Weekly Update #19

Bitcoin transaction fees reach all time high as Coinbase’s petition is denied

Major crypto developments for the week:

Bitcoin transaction fees reach highest level on record due to inscriptions

Ledger undergoes exploit through Ledger Connect Kit

Ark, WisdomTree, Blackrock re-file ETF filings with cash versus in kind settlement after Fidelity, Blackrock met with the SEC to discuss their ETF applications

Coinbase petition denied by SEC

Bitcoin addresses with non-zero balances have breached 50 million

On-chain data reveals “fish” accumulation is nearly offsetting Bitcoin’s entire block issuance

Friend Tech announces v2 launch in Spring of 2024

Leading NFT collection Pudgy Penguins announces multiplayer game on zkSync

Worldcoin announces World ID 2.0

Synthetix turns off $SNX inflation and will use fees to buy back and buy $SNX

Tether freezes 161 wallets sanctioned by the US

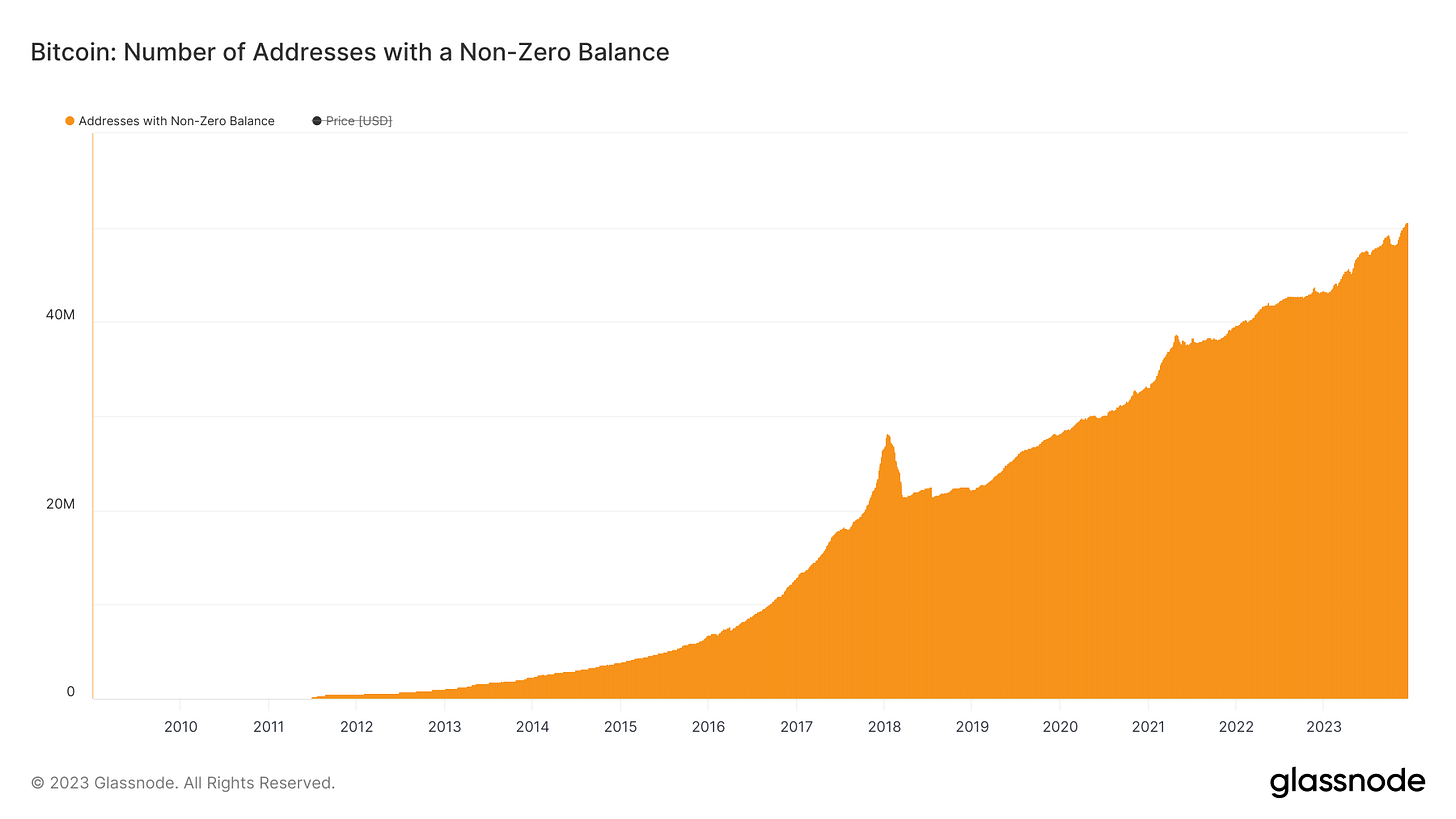

Bitcoin addresses with non-zero balances have breached 50 million for the first time

Over the last few weeks, the Bitcoin network crossed a major milestone with 50 million addresses with a balance of greater than 0 BTC. This perpetual rise is one way to measure Bitcoin’s accelerative growth as an emerging digital monetary network.

