Major crypto developments for the week:

FTX sells over $1 billion in GBTC as total outflows top 50,000 BTC

US trading hour premium gets slashed amidst market sell-off

CME Bitcoin futures open interest drops over $1 billion as annualized futures basis drops to 6%

Alameda Research drops Grayscale lawsuit

2023 brought in 150 million new crypto users according to research from Crypto dot com

Bitcoin ordinals-based art piece 'Genesis Cat' Sells for $254,000 at Sotheby's

Ethereum L2 Blast launches testnet

Ethereum developers deploy Dencun upgrade on Goerli testnet

Real world asset protocol Ondo Finance launches $ONDO token

Chainlink integrates Circle’s CCTP for cross-chain USDC transfers

US Trading Hour Premium Drops Sharply

The story of H2 2023 was US driven flows front-running the Bitcoin spot ETF approvals. Since the day that BTC spot ETFs began trading, we have seen these flows reverse, with the US trading hour premium that fueled the rally to $49K having sharply dropped off, now below that of the APAC region. Why is this the case?

Grayscale Flows Dominate Market Structure This Week

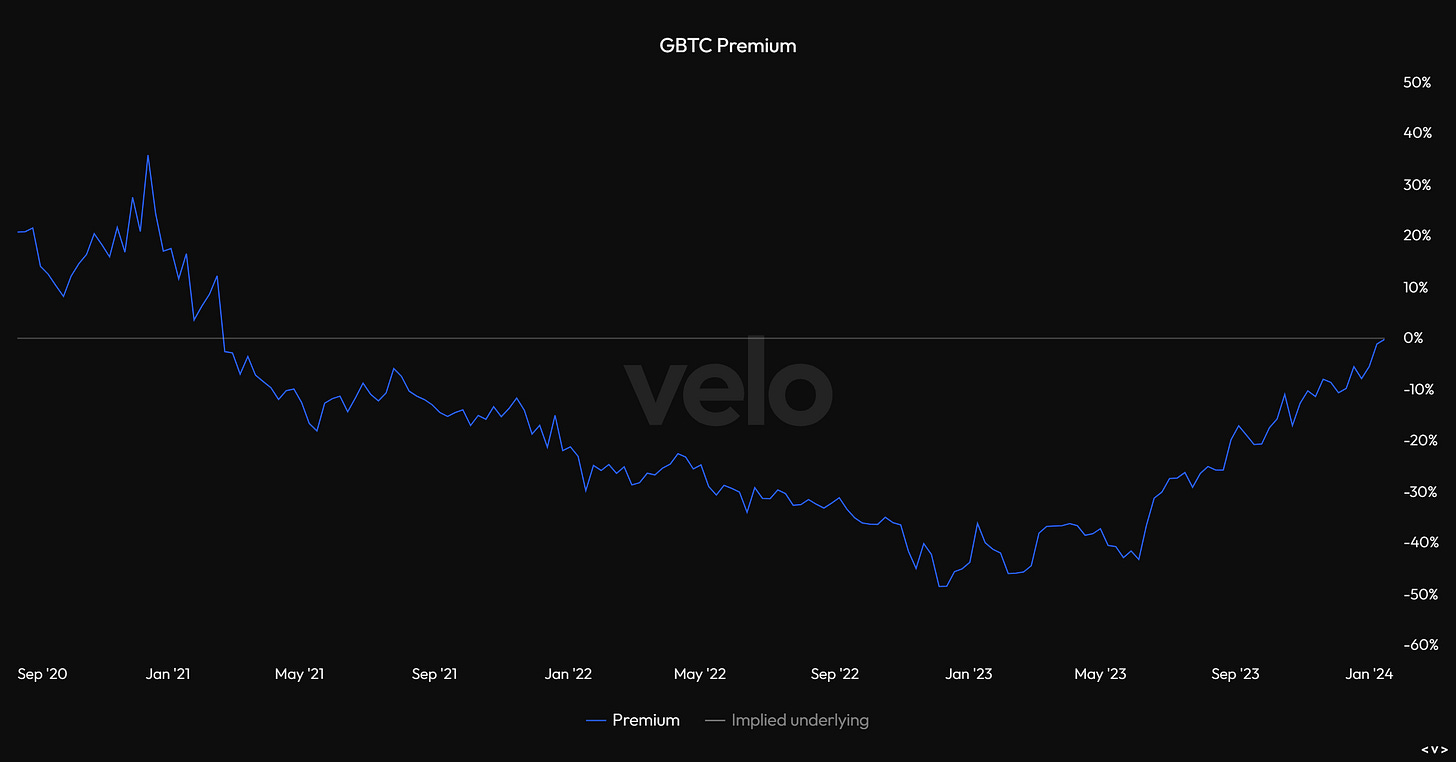

The answer is that US sessions have been dominated by the selling of GBTC, particularly in early morning hours. With GBTC’s discount to NAV, which at one point reached as low as -48%, now sitting at par, previously underwater investors and funds arbitraging the discount have begun offloading their GBTC holdings, causing immense sell pressure in the Bitcoin spot market.

Below we have the on-chain GBTC balance according to Glassnode’s datasets, showing that GBTC’s Bitcoin holdings have declined by just over 50,000 BTC; the equivalent to $2 billion at a $40,000 Bitcoin price. On Monday morning it was revealed that $1 billion of this had come from the FTX bankruptcy estate offloading its GBTC holdings, according to private data obtained by Coindesk.

