Hong Kong spot Bitcoin and Ether ETFs go live as Stripe reopens Crypto Payments

Weekly Market Update #37

Major developments for the week:

Bitcoin ETF products saw net outflows of $328 million last week

Franklin Templeton has activated peer-to-peer transfers for its on-chain US Government Money Fund

Morgan Stanley is considering permitting its brokers to recommend Bitcoin ETFs to clients

Payment giant Stripe reopens crypto payments with USDC focus

A Paraguayan Deputy has introduced legislation to legalise Bitcoin and recognize it as legal tender

Brazil's biggest digital bank, Nubank, now enables customers to send and receive Bitcoin via its banking app

Grayscale filed for S-3 for spot Ether ETF and mini spot Ether ETF

Hong Kong's spot Bitcoin and Ether ETFs, which are 'in-kind', commence trading

SEC served Consensys with a Wells Notice. Consensys filed a Lawsuit against the SEC

The next sale of FTX's collection of locked Solana will reportedly be conducted through an auction, likely due to strong buyer demand

Shiba Inu has raised $12 million via the TREAT token to develop its new privacy-focused Layer 3 blockchain

Metis Announced Phase 2 of its Decentralized Sequencer

MEME will undergo a $136.91 million unlock on May 3rd, 2024

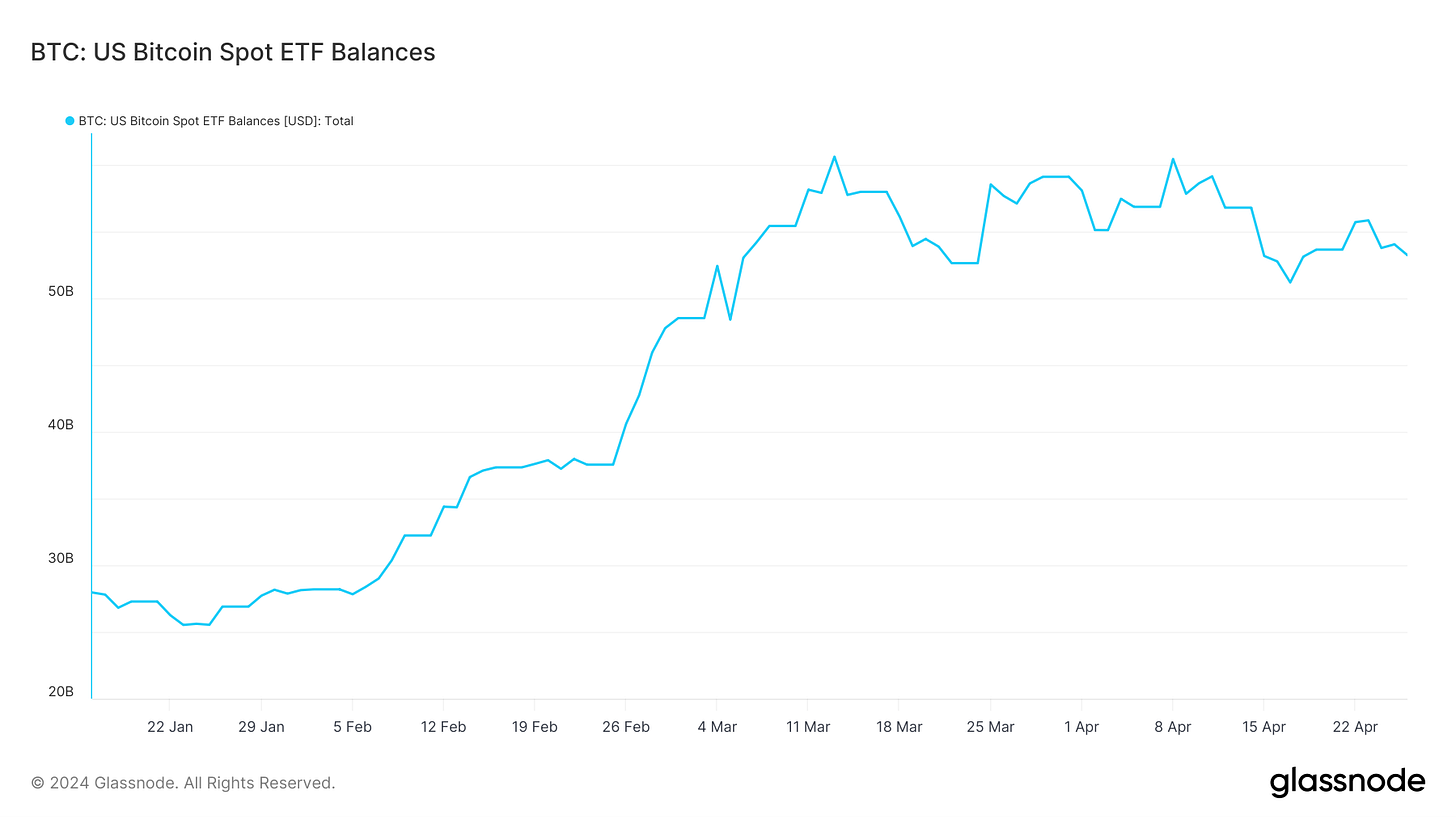

Bitcoin ETF products saw net outlfows of $328 million last week

During the period of April 22nd to April 26th, the aggregate data shows that IBIT received a total of $57.6 million, while FBTC experienced inflows of $19.4 million. BITB and ARKB saw inflows of $15.6 million and $34.2 million, respectively. Conversely, GBTC witnessed significant outflows, totaling $454.1 million for the period. Other funds, such as ARKB, faced a notable single-day outflow of $31.3 million on April 25th. The total movement across all Bitcoin ETFs for this five-day period was an outflow of $328 million. A more granular look at recent trends reveals that the total on-chain holdings over the last 14 days, if annualised, project a decrease in Bitcoin supply absorption by 1.37%.

Last week GBTC announced its intention to convert 20% of its holdings into a new Bitcoin ETF, featuring the lowest fee among all existing spot ETFs. The significance of this move is highlighted by an SEC filing, which indicates that GBTC plans to shift 63,000 BTC into this ETF. This transfer represents 20% of their total assets under management, elevating the Bitcoin ETF to become the fourth largest, with an AUM of $4 billion. Additionally, the new ETF will have a management fee of only 0.15%, the most competitive rate across all Bitcoin ETFs.

Franklin Templeton has activated peer-to-peer transfers for its on-chain US Government Money Fund

Franklin Templeton made history in 2021 as the first U.S-registered fund to utilise a public blockchain for processing transactions and recording share ownership. Last week they announced that they have facilitated peer-to-peer transfers of tokenized shares within its on-chain U.S. Government Money Fund.

