Weekly Update #12

CME activity soars as Bitcoin's correlation to Nasdaq reaches lowest reading in over 2 years

Major crypto developments for the week:

Bitcoin’s correlation to gold reaches highest level since March as correlation to Nasdaq drops

CME futures volumes reach highest level of 2023

CME futures dominance reaches all-time highs

Bitcoin options open interest reaches all time highs relative to perpetual futures open interest

Bitcoin implied volatility rises to highest levels since Q1

Bitcoin that hasn’t moved in at least 10 years surpassed Bitcoin on exchanges

Vaneck releases report on Solana with $3,200 bull case

dYdX chain goes live, bringing new utility to the DYDX token

Bitcoin’s correlation to gold reaches highest level since March as correlation to Nasdaq drops

The seasonality that we described in our first weekly report of October has once again continued, with the last month has been the strongest for Bitcoin for the entirety of 2023, which has been a strong divergence from the performance of major equity indices including the Nasdaq. As shown in the lower pane of the chart below, Bitcoin’s weekly correlation is the lowest that it’s been since August of 2021.

Meanwhile, its correlation to gold is the highest that it has been since the banking crisis earlier this year. While it’s difficult to make conclusions based on a few weeks of data, it will be interesting to see if this persists and a potential shift in the behavior of Bitcoin as an asset and how it can be viewed within an investor’s portfolio.

