Delaware Judge Approves FTX Estate’s Bankruptcy Plan as Franklin Templeton launches on-chain fund

Weekly Market Update #44

Before diving into this week’s report, be sure to check out some of our recently released research content:

Major developments for the week:

Delaware Judge Approves FTX Estate’s Bankruptcy Plan

Bitwise submits filing to the SEC for a Bitcoin & Treasuries Rotation ETF

Franklin Templeton, managing $1.6 trillion in assets, files with the SEC for a Bitcoin and Ethereum Index ETF

Bitwise submits application for a Spot Ripple XRP ETF

Grayscale introduces an Aave investment fund

Franklin Templeton launches an on-chain money market fund on the Aptos blockchain

Visa is tokenizing assets using Ethereum

Sonic Labs reviews its loyalty points program

Sophon unveils additional details about their protocol

FTX estate plans to sell $38 million worth of locked Worldcoin tokens at a discount

Last week, Bitwise Asset Management submitted a filing to the SEC to convert three existing crypto futures ETFs into a new strategy named "Trendwise," which shifts between cryptocurrencies and U.S. Treasuries. This strategy utilizes a proprietary signal based on the 10- and 20-day exponential moving averages of crypto assets to adjust exposure according to market trends. The conversion is set for December 3, 2024, aiming to improve risk-adjusted returns by reducing downside volatility.

Ethereum also came under the spotlight due to the Visa Tokenized Asset Platform (VTAP), enabling banks to issue and manage fiat-backed tokens on the Ethereum blockchain. VTAP offers tools for minting, burning, and transferring these tokens, which are backed by fiat currencies to maintain stability. BBVA is one of the first banks to test the platform, with live pilots anticipated in 2025. The goal of VTAP is to integrate blockchain technology into banking operations, providing programmability and interoperability across various networks.

In other Ethereum and Bitcoin related news, Franklin Templeton has filed with the SEC to introduce a Bitcoin and Ethereum Index ETF, designed to offer exposure to both cryptocurrencies without direct ownership. The ETF will be traded on the Chicago Board Options Exchange, with BNY Mellon responsible for cash custody and Coinbase managing the digital assets. It will not include staking and will be sold in large blocks of 50,000 shares, with its value linked to the net asset value of Bitcoin and Ethereum.

In addition to this, Franklin Templeton launched its OnChain U.S. Government Money Market Fund on the Aptos blockchain, marking a major step into decentralized finance. Valued at $435 million, this fund is the second-largest tokenized fund globally and is now available across multiple blockchains, including Ethereum, Stellar, Polygon, and Avalanche. Aptos was selected for its distinctive features, such as the Move programming language, which improves transaction speed and security. This launch is a significant move towards integrating traditional finance with blockchain technology, expanding access to non-Ethereum Virtual Machine networks.

Bitwise submits application for a Spot Ripple XRP ETF.

More institutional activity stemmed from Bitwise Asset Management who submitted an application to the Delaware Department of State for a spot Ripple exchange-traded fund . This is a notable development, as Bitwise is the first firm to apply for an XRP ETF, despite the ongoing regulatory uncertainties surrounding XRP due to its legal disputes with the SEC. The filing names CSC Delaware Trust Company as the registered agent.

