Weekly Market Update #26

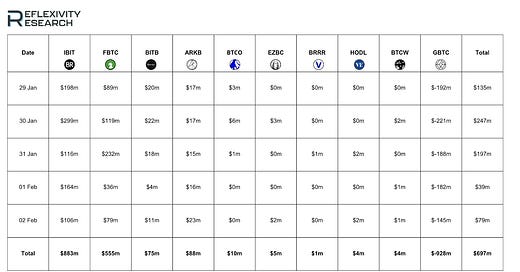

Weekly ETF net flows reach ~$700 million as Bitcoin hovers around $43,000

Major developments for the week:

Bitcoin ETF products see net inflow of $697 million last week

Genesis Global Capital has submitted a request to the U.S. Bankruptcy Court for the Southern District of New York for permission to sell around $1.6 billion in trust assets. This includes about $1.4 billion in GBTC and roughly $165 million in Grayscale Ethereum Trust

FTX has requested court approval to sell its ~8% share in the AI firm Anthropic, valued at $18 billion, equating to a stake worth around $1.4 billion

President Nayib Bukele of El Salvador was re-elected with 87% of the vote. Vice President Felix Ulloa confirmed that Bitcoin would remain legal tender during Bukele's second term, with ongoing plans for Bitcoin bonds, cities and passports

Financial Times have reported that BlackRock, Fidelity, Grayscale, Invesco and Bitwise are advertising Bitcoin spot ETFs on Google, in line with its policies that permit crypto exchange and wallet ads but ban ICO promotions

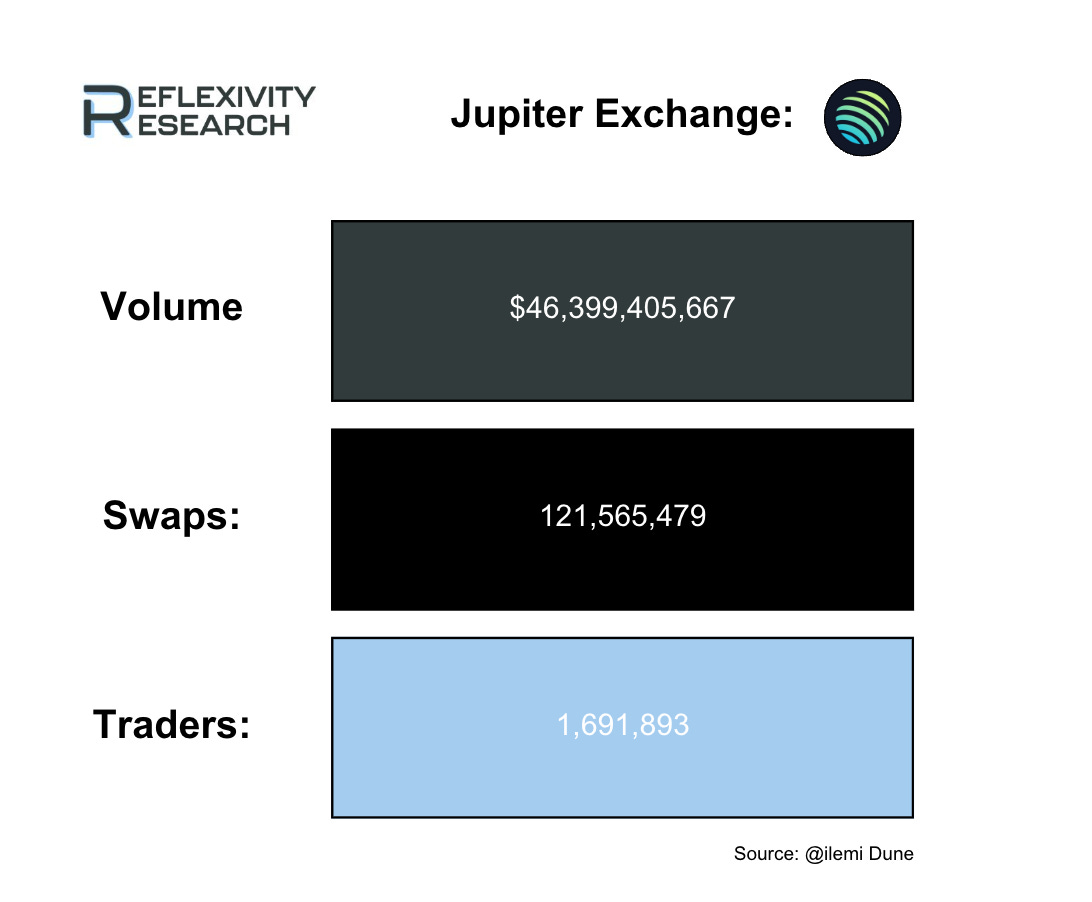

Jupiter ($JUP) completed its token generation event and is now 70% claimed

Puffer Finance surpasses $400 million in Total Value Locked (TVL)

Pendle’s TVL surpasses $900 million

Aptos is scheduled to unlock 7.34% of its circulating supply on February 11th

Bitcoin ETFs experience $697mm in net inflows last week

Last week marked a reduction in BTC outflows from Grayscale, following our previous report of $2.2 billion outflows from January 29th to February 2nd. The recent figures show a decrease of nearly $1.3 billion, bringing the total outflows to $928 million. Leading the inflows was Blackrock's IBIT with $883 million, while Fidelity followed in second with $555 million.

