SEC Approves ETH ETFs as Bitcoin ETFs see $1 billion of inflows

Weekly Market Update #31

Key Takeaways:

Bitcoin ETF products saw inflows of $1.056 billion last week

Spot Ethereum ETFs have been greenlighted by the SEC

Hong Kong’s SFC is in talks to allow staking for Ether ETF issuers

Donald Trump enables crypto donations for his presidential campaign

On May 31st, the Uniswap Foundation will start an onchain vote to update the Protocol. This upgrade aims to allow the fee mechanism to provide rewards to UNI token holders who have staked and delegated their tokens.

Cosmos introduced Hydro, a bidding and governance platform for the efficient deployment of liquidity across the interchain

Kabosu, the dog behind the 'doge' internet meme, has passed away

Optimsim will unlock 2.88% ( $80.55 million ) of its supply on May 31st

Bitcoin ETF products saw inflows of $1.056 billion last week

This week's performance from May 20th - 24th saw a total value inflow of $1.056 billion. IBIT emerged as the largest contributor with $719.5 million, while GBTC faced outflows amounting to $20.5 million.

As detailed by the above illustration from Hildobby’s dune dashboard, this was the highest net inflow that the ETF products have experienced in the last 10 weeks.

Ethereum Spot Bitcoin ETF is approved

Last week The U.S. Securities and Exchange Commission approved eight spot Ethereum ETFs, a significant milestone in the cryptocurrency industry following the approval of spot Bitcoin ETFs earlier this year in January.

The approved ETFs come from major financial institutions such as BlackRock, Fidelity, Grayscale, Bitwise, VanEck, ARK 21Shares, Invesco Galaxy and Franklin Templeton. Unlike the spot Bitcoin ETFs, which were approved via a vote by the full SEC commission, these Ethereum ETFs received approval through the SEC's Trading and Markets Division.

Despite this approval, the ETFs are not yet available for trading. The issuers still need to obtain final approval for their S-1 registration statements from the SEC, which could take additional time and potentially delay the launch by weeks or even months.

The approval of these ETFs is expected to enhance Ethereum's market liquidity and attract substantial institutional investment. This move signifies increasing regulatory acceptance of digital assets and is anticipated to potentially boost Ethereum's market position.

Uniswap Foundation Discloses Financial Assets and Fund Allocation Prior to Fee Switch Vote

In regards to protocol specific news, the Uniswap community is set to vote on a proposal to activate protocol fees in V3 pools, beginning on Friday, May 31st. This proposal aims to upgrade the protocol, enabling its fee mechanism to reward UNI token holders who have staked and delegated their tokens. Previous attempts to activate this fee switch have failed, including the most recent proposal that did not pass the preliminary voting stage. The new proposal's authors anticipate that this change will encourage more active delegation and increased engagement in the governance process.

