Weekly Update #11

Blackrock filing revealed on DTCC website as CME futures volume hits 2023 high

Major crypto developments for the week:

NYAG sues DCG and Gemini over earn program

Ripple case dismissed

Bitcoin dominance sets fresh 2023 highs

MicroStrategy’s $4.7 billion Bitcoin bet is now back in the green

Blackrock CEO Larry Fink calls crypto price action “a flight to quality”

Updated ETF deadlines released

Court orders SEC to revisit Grayscale ETF conversion application

Stablecoins revealed to be 16th largest sovereign holder of US treasuries

Bitcoin dominance sets fresh 2023 highs

This week Bitcoin dominance has set fresh 2023 highs, reflecting Bitcoin’s significant outperformance relative to the rest of the crypto market throughout the year.

Bitcoin reclaims 200 week and 200 day moving averages

In addition, Bitcoin has now reclaimed both its 200 day and 200 week moving averages, as well as its 2021-2022 $30k-$60k trading range.

Updated ETF deadlines

This week James Seyffart from Bloomberg posted an updated table of the most important ETF deadlines to keep in mind moving forward. As you can see in the table below, the first batch of major ETF deadlines for the SEC to abide by comes on January 10th of next year, with Ark Invest’s final deadline. Next is a swash of several filings reaching their final deadlines on March 14th of next year, including Blackrock/iShares, Bitwise, WisdomTree, Invesco, and Fidelity/Wise Origin. Earlier in the week we saw Blackrock file an addendum to their current ETF filing, a reflection that Bitcoin ETF filers have been in talks with the SEC on the specifics of their respective fillings. In addition, it was revealed that Blackrock and iShares filing was uploaded to the DTCC database.