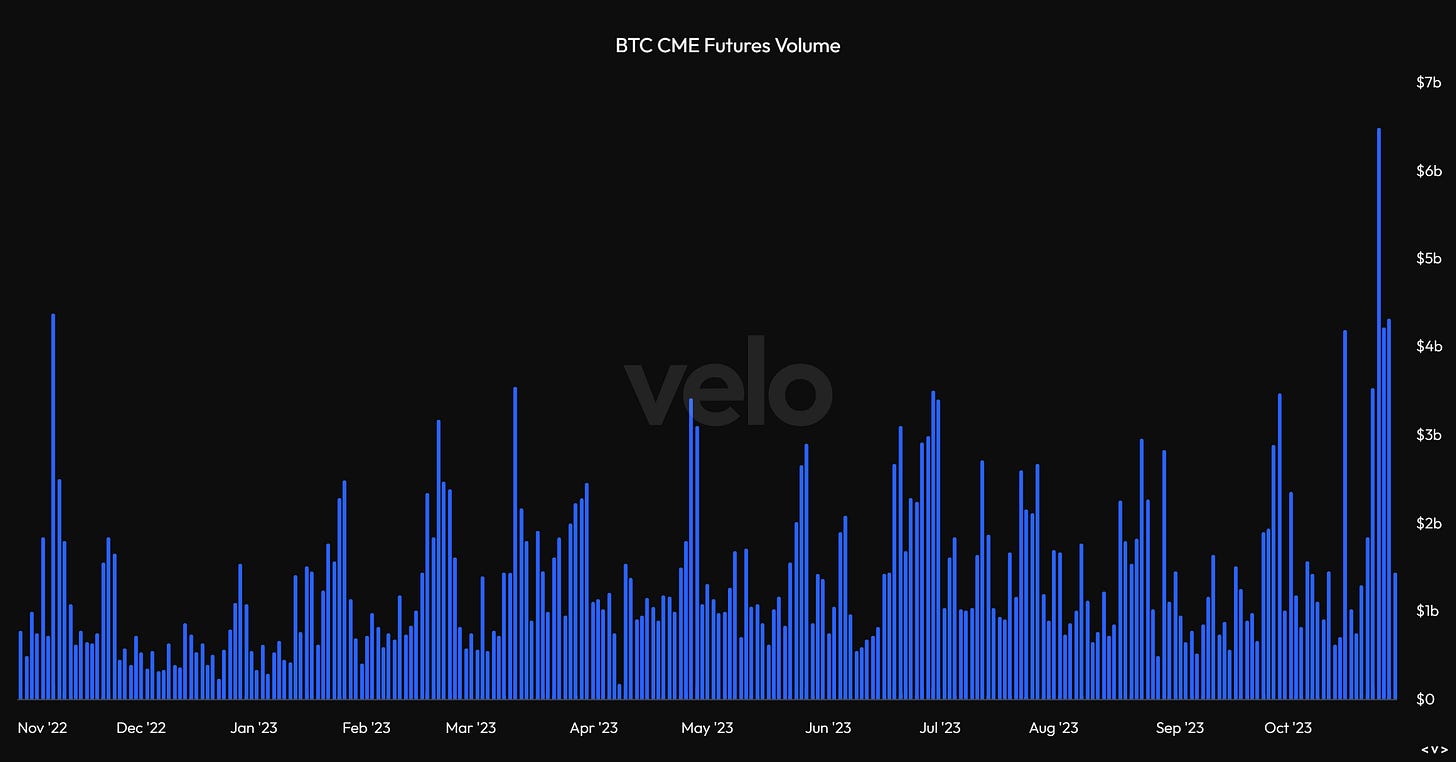

CME futures volumes reach highest level of 2023

Another interesting development came as futures volume on the CME reached the highest single day of trading throughout the entirety of 2023. This is an interesting dynamic to continue to monitor because traditional hedge funds and financial organizations are the types of entities that trade on the CME, as opposed to crypto natives that trade derivatives on crypto native venues such as Binance, OKX, Bybit, etc. This perhaps suggests that some traditional financial players have been tipping their toes in the Bitcoin market, potentially around the expectation of a Bitcoin ETF approval on the horizon.

