Hong Kong gives greenlight for Bitcoin ETFs as halving sits just days out

Weekly Market Update #35

Major developments for the week:

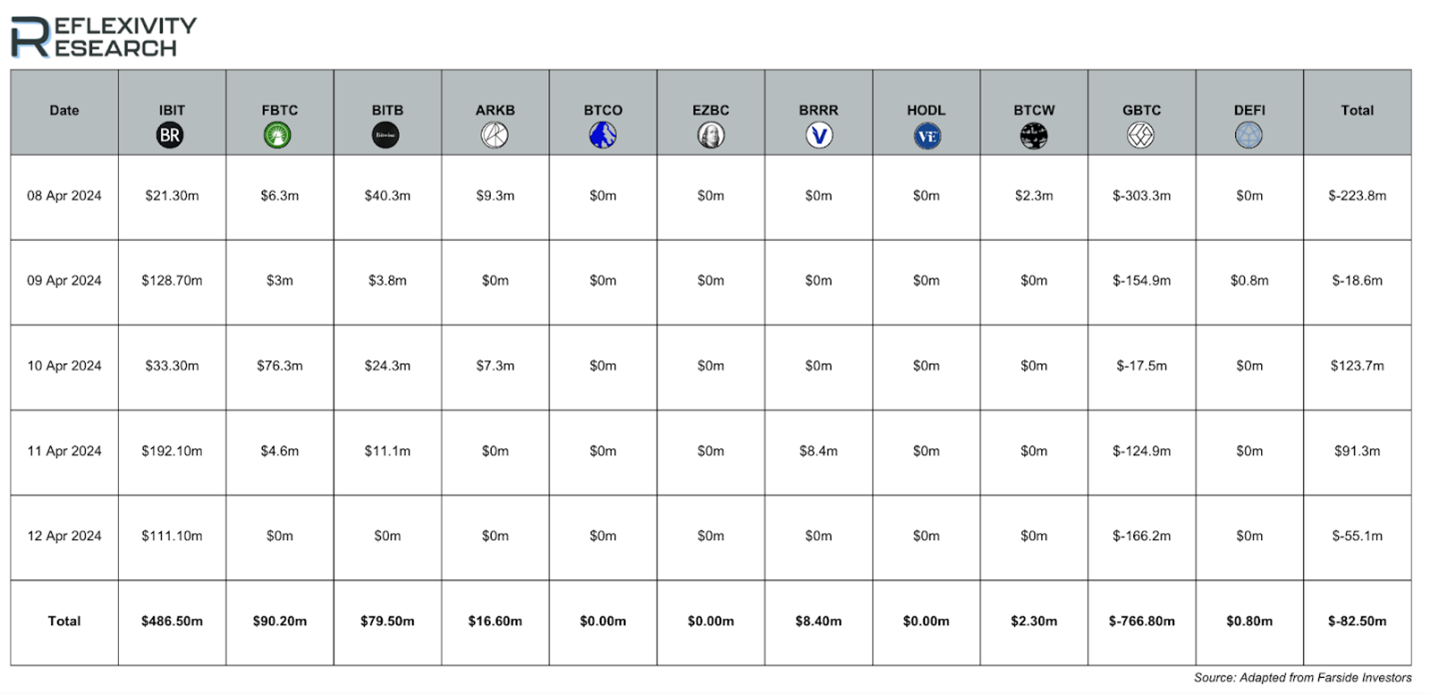

Bitcoin ETF products saw net outflows of $82.5 million last week

Hong Kong gives initial approval to Bitcoin and Ether spot ETFs

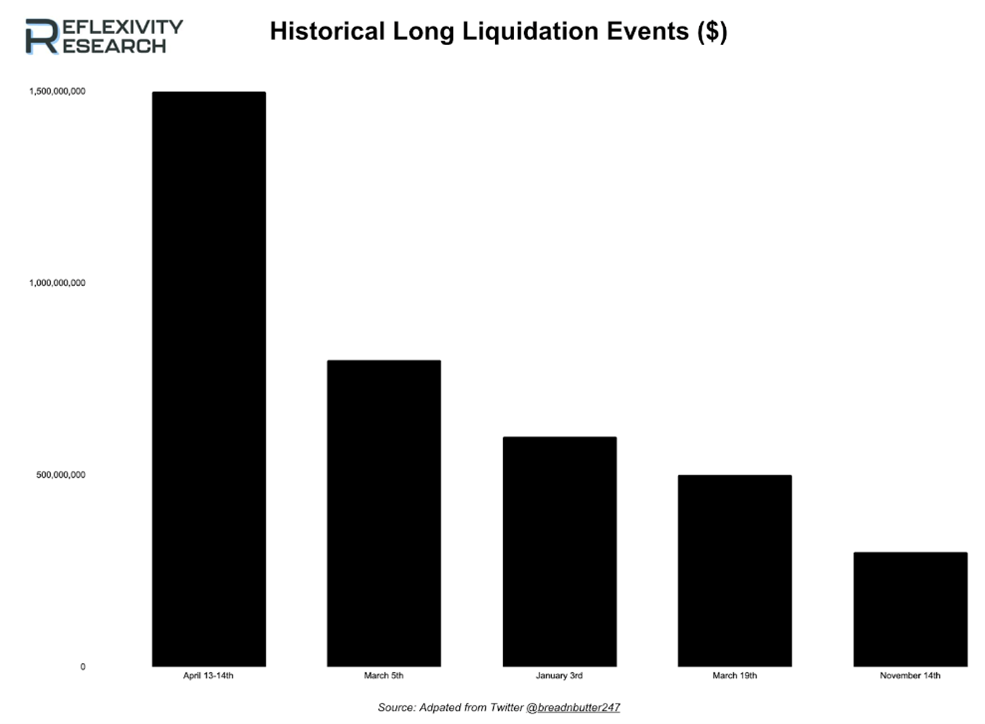

Last week digital asset markets experienced over $1.5 billion in long liquidations

Bitcoin halving is in 4 days, set for April 19th at 15:13 UTC

Chainlink has introduced Transporter, a new application designed to transfer cryptocurrency tokens and messages across different blockchains, utilising its Cross-Chain Interoperability Protocol

Aptos announces partnership with Ionet

Andre Cronje announces a framework for launching memecoins to foster a safer environment

Tether announced that their tokenized platform will soon be available

Circle announced new capabilities that allow Blackrock BUIDL customers to use USDC for transactions, facilitating smooth on-chain integration with their innovative tokenized fund

Uniswap received a Wells notice from the SEC

EigenDA went live last week and restaking deposits will be unpaused on April 16th

Google Cloud has become a node operator on the EigenLayer mainnet

ARB will undergo a $94.87 million unlock on April 16th, 2024

Bitcoin ETF products saw net outflows of $82.5 million last week

Last week, Bitcoin ETFs experienced net outflows of $82.5 million, a marked change from the previous week's net inflows of $845 million. Since their inception, these ETF products have recorded a total net flow of $12.7 billion, with current on-chain holdings at 841,000 BTC, representing 4.27% of the total circulating supply of Bitcoin.

