Weekly Market Update #28

Bitcoin hovers above $50,000 as Microstrategy's holdings exceed $10 billion

Major developments for the week:

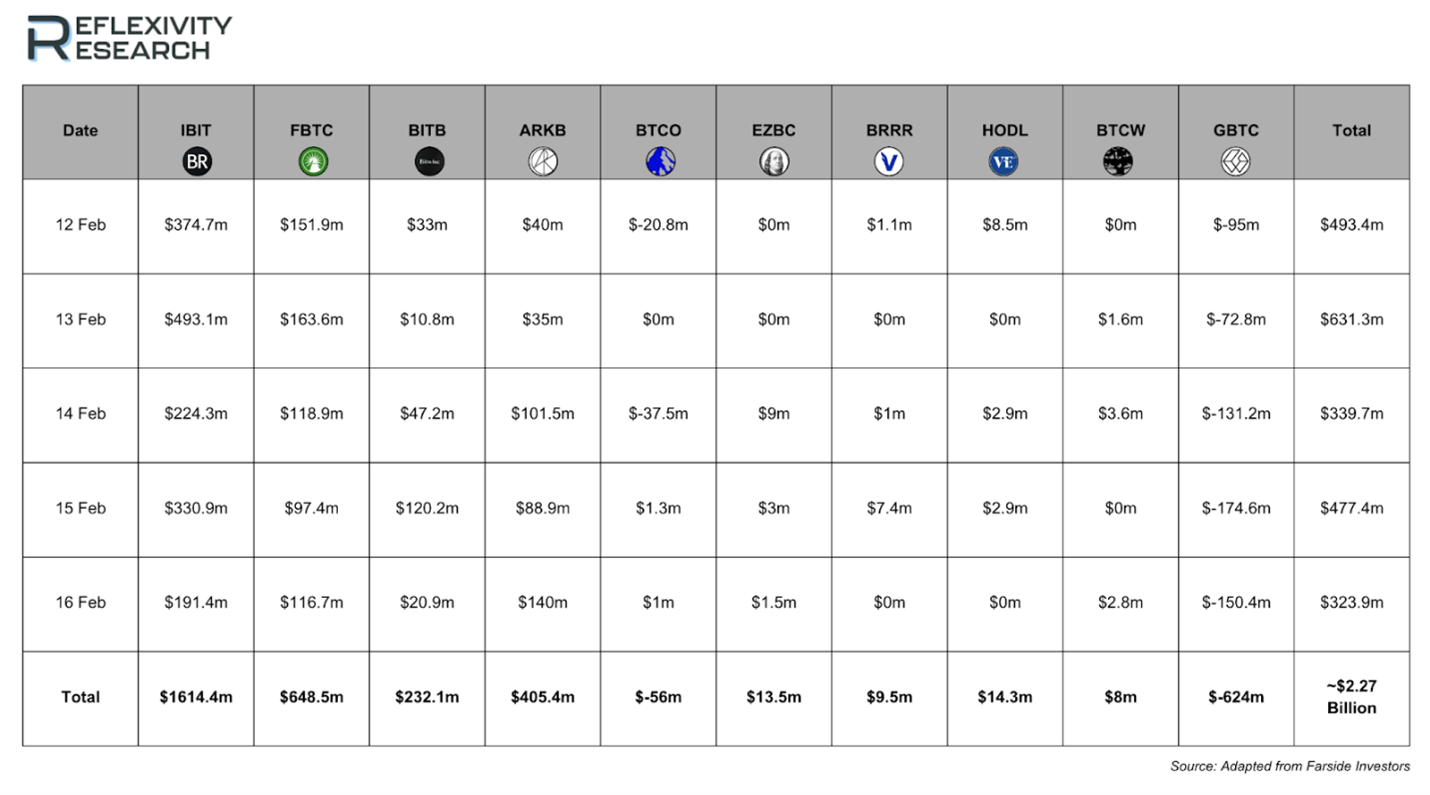

Bitcoin ETF products saw total net inflows of $2.27 billion last week

Michael Saylor's MicroStrategy has seen its Bitcoin investment exceeds $4 billion in profits

