Hyperliquid's HIP-3 Growth Mode, Monad Mainnet Launches, Kraken Files for IPO, and More While Prices Stay Depressed

Weekly Market Update #96

This edition brought to you in partnership with Valour

Valour makes it easy for retail and institutional investors to invest in digital assets & decentralised finance, with Europe’s largest selection of crypto ETPs.

Happy start to the week! Welcome back to the Reflexivity Weekly Market Update — your concise rundown of the biggest moves in crypto. If someone forwarded you this, you can Sign up here for free to get it straight to your inbox!

Before jumping into last week’s action, check out some of the research published last week by the Reflexivity team:

Major Market Developments:

🚀 Megaeth unveils Frontier

🚀Monad mainnet launches

⚙️ Hyperliquid HIP-3 Growth Mode slashes fees 90% to boost new markets

🧩 Coinbase app code hints prediction markets and stock trading modules

🏛️ Kraken files confidentially for a U.S. IPO

📈 Kalshi raises $1B at an $11B valuation

🧠 caesar_data takes first steps toward on-chain equity issuance

🎓 Open Campus × Animoca × ANPA launch $50M EDU DAT initiative

🧪 nunchi introduces nHYPE

🟣 Solana SIMD-0411 proposes doubling the disinflation rate

🏦 Upbit eyes Nasdaq listing after Naver merger

🌧️ Enlivex plans $212M raise for RAIN token treasury

Fear & Greed Index:

The Crypto Fear & Greed Index remains low this week at 15, i.e., deep extreme fear. Positioning is very risk-off, liquidity is thin, and price moves are highly headline-driven. These levels can produce sharp reflex bounces as shorts cover, but without a clear positive catalyst or fresh inflows, rallies usually stall quickly.

Note: The index ranges from 0 (extreme fear during capitulations and sell-offs) to 100 (extreme greed during euphoric, overbought conditions).