Meanwhile, Genesis Global Capital has submitted a request to the U.S. Bankruptcy Court for the Southern District of New York for permission to sell around $1.6 billion in trust assets. This includes about $1.4 billion in GBTC and roughly $165 million in Grayscale’s Ethereum Trust.

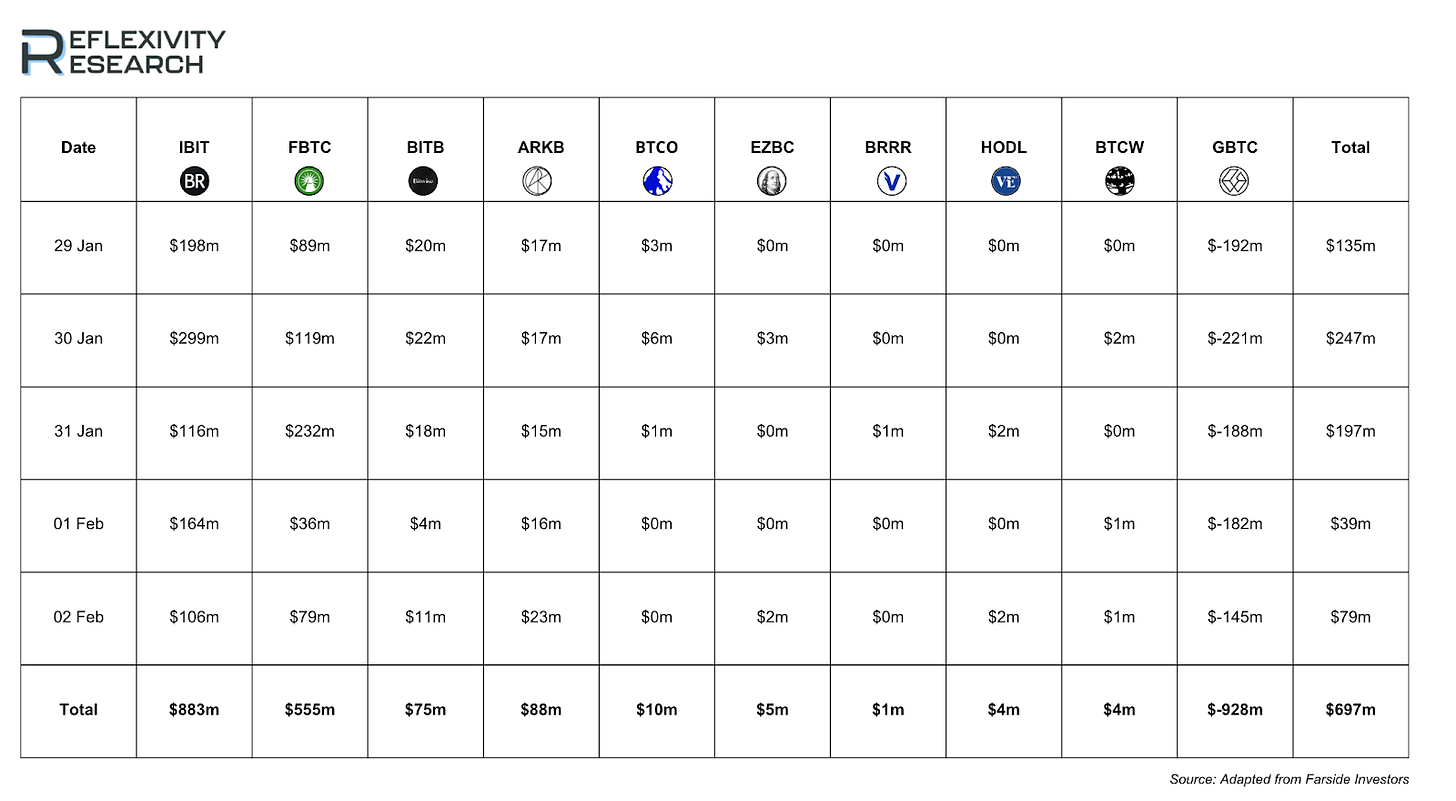

After a sharp decline post ETF launch, this week we saw a continued upward grind in the cumulative return by session during US hours. This can be largely attributed to the reduction in outflows from Grayscale that dominated the initial weeks of trading post ETF approval.

