Weekly Market Update #22

Filers reveal fee structures as Bitcoin ETF decision deadline is tomorrow

Sign up for a free Bitcoin 2024 outlook webinar on January 16th with our co-founders Will Clemente and Anthony Pompliano: https://lu.ma/BTC2024

Major developments for the week:

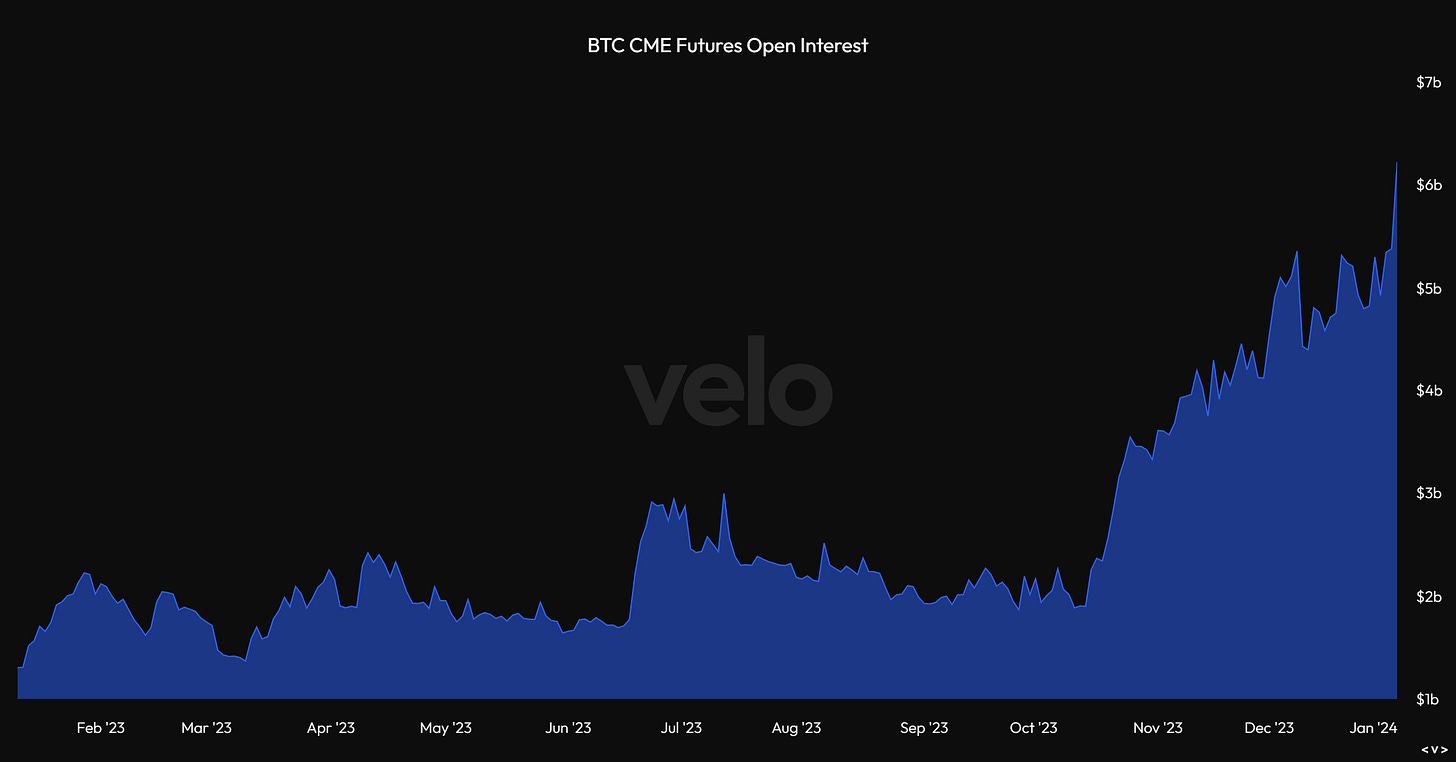

BTC CME futures open interest reaches new all-time high

January 10th will mark the final deadline for the SEC’s decision on ARK/21Shares’ spot Bitcoin ETF filing

BTC ETF applicants have filed S-1 amendments outlining their fees

CBOE to launch margined Bitcoin and Ethereum futures on Thursday the 11th of January

Ethereum L2 Arbitrum’s 24-hour decentralized exchange volume briefly flips that of the Ethereum base chain

Friend Tech’s average daily transactions for a 1-week period drops to 4,000

APT to unlock 8.05% of the circulating supply on Friday the 12th

This week is poised to be one of the most pivotal moments in the history of digital assets as the deadline and conclusive decision for approval or rejection of the Bitcoin ETF rapidly approaches.

