Microstrategy to buy more Bitcoin as SEC’s head of crypto enforcement steps down

Weekly Market Update #34

Key Takeaways:

Last week Bitcoin ETF products saw net outflows of approximately $600 million

MicroStrategy Announced a Plan for Private Offering of $500 Million in Convertible Senior Notes MSTR 0.00%↑

SEC’s head of crypto enforcement division leaves after 9 years

The anticipated date for the launch of the spot Ether ETF has been moved up to July 2nd

The Sol Foundation has removed certain operators from its delegation program due to their involvement in sandwich attacks

The Arbitrum gaming grant proposal has been passed

SushiSwap introduces Sushi Labs and a multi-token ecosystem

Layer Zero released their Token Generation Event Date; 06.20.2024

Space ID will unlock 18.23% of their circulating supply, a $44.18 million equivalent, on June 22nd at 12:00am UTC

Last week Bitcoin ETF products saw net outflows of approximately $600 million

Last week IBIT recorded the highest net inflow of $41.6 million, contrasting sharply with the significant net outflows from ARKB and GBTC, which lost $149.7 million and $274.3 million respectively. The most substantial daily outflows occurred on June 11th and 13th, with net changes of $-200.4 million and $-226.2 million, driven by major outflows in FBTC, GBTC and ARKB. IBIT showed consistent positive inflows on most days, whereas EZBC, BTCW and DEFI showed no net changes, indicating inactivity. This period underscores significant volatility, with major outflows in FBTC and GBTC overshadowing the few positive inflows, particularly impacting the overall balance.

This outflow is the largest since March 22, 2024 and is likely driven by a more hawkish-than-anticipated FOMC meeting, which led investors to reduce their exposure to fixed-supply assets.

The anticipated date for the launch of the spot Ether ETF has been moved up to July 2nd

One of the major news updates of the week came from Bloomberg analyst Eric Balchunas in which he stated the estimated launch date for the spot Ether ETF has been moved up to July 2nd. The SEC staff has sent comments on the S-1 filings to issuers, which are relatively minor, with a one-week turnaround requested. Based on this he suspects there is a possibility that the SEC will finalise the filings the following week, before the holiday weekend. This update follows Gary Gensler's previous indication of a "sometime in summer" launch, offering a more specific timeline.