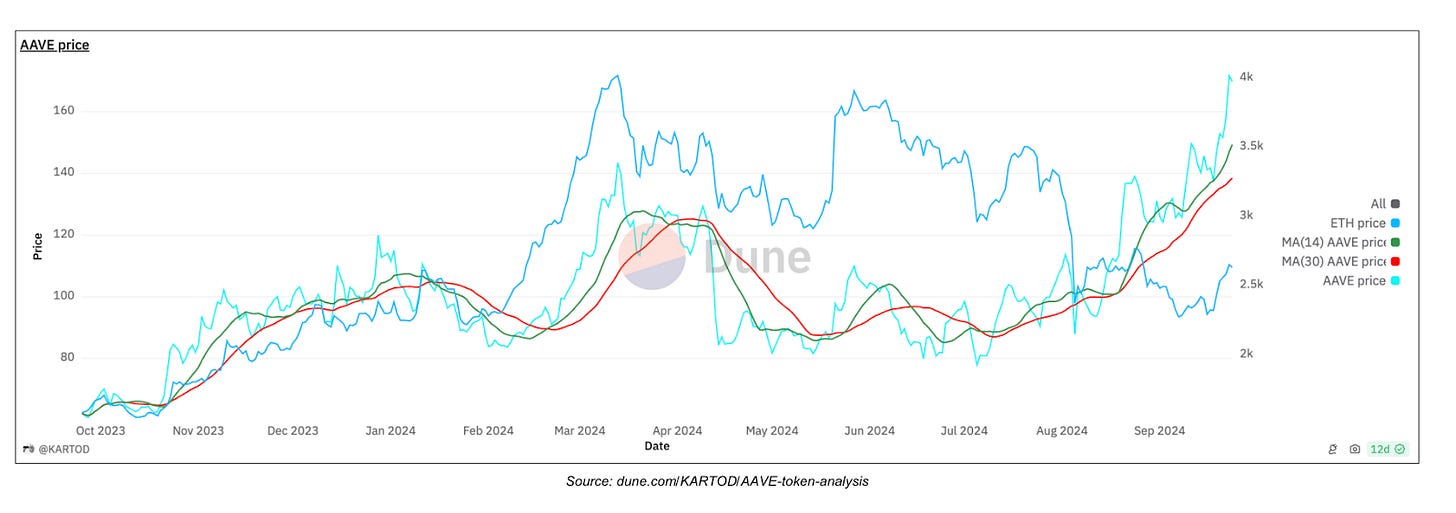

Grayscale introduces an Aave investment fund

Grayscale also had a notable update last week in which it introduced the Grayscale Aave Trust, a new fund centered on AAVE, the native cryptocurrency of the Aave lending platform. This trust is exclusively available to accredited investors, providing exposure to AAVE without the need to directly manage the cryptocurrency. The fund offers a simple avenue for investing in decentralized finance, utilizing Aave’s platform, which enables lending and borrowing via smart contracts, bypassing traditional intermediaries.

Franklin Templeton launches an on chain money market fund on the Aptos blockchain

Franklin Templeton was in the news a second time following the launch of its OnChain U.S. Government Money Market Fund on the Aptos blockchain, marking a major step into decentralized finance. Valued at $435 million, this fund is the second-largest tokenized fund globally and is now available across multiple blockchains, including Ethereum, Stellar, Polygon, and Avalanche. Aptos was selected for its distinctive features, such as the Move programming language, which improves transaction speed and security. This launch is a significant move towards integrating traditional finance with blockchain technology, expanding access to non-Ethereum Virtual Machine networks.

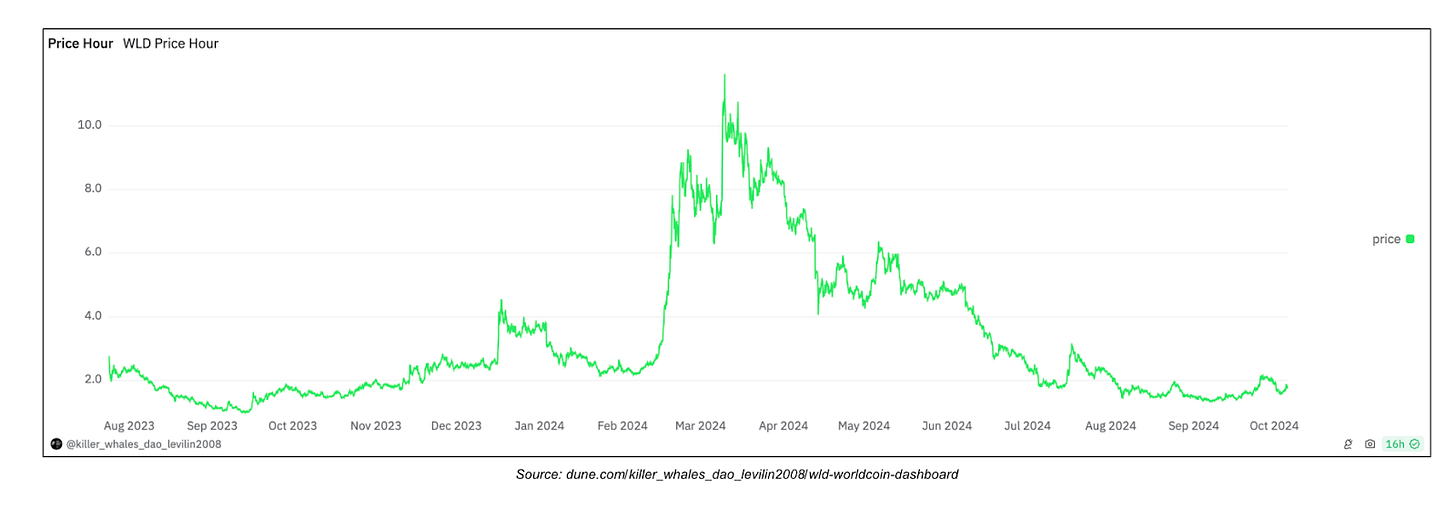

FTX estate plans to sell $38 million worth of locked Worldcoin tokens at a discount

For the final update of this week, the FTX bankruptcy estate is auctioning 22.3 million locked Worldcoin tokens, worth around $38 million, at a steep discount of up to 75%. This auction is part of the effort to recover funds for creditors following FTX's collapse. The minimum bid was set at $2.5 million. The tokens will gradually unlock until 2028, affecting their liquidity and value. This approach has sparked controversy due to concerns over potential undervaluation of the assets.

This week’s round-up is brought to you by:

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.