Trump speaks at Bitcoin Conference as ETH ETFs see outflows in first week

Weekly Market Update #40

Before diving into this week’s update, be sure to check out some recently released research content from our team:

Major developments for the week:

Last week Bitcoin ETF products saw net inflows of approximately $535 million

Ethereum ETF products see $341 million in outflows during first week of trading

Donald Trump spoke at Bitcoin event in Nashville

US Senator Cynthia Lummis introduces bill to create Bitcoin strategic reserve

Bitwise to donate 10% of profits from their Ethereum ETF

dYdX is in talks to sell some of its v3 software

Karak Network integrates MKR native staking

RuneKek shares more about Maker Endgame

Jito announces Restaking

TON blockchain gasless transactions go live

Last week Bitcoin ETF products saw net inflows of approximately $535 million

Spot Bitcoin ETF flows from 22nd to 26th July 2024 reveals significant variances among different ETFs. IBIT had the highest total inflow, amassing $758.5m and consistently showed positive daily inflows. Conversely, BITB and HODL experienced substantial outflows, with -$86.6m and -$119.6m respectively, indicating a negative trend. GBTC also saw consistent outflows totaling -$19.2m. Notably, BRRR and BTCW had no activity during this period. The total net flow for all ETFs combined was $535.3 million, reflecting a positive overall market trend despite the mixed performance among individual ETFs.

Donald Trump Speaks at Bitcoin event in Nashville

Some of the most substantial news came from the 2024 Bitcoin conference at which Donald Trump was an attendee and speaker.

Donald Trump made several key announcements that marked a significant departure from his earlier skepticism of cryptocurrency. He committed to dismissing SEC chairman Gary Gensler immediately if he returns to office, which was well-received by the audience. Trump also disclosed plans for a Strategic National Bitcoin Stockpile, intending to retain around 210,000 BTC currently owned by the government and described Bitcoin as a "miracle of cooperation and human achievement," likening its impact to that of the steel industry a century ago. Additionally, he promised to terminate "Operation Choke Point 2.0," which aims to restrict financial services to cryptocurrency firms, and proposed the creation of a bitcoin advisory council to advise the President on digital asset issues.

Furthermore, Trump said he would pardon Ross Ulbricht, the incarcerated founder of Silk Road, and suggested the construction of fossil fuel power plants to support both Bitcoin mining and AI development in the U.S. He criticized the Biden-Harris administration for their stance against cryptocurrencies, warning of negative repercussions for the industry if they are re-elected.

Senator Lummis Introduces Bill to Create Bitcoin Strategic Reserve

Senator Lummis further expanded upon the Bitcoin reserve by introducing a pioneering bill to establish a strategic Bitcoin reserve in the United States, marking a notable pivot in economic policy by integrating cryptocurrency into the national fiscal strategy.

The bill proposes that the U.S. government acquires 1 million Bitcoins, approximately 5% of the global supply, over a five-year span. These Bitcoins, including an initial 210,000 seized by law enforcement, would be securely stored in various locations and managed by the U.S. Treasury Department. The cryptocurrency would be held for at least 20 years and is designated exclusively for reducing the national debt. Notably, the funding for these purchases would come from reallocating existing resources within the Federal Reserve System and the Treasury Department, avoiding any tax increases.

The strategy aims to reflect the magnitude of the U.S. gold reserves in digital assets and also reaffirms the self-custody rights of private Bitcoin holders. Lummis has likened the initiative to America's "Louisiana Purchase moment," suggesting that it could halve the national debt by 2045 and transform the country’s fiscal future.

Ethereum ETFs went live resulting in a Netflow of -$341 million week one

Spot Ethereum ETFs had a mixed performance in their first week of trading. The ETFs launched on Tuesday, July 23, with a solid start, recording net inflows of approximately $106.8 million on day one. However, the following three days saw significant net outflows: $133 million on Wednesday, $152 million on Thursday and $162 million on Friday.

Overall, the spot Ethereum ETFs experienced a net outflow of roughly $341 million during their opening week. Grayscale's ETH Trust (ETHE) contributed significantly to these outflows, with a single-day outflow of over $356 million on Friday. Despite these outflows, the total trading volume for Ethereum ETFs on the first day reached $1 billion, about 22% of the volume seen by Bitcoin spot ETFs on their first day ($4.6 billion).

Jito Announces Restaking

The Jito Foundation has unveiled the code for Jito restaking on Solana, marking a significant advancement in the blockchain ecosystem. This initiative positions Jito at the forefront of restaking on Solana, providing a robust framework for enhancing economic security across various on-chain applications. Key features of Jito restaking include multi-asset support, allowing users to secure Actively Validated Services (AVS) with any chosen crypto asset, and two main components: the Vault Program, which manages Liquid Restaking Tokens (LRTs) and supports multiple SPL tokens as underlying assets and the Restaking Program, which facilitates the creation and management of AVSs and operators.

Additionally, flexible slashing conditions offer tailored risk management to meet the specific needs of each project. This system can be applied widely, securing L2 sequencers, provers, insurance funds, cross-chain bridges and more.

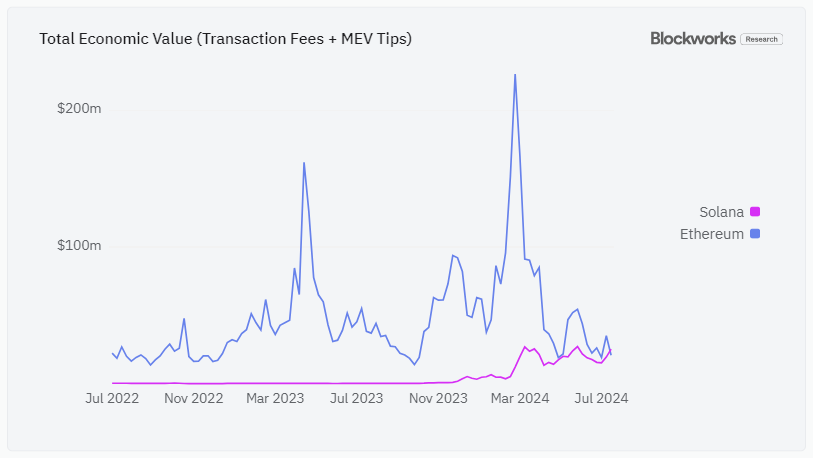

Solana surpassed Ethereum in total transaction fees and MEV tips

Lastly, as noted by Dan Smith from Blockworks Research, Solana surpassed Ethereum in total transaction fees and MEV tips on the weekly timeframe for the first time ever.

Furthermore, he noted that Solana generated $5.5 million in total fees on April 28th which amounts to the highest amount recorded over the prior three months. The majority of this activity stemmed from spot DEX trading.

This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

DEFTF