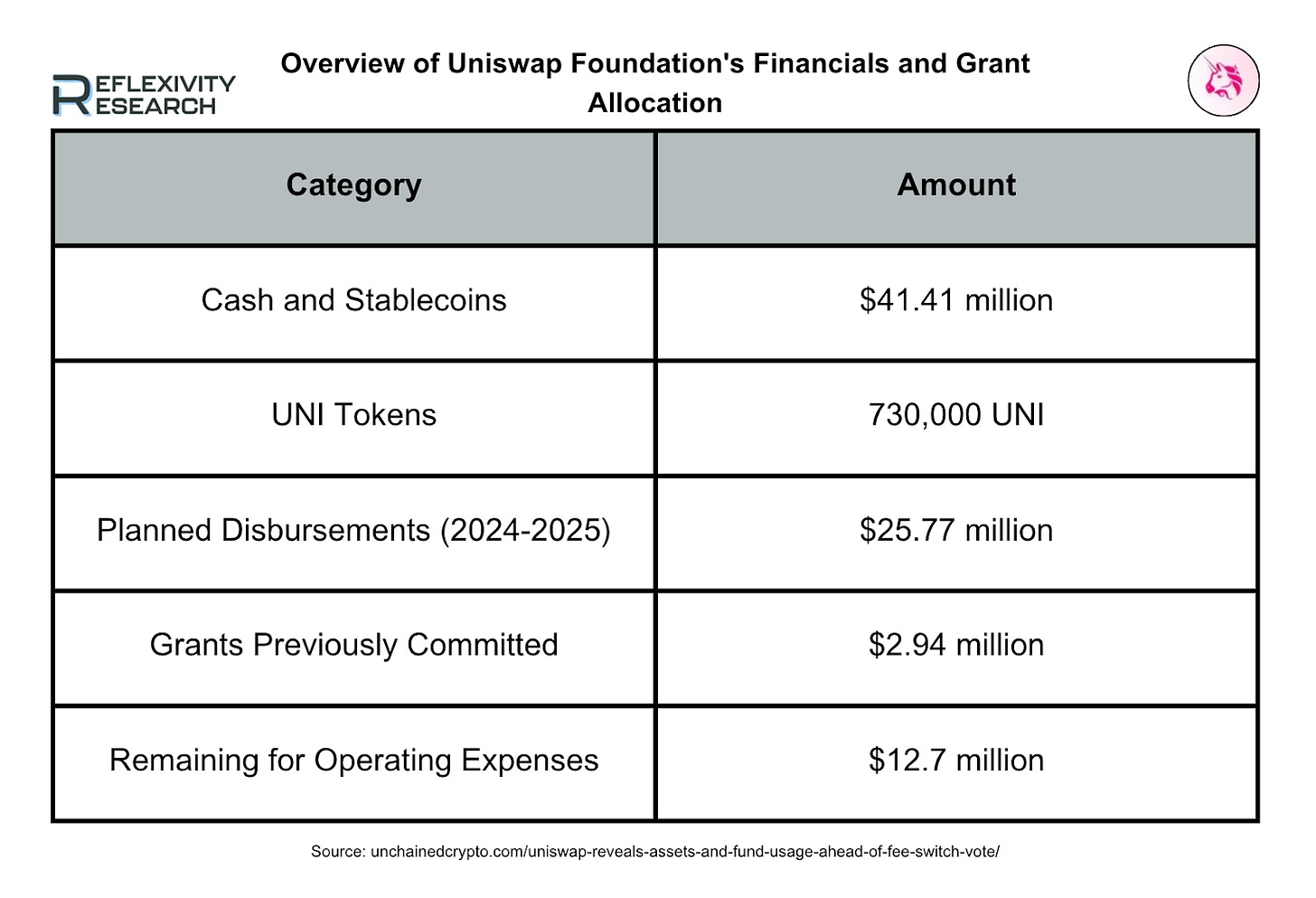

In preparation for the vote the Uniswap Foundation released its financial summary for the first quarter of 2024 as detailed below:

During the first quarter, most grants were directed towards protocol development and governance, with additional funds allocated to innovation, research and security. This financial disclosure provides transparency ahead of the significant vote on protocol fees.

Activating the fee switch would benefit UNI holders at the expense of liquidity providers, who have been earning fees from token swaps so far. Since its inception, Uniswap has generated $3.6 billion in fees, according to DeFiLlama. If the vote on May 31st passes, the fees will not be activated immediately. The Uniswap governance team plans to propose another upgrade to streamline the fee-setting process, reflecting their commitment to continuous improvement and adaptation of the protocol.

Cosmos introduced Hydro, a bidding and governance platform for the efficient deployment of liquidity across the interchain

