The Bitcoin Reserve, Bullish Regulatory News, and Macro/Tariffs Headlines Make for a Volatile Week

Weekly Market Update #63

Weekly Market Update

Major developments for the week:

White House Hosts High-Level Crypto Policy Summit

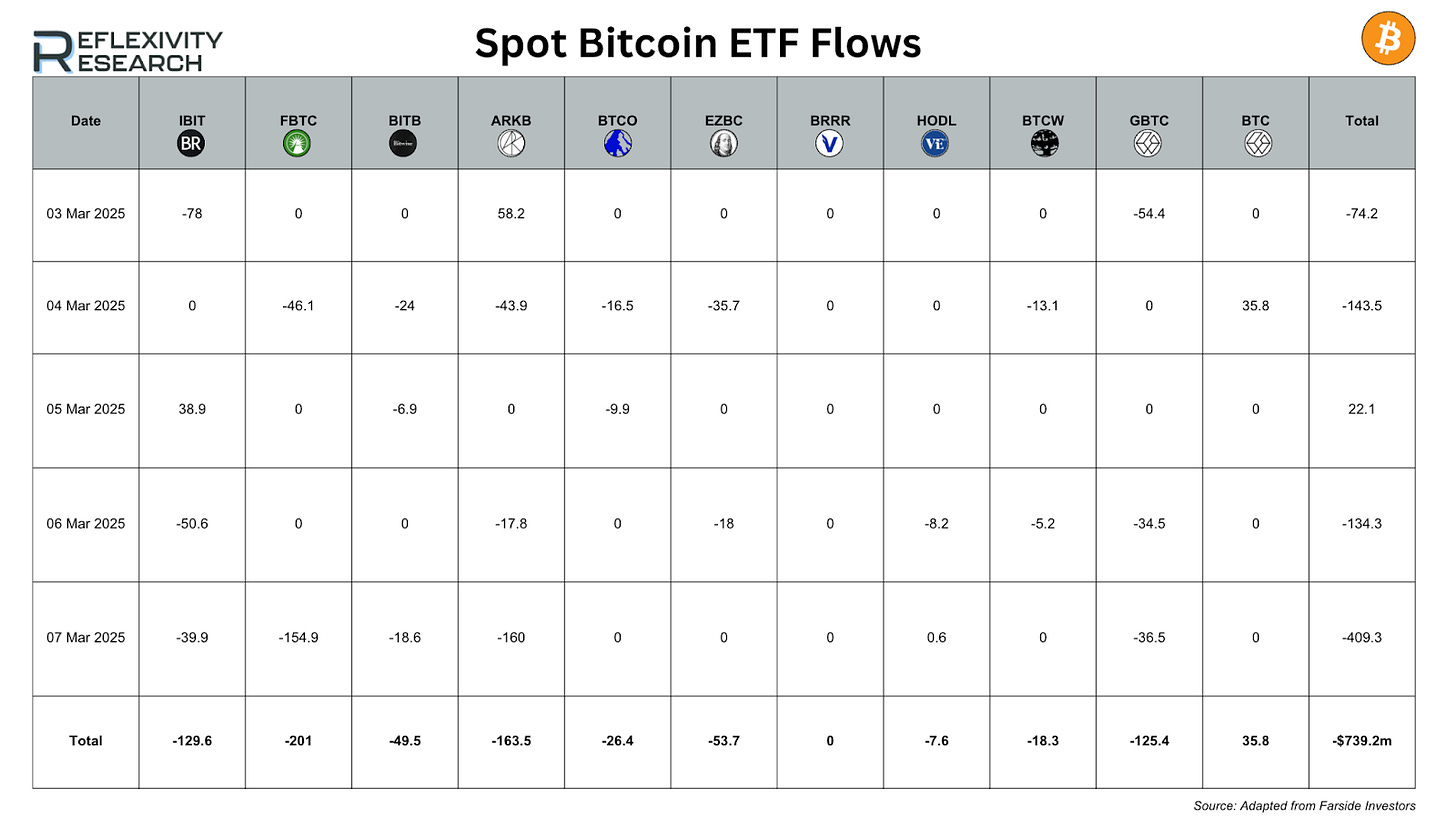

Spot Bitcoin and Ethereum ETFs: Net flows were -$739.2 million for Bitcoin ETFs and -$93.9 million for Ethereum ETFs