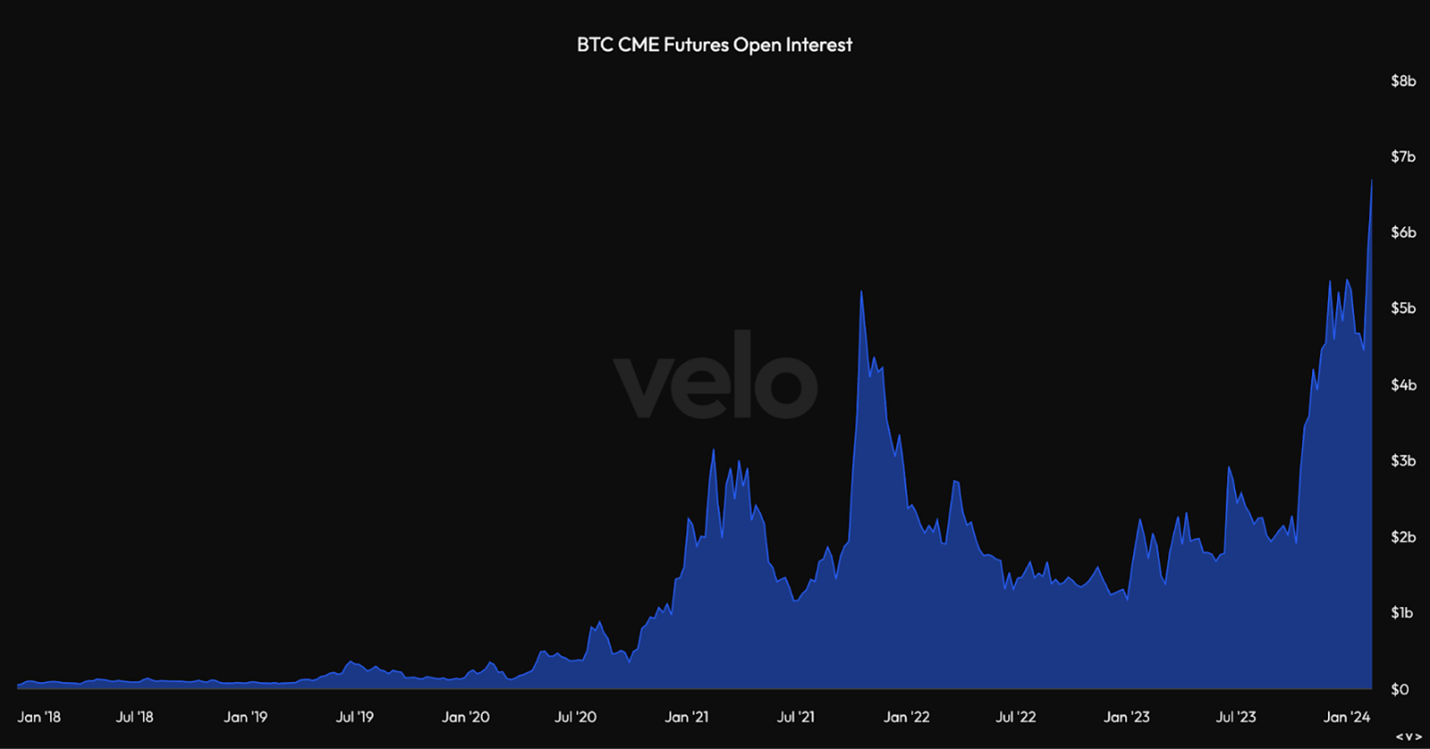

Bitcoin futures market starting to heat up, although far from levels reached during the peak of 2021

