Hyperliquid’s Governance Crossroads: Fee Cuts, Permissionless Quotes, and USDH Control

Weekly Market Update #85

In partnership with DeFi Technologies Inc

Happy start to the week! Welcome back to the Reflexivity Weekly Market Update — your concise rundown of the biggest moves in crypto. If someone forwarded you this, you can sign up here for free to get it straight to your inbox!

Today’s Market Update is in partnership with DeFi Technologies Inc. DeFi Technologies Inc. (Nasdaq: DEFT) (CBOE CA: DEFI) (GR: R9B) is a financial technology company bridging the gap between traditional capital markets and digital assets. As the first Nasdaq-listed digital asset manager of its kind, DeFi Technologies offers equity investors diversified exposure to over 70 crypto assets through its integrated and profitable ETF and trading business model.

Before jumping into last week’s action, check out some of the research published last week by the Reflexivity team:

Major Market Developments:

🪙 Galaxy × Superstate list tokenised GLXY public shares on Solana

⚡ Tempo introduced, incubated by Stripe and Paradigm

🧩 Jito details four updates to $JTO tokenomics

🏛️ StablecoinX announces an additional $530 M raise for its ENA accumulation plan

🏦 Lido unveils stETH-powered vaults for programmable staking yield

🚀 pump.fun announces Project Ascend to expand the platform

📈 Rabby unveils Rabby Perps for on-chain derivatives trading

🚗 Avalanche × Toyota to explore blockchain-based robotaxi infrastructure

📅 YieldBasis posts launch timeline for its yield platform

🧾 Mega Matrix files a $2 B shelf to fund an ENA treasury (DAT) strategy

💸 Arbitrum rolls out a DeFi incentive programme to boost on-chain activity

🔎 Etherscan launches SeiScan, a block explorer for Sei

🪞 BlackMirror publishes $MIRROR tokenomics

🌐 OCTO secures $250 M (plus $20 M strategic) to initiate a WLD treasury strategy

Fear & Greed Index:

The Crypto Fear & Greed Index is 51 this week, essentially neutral. Sentiment has edged just to the risk-on side, but there’s no euphoria - positioning looks balanced, with traders adding selectively and keeping dry powder. In this zone, markets often chop and wait for a catalyst; a clear macro or regulatory headline typically decides the next leg.

Note: The index ranges from 0 (extreme fear during capitulations and sell-offs) to 100 (extreme greed during euphoric, overbought conditions).