Aave Proposes Overhaul of Tokenomics with Aavenomics Implementation

Aave Introduces sGHO, a Yield-Bearing Stablecoin

Elixir Completes Token Generation Event (TGE)

Binance Launches Community-Driven Token Listing and Delisting Votes

Gemini Confidentially Files for Initial Public Offering (IPO)

Kraken Sets Sights on Public Listing in 2026

KaitoAI Executes Token Buyback Using Platform Fees

U.S. Banks Now Permitted to Serve as Ethereum Validators

White House Crypto Summit (March 2025) – Key Takeaways

Last week the White House Crypto Summit was held on March 7, 2025, marking a major shift in U.S. crypto policy under President Donald Trump. The administration embraced Bitcoin, stablecoins and pro-crypto regulation while rejecting the heavy-handed enforcement of past years. The event featured top officials, including Treasury Secretary Scott Bessent, SEC Chairman Paul Atkins, alongside industry leaders such as Brian Armstrong and Michael Saylor.

Major Announcements & Policy Shifts

U.S. Strategic Bitcoin Reserve

Trump signed an executive order creating a Bitcoin reserve, starting with 200,000 BTC seized from criminal cases.

The BTC will never be sold, aligning with the "HODL" strategy.

No taxpayer money will be used: future acquisitions will be budget-neutral.

Other cryptocurrencies may be held but only if seized.

Stablecoin Legislation & Dollar Dominance

A stablecoin framework will be finalized by August 2025 to regulate USD-backed digital assets.

The administration sees stablecoins as an extension of U.S. monetary power to strengthen the dollar globally.

Lighter Crypto Regulation & SEC Reforms

Trump’s new SEC Chairman, Paul Atkins, has halted lawsuits against crypto firms like Coinbase and Kraken.

The government rolled back Biden-era crypto regulations, including restrictive tax policies.

Banking restrictions on holding crypto have been lifted.

Moving onto the ETF flows, over the five trading days from 3rd to 7th March 2025, spot Bitcoin ETFs experienced significant net outflows, totaling $739.2 million. The largest single-day outflow occurred on 7th March, with $409.3 million leaving various funds, primarily driven by $154.9 million from FBTC and $160 million from ARKB. Among individual ETFs, FBTC (-$201 million), ARKB (-$163.5 million), and GBTC (-$125.4 million) saw the most substantial cumulative outflows. IBIT and BITB also contributed to the losses with $129.6 million and $49.5 million in net redemptions, respectively. Notably, BTC was the only ETF to record any inflows, bringing in $35.8 million, helping slightly offset losses. The data suggests strong selling pressure and investor withdrawals across most Bitcoin ETFs, with only minor sporadic inflows.

Over the five trading days from 3rd to 7th March 2025, spot Ethereum ETFs recorded net outflows of $93.9 million, indicating weak investor sentiment toward Ethereum-based funds. The most significant single-day outflow occurred on 5th March, when $63.3 million exited ETHE. ETHA also faced notable withdrawals, totaling $63.6 million over the period, while FETH was the only ETF to record meaningful inflows at $9.8 million. ETHW saw minor inflows of $4 million, while Grayscale ETH had a small positive inflow of $8.5 million. Despite a $14.6 million net inflow on 4th March, overall selling pressure dominated, particularly from ETHE, which lost $52.6 million. The trend suggests ongoing capital flight from Ethereum ETFs, mirroring the bearish sentiment seen in Bitcoin ETFs during the same period.

In other Ethereum related news, the regulatory landscape has recently shifted in a way that could accelerate institutional adoption. The Office of the Comptroller of the Currency (OCC) has clarified that U.S. banks can now participate in certain cryptocurrency activities, including serving as validators on Proof-of-Stake networks like Ethereum. This means banks can stake Ether, validate transactions and earn staking rewards, a significant milestone for integrating Ethereum into the traditional financial system. Previously, banks were required to seek regulatory approval before engaging in such activities, but this restriction has now been lifted. However, they must still adhere to strict risk management and compliance protocols to ensure security and regulatory alignment.