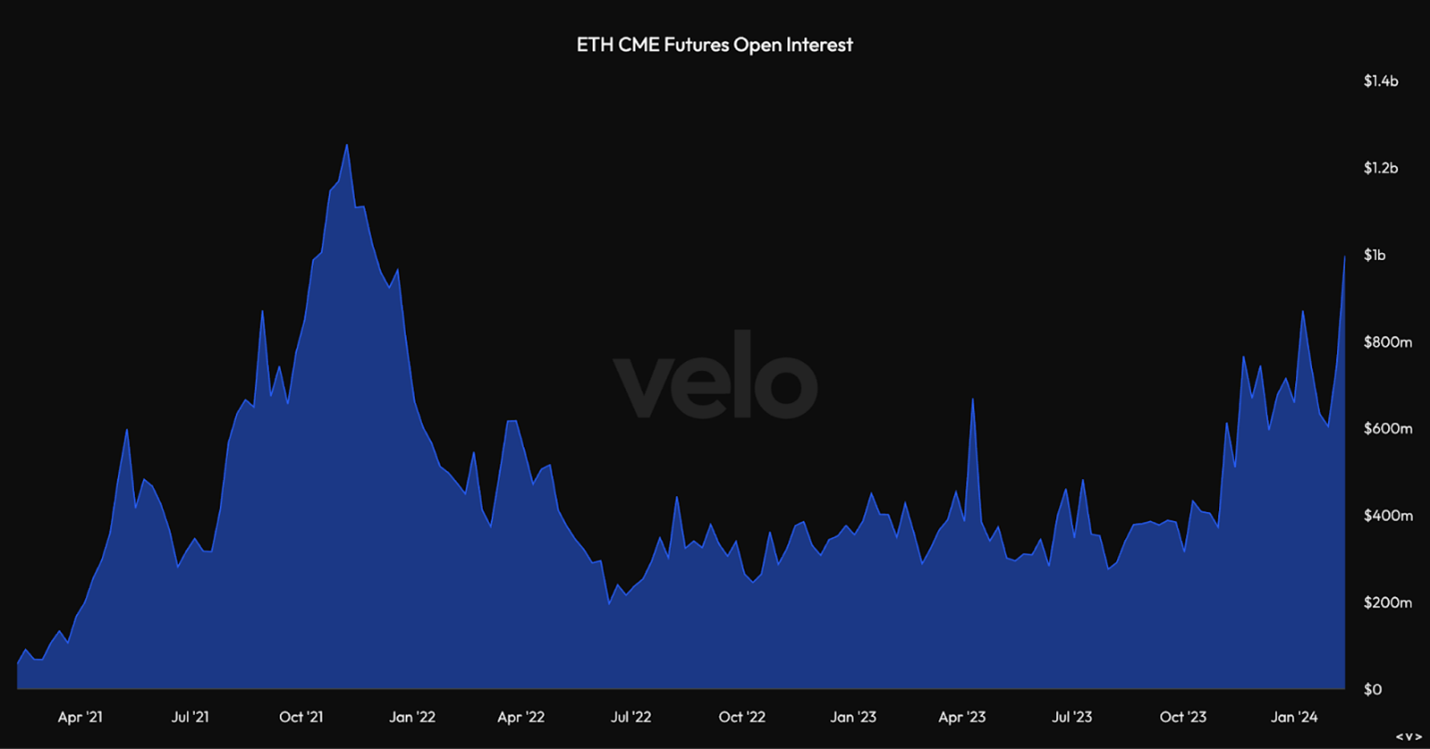

Bitcoin CME Futures Open Interest reach $6.7 billion, marking new all time highs, as Ethereum CME futures open Interest hits $1 billion for the first time in over two years

Apecoin's 'ApeChain' will be powered by Arbitrum, following a majority vote of 50.35% that favored it over other options such as Polygon and zkSync

Injective launched what is described as the "first ever" omnichain domain name service, supporting both Injective and Solana

Solana Mobile has announced Snapshot 2, set for February 21st 7pm UTC

Blast’s big bang competition will take place on Tuesday, February 20th

Avalanche will undergo a $379.76 million unlock on February 22nd, 2024

Delta neutral stablecoin Ethena announces $14 million raise

Bitcoin ETF products saw net inflows of $2.27 billion last week

Last week saw a significant surge in net Bitcoin ETF flows, increasing by $1 billion compared to the previous week. A substantial portion of this increase was driven by BlackRock's IBIT product, which attracted an impressive $1.6 billion, marking an approximately 170% increase from the week before.

