that it will have a TGE soon

Last week also saw the announcement of another coveted token launch from the Puffer Finance team in which they announced the $PUFFER governance token will soon be live, giving users the ability to participate in shaping the future of the Puffer and UniFi ecosystems. Tokenomics details will be released in the coming days.

Key Points:

Airdrops will reward active participation within the Puffer ecosystem.

$PUFFER will be used in Puffer LRT, UniFi, and UniFi AVS, with holders managing treasury rewards.

vePUFFER, a new governance mechanism, will incentivize long-term engagement.

Puffer’s Development in Decentralized Infrastructure: Puffer has expanded from its Liquid Restaking Token (LRT) to include UniFi, a rollup solution, and UniFi AVS on EigenLayer. The platform reports over 538k ETH in total value locked and a community of approximately 300,000 users. A recent campaign reportedly reduced the dominance of stETH by 2.38%, with the aim of enhancing decentralization on Ethereum. Puffer has also lowered validator bond requirements to 2 ETH, enabling more participants to become validators.

Token Distribution and Community Values: The TGE will focus on rewarding active participants and those aligned with Ethereum’s long-term goals. The distribution model is designed to avoid concentration of tokens among Sybil attackers or large holders that could disrupt governance.

Governance Role of $PUFFER: After launch, $PUFFER will govern several elements of the ecosystem:

Puffer LRT: Management of fees, bond requirements, and selection of restaking operators.

UniFi AVS: Fee management and security oversight.

UniFi Rollup: Control of transaction fees, ecosystem rewards, and treasury management.

vePUFFER Governance Mechanism: The vePUFFER model will allow users to stake $PUFFER to mint vePUFFER NFTs. This model does not require a lockup duration, and users can unstake at any time. However, unstaking resets accrued voting power, incentivizing ongoing participation.

Next Steps: Further details on $PUFFER tokenomics and governance will be released soon. The launch is intended to support a decentralized governance structure for the Puffer and UniFi ecosystems.

Arkham announces plans for derivatives exchange

We also saw an interesting development from Arkham Intelligence, a blockchain data firm supported by prominent investors, including OpenAI's Sam Altman. It was announced that they are set to launch a cryptocurrency derivatives exchange next month. Aimed at retail investors, the platform will compete with major exchanges such as Binance. The exchange will not be accessible to U.S. users due to regulatory restrictions.

Uniswap Labs shares details about Unichain

For the final piece of news this week, Uniswap Labs has announced the launch of Unichain, a Layer 2 Superchain designed to enhance decentralized finance and liquidity across chains. Built as a fast, decentralized solution, Unichain aims to address key challenges in DeFi, such as high costs and slow transaction speeds, while furthering Ethereum’s scaling roadmap.

Key Features of Unichain:

Lower Costs: Unichain is designed to reduce transaction fees by around 95% compared to Ethereum L1, leveraging Ethereum’s rollup-centric scaling approach.

Faster Transactions: The chain will have one-second block times, with future plans to introduce 250ms “sub-blocks” for near-instant transactions, enhancing market efficiency.

Decentralization: A decentralized validation network will ensure secure block verification, reducing risks associated with invalid or conflicting blocks.

Cross-chain Swapping: Unichain will support seamless multi-chain swapping, with native interoperability through the Optimism Superchain, enabling efficient cross-chain transactions.

Unichain’s development includes a collaboration with Flashbots to build a trusted execution environment (TEE) for secure, transparent transaction ordering. While not a replacement for decentralized consensus, the TEE enhances security and trust in transaction processing.

As part of its open-source architecture, Unichain’s block builder and node software are available for other chains, and Uniswap Labs is contributing to scaling Ethereum through the OP Stack. The Unichain testnet is live, with a mainnet launch planned later this year. Developer resources and support are provided through the Uniswap Foundation.

This week’s round-up is brought to you by:

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.