Each share is represented by the BENJI token, which operates on the Polygon and Stellar blockchains. At present, Franklin Templeton strands as the leader in the tokenized U.S. Treasuries sector as detailed by the below table:

The firm currently boasts $384.27m in AUM and 29.6% market share. It is noteworthy, however, that Blackrock has achieved rapid growth since its launch in late March of this year.

Consensys filed a lawsuit against the SEC

In other news, last week saw major developments on the litigation front between SEC and Consensys. The recent lawsuit filed by Consensys against the SEC challenges the agency's attempt to classify Ethereum's native token $ETH as a security. This legal dispute underscores broader issues concerning regulatory jurisdiction and the potential impact on the Ethereum blockchain and the wider cryptocurrency sector.

Consensys argues that the SEC's actions are inconsistent with previous regulatory guidance and contradict the Commodity Futures Trading Commission's classification of Ether as a commodity. The company is contesting the SEC's issuance of a Wells notice and potential enforcement actions related to their MetaMask wallet product, asserting that such actions represent a misapplication of securities law to a technology that functions primarily as a commodity.

The lawsuit seeks a judicial declaration that Ether is not a security and that MetaMask does not operate as an unlicensed broker-dealer.

Hong Kong's spot Bitcoin and Ether ETFs will commence trading

On a more positive note, Hong Kong’s spot BTC and ETH ETFs have begun trading. These ETFs have been approved by Hong Kong's Securities and Futures Commission and include products managed by prominent asset managers like China Asset Management, Harvest Fund Management and Bosera Asset Management in partnership with HashKey. This marks a significant development in Hong Kong's digital assets space, aiming to provide investors with a regulated, efficient and safe means to invest in Bitcoin and Ethereum.

The spot Bitcoin and Ether ETFs in Hong Kong will employ an "in-kind" creation model. This differs from the cash-creation model used in the United States, as it allows the direct exchange of cryptocurrencies for ETF shares, which could lower costs and enhance liquidity.

With US Bitcoin spot ETF balances having slowed, could Hong Kong pick up the slack?

So far, with BTC and ETH ETFs in HK trading roughly $10mm on their first day, this seems unlikely so far.

Metis Announced Phase 2 of its Decentralised Sequencer

Another interesting development last week came from Metis in which it announced Phase 2 of its Decentralised Sequencer. The completion of Phase 1 of the Metis Decentralised Sequencer upgrade occurred on March 14th 2024. This advancement positioned Metis as the pioneer rollup platform featuring a decentralised sequencer. Phase 2 is currently underway, aiming to improve incentive alignment among all network participants. Below is a summary of the main aspects of Phase 2 and how they will impact the community:

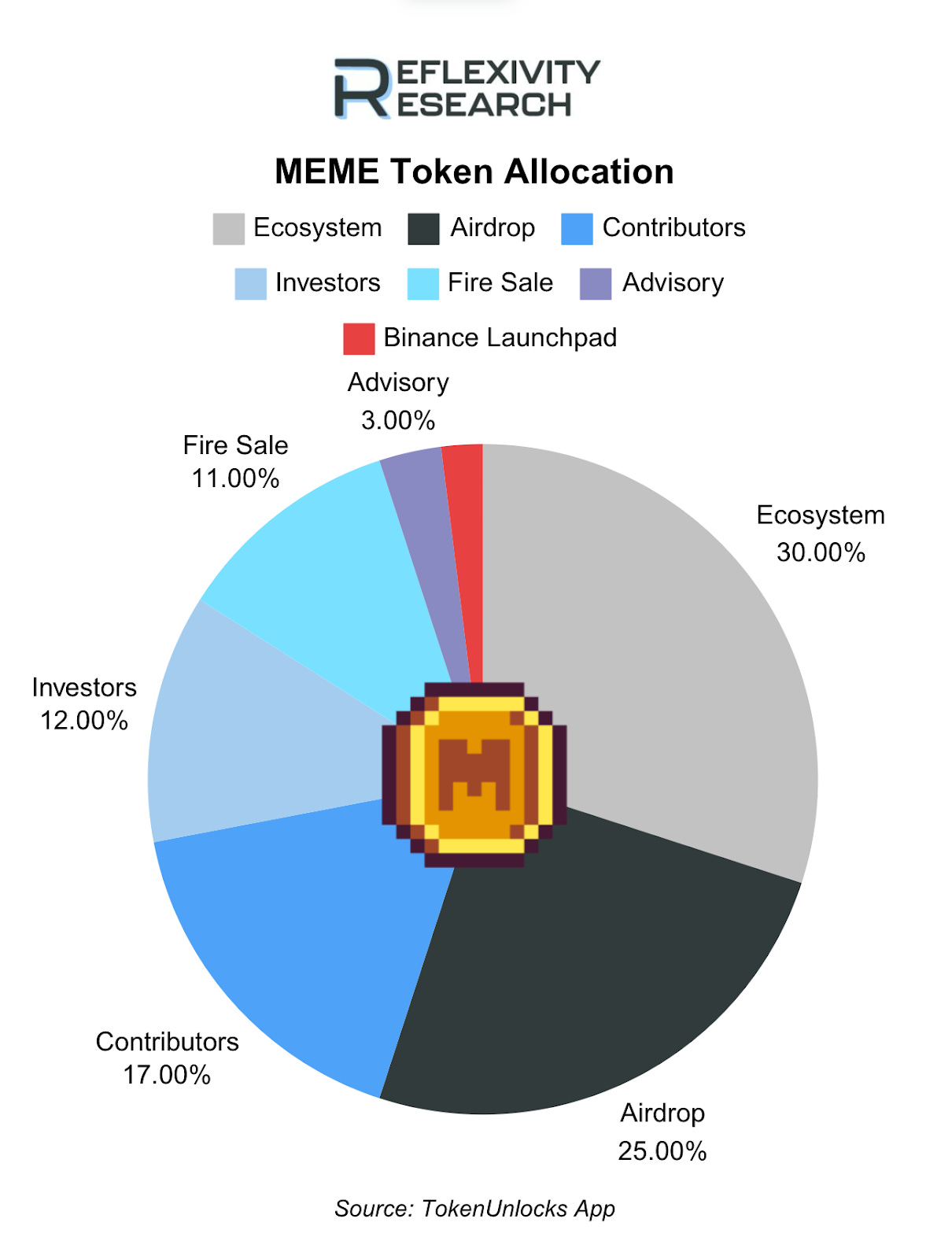

MEME will undergo a $136.91 million unlock on May 3rd, 2024

Lastly, the major unlock event of this week features $MEME. To begin with, there will be a Cliff Unlock in which; the Airdrop is expected to unlock 3.45 billion MEME tokens, constituting 20.73% of the circulating supply and is valued at an estimated $96.07 million or 22.65% of the market cap. The Advisory portion is set to release 1.04 billion MEME tokens, which is 6.22% of the circulating supply and corresponds to 6.79% of the market cap, valued at approximately $28.82 million. For Investors, the unlock will comprise 828 million MEME tokens, representing 4.98% of the circulating supply and 5.44% of the market cap, with an estimated value of $23.06 million.

Secondly, there will be a Linear Unlock in which; the Fire Sale will release 10.41 million MEME tokens per day for 184 days, amounting to nearly $53.32 million. The Ecosystem unlock rate is set at 25.49 million MEME tokens per day over the same duration, totalling about $130.59 million. Additionally, Investors are set to receive 13.57 million MEME tokens per day, adding up to approximately $69.55 million over the 184-day period.

Note: The content in this weekly report has also been utilized in our weekly collaborative series with stock/crypto trading platform eToro.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

View 50+ free reports on our homepage: reflexivityresearch.com