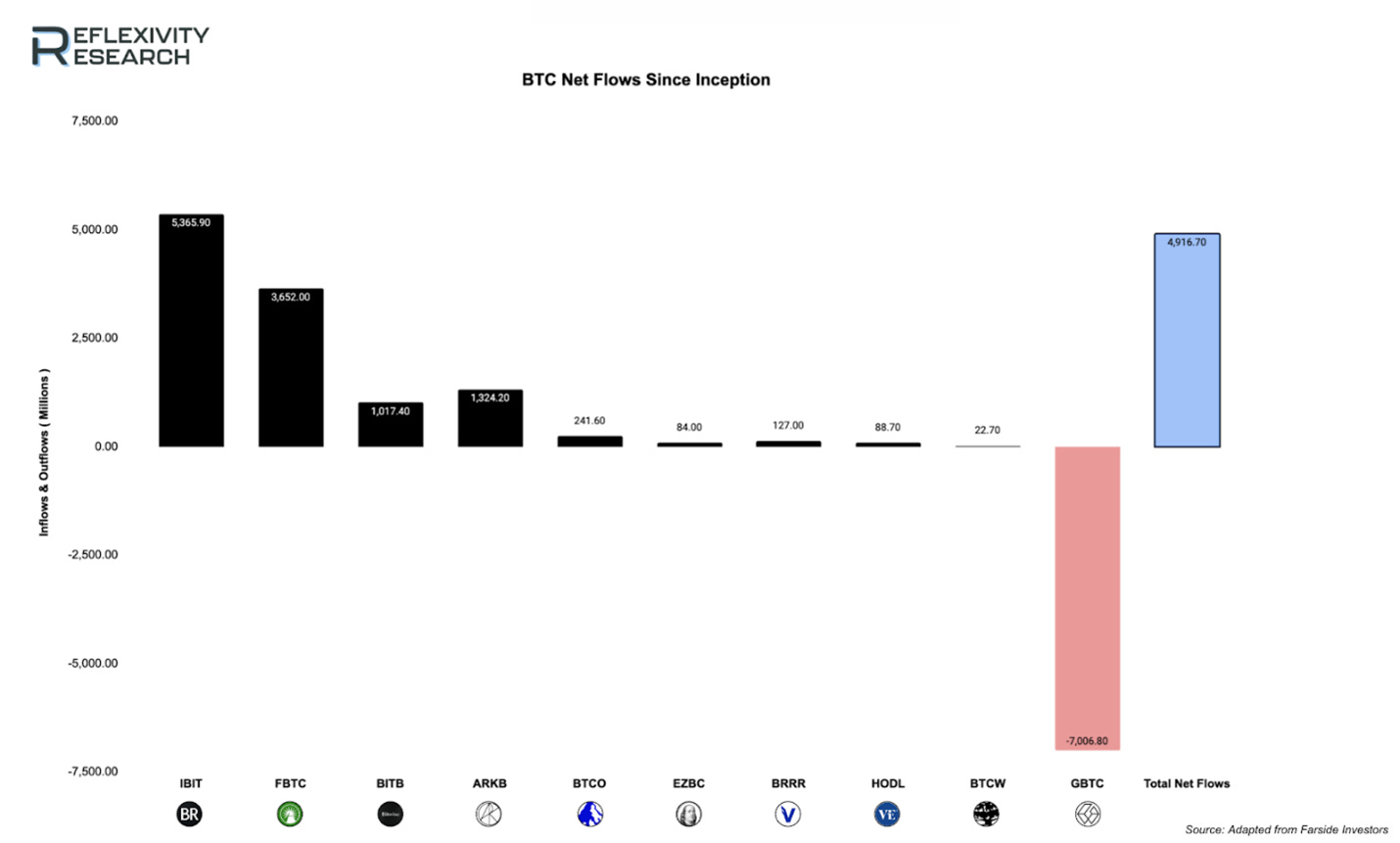

Despite Grayscale experiencing $700 million in outflows since January 11th, Bitcoin ETF products have witnessed 16 consecutive days of net inflows. This has brought the total inflow figure to $4.9 billion.

Amongst the largest contributors of net inflows are Blackrock’s IBIT, Fidelity’s FBTC and Ark 21 Share’s ARKB.

Additionally, a subject that has been extensively covered in our previous editions of our weekly series is BTC CME Futures Open Interest. As of February 16th, we have reached historic highs for this metric, with open interest surpassing $6.7 billion, as illustrated by the chart below:

Furthermore, Ethereum has achieved a milestone by reaching $1 billion in CME Futures Open Interest, a level not observed in over two years. The surge in Open Interest for Ethereum CME Futures Open Interest occurred shortly after Franklin Templeton announced their application for a spot Ethereum ETF last Tuesday. This application places Franklin Templeton among other notable firms such as BlackRock, Fidelity, Ark 21Shares, Grayscale, VanEck, Invesco, Galaxy and Hashdex, all of whom have submitted similar applications in recent months.

