Major crypto developments for the week:

Blackrock seeds ETF with $100K, adding evidence to there being a high likelihood of ETF approval

Bitcoin undergoes sharp correction after breaching $44k and achieving 8 consecutive positive weekly returns for the first time since mid 2017

MVRV shows that on a multi-year view Bitcoin still far from “overvalued” territory

Google search trends show that there is still a lackluster of retail exuberance in the crypto market

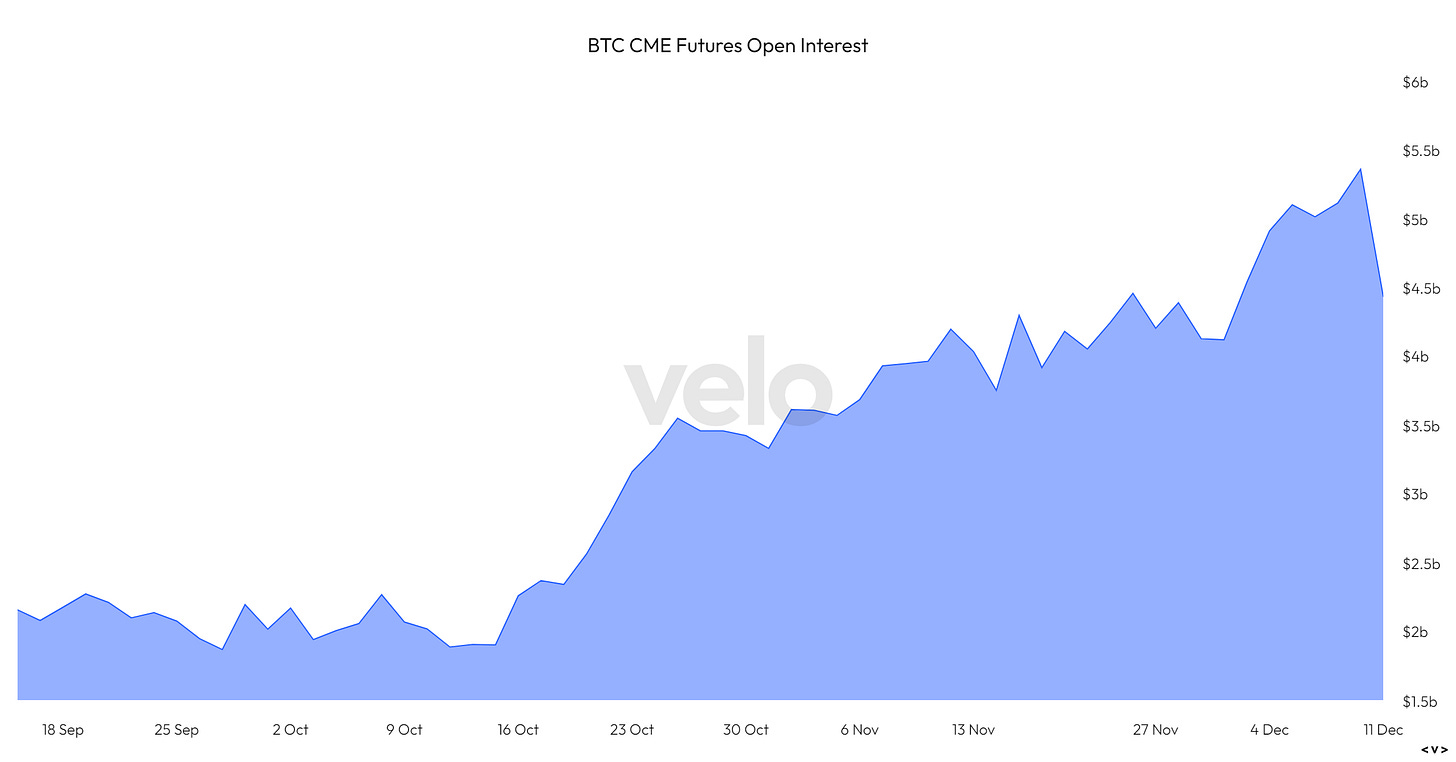

CME futures open interest for Bitcoin reaching all time highs of over $5 billion, draws down by $930 million briefly after

