Major crypto developments for the week:

Bitcoin currently #1 chain by transaction fees over the last 7 days

Two weeks out from final deadline for the SEC’s decision around a potential Bitcoin ETF

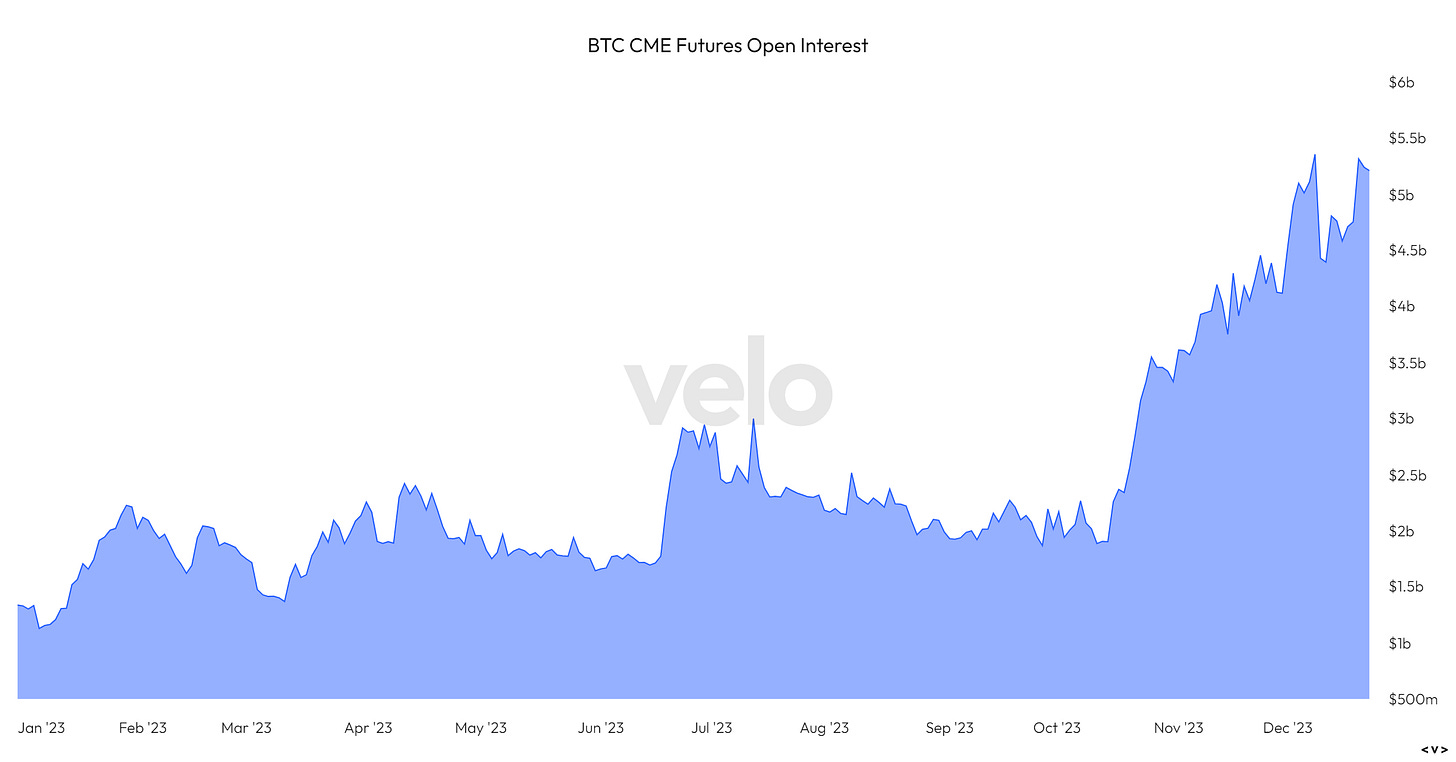