Bitcoin Derivatives Market Starting to Heat Up

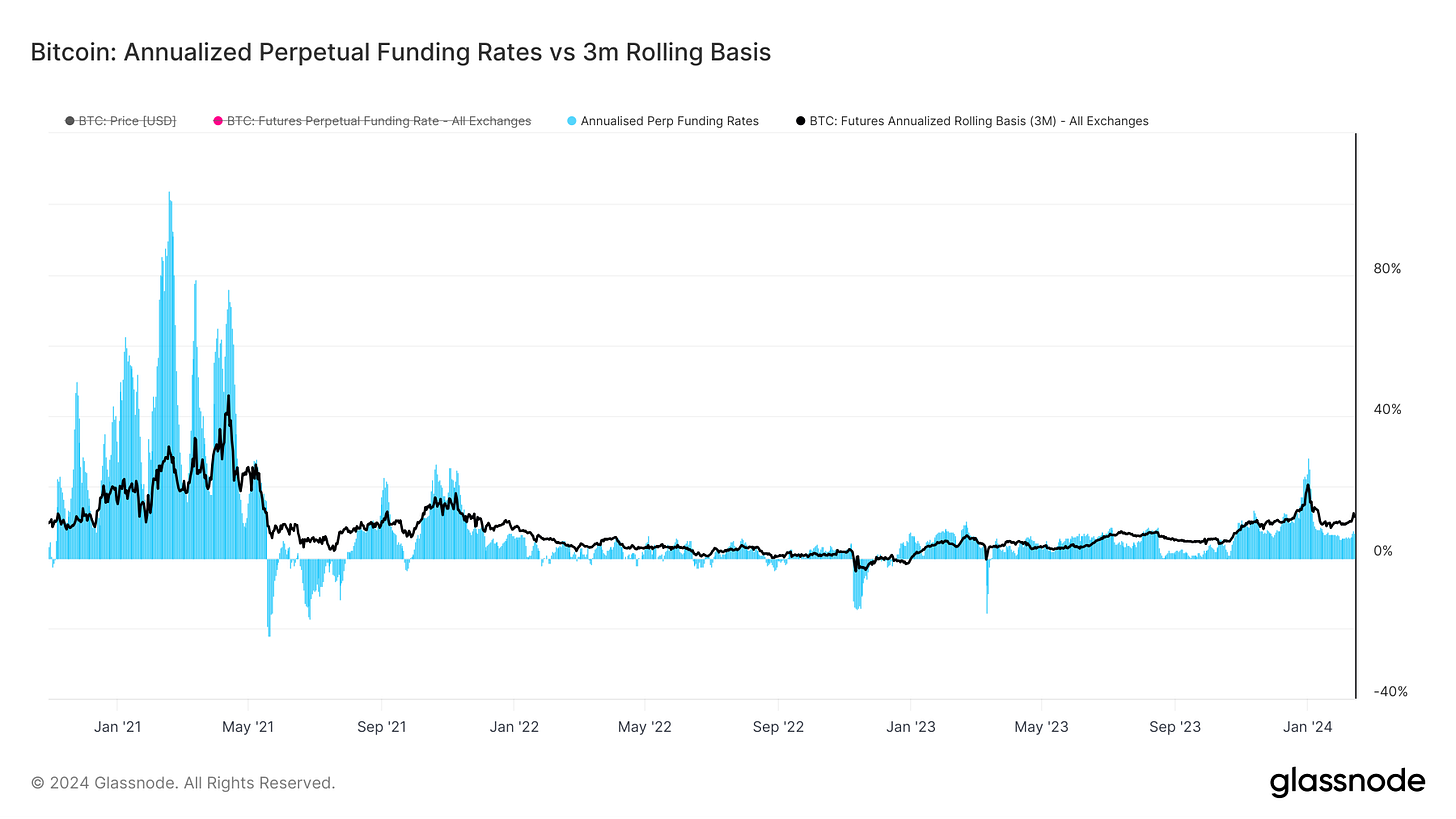

One of the most important metrics to follow for the state of the Bitcoin market is the derivatives landscape, not only on CME but on crypto native venues as well. Following derivatives data can offer insight into the positioning of market participants and sentiment. Below we can see the annualized calendar futures basis and the annualized perpetual futures funding rates. The calendar futures basis simply looks at the spread between the current Bitcoin spot price and where calendar futures are trading; the higher this spread is the stronger the demand is to be long. Similarly, funding rates are the mechanism used to peg perpetual futures, the most liquid instruments in crypto, contracts to the underlying spot market. Every 8 hours this funding rate is paid out to the other side of the perpetual futures contracts based on demand to be long or short relative to activity in the spot market. As we can see below, while these readings are of course no longer negative and starting to grind up, they are still far from levels reached during peak bull market euphoria in 2021. These will be two indicators to continue to keep an eye on.

caption.