Bitcoin enters top 10 largest global assets

Failed Terra Luna founder Do Kwon extradited to the United States

Jito, a liquid staking protocol on Solana, airdropped 10% of its maximum token supply ($JTO) to community members

Blackrock seeds ETF with $100K, adding evidence to there being a high likelihood of ETF approval

This week we got further color on developments around the anticipated Bitcoin ETF. In Blackrock’s most recent updated filing it was revealed that they had received seed funding for their potential ETF. In the context of an ETF, seed funding refers to the initial capital allocated towards the initial creation of shares to be traded once the vehicle goes live in public markets. The filing revealed that the seed investor agreed to purchase $100,000 in shares on October 27, 2023 and took delivery of 4,000 shares at a price of $25 per share. While the outright number of $100,000 in seed capital is not a remotely significant number, this adds further evidence of the expectation for approval by the upcoming January 10th decision deadline.

Bitcoin undergoes sharp correction after breaching $44k and achieving 8 consecutive positive weekly returns for the first time since mid-2017

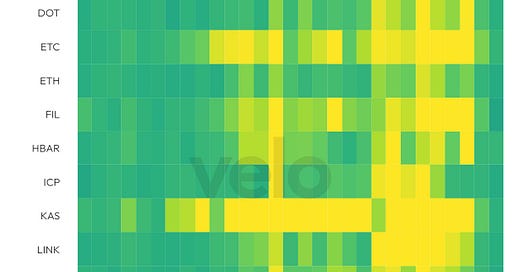

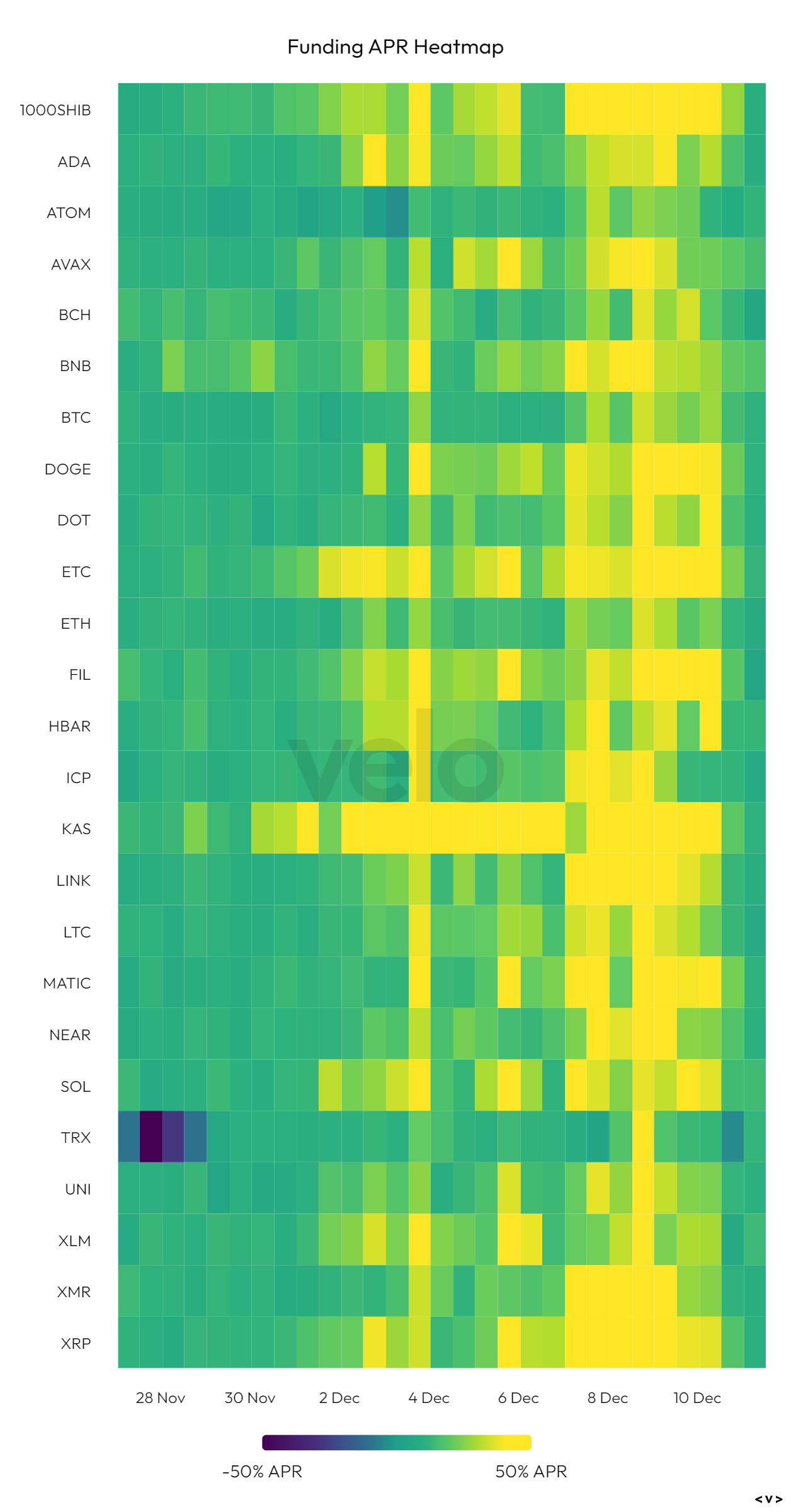

After 8 positive consecutive positive weeks pushing Bitcoin to yearly highs of exactly $45,000, the leading digital asset underwent its largest peak to trough correction so far since early September; down from $45,000 to just above $40,000. This correction wiped out hundreds of millions in open interest in short order, signaling that leveraged longs in the futures market were liquidated. Below we can see a heatmap of funding rates, which are based on the delta between the spot and futures market. After this recent move we can see a shift in the heat map for large cap crypto assets from bright green (high funding rates) to darker green, showing the funding rates have undergone a healthy neutralization. In laymen’s terms this means that at the moment the futures market has cooled off from a state of high exuberance.