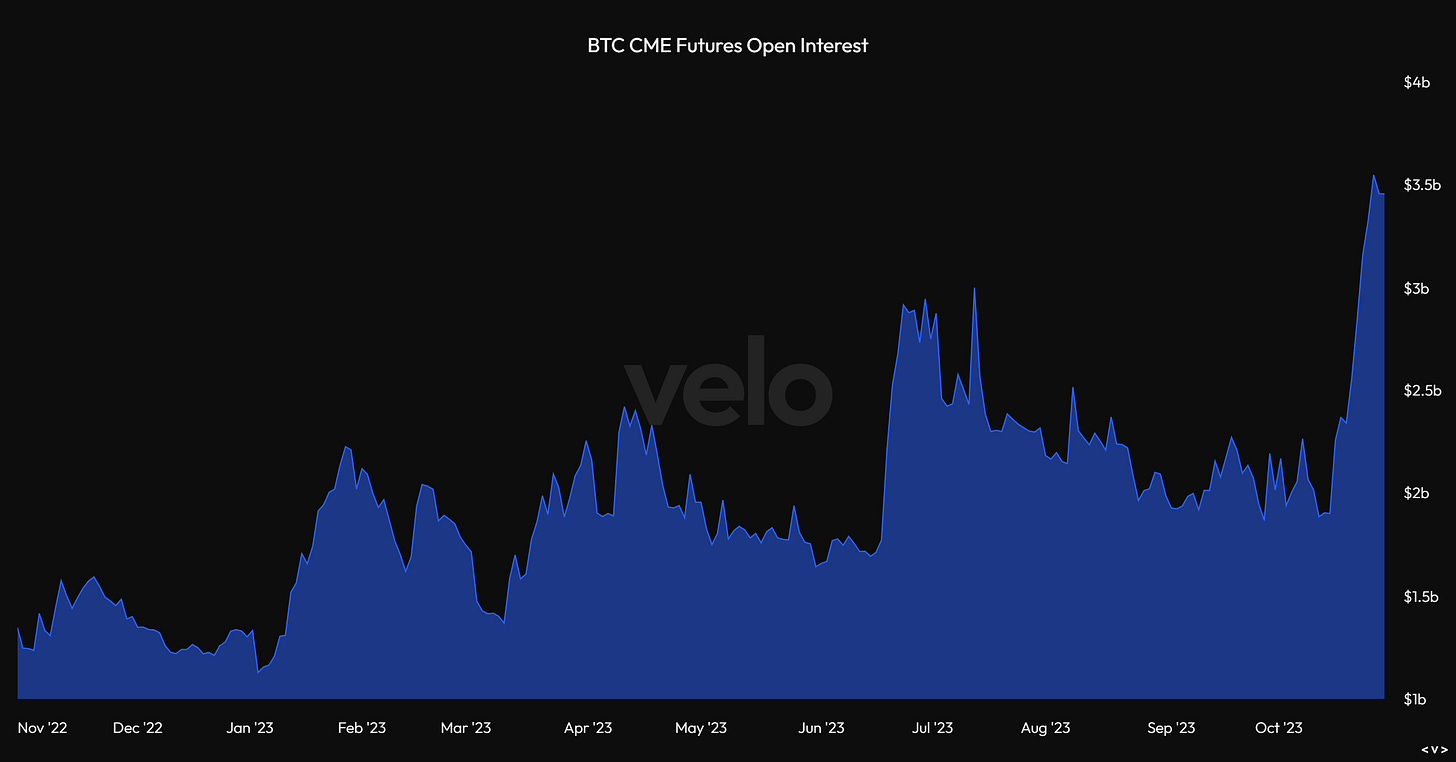

This is also represented in looking at futures open interest in addition to volume. This represents the number of futures contracts outstanding as opposed to how many have been traded on a given day.