Blast’s Big Bang Competition

This week also features an interesting development from the highly anticipated Blast Protocol.

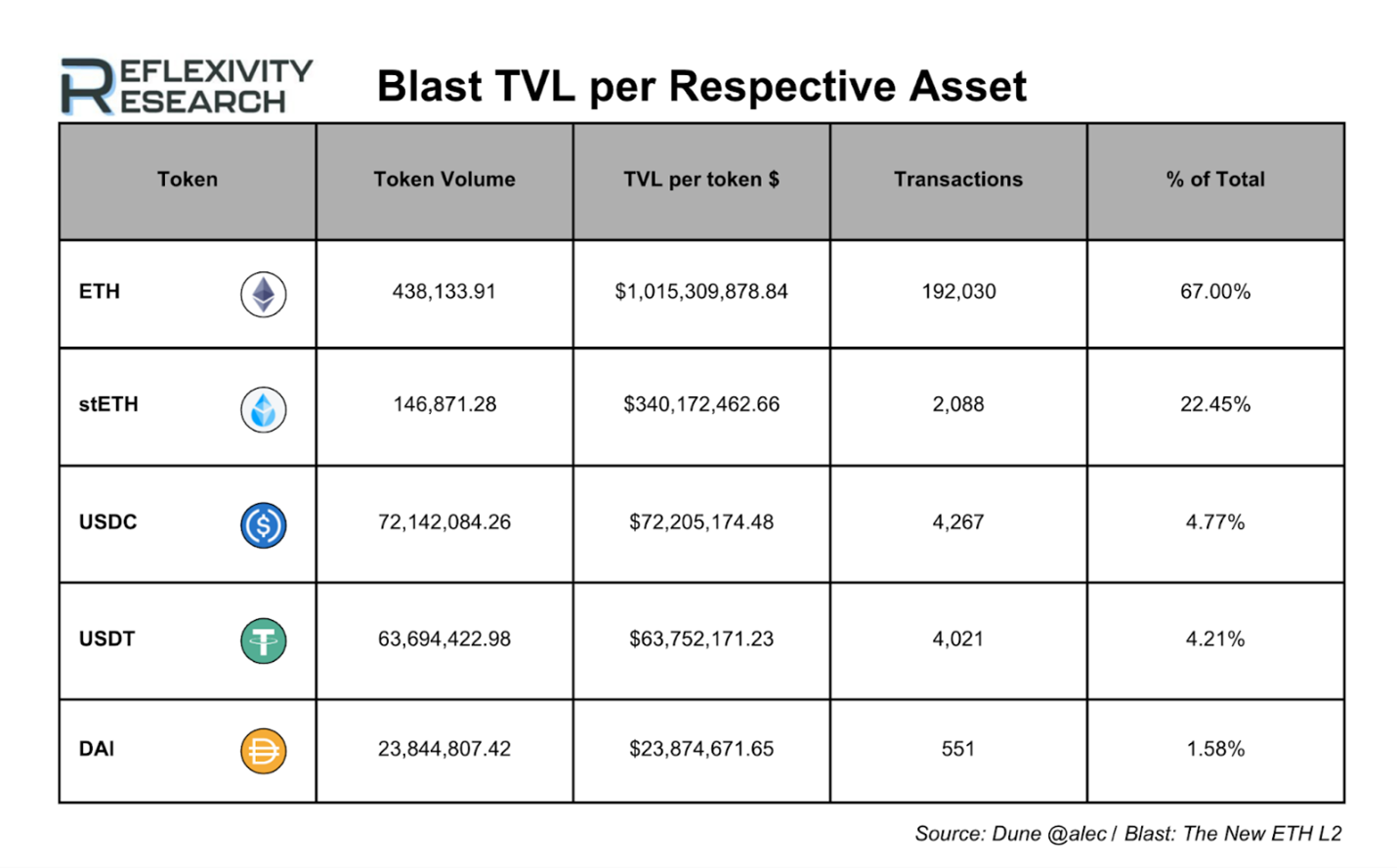

Blast is an advancement in Ethereum Layer 2 platforms, introducing native yield for ETH and stablecoins. It offers a 4% yield on ETH and 5% on stablecoins through automatic compounding of user balances. Since launching, Blast has accumulated a Total Value Locked (TVL) of $1.8 billion and has 174,000 users.

The recent launch of the Blast Testnet initiated the Blast BIG BANG competition, providing Decentralized Applications (DApps) an opportunity for increased visibility among Blast's user base of over 174,000 and access to a TVL of $1.3 billion. The competition also offered a platform for DApps to engage with leading investors and to participate in the Blast Airdrop, with 50% of the airdrop specifically earmarked for developers, representing a significant distribution effort.

DApps participating in the competition can leverage the Blast Airdrop to foster growth on the Blast Mainnet, thereby securing a competitive edge. Moreover, Blast aims to facilitate networking opportunities between successful teams and investors interested in supporting Blast-native DApps.