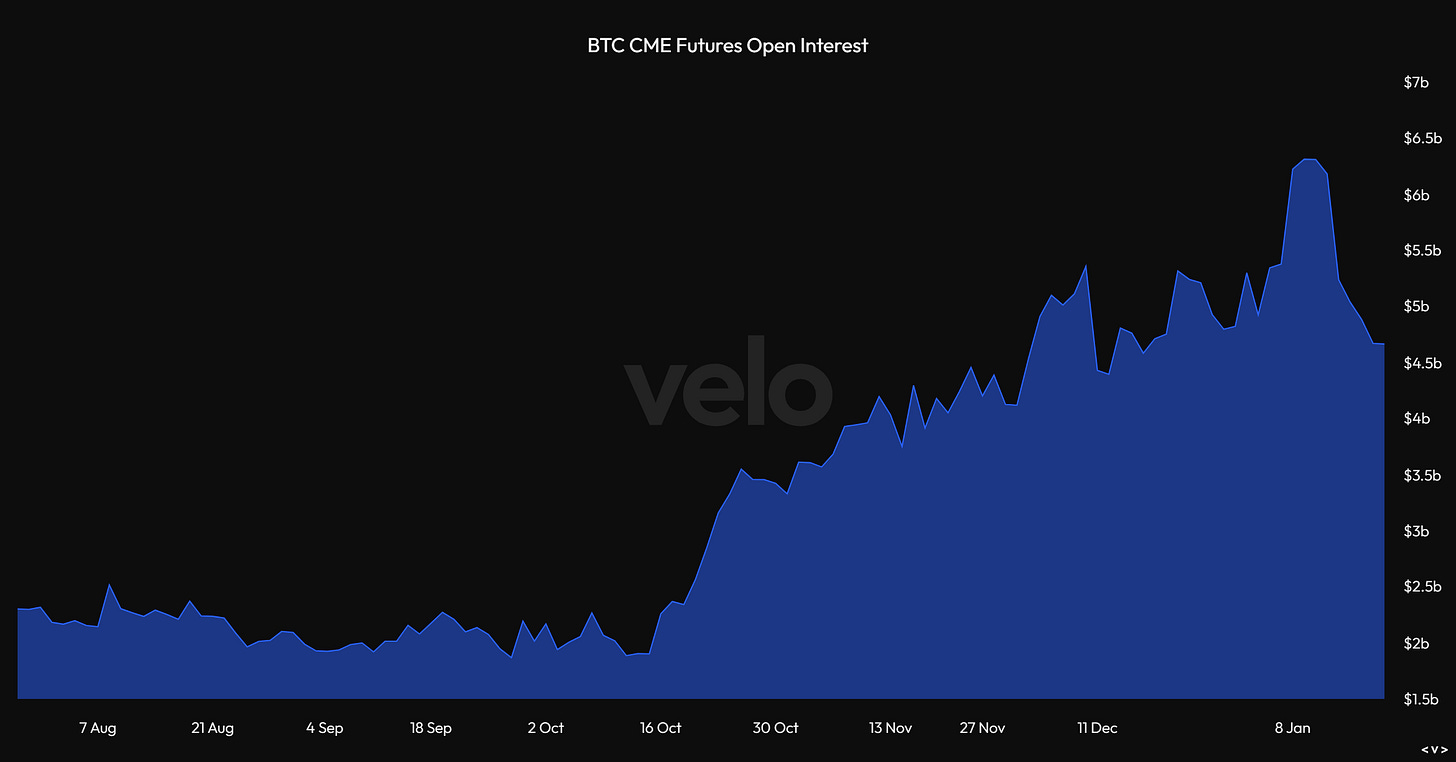

We have also seen an unwinding of Bitcoin CME futures open interest, declining by over $1.5 billion as the annualized basis has dropped to as low as 6%, after reaching levels upwards of 20% prior to ETF approvals/launches. This illustrates an unwinding of longs betting on ETF approval as well as entities that had been using BITO/CME futures as a liquidity bridging vehicle leading into the ETF launches.

Bitcoin ordinals-based art piece 'Genesis Cat' Sells for $254,000 at Sotheby’s

A big piece of news for the world of ordinals came out Monday with "Genesis Cat," created by the Taproot Wizards team, sold for $254,000 in a Sotheby's auction. Genesis Cat was a 1-of-1 piece by Taproot Wizards artist Francisco "FAR" Alarcon and was part of a broader ordinals auction by Sotheby’s, which began on January 12th and ended on Monday. According to CoinDesk, in total the 19 lots in the ordinals auction generated roughly $1.1 million proceeds. It will be interesting to see whether the excitement around ordinals persists and what the implication of this activity will mean for miners and the network more broadly.

Ethereum developers deploy Dencun upgrade on Goerli testnet

Lastly, the highly anticipated EIP-4844 mainnet launch appears to be inching closer as Ethereum developers deploy the Dencun upgrade on the ETH Goerli testnet. EIP 4844 introduces proto-danksharding to the network, which should reduce transaction fees for L2s, in theory allowing ETH to scale and on-board new users who have been priced out by high base layer fees. The next steps from here are to deploy on the Sepolia testnet over the coming weeks, followed by the Holesky testnet. This will be the biggest upgrade to Ethereum since the Shapella upgrade that took place last year.

Note: The content in this weekly report has also been utilized in our weekly collaborative series with stock/crypto trading platform eToro.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

View 50+ free reports on our homepage: reflexivityresearch.com