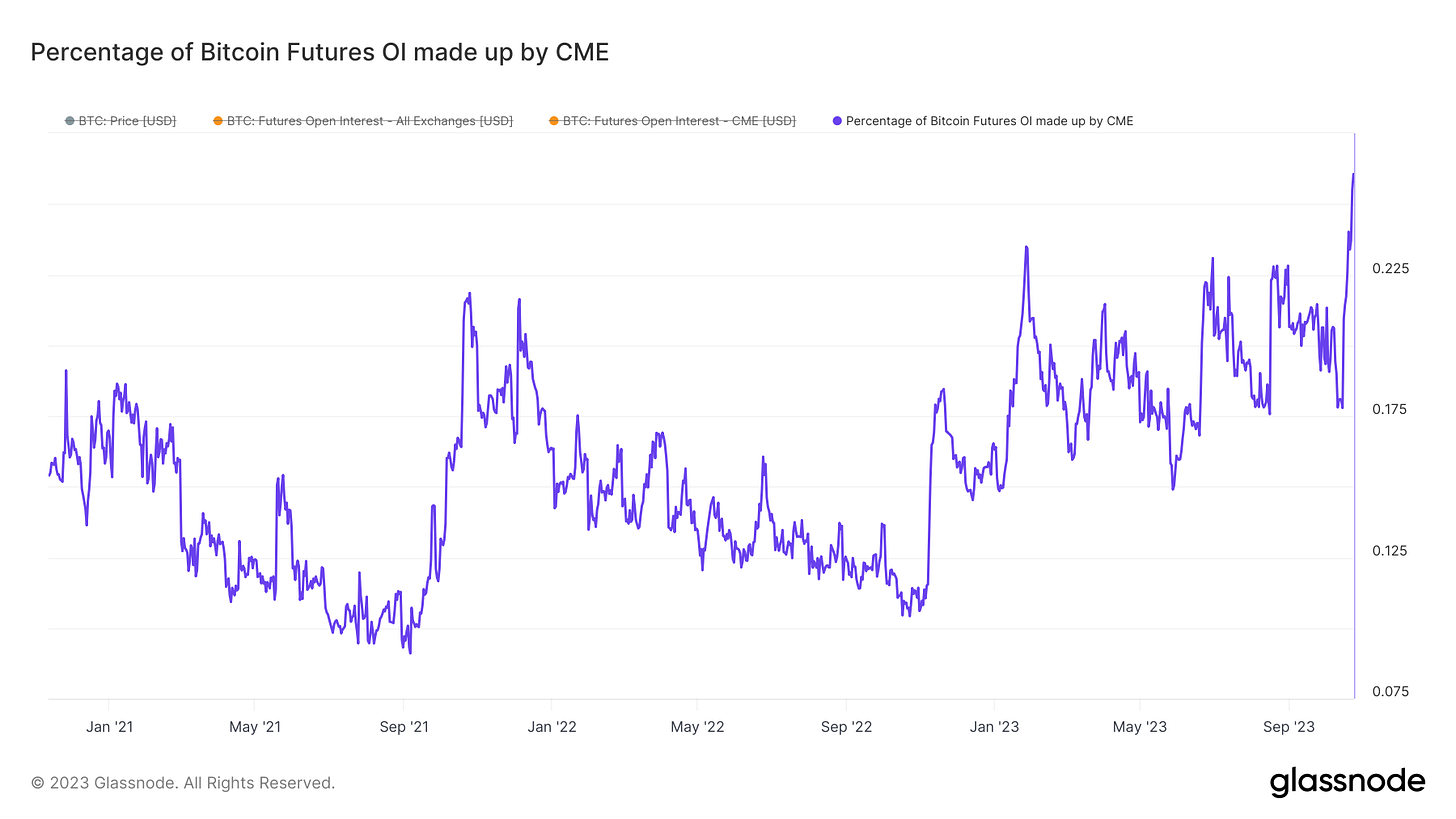

CME futures dominance reaches all-time highs

On a similar note, we can also take this a step further and look at the percentage of Bitcoin’s overall futures open interest that is derived from CME as opposed to crypto native venues that have historically dominated the Bitcoin derivatives landscape. We can see in the chart below that the percentage of Bitcoin futures open interest made up by the CME has reached an all time high of over 25%. This hints at a potential shift of market participants in Bitcoin/crypto that we may see as more traditional financial institutions become comfortable allocating/trading the asset class.