The competition was structured as follows:

DApp developers were required to register for the Blast Builders Slack by February 16th.

Project submissions are due by 1am HKG on February 19th.

Judges are set to livestream their evaluations of the top projects and announce the winners on February 20th.

The winning projects are set to be showcased to an audience of over 174,000 users at the Mainnet launch, which is scheduled for the end of February.

Avalanche will undergo a $379.76 million unlock on February 22nd, 2024

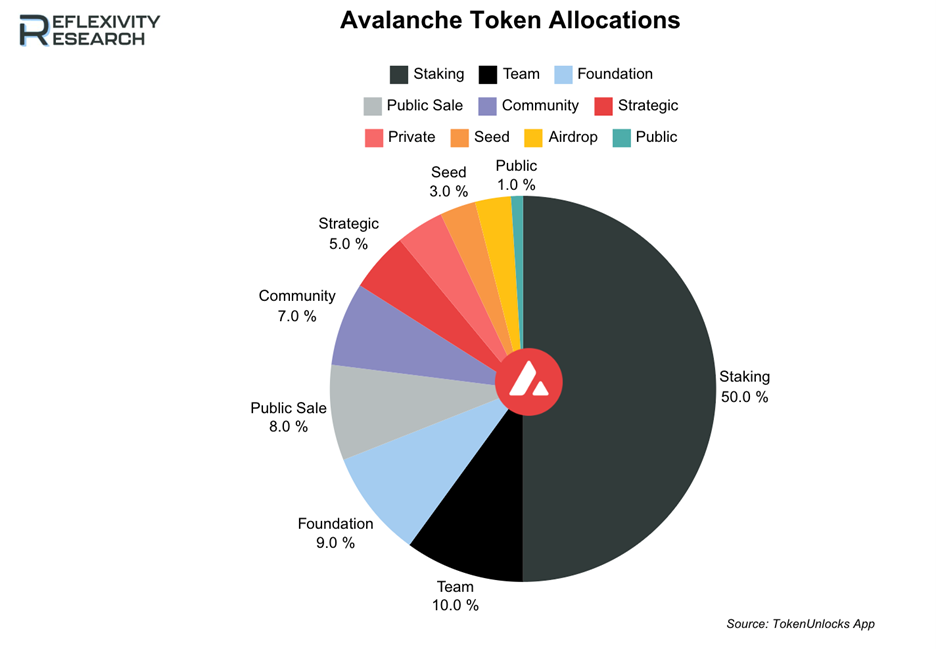

Lastly, the primary unlock event this week features Avalanche. Scheduled for February 22nd, $AVAX plans to release 2.60% of its circulating supply. This comprises $182.25m million for Team, $91.13m million for Strategic Partners and $67.51m million for the Avalanche Foundation. $AVAX’s vesting schedule is estimated to reach completion by October 20th, 2030.

Note: The content in this weekly report has also been utilized in our weekly collaborative series with stock/crypto trading platform eToro.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

View 50+ free reports on our homepage: reflexivityresearch.com