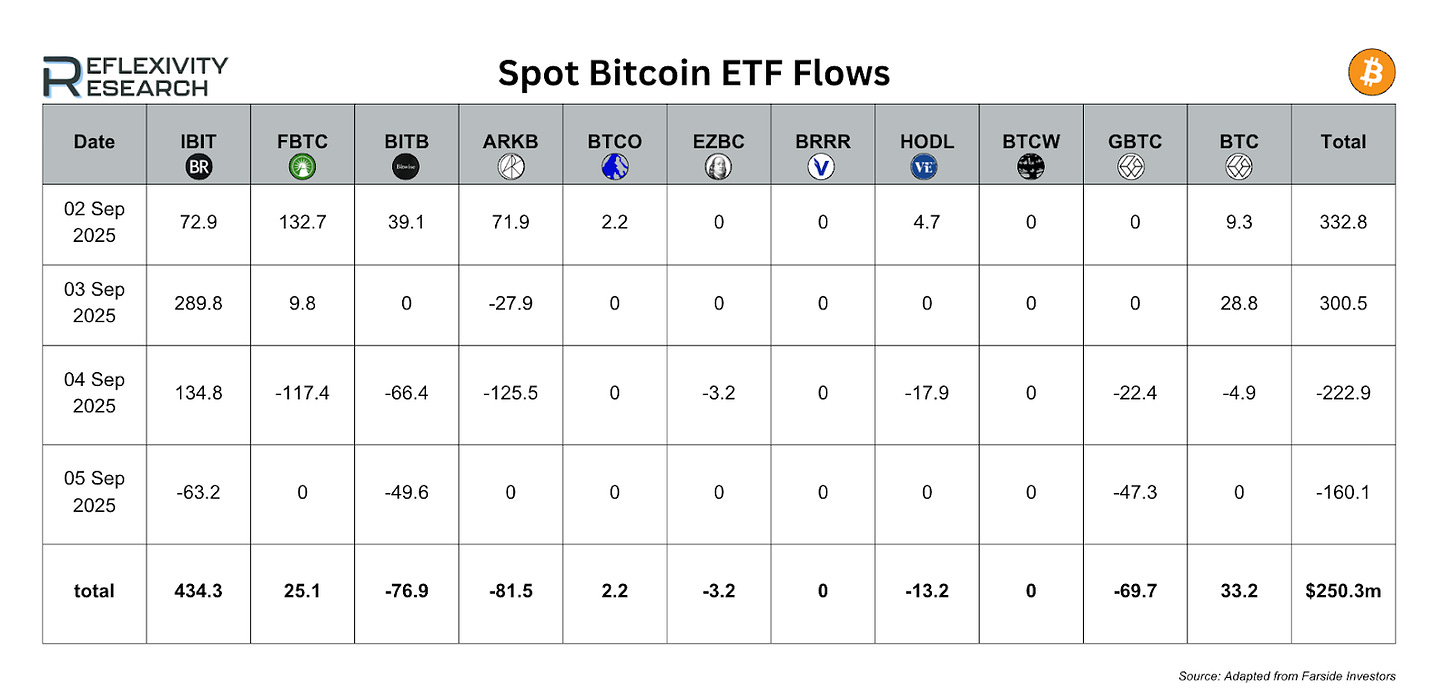

ETF Flows:

Net +250.3. Strong creations on 2 Sep (+332.8) and 3 Sep (+300.5) more than offset 4 Sep (-222.9) and 5 Sep (-160.1). By issuer: IBIT +434.3, FBTC +25.1, BTC +33.2, BTCO +2.2. Offsets came from BITB -76.9, ARKB -81.5, GBTC -69.7, HODL -13.2, EZBC -3.2. The upshot is a modest weekly gain led almost entirely by IBIT while legacy GBTC and several peers saw outflows.