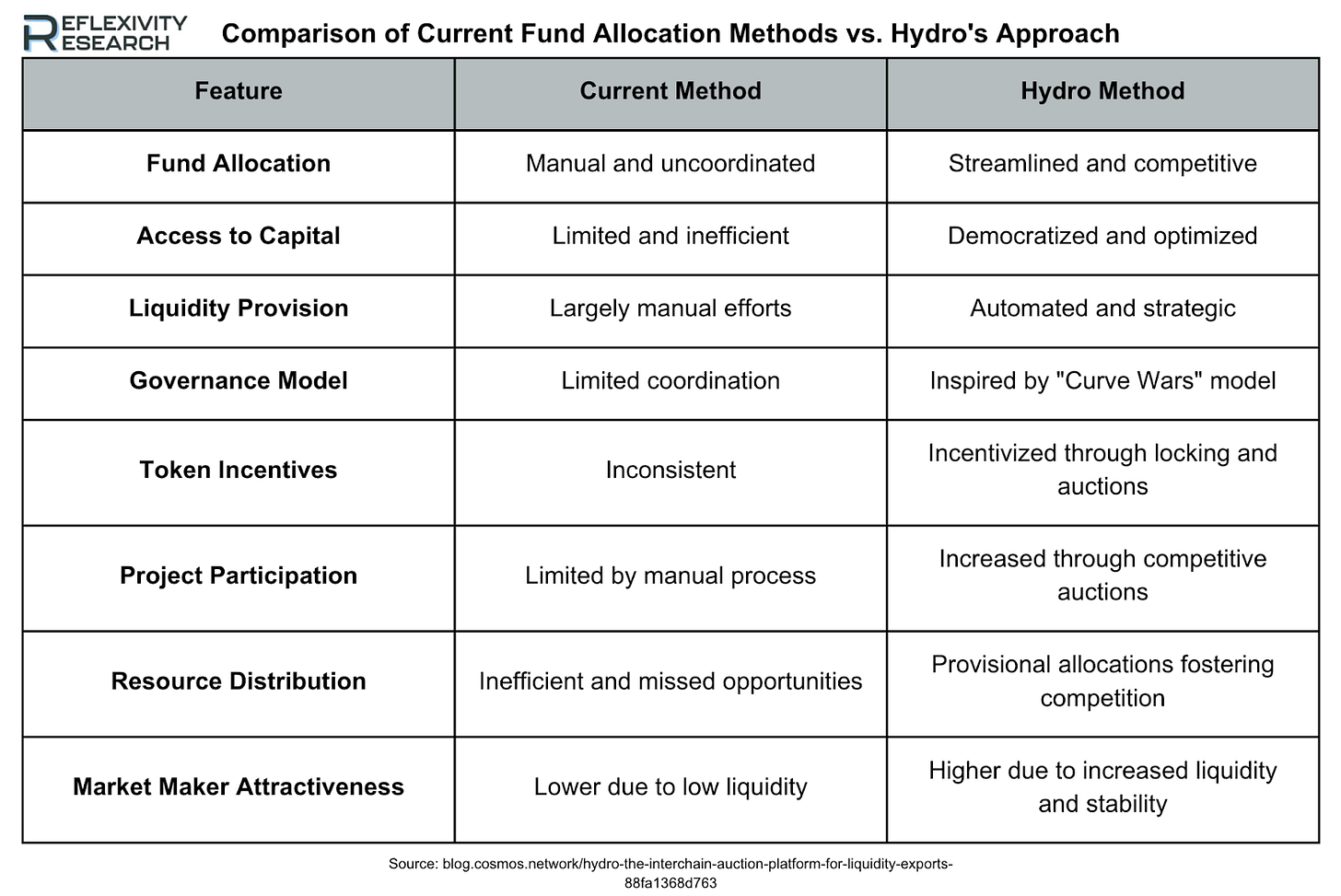

In other news last week, Cosmos announced Hydro; a bidding and governance platform designed to efficiently deploy liquidity across the interchain ecosystem. It is pivotal to the ATOM wars and addresses the interchain's primary challenge since its inception: token liquidity.

The below table highlights the core differences of current fund allocation methods versus what hydro proposes to introduce:

Optimism will unlock 2.88% ( $80.55 million ) of its supply on May 31st

Lastly, Optimism will unlock 2.88% of its circulating supply on May 31st. This consists of $42.18 million for core contributors and $37.74 million for investors. Optimism’s token allocation breakdown can be seen as illustrated below;

Note: The content in this weekly report has also been utilized in our weekly collaborative series with stock/crypto trading platform eToro.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

View 50+ free reports on our homepage: reflexivityresearch.com