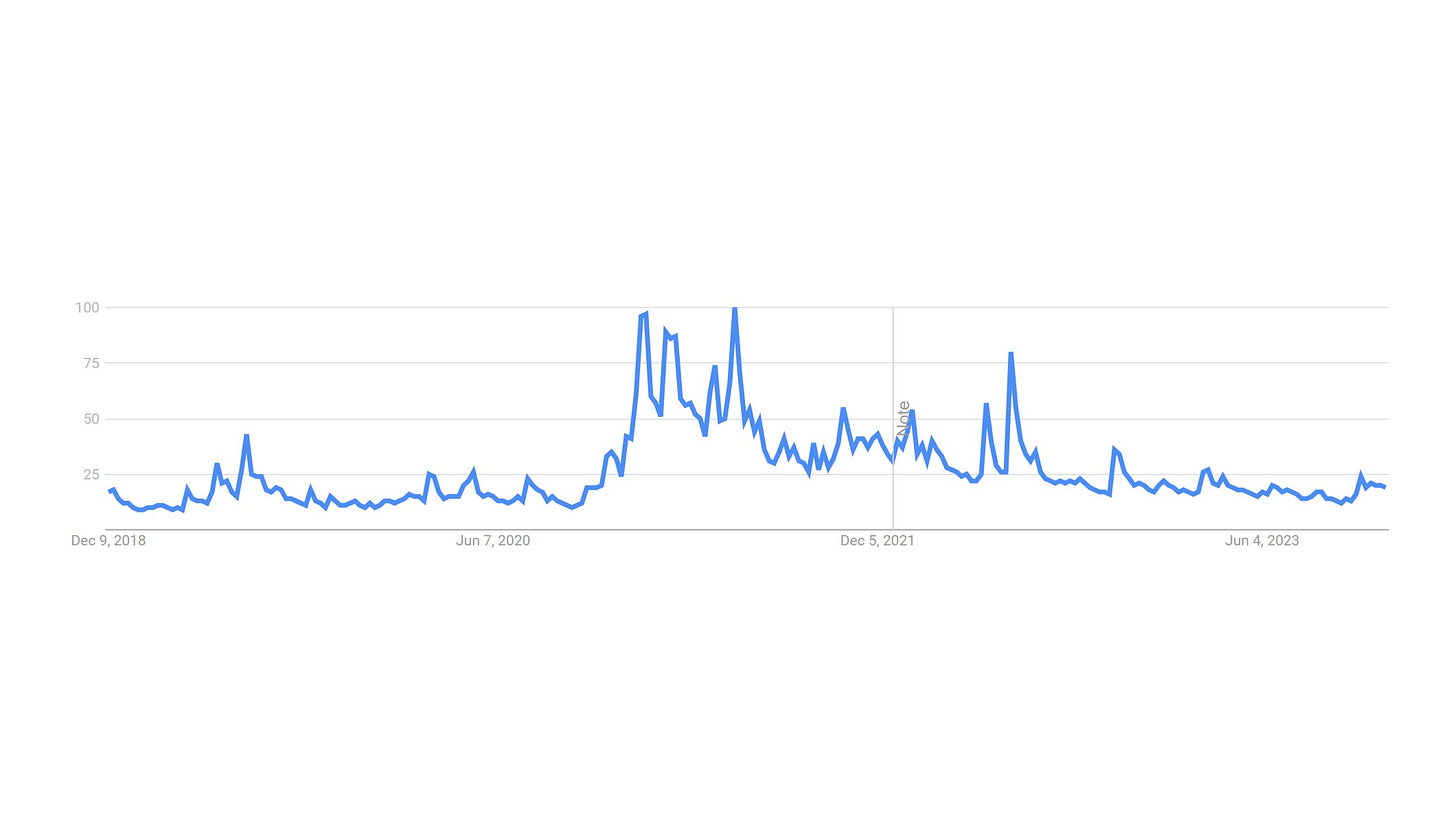

Google search trends show that there is still a lackluster of retail exuberance in the crypto market

On a similar note, looking at google search trends for “Bitcoin” we can see that the market is still far from levels of euphoria and retail speculative activity that was previously reached during cyclical Bitcoin peaks.