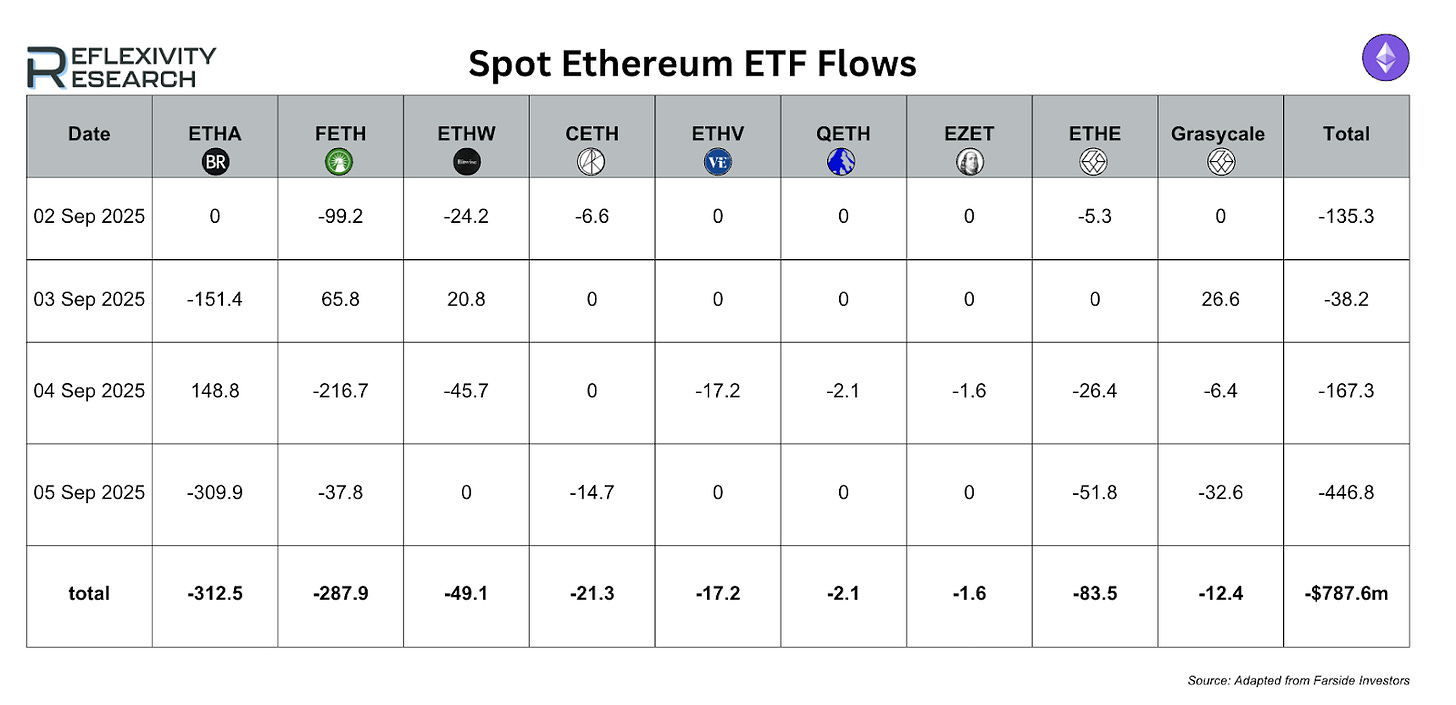

Ethereum ETFs (2–5 Sep 2025, $ millions).

Net -787.6 with the damage concentrated on 5 Sep (-446.8) and additional red days on 2 Sep (-135.3) and 4 Sep (-167.3); 3 Sep was only slightly negative (-38.2). Biggest drags: ETHA -312.5, FETH -287.9, ETHE -83.5. Smaller products were also soft: ETHW -49.1, CETH -21.3, ETHV -17.2, QETH -2.1, EZET -1.6; Grayscale ETH was mixed and finished -12.4 despite a one-day +26.6 inflow on 3 Sep.

Spotlight 🔦- Hyperliquid’s Governance Showdown

Hyperliquid is preparing a network upgrade that slashes taker fees by ~80% on quote-to-quote spot pairs, adds maker rebates, and credits user volume - plus it’s moving toward permissionless spot quotes with future staking/slashing.