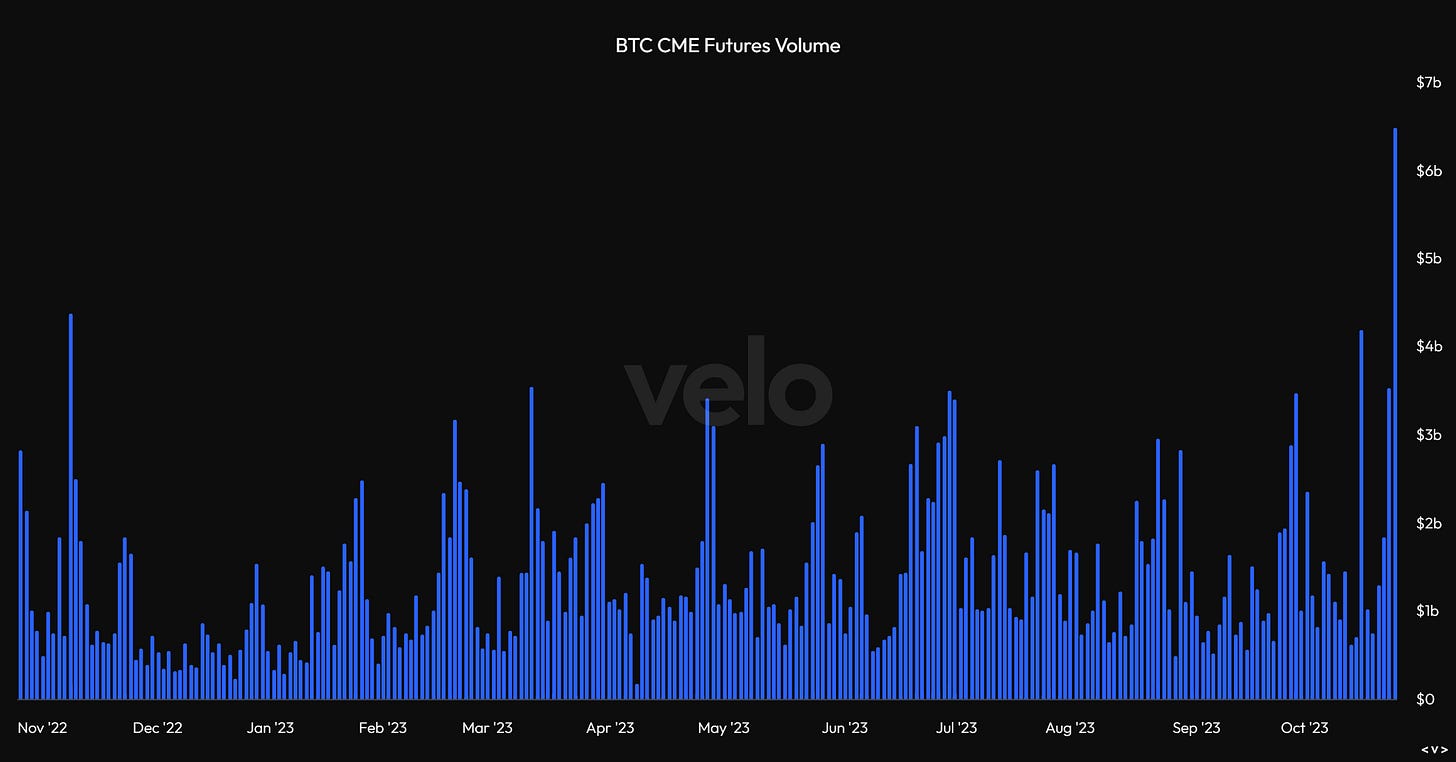

The ETF trade appears to be back in full force, with COIN and GBTC rallying, as well as CME futures open interest and volumes rising. Yesterday CME futures volumes reached their highest level of the entirely of 2023 at over $6 billion.

NYAG sues Gemini and DCG over Gemini Earn Program

One of the biggest stories of last week came on Thursday as New York Attorney General Letitia James filed a lawsuit against Gemini Trust Company, Genesis and Digital Currency Group for allegedly defrauding over 230,000 investors out of over $1 billion. According to the press release from the NYAG, Gemini mis-represented its “Earn” program as low risk, when in reality funds contributed to Gemini Earn were utilized by Genesis to make risky loans to numerous entities throughout the digital asset industry, including overconcentration to failed hedge funds Three Arrows Capital and Alameda Research. The suit also alleges that Genesis and DCG concealed the health of the organization’s balance sheet after taking substantial losses throughout mid-2022.

SEC drops claims against Ripple Labs

This week revealed another substantial development on the legal front, with the SEC dismissing its claims against Ripple executives Bradley Garlinghouse and Christian Larsen for allegedly violating securities laws in the distribution/sales of the XRP token. While the public sale of XRP was not deemed to be in violation of securities laws by the Southern District of New York, the court had deemed institutional sales to be unregistered securities in its July summary judgment decision. With the SEC now dropping these claims as well, the trial, which was set for early 2024, has now been cancelled. This marks a significant win for Ripple and XRP.

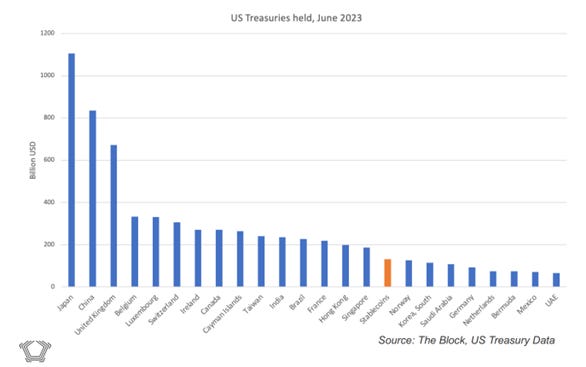

Stablecoins revealed to be 16th largest sovereign holder of US treasuries

Stablecoins continue to solidify themselves as one of the clearest use cases of crypto, with roughly $120 billion of stablecoins in circulation despite the broader market decline. One interesting statistic from a recent presentation given by Castle Island’s Nic Carter is that of the top sovereign nation US treasury holders as of June 2023. In the chart below we can see that stablecoins, which are largely backed by US treasuries, in aggregate would be the 16th largest US treasury holder in the world. As stablecoins presumably grow over the coming years with individuals around the world looking for access to digital dollars, the importance of stablecoins as an entity for the sake of the US financial system will increase, and at some point over the coming years may be deemed “too big to fail”.

Source: Nic Carter, CoinMetrics, The Block, US Treasury Data

Someone got strong-armed to dismiss the Ripple case?