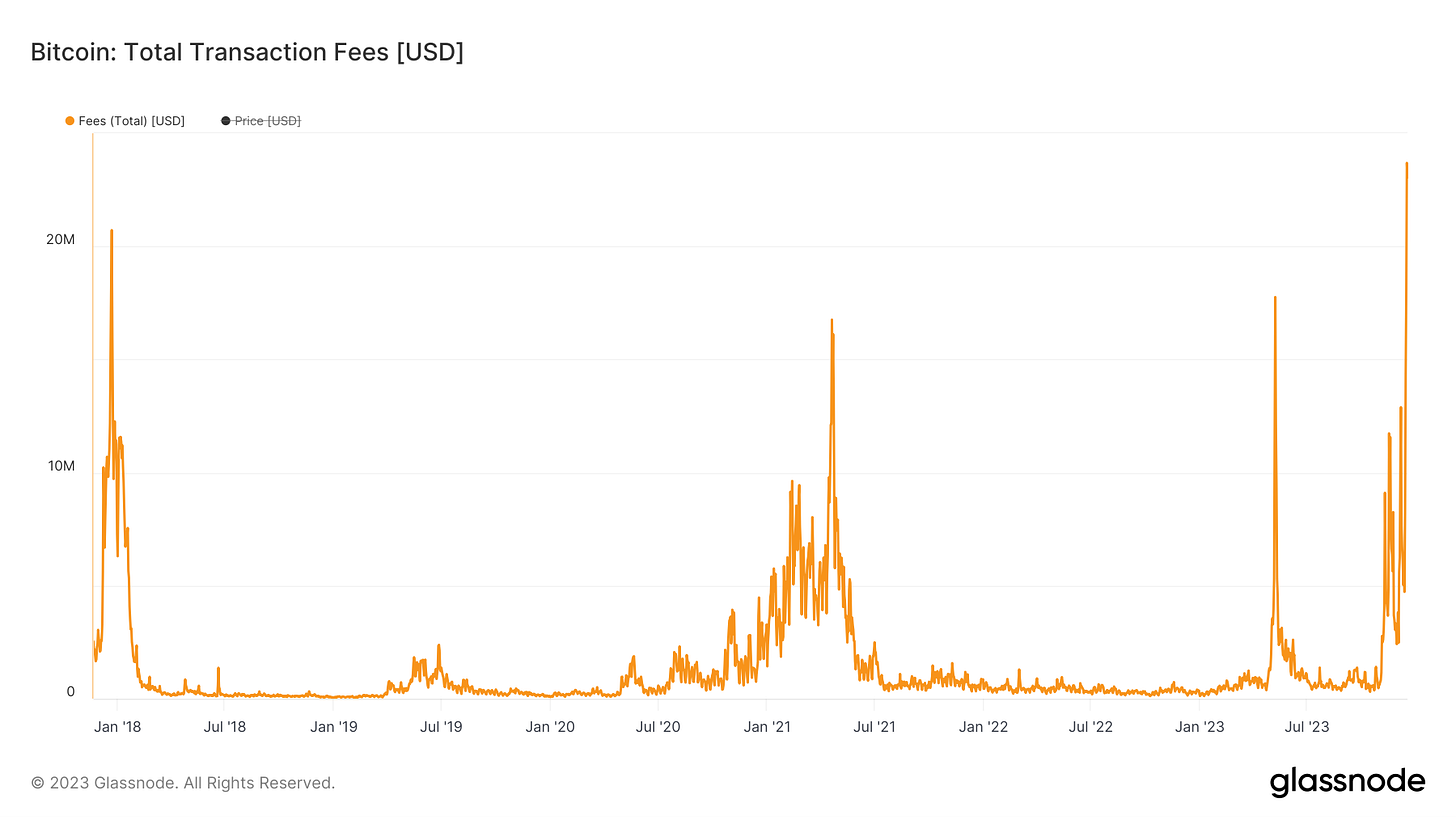

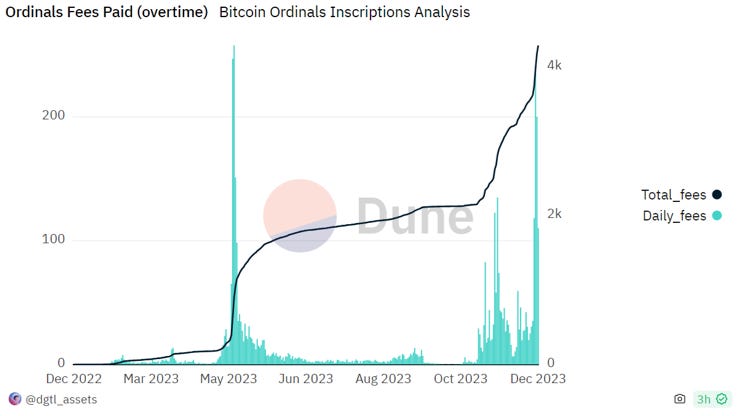

Bitcoin transaction fees reach highest level on record due to inscriptions

This week Bitcoin transaction fees surged to their highest single day reading of all time at $23.6 million.

What’s behind the spike in Bitcoin network transactions?

Ordinals inscriptions have caught a second wind, as shown in both the daily and cumulative values of transaction fees derived from ordinals inscriptions. Inscriptions have now generated over $175 million in transaction fees for the Bitcoin network.

What are the implications going forward?

Bitcoin miner revenues are made up by the block subsidy paid out from the protocol as well as transaction fees paid by users to get their transactions included in the next block on the blockchain. While higher transaction fees on Bitcoin’s base chain may price out small purchases, more miner revenue up for grabs means that more miners will plug in machines to capture the surge in fees; ultimately making the network more secure.

Does this solve Bitcoin’s “security budget issue”?

This also brings into question the concerns some pundits have expressed around Bitcoin’s security budget issue; the theory that Bitcoin will run into a security issue once Bitcoin rewards are longer being issued after the 21 millionth coin has been mined. The idea of sustained transaction fees from inscriptions combats this theory. It is also worth noting that should there ever be a substantial drop in miner revenues and hash rate comes offline, the difficulty adjustment that takes place every two weeks would bring block times back in line with the amount of hash rate; the China mining ban of summer 2021 is a great example of this. The theoretical debate lies on whether there is a quantifiable threshold of “sufficient security”.

Ledger undergoes exploit

This week Ledger, the crypto hardware wallet company based out of Paris, was exploited on Friday. This led to an exploit of several applications including SushiSwap, Balancer, and Revoke.cash. According to a post from Ledger, a former employee was phished, giving the hackers access to this former employee’s software account. Ledger Connect Kit, which is software connecting the hardware wallet to dApps on their interface, was the target of the attack; draining user funds whenever their wallets approval fake transactions on dApps. According to Ledger no users’ private keys were at risk, but this event serves as a reminder for the need to prioritize security around one’s crypto holdings. As a basic rule, it is seen as wise to utilize one wallet for strictly holdings assets and another for interacting with decentralized applications.

