Major developments for the week:

Bitcoin ETF products saw net outflows of $433 million last week

Hong Kong BTC and ETH ETFs now hold $250.34 million and $48.53 million respectively

Dash and Ethereum Classic approach their halving dates

CZ got sentenced to 4 months in prison

1inch launched a virtual crypto debit card

Tesla added Dogecoin payments to their website

Hyperliquid and Aevo launch EIGEN pre-markets

FriendTech’s Token Generation Event occurred

MakerDao prepares to introduce two new tokens; NewStable and NewGovToken

Aave released a proposal discussing its vision for v4 and beyond

APT will undergo a $103.15 million unlock on May 12th, 2024

Bitcoin ETF products saw net outflows of $328 million last week

During the period from April 29th to May 3rd, 2024, Bitcoin ETFs experienced significant movements, predominantly in the form of outflows. Notably, FBTC saw the most substantial outflows totaling $130.7 million, with a single-day outflow of $191.1 million on May 1st. Similarly, BITB and ARKB recorded notable outflows, with BITB losing $34.3 million on April 30th and ARKB $98.1 million on May 1st. GBTC also faced outflows, culminating in $277.2 million for the week, highlighting its largest single-day loss of $167.4 million on May 1st.

It is noteworthy that last week was a week of firsts for both IBIT and GBTC in which IBIT experienced its first net outflow day amounting to $36.9 million and GBTC experienced its first net inflow day amounting to $63 million, putting the 78 net outflow streak to an end.

In other ETF related news, Hong Kong made its ETF debuts on April 30th.

SoSoValue pointed out that ETF shares acquired through in-kind subscriptions of physical Bitcoin are not considered in the daily net inflow figures since they do not involve cash inflows denominated in dollar terms. Instead, the firm tracks the BTC inflow metric, which reflects the actual amount of bitcoin that moved into or out of the ETFs on a given trading day.

As of Friday, the three ETFs, managed by China Asset Management, Harvest, Bosera and HashKey, had a collective holding of approximately 4,220 BTC. It is noteworthy that May 1st was a public holiday in Hong Kong, leading to market closure.

ETH inflows also trended upwards for each of the trading days, ending the third day with a total of 16,280 ETH in the three ETFs.

Dash and Ethereum Classic Halvings Approach

With the Bitcoin halving successfully concluded, two new halving events are now on the Horizon with Dash and Ethereum Classic.

Dash, like Bitcoin, offers a block reward to miners; however, its reduction mechanism is different. While Bitcoin’s reward halves, Dash’s reward decreases by 7.14% every 210,240 blocks. Given Dash’s block time of 2.5 minutes, these reductions occur approximately every 365 days.

Currently, Dash miners receive a block reward of 2.48734 Dash plus transaction fees. After the upcoming reward reduction, this will decrease to 2.30974 Dash plus transaction fees.

The last reduction took place on June 23rd 2023, making the next one Dash’s 7th reduction.

This reduction strategy is integral to Dash's approach, designed to control the rate at which new coins are introduced, thereby supporting its governance structure and economic model and ensuring sustainability.

Ethereum Classic implements a block reduction event every 5,000,000 blocks. Initially set at 4 ETC, the block reward decreases by 20% approximately every two years, effectively slowing down the rate of new ETC coin generation. This reduction mechanism is hard-coded into Ethereum Classic's blockchain software.

Currently, the block reward stands at 2.56 ETC. Following the upcoming reduction, it will adjust to 2.048 ETC.

The most recent reduction took place on April 25th 2022 and the upcoming event will mark Ethereum Classic’s fourth reduction.

The purpose of this structured reduction is to manage the supply of ETC prudently, ensuring the cryptocurrency's long-term sustainability and stability. By incrementally lowering the rewards, Ethereum Classic aims to mitigate inflationary pressures while maintaining network security.

Aave released a proposal discussing its vision for v4 and beyond

Another interesting development came from Aave Labs last week in which they submitted a detailed proposal aimed at enhancing Aave's role in the decentralised finance sector over the next decade. The proposal seeks to implement innovative solutions and strategic initiatives based on the recent updates from Aave V3 and GHO. Its objective is to increase adoption within the Aave ecosystem and expand access to decentralised finance, targeting the next billion users. The plan includes a three-year technical contributor grant from Aave Labs, with annual reviews to ensure it aligns with Aave's long-term goals.

APT will undergo a $103.15 million unlock on May 12th, 2024

Lastly, the primary unlock event this week features APT. Scheduled for May 12th 2024, $APT plans to release 2.64% of its circulating supply. This comprises $36.1 million for Core Contributors, $29.2 million for community, $25.61 million for investors and $12.16 million for the foundation. $APT’s vesting schedule is estimated to reach completion by October 9th, 2032.