The industry response has been largely positive, with many viewing this as a key step in merging blockchain technology with conventional banking. Allowing banks to act as Ethereum validators is expected to strengthen the network's security and encourage further institutional investment in the industry.

Aavenomics Implementation

Another interesting development came from Aave’s community who are considering a major governance proposal to implement updated Aavenomics, overhauling the protocol’s tokenomics. The proposal’s objectives are to redistribute Aave’s protocol revenue to AAVE holders and enhance long-term sustainability. Key changes include creating an Aave Finance Committee (AFC) to actively manage the treasury and allocate excess revenue (e.g. to safety modules like “Umbrella” for bad debt protection), and deprecating the old LEND tokens. The plan also introduces an “Anti-GHO” system (replacing the prior GHO discount) that lets staked AAVE earn rewards or reduce borrowing costs. Additionally, Aave would adjust liquidity mining incentives to be more efficient (reducing reliance on heavy AAVE emissions) and initiate a buyback program using a portion of fees to purchase AAVE on the market for the ecosystem reserve. Overall, the Aavenomics update aims to bolster AAVE’s value capture and align incentives for both token holders and liquidity providers.

Kaito Conducts Buyback

Another protocol specific update came from KaitoAI, an AI-driven crypto analytics platform, which has implemented a token buyback strategy funded by fees, significantly impacting its tokenomics. Recently, the project conducted a notable buyback of its native token ($KAITO) shortly after a community airdrop. As part of the airdrop process, users paid a small claim fee (0.0015 ETH, roughly $4) to receive their tokens, which collectively generated approximately 36 ETH (~$98,800) in fees.

Following the airdrop, on-chain data revealed that a significant wallet bought back ~579,000 KAITO tokens from the open market at an average price of $2.40, spending approximately $1.39 million. This move effectively reduced the circulating supply, triggering a 15% price surge from $2.10 to $2.40 within hours and boosting trading volumes.

This strategy highlights how KaitoAI is leveraging platform-generated fees to reinforce its token’s value. By redirecting fee revenue into buybacks (and potentially token burns), the project aims to strengthen its tokenomics, increasing investor confidence by supporting the price, mitigating post-airdrop sell-offs, and rewarding long-term holders through scarcity effects.

In essence, KaitoAI’s buyback via fees mechanism directly ties the platform’s success (usage generating fees) to token value accrual, demonstrating a commitment to sustained value support for $KAITO within its ecosystem.

Binance “Vote to List” and “Vote to Delist” Mechanisms

The final update of this week comes from Binance who has introduced new community-driven voting mechanisms for token listings and delistings, empowering users to have a direct say in the exchange’s offerings. Under the “Vote to List” program, Binance users who hold a minimum amount of BNB (Binance’s native token) can vote on candidate projects that Binance pre-selects; the token that receives the most community votes (and passes Binance’s due diligence checks) will be listed on the exchange. Conversely, the “Vote to Delist” mechanism lets users vote to remove tokens that have been put in Binance’s Monitoring Zone: typically underperforming projects or those with development and community issues. If the community votes in favor of delisting a monitored token, Binance can more rapidly remove it from trading. These measures are meant to “return power to the community,” according to Binance, by involving users in curation of the platform’s market. Alongside the voting, Binance also expanded its listing framework with options like direct listings, Launchpool and an Alpha incubation zone, all while reiterating it charges no listing fees and will disclose any project-provided listing budgets. Implications: This co-governance approach could lead to listings that better reflect community interest and trust, and it provides transparency in weeding out inactive or risky projects.

Conclusion

This week's market update highlights the continued volatility in Bitcoin and Ethereum ETFs, with significant net outflows reflecting investor caution. However, regulatory shifts—such as the White House’s pro-crypto stance and the OCC allowing banks to serve as Ethereum validators—suggest growing institutional integration. Meanwhile, DeFi protocols like Aave and KaitoAI are evolving their tokenomics to strengthen ecosystem sustainability. Binance’s new community-driven listing mechanism further underscores the industry's push for greater decentralization and user participation. As regulatory clarity improves and projects refine their value propositions, the long-term trajectory for crypto adoption remains promising.