Major developments for the week:

Bitcoin ETF products saw a net inflow of $1.19 billion last week

Franklin Templeton files for Ethereum ETF

EigenLayer’s Total Value Locked (TVL) surpasses $6 billion after the deposit caps were raised on February 5th

Puffer Finance, a native liquid staking token on EigenLayer, surpasses $800 million in TVL

Dymension’s Token Generation Event (TGE) took place on February 6th

Wormhole announced that they will release their own native token ( $W )

On February 17th, ApeCoin will unlock 2.61% of its supply; a $22.47 million equivalent

Ethereum's upcoming network upgrade, Dencun, is set to launch on the mainnet on March 13.

$APT will unlock 9.5% of its circulating supply today

Solana’s Saga phone secured 100,000 orders ($45m) in just over one month

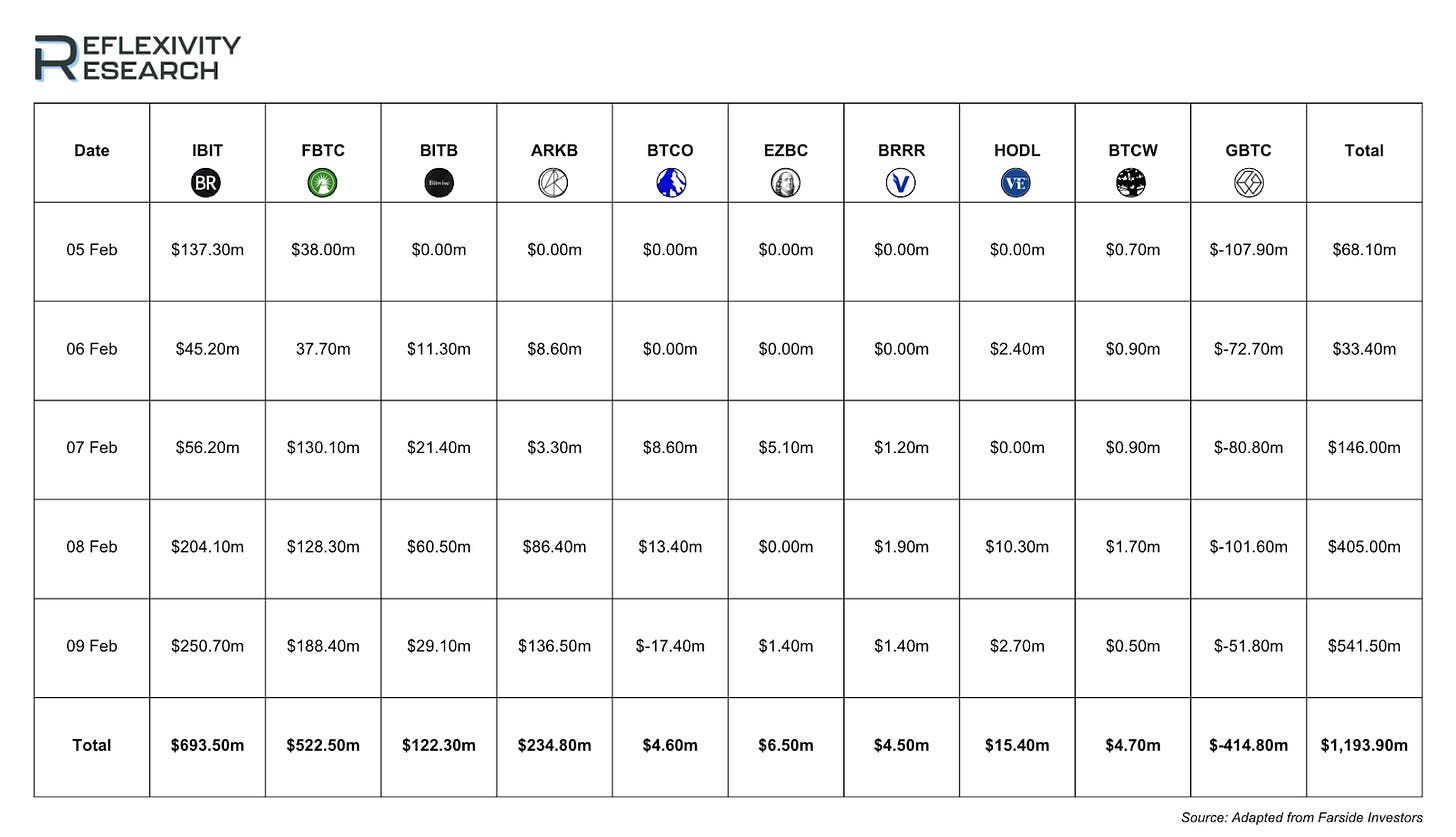

Bitcoin ETFs experience $1.19 billion net inflows last week

Last week, the trend of decreasing BTC outflows from Grayscale persisted, with the total outflows for the 7-day period reaching -$414.8 million, marking a 50% reduction compared to the previous week. Despite these outflows, BTC ETF products experienced net inflows of approximately $1.2 billion, nearly doubling the net inflows from the week before.

During this period, there's been a significant increase of approximately $1.5 billion in BTC CME futures open interest, a trend reminiscent of the weeks leading up to the official ETF approval.

Additionally, ETH CME futures open interest saw an increase of roughly $200 million. Monitoring this metric for ETH in the weeks leading up to the ETF deadline will be intriguing, in anticipation of a similar rise in open interest as observed with BTC in the weeks before its approval.