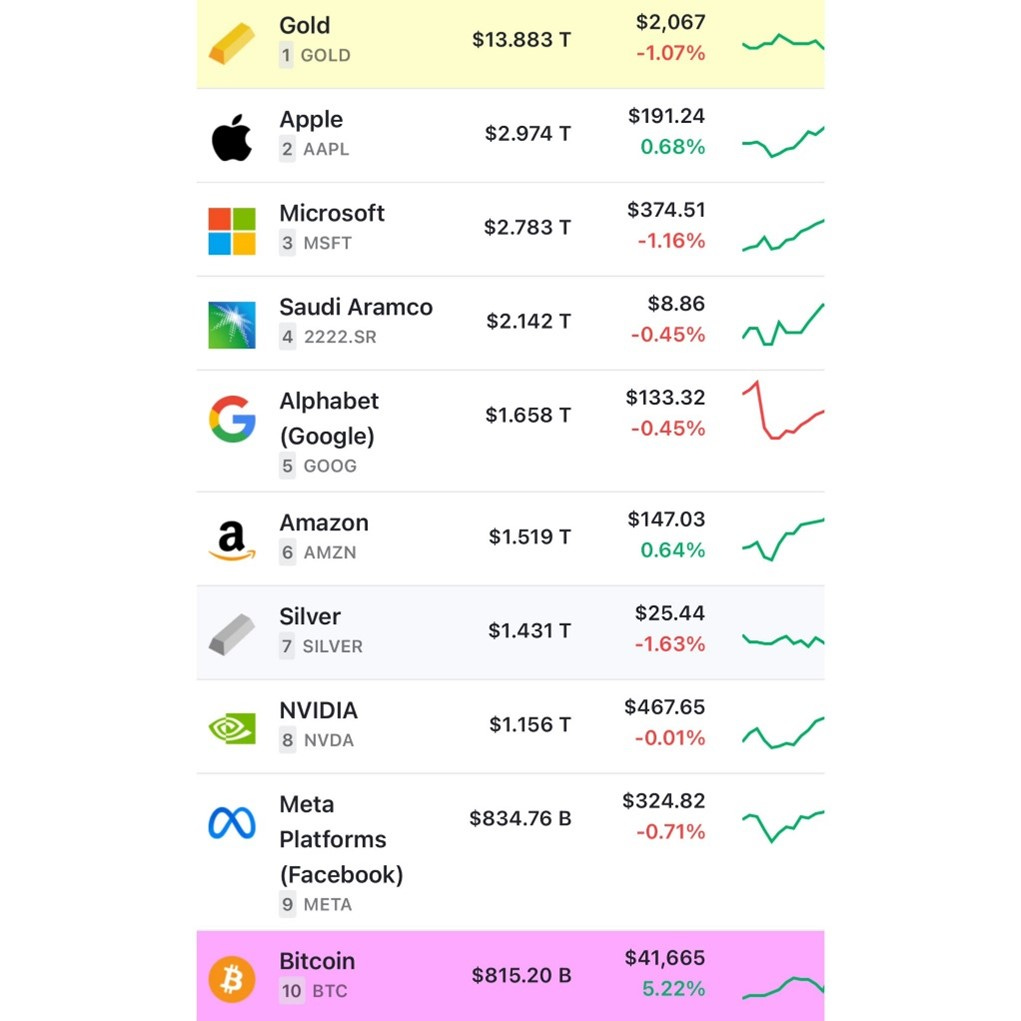

Bitcoin enters top 10 largest global assets

With Bitcoin’s recent price action to the upside, the leading digital asset crossed back into the top 10 largest assets by market capitalization. Breaching $800 million in market capitalization, Bitcoin surpassed for the #10 slot and now sits behind other major assets such Gold at ~$14 trillion, Silver at $1.5 trillion, and Apple at $3 trillion. This reflects Bitcoin’s growing relevancy and legitimacy as a global macro asset.

State of Crypto Market Structure: brought to you by Bitget

CME futures open interest for Bitcoin drops by $930 million after breaching $5 billion for first time since late 2021

Something that we’ve tracked closely for throughout the last few months, on Friday Bitcoin futures open interest on the CME breached all time highs of over $5 billion for the first time since late 2021. While a large amount of this likely reflects traditional finance putting on the ETF trade, this also reflects that this cohort of market participants is back in a big way for the first time since late 2021. However, after Friday’s all time high, yesterday we saw CME futures open interest drop by roughly $930 million; the largest single-day decline since the original Blackrock ETF filing. While it’s difficult to conclusively note this as a trend shift, this is something to continue monitoring as a proxy for sentiment from tradfi around Bitcoin and the expected returns still left from the ETF trade.

MVRV shows that on a multi-year view Bitcoin still far from “overvalued” territory

It is worth keeping in mind that Bitcoin historically has undergone multiple 30%+ corrections throughout multi-year price runs such as 2013, 2017, and 2017. However, with this being said, zooming out we can see that Bitcoin remains far from overheated levels of valuation that marked cyclical peaks in 2013, 2017, and 2021. It’s worth maintaining this perspective while also understanding Bitcoin’s tendency for high volatility which includes aggressive corrections.