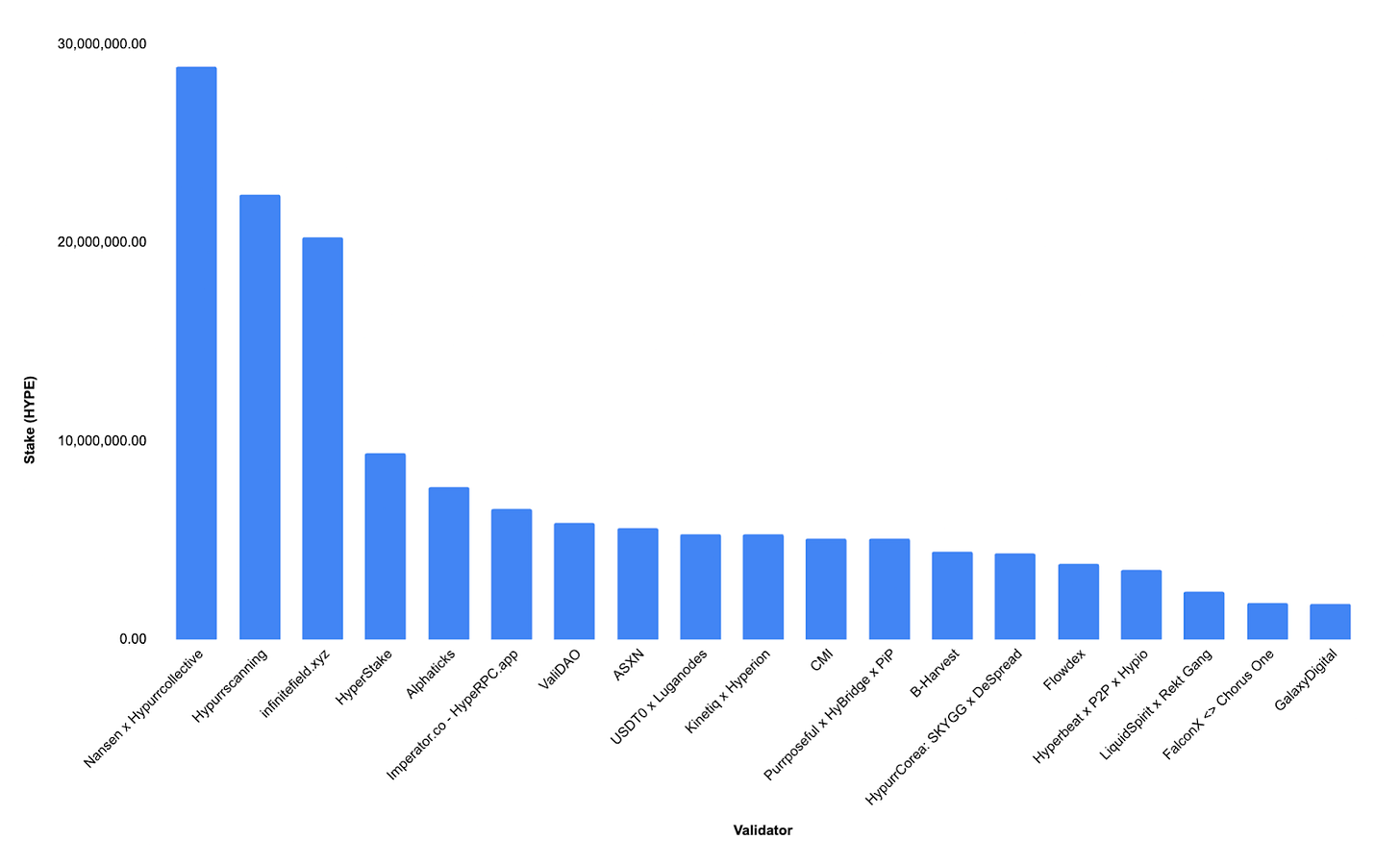

A validator vote will also release the reserved USDH ticker to a selected team. Below is a breakdown of the amount of stake per validator as of September 9th:

Two early proposals want the USDH mantle: Native Markets (via Bridge, a Stripe company) and Paxos Labs (Paxos’ new entity; it also acquired Molecular Labs, the team behind LHYPE/WHLP).

The outcome could reshape Hyperliquid’s liquidity, fee capture, and institutional credibility - especially if reserve interest is routed back to the ecosystem as proposed.

Rapid Reflexivity: Quick Market Takes ⚡

Tempo unveiled: A new project incubated by Stripe and Paradigm, pointing to continued fintech experimentation with on-chain payments.

Jito $JTO tokenomics: Announced four updates to JTO’s design to refine incentives and governance alignment.

StablecoinX +$530M: Disclosed additional capital for its ENA accumulation plan, scaling a pure-play Ethena treasury strategy.

Avalanche × Toyota: Exploring blockchain rails for autonomous robotaxi infrastructure, putting enterprise mobility use-cases on AVAX’s roadmap.

YieldBasis: Shared a public launch timeline, signalling its yield platform is nearing go-live.