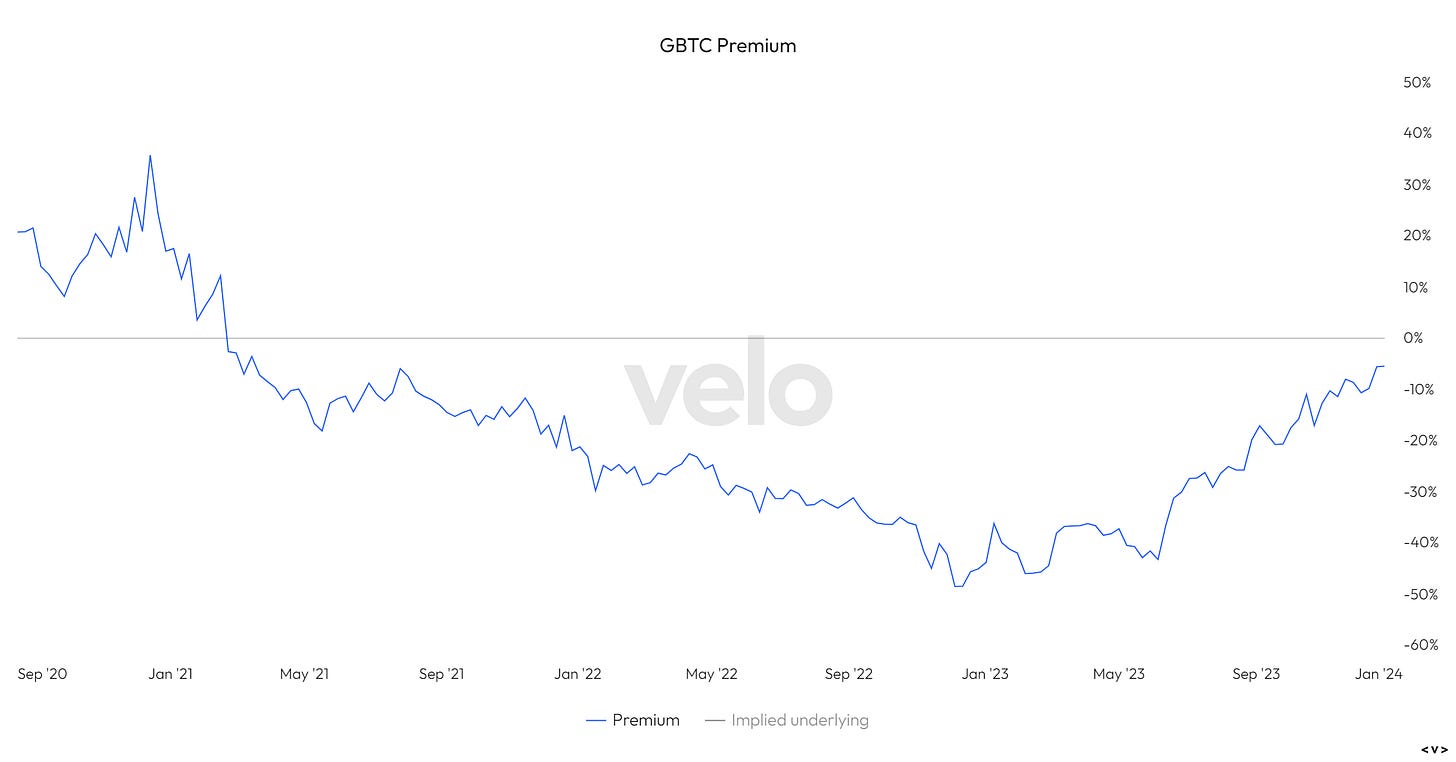

Bitcoin CME futures open interest back above $5 billion as GBTC discount breaches 6%

It has now been 234 days since a 25% drawdown for Bitcoin in the last 12 months, longest since 2011