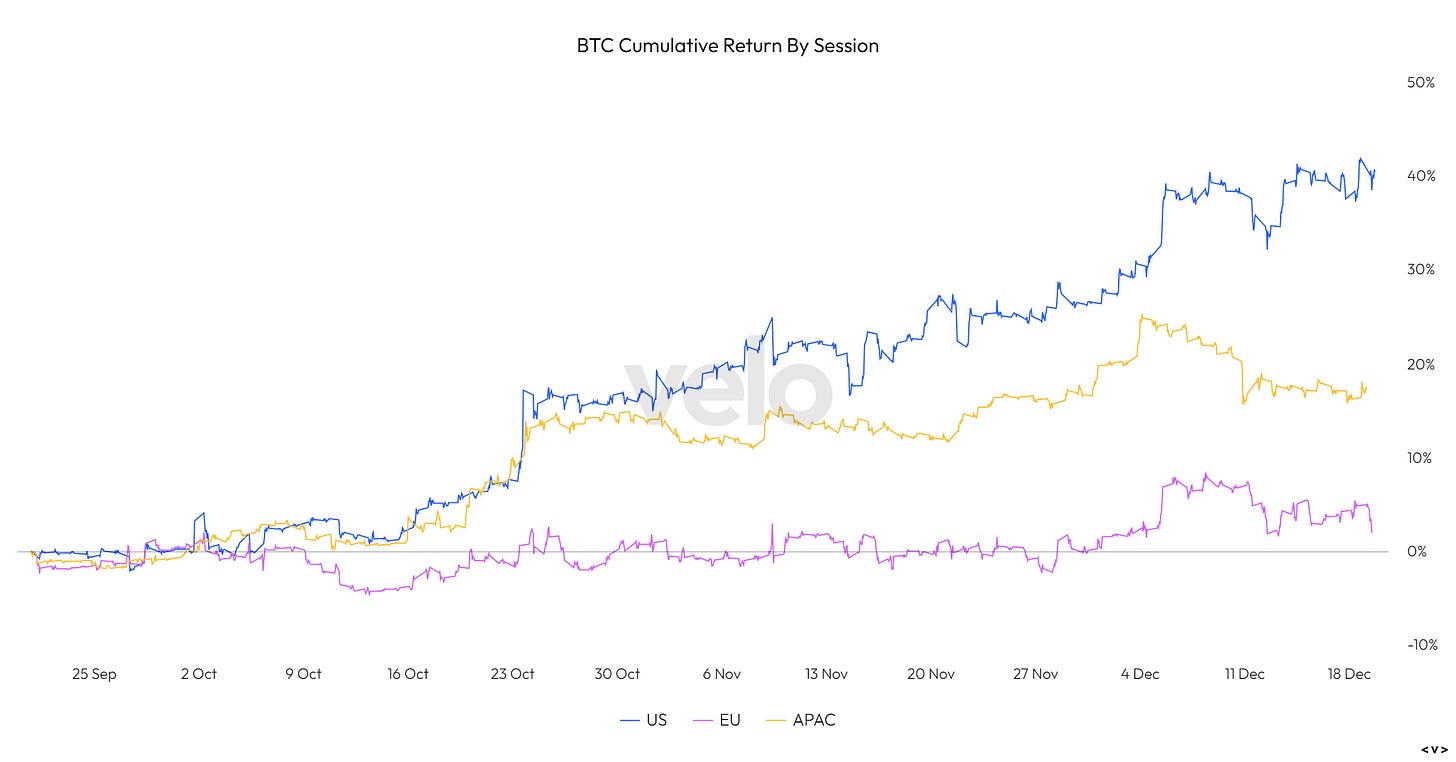

US continues to lead the way on flows for both BTC and ETH

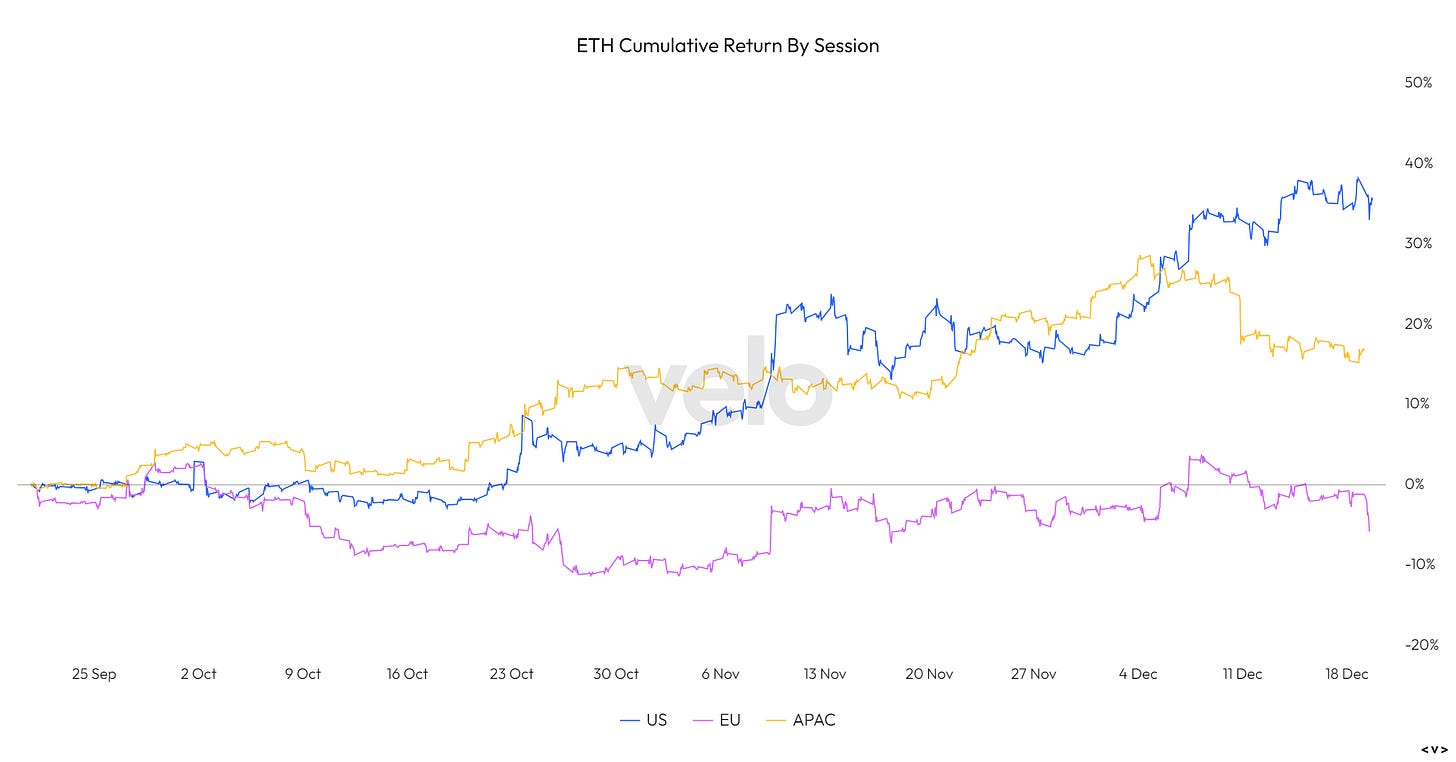

In the charts below, showing cumulative return by geographic trading sessions, we can see that the US has led the way for both BTC and ETH; with the EU clearly falling behind.