Galaxy × Superstate: Listed tokenised GLXY public shares on Solana, advancing real-world equity instruments on-chain.

Lido stETH vaults: Introduced stETH-powered vaults to package staking yield into programmable DeFi building blocks.

Pump.fun Project Ascend: Announced a growth initiative aimed at scaling the launchpad’s product and community footprint.

Mega Matrix $2B shelf: Filed to fund an ENA treasury (DAT) strategy, enabling accelerated capital deployment into Ethena’s ecosystem.

Arbitrum DeFi incentives: Launched a new programme to stimulate liquidity, user growth and app activity across the L2.

Etherscan → SeiScan: Rolled out a dedicated block explorer for Sei, improving transparency and developer tooling.

BlackMirror $MIRROR: Published tokenomics, outlining supply, utility and distribution for the new token.

OCTO $250M placement: Secured funding (plus a strategic top-up) to initiate a WLD treasury (DAT) strategy.

Rabby Perps: Introduced perpetuals trading within the Rabby wallet, bringing one-click access to on-chain derivatives.

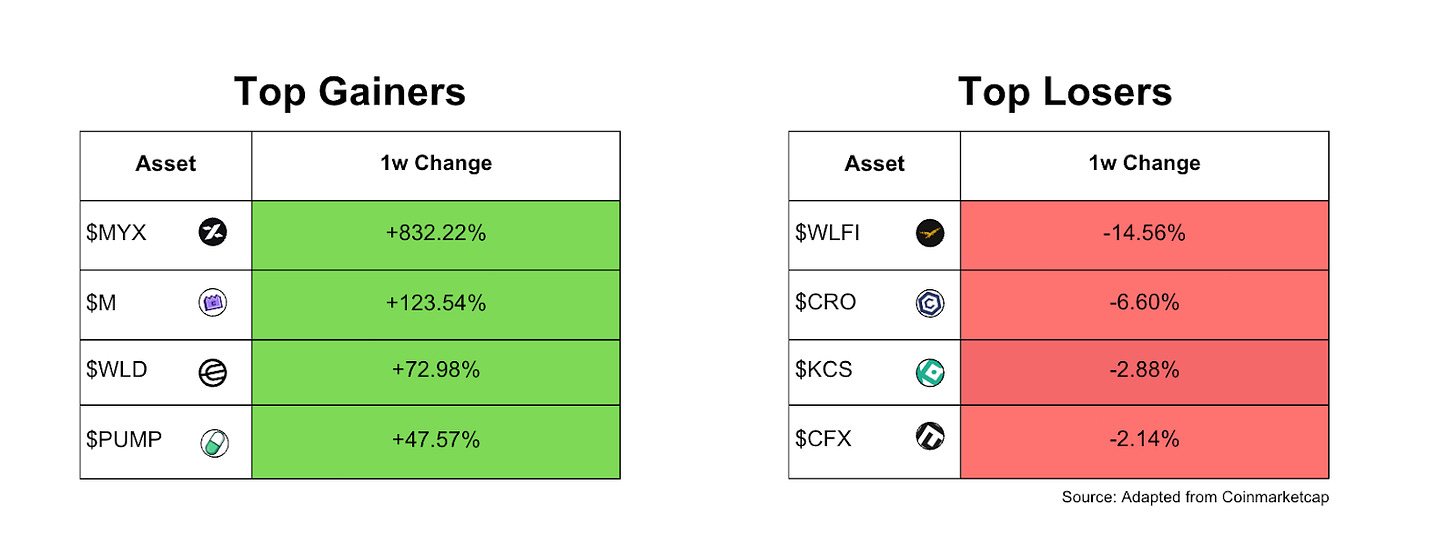

MYX spiked because of a WLFI–listing announcement that drew traders in, derivatives leverage and short squeezes that turbocharged the rally, and a 39M token unlock that added fuel and controversy. Liquidity was thin and concentrated, so whales and liquidations could move prices disproportionately.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky, and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose, and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.