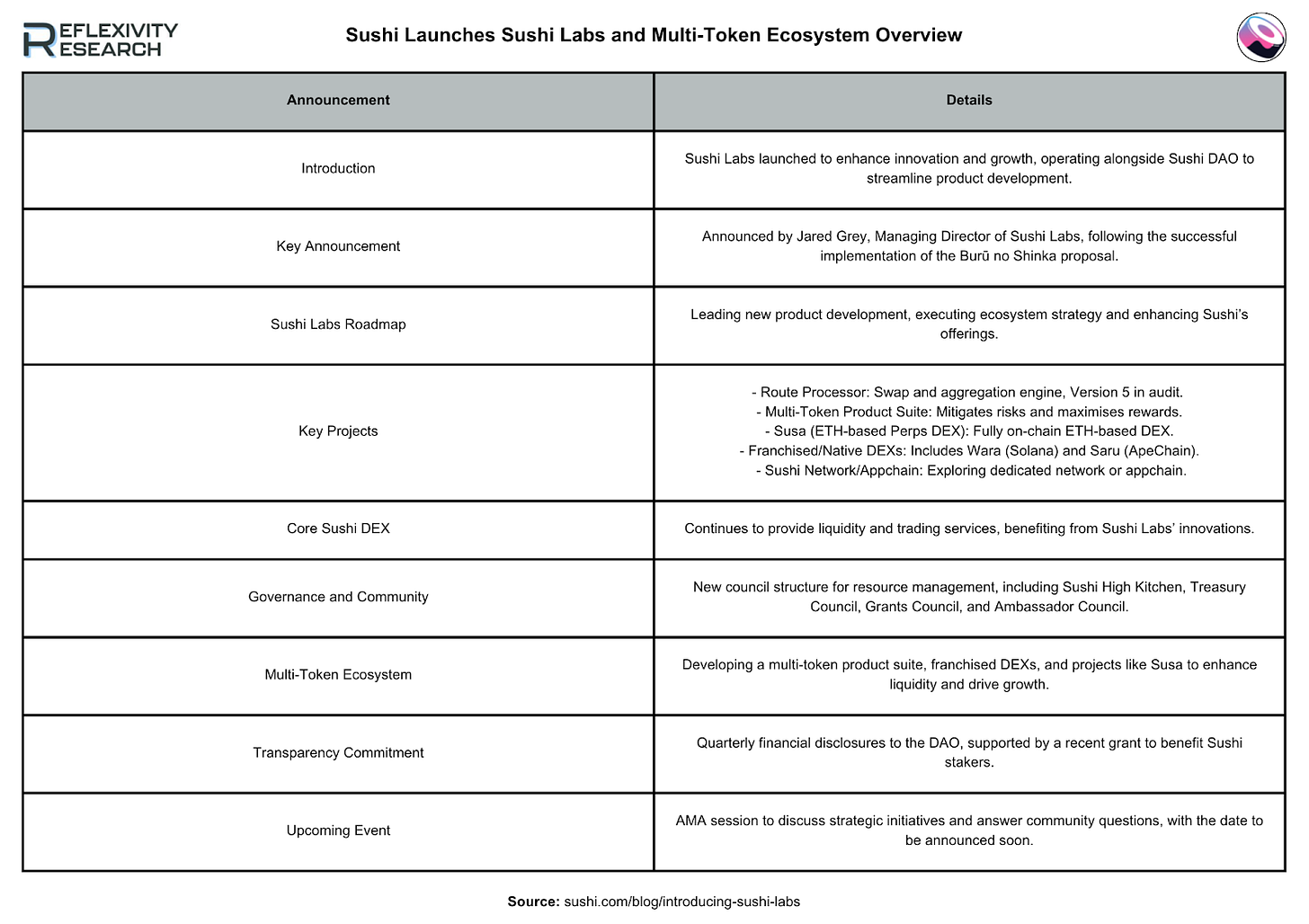

SushiSwap introduces Sushi Labs and a multi-token ecosystem

In other news last week, Sushi has launched Sushi Labs and a multi-token ecosystem to drive innovation and efficiency alongside the Sushi DAO. Announced by Managing Director Jared Grey, following the Burū no Shinka proposal, Sushi Labs will lead product development with key projects like the Route Processor (Version 5 in audit), a multi-token product suite and Susa, an ETH-based perpetuals DEX. Additionally, Sushi is developing tailored DEXs for specific blockchains, such as Solana and ApeChain and exploring a dedicated network for DeFi products. A new council structure will manage resources and quarterly financial disclosures will enhance transparency.

The Arbitrum gaming grant proposal has been passed

Another interesting development came from arbitrum last week in which an approval to spend 225 million $ARB over three years to support gaming projects passed.

Proposal Overview: Initiated by Vela Exchange co-founder Dan Peng, the Gaming Catalyst Program (GCP) aims to boost the visibility and adoption of Arbitrum, Orbit and Stylus among developers and gamers.

Voting Outcome: The proposal was approved with over 75% support, backed by entities such as L2Beat, Wintermute and Treasure DAO.

Funding Allocation: The program will provide grants and investments up to 500K ARB (approximately $484K) for both new and established developers, infrastructure bounties and operational costs. Up to $25M is allocated for the GCP team's daily operations.

Space ID will unlock 18.23% of their circulating supply, a $44.18 million equivalent, on June 22nd at 12:00am UTC

Lastly, the primary unlock event of the week features $ID, releasing a total of $39.9 million. This unlock consists of $1.38 million for the Ecosystem Fund, $2.48 million for the Foundation, $9.91 million for the Seed Sale, $6.61 million for the Strategic Sale, $2.89 million for the Community Airdrop, $2.42 million for Marketing, $5.78 million for Advisors and $7.43 million for the Team.

Note: The content in this weekly report has also been utilized in our weekly collaborative series with stock/crypto trading platform eToro.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

View 50+ free reports on our homepage: reflexivityresearch.com