Key Developments of the week:

Last week, Bitcoin and Ethereum ETFs saw net flows of -$167 million and $104.8 million, respectively.

Saylor personally owns more than $1 billion in BTC

The judge ruled that Ripple shall pay $125 million in civil penalties

Putin signs a law on legalizing cryptocurrency mining in Russia

The judge approves a $12.7 billion settlement between FTX and the CFTC

The Arbitrum proposal to unlock ARB staking is live

The AnubisDAO rugger returns after 3 years to deploy a token in a possible attempt to rug again

CelestiaOrg releases details about their Lemongrass upgrade

Binance is set to list $TON

Ethena Labs expands to Solana

Grayscale launches new crypto investment trusts for SUI and TAO

The YTD Spot BTC ETF Flows chart illustrates the year-to-date flows in millions of USD for all of the spot Bitcoin ETFs. The data reveals that IBIT and FBTC lead with significant inflows of $20,316.82 million and $9,734.10 million, respectively, indicating strong investor interest in these funds. ARKB and BITB also show notable inflows, while HODL, BRRR, EZBC, BTCO, BTC and BTCW recorded more moderate positive flows. On the other hand, DEFI is nearly neutral with a slight outflow of -$1.79 million. GBTC stands out with a significant outflow of -$17,465.11 million. Despite such outflows, the total net inflows for the year amount to +$19 billion.

Ethereum experienced a 40% correction following the ETF launch, which led to a $3.6 billion reduction in open interest, bringing it to its lowest point since February 2024. Additionally, futures funding rates turned negative on a weekly basis for the first time since October 2023.

As mentioned in our previous weekly update, Ethereum ETFs have started to show resilience despite the broader macroeconomic turmoil and aggressive sell-offs in risk assets. This trend persisted, with net inflows across various ETH ETF products amounting to $104.8 million last week. Since the crash Ethereum has rebounded ~30%. It is interesting to also note that BTC ETF products saw net outflows of $106 million last week. If this trend is to persist the ETHBTC ratio could begin to see some respite from its 700 day downtrend.

The Arbitrum proposal to unlock ARB staking is live

Last week this proposal went live that introduces ARB staking to enhance the utility, governance and security of the Arbitrum protocol without immediately enabling fee distribution to token holders. ARB staking will allow token holders to delegate to active governance participants, capturing value. A liquid staked ARB token (stARB) will be implemented via the Tally Protocol, enabling future rewards to auto-compound, restaking and DeFi compatibility. The Arbitrum DAO will decide on funding and reward distribution.

Motivation:

The ARB token currently struggles to accrue value and maintain governance effectiveness. With low active participation and growing DAO treasury reserves, there’s an increased risk of governance attacks. ARB staking addresses these issues by unlocking token utility and aligning governance incentives.

Key Points:

ARB Staking: Introduces a system to stake ARB tokens, enhancing their utility and enabling delegated governance participation.

stARB Token: A liquid staked token that auto-compounds rewards and remains compatible with DeFi, while preserving governance rights.

Governance Protection: Returns voting power to the DAO if stARB is used in non-compatible contracts, protecting against governance attacks.

Timeline:

June: Feedback on proposal

August: Temp check and development

September: Smart contract audit

October: Full implementation proposal

Cost:

Requesting $200,000 USD in ARB for development, integration and audit, with funds allocated to smart contract development, integration into Tally.xyz, Karma integration and technical support.

Celestia Introduces Lemongrass Upgrade with Key Enhancements

In other news, Celestia has rolled out its first major upgrade, named 'Lemongrass.'

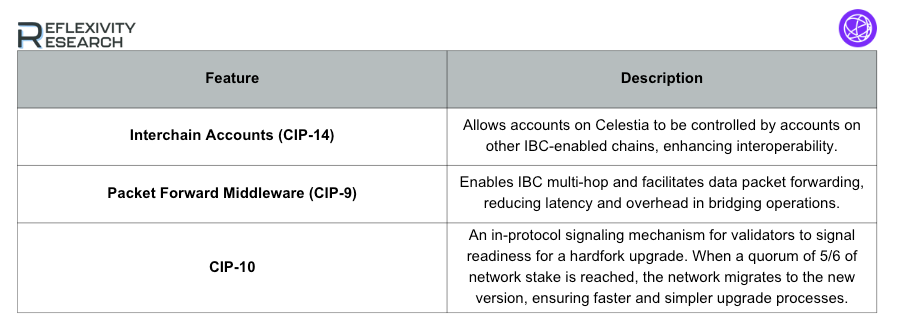

This upgrade brings several significant changes to the consensus layer, including:

Additionally, the upgrade modifies the Data Availability (DA) layer with features like blob data pruning (CIP-4) and the introduction of Shwap (CIP-19), a new messaging framework for DA and sampling.

The Lemongrass hard fork is slated to go live on the Arabica Devnet in August 2024, followed by deployment on the Mocha Testnet and Celestia Mainnet Beta by early to mid-September.

This upgrade is a major step forward for Celestia, paving the way for improved interoperability, efficiency and scalability of the network.

The judge ruled that Ripple Labs shall pay $125 million in civil penalties

For the final update of this week, a federal judge has ordered Ripple Labs to pay a $125 million civil penalty for improperly selling its XRP token to institutional investors. This decision, made by Judge Analisa Torres, is significantly lower than the $1 billion initially sought by the SEC. Ripple is also permanently barred from future violations of securities laws and is required to file a registration statement for any future securities sales.

This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.