Solana sits at #1 by DEX volume by layer one

DCG’s Barry Silbert resigns from board of Grayscale Investments

British Virgin Island freezes $1 billion of assets from Three Arrows Capital

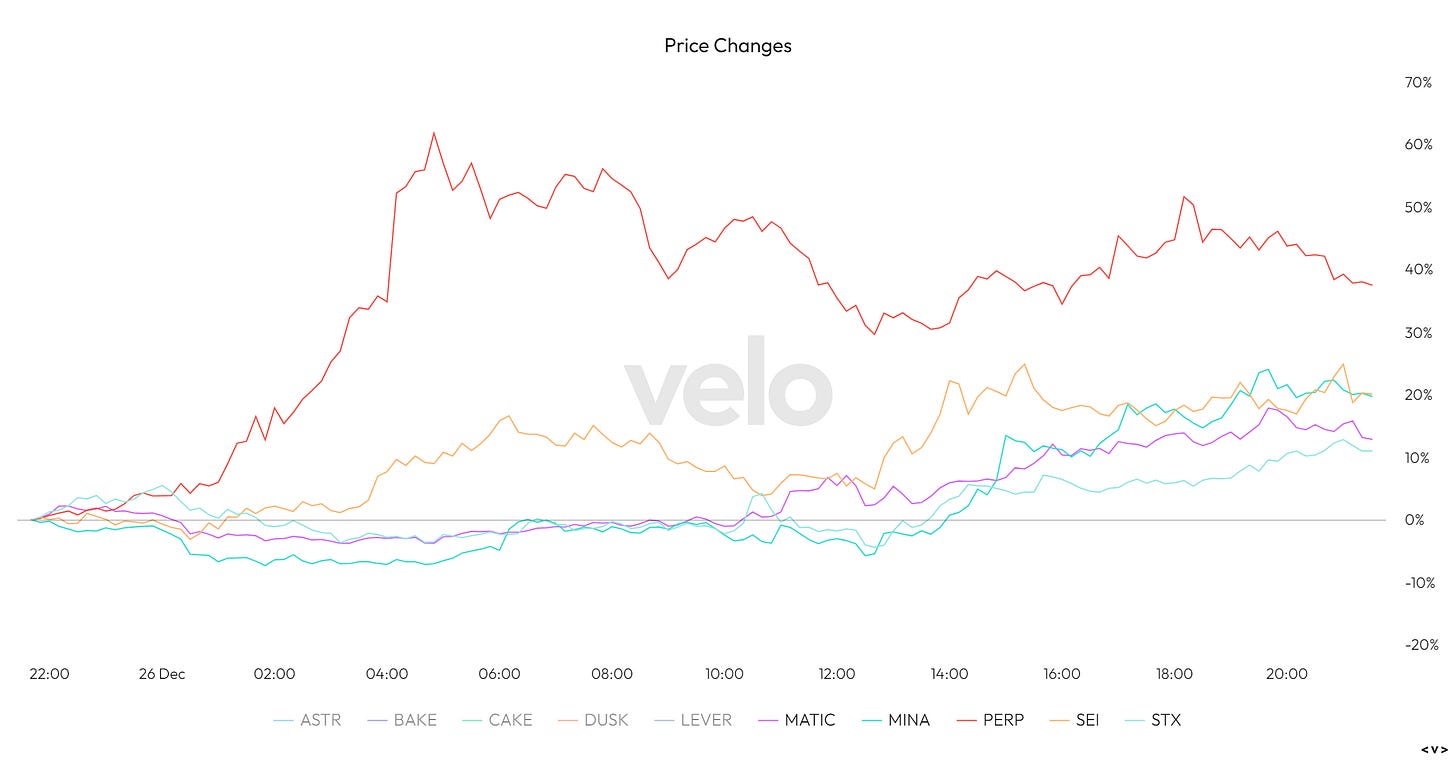

Matic, Mina, Sei, STX, Perp amongst top price performers for the week

JMP Securities calls Coinbase “the Amazon of crypto”

Amongst the top price performers of the week, noteworthy names include MATIC, Mina, Perp, Sei, and STX.

With altcoins flying across the board, it is important that currently the market has not experienced a 25% drawdown over the last 12 months in 234 days, the longest streak since 2011. This signals an increasing likelihood for short-term market volatility to shake out market participants, particularly those positioned through leveraged longs in the futures market. While short term price is difficult to predict, it is important to be cognizant of the increasing levels of market froth without any major price drawdowns during the latter half of the year.

Source: TradingView, Capriole Investments

Solana has continued its impressive hot streak, both in terms of price performance as well as network activity. As shown in the table below, this week Solana took the #1 spot from Ethereum for decentralized exchange volume over the last 24 hours as well as 7 days. Fueled by spiked interest due to price action, newly launched projects, and numerous memecoin rallies, this signals increasing willingness from market/network participants to conduct activity on Solana relative to other smart contract platforms.

Source: DeFiLlama

In addition to flipping Solana on DEX volumes, Solana relative to Ethereum (SOL/ETH ratio) is nearing its 2021 all time highs. Up over 500% from its lows, the SOL/ETH ratio came within 10% of reaching all-time highs this week.

Meanwhile, the rise of Bitcoin transaction fees has remained prevalent, with Bitcoin posting the largest 7 day cumulative transaction fees of any blockchain network at over $100 million.