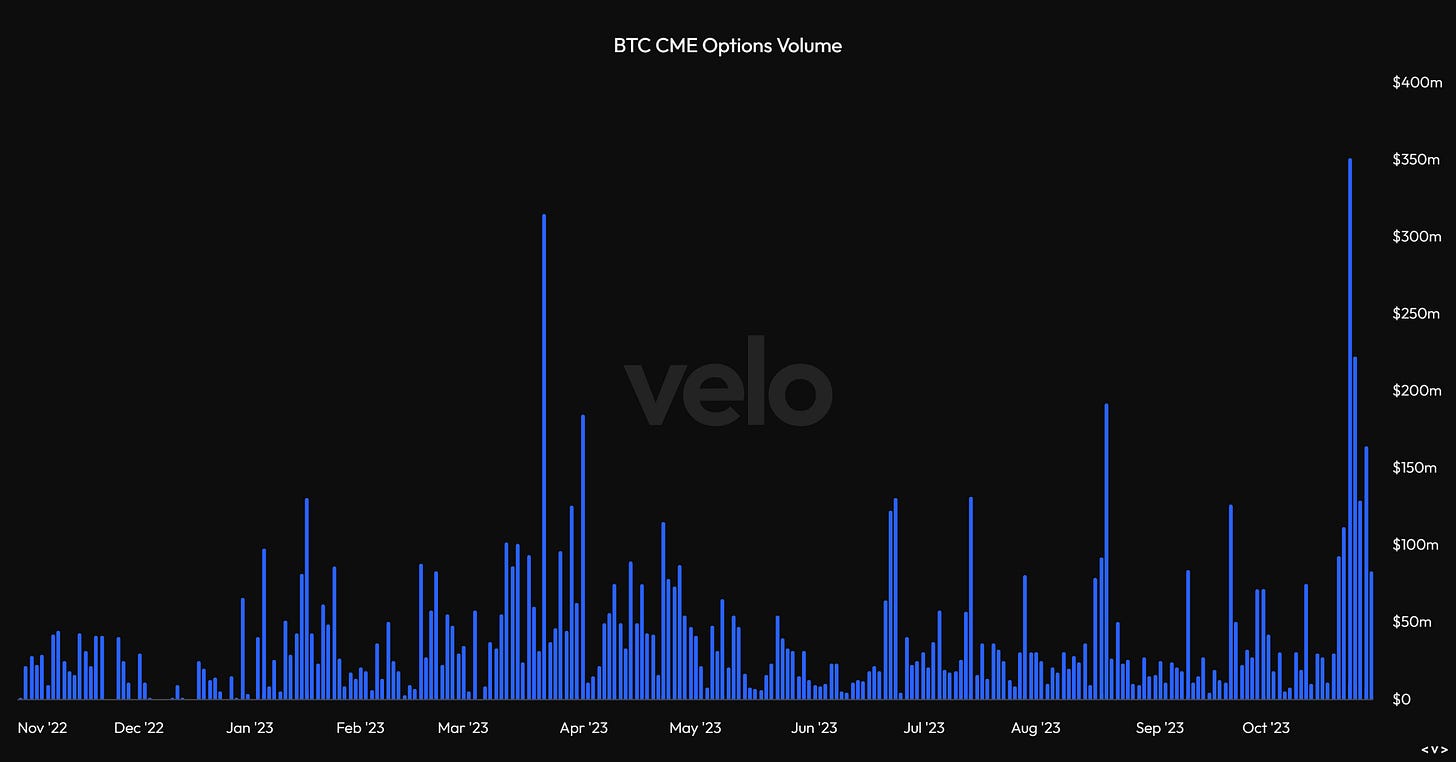

Bitcoin options open interest reaches all time highs relative to perpetual futures open interest

Continuing with a look into the Bitcoin derivatives market, we have seen a similar spike in options volumes, reaching the highest level of single day trading volume that they have for the entirety of 2023 at roughly $350 million.

Bitcoin options open interest relative to perpetual futures open interest has reached all time highs this week. This is significant as it represents a market structure shift towards increasing usage of options relative to perpetual futures, which historically have been the most liquid tradeable derivatives product in crypto.