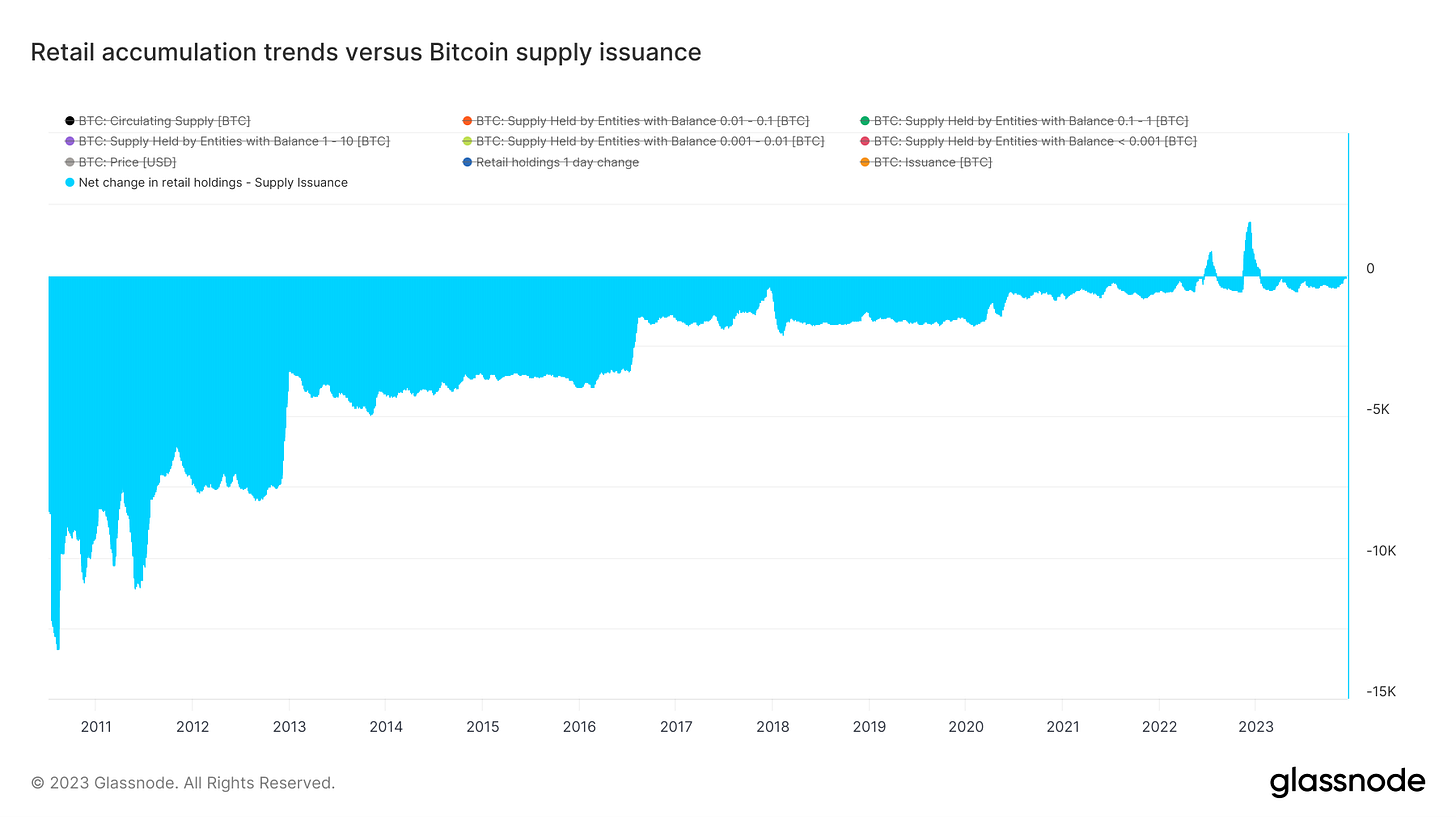

“Fish” continue to accumulate Bitcoin relentlessly

One interesting development to continue to keep an eye on is already trends within on-chain wallet cohorts by size. The chart below compares the daily net change in on-chain wallet clusters with 1 Bitcoin or less to the daily issuance of Bitcoin that is rewarded to miners. As you can see, this spread has continues to push towards positive territory. With the upcoming halving set to cut issuance in half, should accumulation from “fish”’ persist at current rates, this would offset the entirety of Bitcoin’s block issuance of the first sustained period of time ever.

Coinbase petition denied by SEC

This week we got an interesting headline on the regulatory front. The petition, filed by Coinbase in a federal appeals court to request a review of the SEC’s decision to deny the exchange's request for specified rules for a unique emerging asset class, was denied. The SEC decided in a 3-2 vote that it would not be proposing new rules, claiming that it fundamental disagrees with Coinbase’s notion that current regulatory conditions are unworkable.

This serves as a reminder to market participants that the regulatory path for the industry is still an uphill battle.