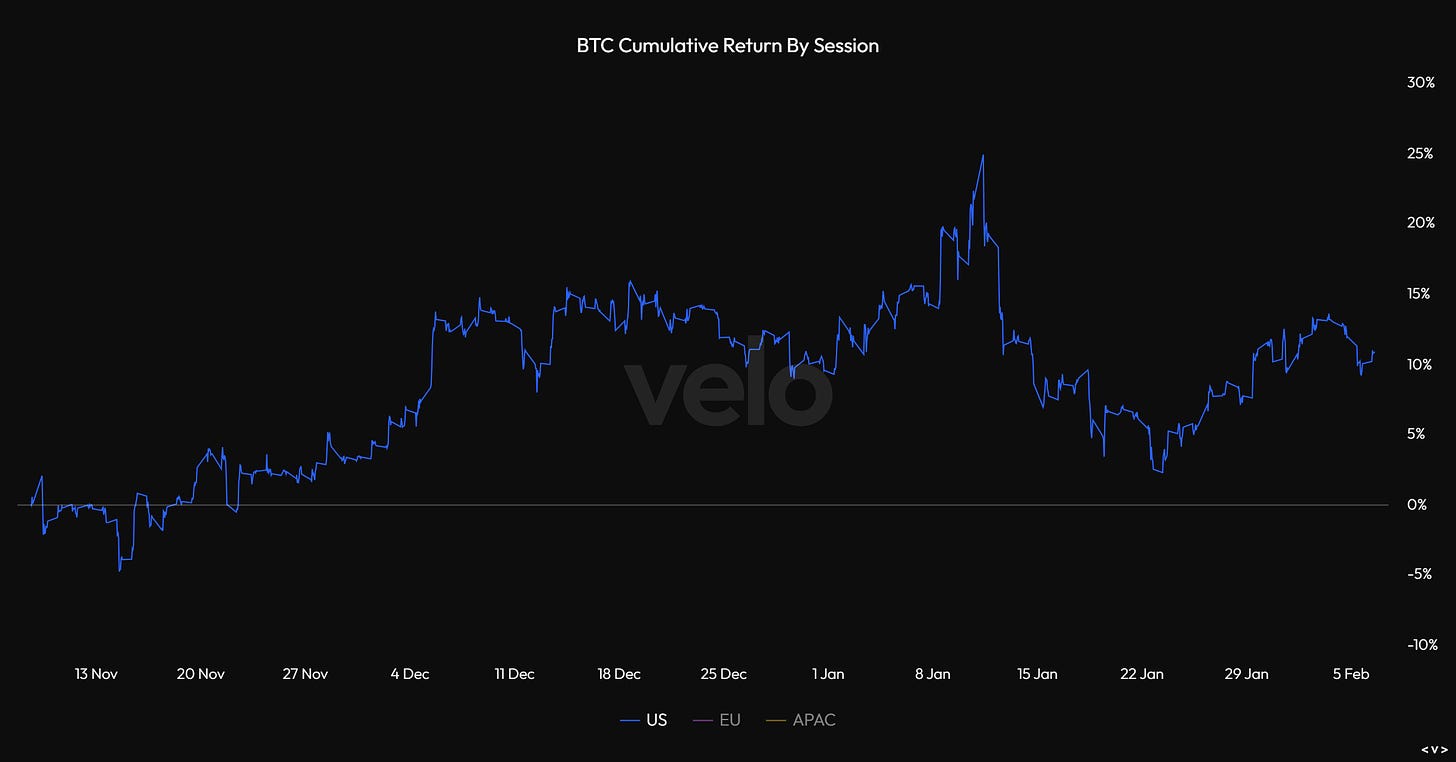

Jupiter concludes its airdrop

One of the major events of last week surrounded Jupiter’s highly coveted airdrop.

The airdrop concluded last week at 10:00 am EST January 31st. Prior to the airdrop, pre-market platforms such as Aevo gave an insight as to the price action and demand of the token, with the majority of trading taking place between 50-60 cents. Upon launch the token debuted on decentralized exchanges at approximately 40 cents or a $4 billion fully diluted valuation. Since its launch, 70% of the tokens have been claimed across 484,047 wallets, totaling 693,994,550 $JUP tokens.

Puffer Finance accumulates more than $400 million in TVL

As highlighted in our previous weekly report, EigenLayer is set to increase the limits for its existing and newly issued Liquid Staking Tokens today at 12 PM PT. Within the EigenLayer ecosystem, Puffer Finance has emerged as a rapidly growing project.