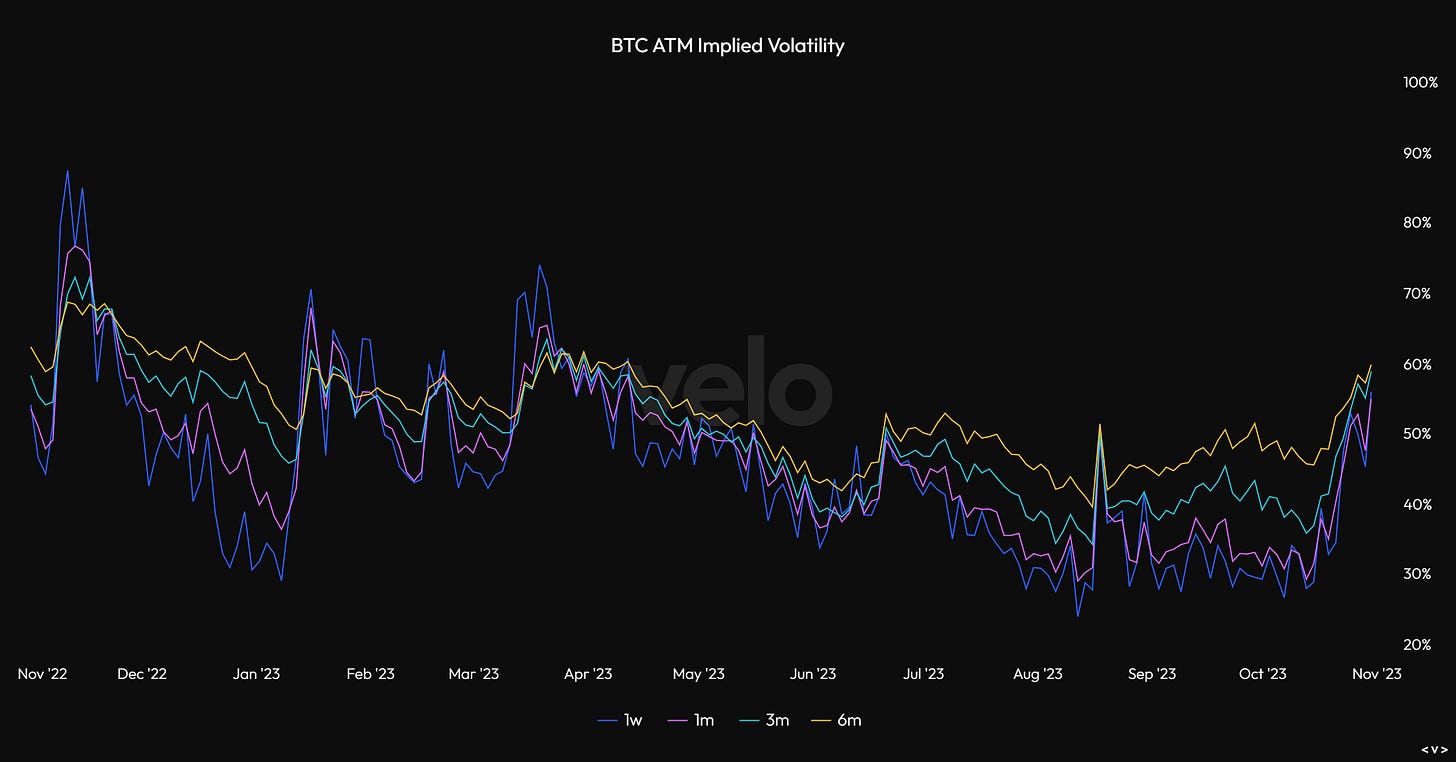

Bitcoin implied volatility rises to highest levels since Q1

Implied volatility, which is the expected future volatility priced in through the options market, has reached the highest levels since the banking crisis earlier this year. After a slow summer with low volume and volatility, we may finally be seeing some volatility come back to the crypto market.

Bitcoin that hasn’t moved in at least 10 years surpassed Bitcoin on exchanges

In previous weekly updates we have described the deep belief being reflected by Bitcoin’s holder base throughout the bear market. One very interesting way to illustrate this is by looking at the amount of Bitcoin that hasn’t moved in at least 10 years relative to the amount of Bitcoin sitting on exchanges. What we can see is that there are now over 600,000 more BTC that have not moved in at least 10 years than there currently are on exchanges.

Vaneck releases report on Solana with $3,200 bull case

An interesting report that came out this week was from VanEck, a multi-billion dollar institutional asset manager, who laid their investment thesis for Solana and its SOL token. The report describes their thesis for Solana’s high performance high throughput technical architecture and areas of market share that it may be able to capture relative to other protocols. Most notably, the report laid out their bear base and bull case for SOL, which included the headline number of a $3,200 bullish case for the asset by the year 2030. We encourage you to read the report, which is just another reflection of continued interest to get involved in crypto by traditional asset managers. You can view the full report here: https://vaneck.com/us/en/blogs/digital-assets/matthew-sigel-vanecks-base-bear-bull-case-solana-valuation-by-2030/

dYdX chain goes live

This week was a significant one for dYdX holders, with the long awaited dYdX chain launching. This creates new utility for the DYDX token, as it will be staked to secure the network, receive a portion of fees, and be involved with network governance moving forward. According to the dYdX foundation: "This is a significant change from ethDYDX, which is solely a governance token in dYdX v3, to DYDX, a native token powering the dYdX Chain, a standalone PoS blockchain network,".