Source: TokenTerminal

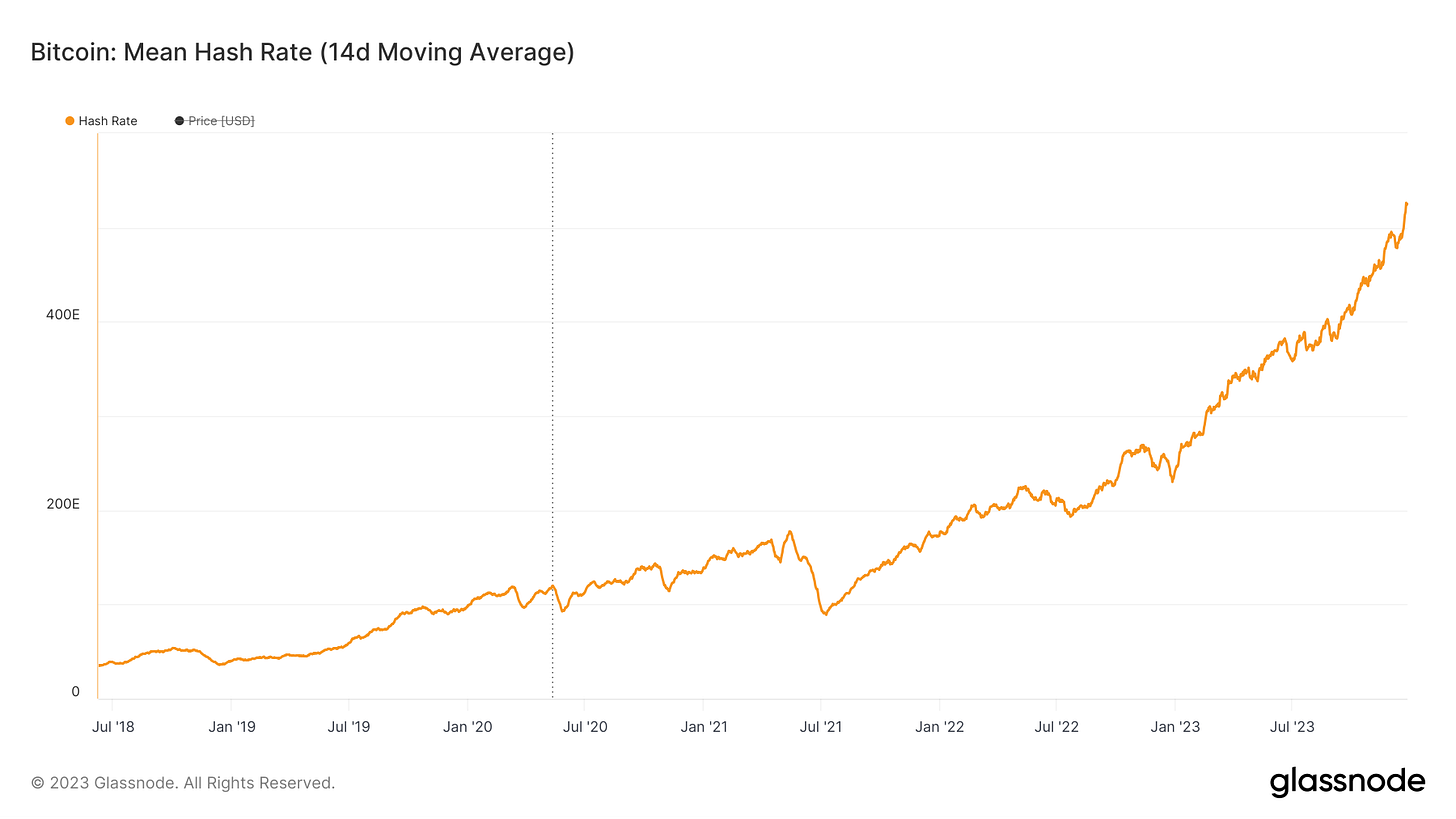

As mentioned in prior updates, this influx of miner revenue incentives more operators to plug in machines to capture a larger portion of the transaction pie. Hash rate has once again grown this week, pushing to new all-time highs. While in addition to more energy being utilized to secure the network, hash rate is a reflection of more efficient mining rigs being plugged in that produce more hashes for less energy expenditure.

Source: Glassnode

Shifting over to the derivatives market, the Bitcoin CME futures open interest that we’ve been tracking closely for several months since the initial Blackrock ETF filing has climbed back above $5 billion. This likely reflects traditional financial players that have put the Bitcoin ETF front running trade on, and will be important to watch given the all time high percentage of Bitcoin’s total futures open interest that the CME currently holds; meaning that CME activity is more relevant than ever for Bitcoin’s price action.

Lastly, the GBTC discount continues to close in, now within 6% of net asset value. This also reflects strong sentiment around expectations of a Bitcoin ETF approval in early January.

Source: Velo