Puffer Finance, which provides a decentralized, permissionless native liquid restaking protocol that merges Ethereum's liquid staking with EigenLayer's restaking, has exceeded a TVL of $400 million. This significant increase in TVL occurred shortly after Binance Labs announced its investment in Puffer. Other notable financial contributions include a $120,000 grant from the Ethereum Foundation, a $650,000 pre-seed investment led by Jump Crypto and a $5.5 million seed funding round jointly spearheaded by Lemniscap and the collaboration between Lightspeed and Faction.

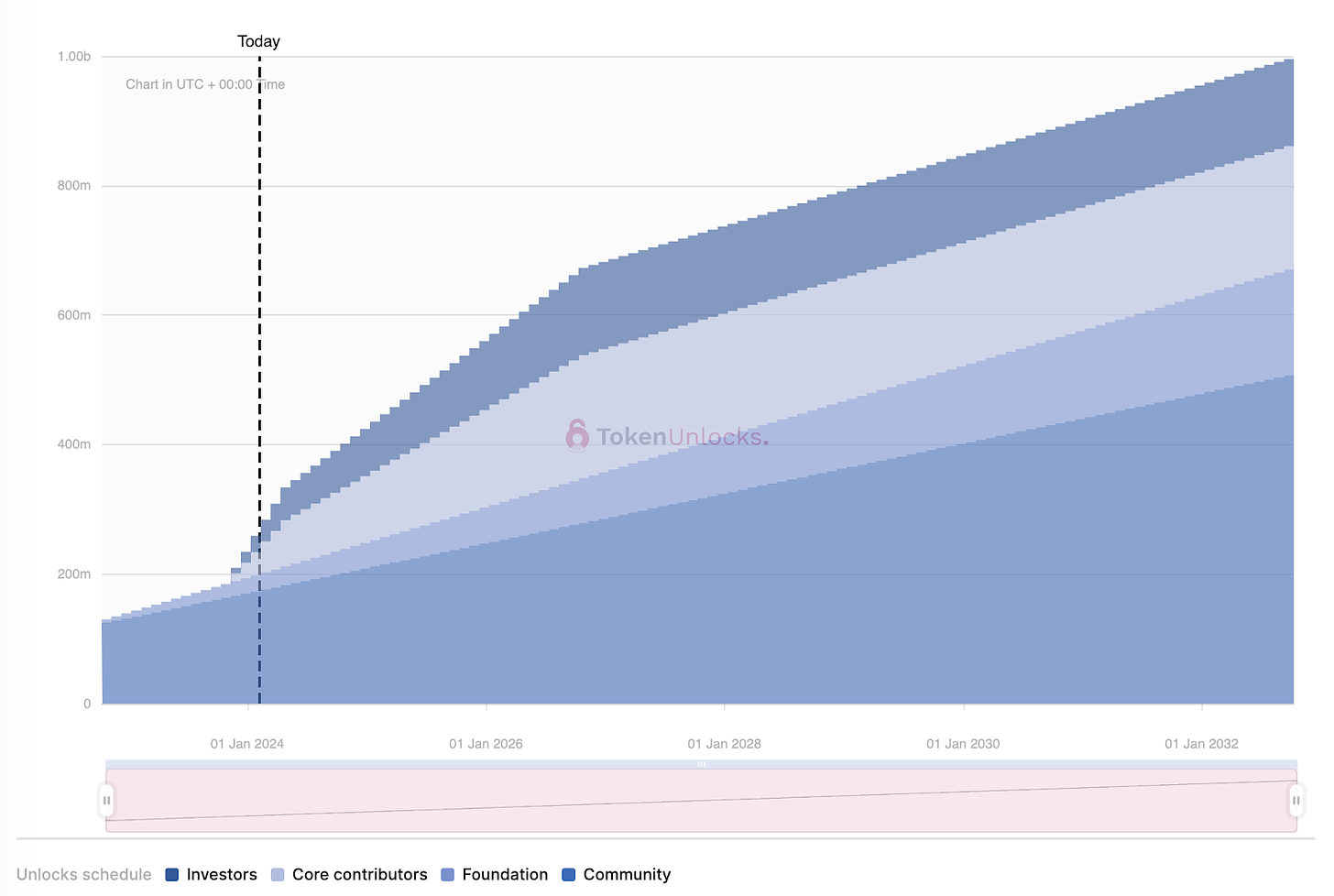

Aptos will undergo a $228.55 million unlock on February 11th, 2024

Lastly, the primary unlock event this week features Aptos. Scheduled for February 11th, $APT plans to release 7.34% of its circulating supply. This comprises $109.25 million for Core Contributors, $77.5 million for investors, $29.53 million for community and $12.27 million for the foundation. $APTs vesting schedule is estimated to reach completion by March 9th, 2032.

Note: The content in this weekly report has also been utilized in our weekly collaborative series with stock/crypto trading platform eToro.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

View 50+ free reports on our homepage: reflexivityresearch.com

What is Jupiter though?