EigenLayer’s TVL soars after latest cap raise

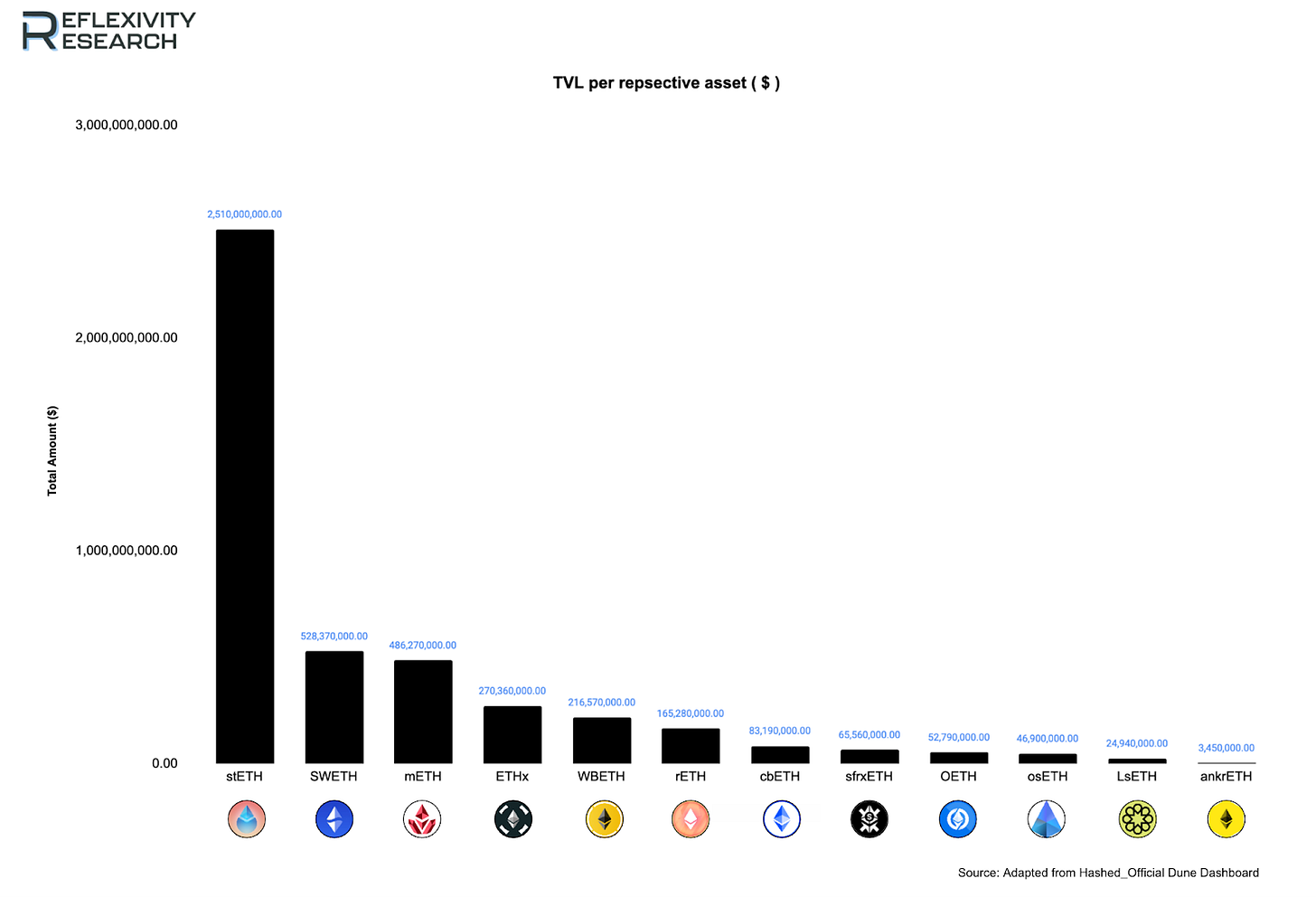

As discussed in our prior weekly reports, EigenLayer’s cap raise commenced on February 5th. This facilitated expanded capacity for both existing and new liquid staking tokens. New tokens introduced in this round included sfrxETH, mETH and LsETH.

Since the cap raise, EigenLayer has seen almost a 300% increase in TVL. Exact market share per liquid staking token in relation to TVL is depicted below.

Lido’s stETH currently accounts for over half of all EigenLayer TVL.

Justin Sun recently made a notable addition to Lido's TVL by depositing 109,327 stETH (valued at $259 million at time of deposit) into EigenLayer. Mantle’s mETH led the way for the new liquid staking token entrants meeting expectations after demonstrating substantial TVL growth post their double dose yield incentive which awarded them market leading APY and saw the protocol amass 466k ETH in a short period of time.

Wormhole announces native token $W

On February 7th Wormhole, a prominent platform enabling interoperability and supporting multichain applications and bridges, announced that they will be releasing a native token $W. Initially, the W token will be utilized for protocol governance through on-chain voting. Its potential future applications encompass adjusting fees across products, changing the token's utility and design, upgrading smart contracts, modifying rate limits, expanding the Guardian set and adding or removing chains. A total of 1.7billion tokens ( 17% of total supply) will be airdropped to the community, the snapshot has likely already occurred and the team has yet to release the specific qualification criteria. Below details the full token distribution;

Wormhole also noted that a comprehensive roadmap for progressive decentralisation will be crafted, drawing on insights from both Wormhole Core Contributors and the wider community. This joint initiative aims to make the journey towards decentralisation clear, inclusive and responsive to the community's insights and requirements.

ApeCoin will undergo a $22.47 million unlock on February 17th, 2024

Lastly, the primary unlock event this week features ApeCoin. Scheduled for February 17th, $APE plans to release 2.61% of its circulating supply. This comprises $10.58 million for Treasury, $6 million for Yuga Labs, $3.2 million for Yuga Labs founder, $2.29 million for Launch Contributors and $400k for Charity. $APE’s vesting schedule is estimated to reach completion by June 17th, 2026.

Note: The content in this weekly report has also been utilized in our weekly collaborative series with stock/crypto trading platform eToro.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

View 50+ free reports on our homepage: reflexivityresearch.com