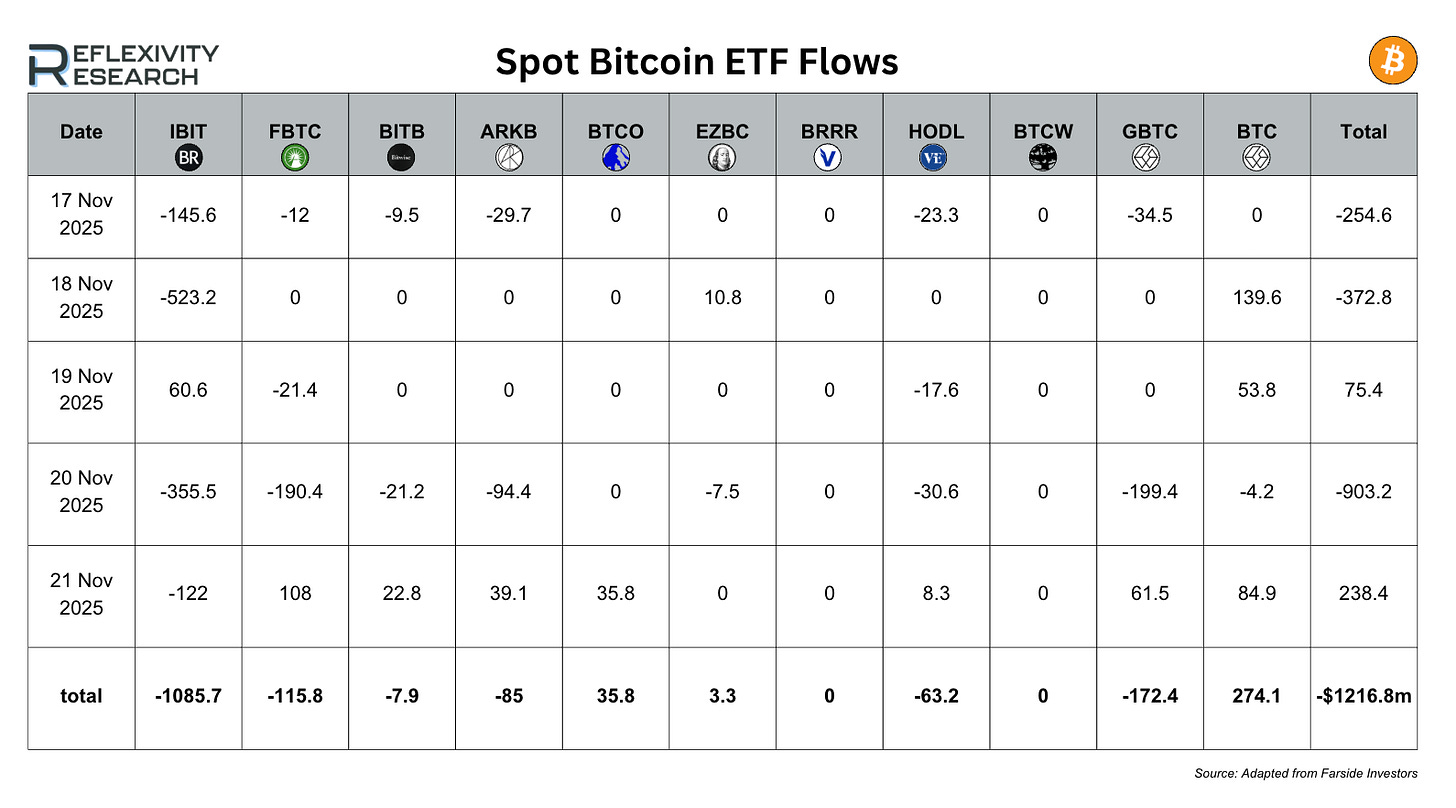

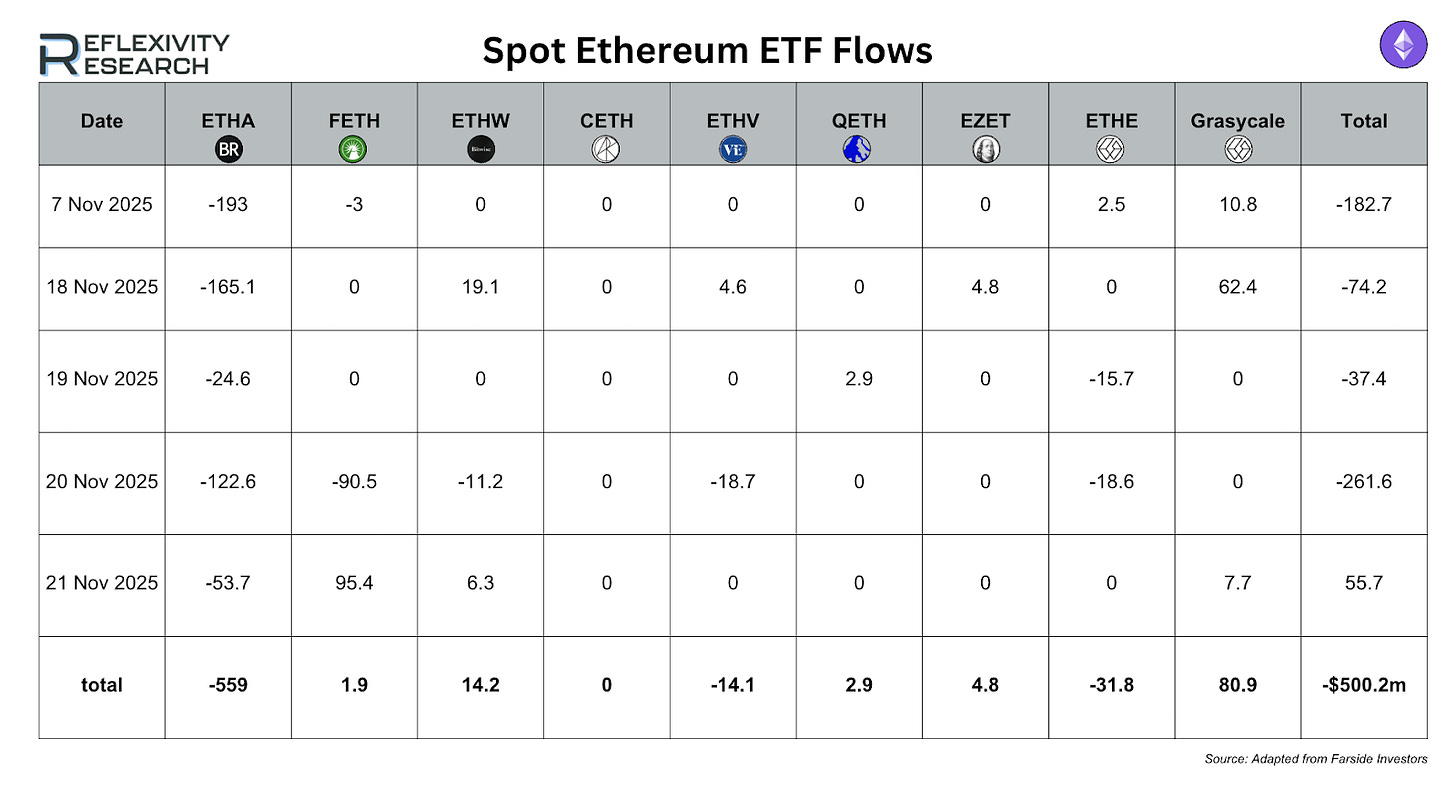

ETF Flows:

Bitcoin ETFs (17–21 Nov 2025, $ millions): Net -1,216.8. The complex saw three heavy sell days (Mon -254.6, Tue -372.8, Thu -903.2) partially offset by Wed +75.4 and Fri +238.4. Outflows were led by IBIT -1,085.7, with additional redemptions from GBTC -172.4, FBTC -115.8, ARKB -85.0, HODL -63.2, and BITB -7.9. Small creations in BTC (+274.1), BTCO (+35.8) and EZBC (+3.3) weren’t enough to change the tone.

Ethereum ETFs (7, 18–21 Nov 2025, $ millions): Net -500.2. Flows were negative on four of five sessions (-182.7, -74.2, -37.4, -261.6) before a modest +55.7 finish. Selling was driven by ETHA -559.0, ETHE -31.8, and to a lesser extent ETHV -14.1; offsets were limited to Grayscale ETH +80.9, ETHW +14.2, QETH +2.9, and EZET +4.8.

Spotlight 🔦Hyperiquid HIP-3 Growth Mode

What it is

Hyperliquid has introduced Growth Mode for HIP-3. Growth Mode applies steep fee discounts (up to about 90%) to new HIP-3 markets so early takers and makers can discover prices and post depth at lower cost. The goal is simple: make it cheaper to spin up liquidity when a market is young and order books are thin.

Why it matters

Lower fees in the bootstrap phase help kick-start volume, tighten spreads, and attract market makers who otherwise avoid new pairs. For builders, it reduces the friction of launching long-tail markets, niche assets, and experimental pairs. For traders, it means earlier access to instruments that would have taken weeks to reach usable liquidity under standard fees.

How it fits together

HIP-3 turns listings into a permissionless, builder-driven process. Growth Mode is the incentive layer that gives those fresh listings a runway. As markets mature and depth improves, they can transition out of the discounted phase, leaving a self-sustaining book with normal economics.

Rapid Reflexivity: Quick Market Takes ⚡

Megaeth: Frontier unveiled - Megaeth introduced Frontier, positioning it as the next phase of its stack with a focus on scaling throughput and developer access. Early materials frame it as a foundation for higher-performance on-chain apps.

Coinbase app code hints - New code references suggest upcoming modules for prediction markets and stock trading inside the Coinbase app. This points to a broader multi-asset, event-driven product direction.

Kraken IPO filing - Kraken submitted a draft registration statement for an IPO. A U.S. listing would give the exchange fresh capital and a public-market currency for expansion.

Kalshi raises $1B at $11B - Event-markets platform Kalshi closed a $1B round at an $11B valuation, signaling investor conviction in prediction markets as a mainstream asset class.

Caesar_data on-chain equity - Caesar_data announced steps toward issuing on-chain equity, an early test of tokenised corporate ownership for an AI company.

Open Campus × Animoca × ANPA: $50M EDU DAT - Partnership launches a $50M EDU Treasury (DAT) initiative to back education-focused tokenised programs and expand distribution.

Nunchi introduces nHYPE - Nunchi debuted nHYPE, adding another liquidity surface around HYPE-related activity with a native toolset for participants.

Solana SIMD-0411 - A proposal would double the network’s disinflation rate, accelerating the decline in SOL issuance. If passed, it could tighten long-run supply faster than the current schedule.

Upbit eyes Nasdaq after Naver deal - Following a merger with Naver, Upbit is exploring a Nasdaq listing, which would marry a major exchange with a tech giant’s distribution.

Enlivex: $212M for RAIN treasury - Enlivex outlined plans to raise $212M to build a RAIN token treasury, extending the trend of listed companies adopting token reserve strategies.

Nillion market-maker claim - Nillion alleged that a market maker sold tokens, adding pressure to near-term price action and putting execution and vesting expectations under scrutiny.

Last week, $KAS was the top gainer. This was largely attributed to Kaspa’s new programmability/smart-contract roadmap and throughput narrative, giving traders a fresh bullish story.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky, and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose, and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.