Bitcoin CME futures open interest remains at all-time highs

Something that we have been paying close attention to over prior weeks and months has been Bitcoin’s CME futures open interest. At present we are sitting at a new yearly high with open interest having surpassed $6 billion, the highest level ever. This has been rising steadily as we approach the final decision for the Bitcoin ETF applications. There are two thoughts that could be drawn from this: On one hand, these positions may be closed around ETF approval as funds look to “sell the news”. On the other hand, if this was the case, why have these positions not begun to close out already? This could be explained by market participants using BITO/CME as a liquidity bridging vehicle for Bitcoin exposure.

Bitcoin ETF applicants file S-1 amendments outlining their fee structures

This morning we witnessed the spot Bitcoin ETF applicants file their amended S-1 forms and with these amendments, the fee structures for each respective filing. Title for the lowest long-term fee is held by Bitwise at 0.24%. Blackrock has suggested 0.20% for the first 12 months or until the $5 billion mark has been met and 0.30% thereafter. ARK and Bitwise have stipulated 0% for 6 months or until the $1 billion threshold has been passed. With a race for AUM/volume/liquidity, it will be interesting to see how the ETF race plays out, should these filings all be approved by the SEC. It will also be interesting to monitor crypto native exchanges responses to these proposed fees by their traditional finance counterparts.

The initial capital provided to seed these ETFs is also shown below, with Grayscale leading the way, followed by Bitwise.

Best and worst performers of the week

Best performers of the week include STX, which continues to perform well as BTC beta leading into the ETF with its relative pair being up 150% since the end of November 2023, as well as AKT OSMO and TIA. Top losers of the week are HNT, BSV, RNDR, and FIL.

US continues to lead with cumulative return by session

US sessions have continued to lead the charge over the prior week in terms of cumulative return; with EU trading hours continuing to clearly fall behind.

Friend Tech’s average daily transactions for a 1-week period drops to 4000

In recent months, socialfi application Friend Tech has experienced a significant decline in volume, total value locked, and overall activity, compared to its peak in October 2023. In the past week, total daily transactions averaged out to 4,000 per day, a stark contrast to over 100,000 daily transactions at the height of its popularity. Furthermore, the total value locked on FT has fallen by 50% from its peak, now standing at $33 million. Monitoring this data will be interesting as we approach the launch of Friend Tech V2, which is proposed for spring 2024.

Arbitrum’s decentralized exchange volume briefly surpasses Ethereum’s

Ethereum layer two Arbitrum’s fundamentals continue to improve alongside its price appreciation ahead of the future EIP-4844 upgrade; which is expected to reduce fees for L2s. Last week we witnessed Arbitrium's total value locked surpass $10 billion with today's total value locked sitting at $9.5 billion. Last Friday, Arbitrum’s 24 hour decentralized exchange volume hit $1.83 billion, almost $400 million more than the Ethereum base chain’s volume for that day.

CBOE to launch margined Bitcoin and Ethereum futures

Starting January 11, CBOE Digital, an arm of the Chicago Board of Options Exchange, will initiate the trading of margined Bitcoin and Ether futures. This move, sanctioned by the Commodity Futures Trading Commission in June, positions CBOE Digital as the inaugural regulated U.S. platform to amalgamate spot and leveraged derivative trading on one platform.

APT to unlock 8.05% of the circulating supply on Friday the 12th of January

APT is scheduled to release 8.05% of its circulating supply three days from now. This is 2.4% of its total supply or $224.58 million USD equivalent. It is noteworthy that the above unlock schedule does not account for staking rewards that Aptos increases with every completed epoch by their validator.