Measures of strong bullish sentiment in the Bitcoin derivatives market have cooled off

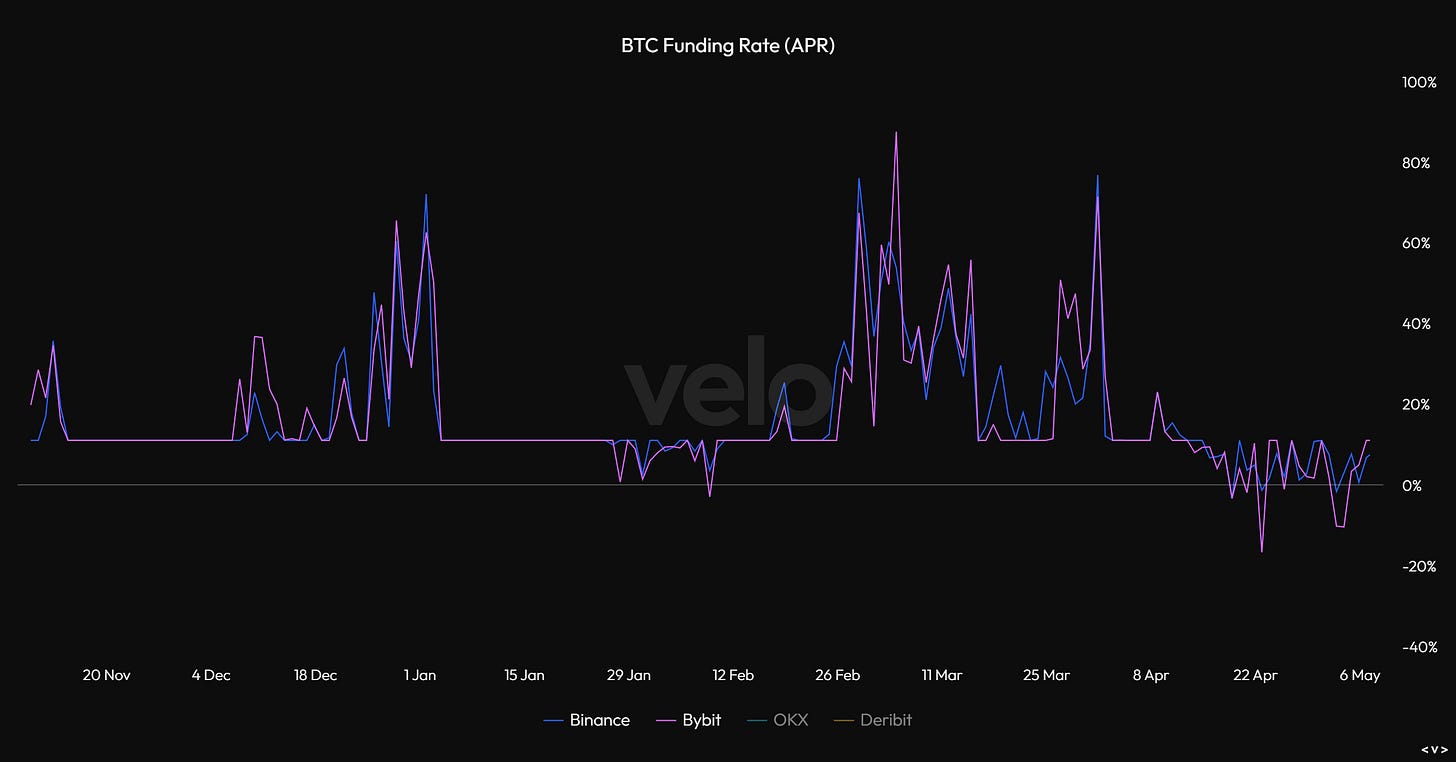

Turning over to the Bitcoin derivatives market, we can see that measures of extreme bullish sentiment has cooled off. Below we can see two charts illustrating this idea. The first is funding rates on perpetual futures, representing the funding mechanism that pegs these Bitcoin futures contracts to the underlying Bitcoin spot price. When high, funding rates indicate that perpetual futures are trading above Bitcoin’s spot price. When negative, funding rates indicate that perpetual futures are trading below Bitcoin’s spot price. As we can see by looking at Binance and Bybit, funding rates have cooled off significantly and briefly reaching negative readings over the last week. This represents a cooling off of the strong bullish sentiment that we saw in the Bitcoin and broader crypto market just weeks ago.

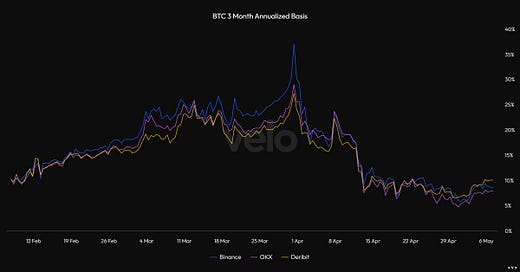

We can also see a similar dynamic by looking at the annualized 3 month futures basis for Bitcoin. This looks at the spread between Bitcoin’s current spot price and the price of a 3 month (or quarterly) futures contract. With the basis having closed in from over 35% to below 10%, this also reflects the same sentiment shown in funding rates.

Meanwhile, stablecoin supplies have begun to rise again, signaling new capital inflows to crypto.

Note: The content in this weekly report has also been utilized in our weekly collaborative series with stock/crypto trading platform eToro.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

View 50+ free reports on our homepage: reflexivityresearch.com