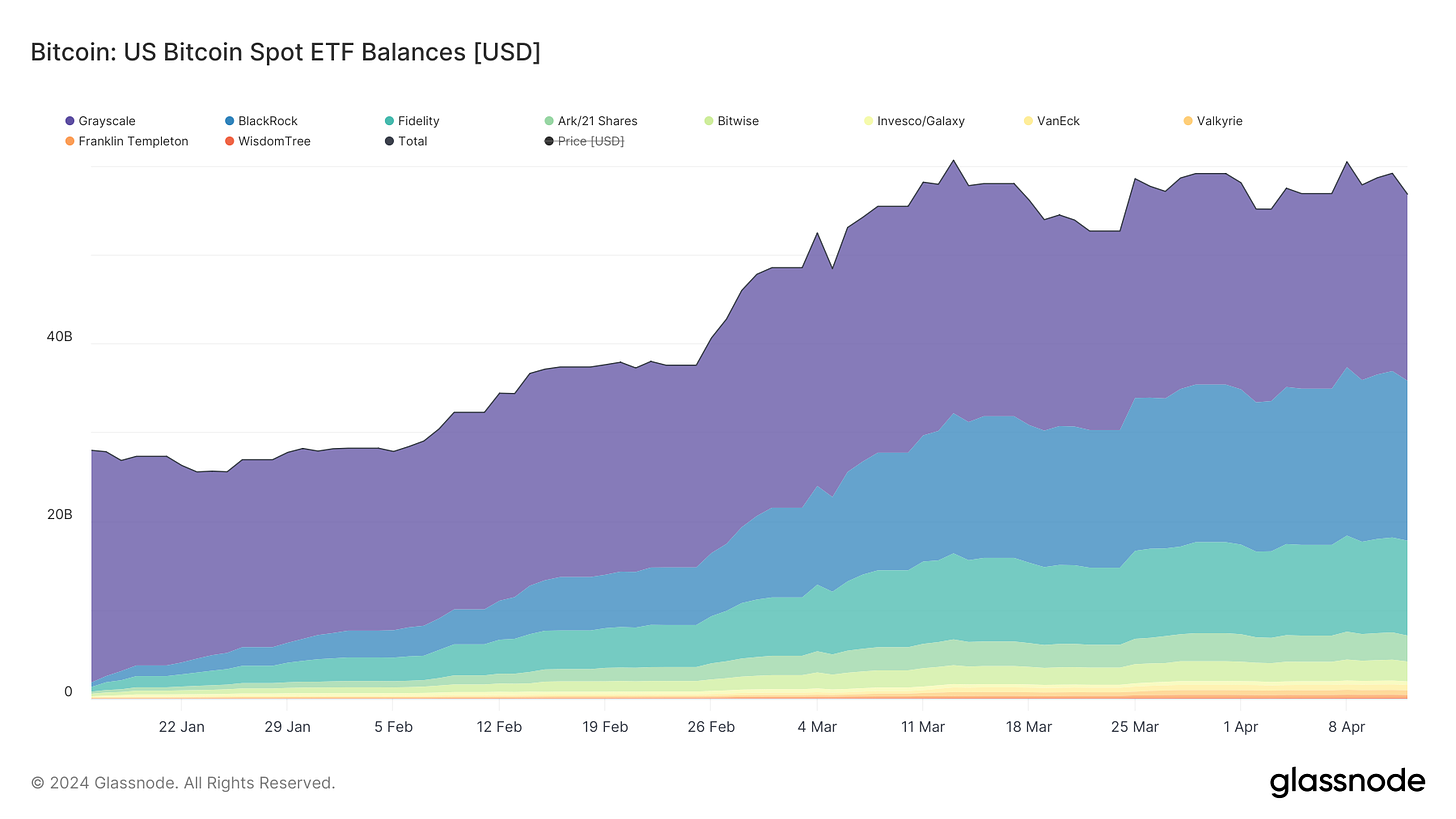

The chart below illustrates that Bitcoin ETFs have held steady with approximately 830,000 BTC (~$55 billion) in assets under management for over a month:

Another interesting development occurred this morning on the ETF front in which Hong Kong regulators approved the introduction of spot Bitcoin and Ether exchange-traded funds. The Hong Kong Securities and Futures Commission has given the green light to three ETF providers. Among them, Harvest Global and Bosera International have confirmed their approval to offer Bitcoin and Ether ETFs. Although these asset managers have received approval, there will be a period of time prior to the official launch of their ETF products.

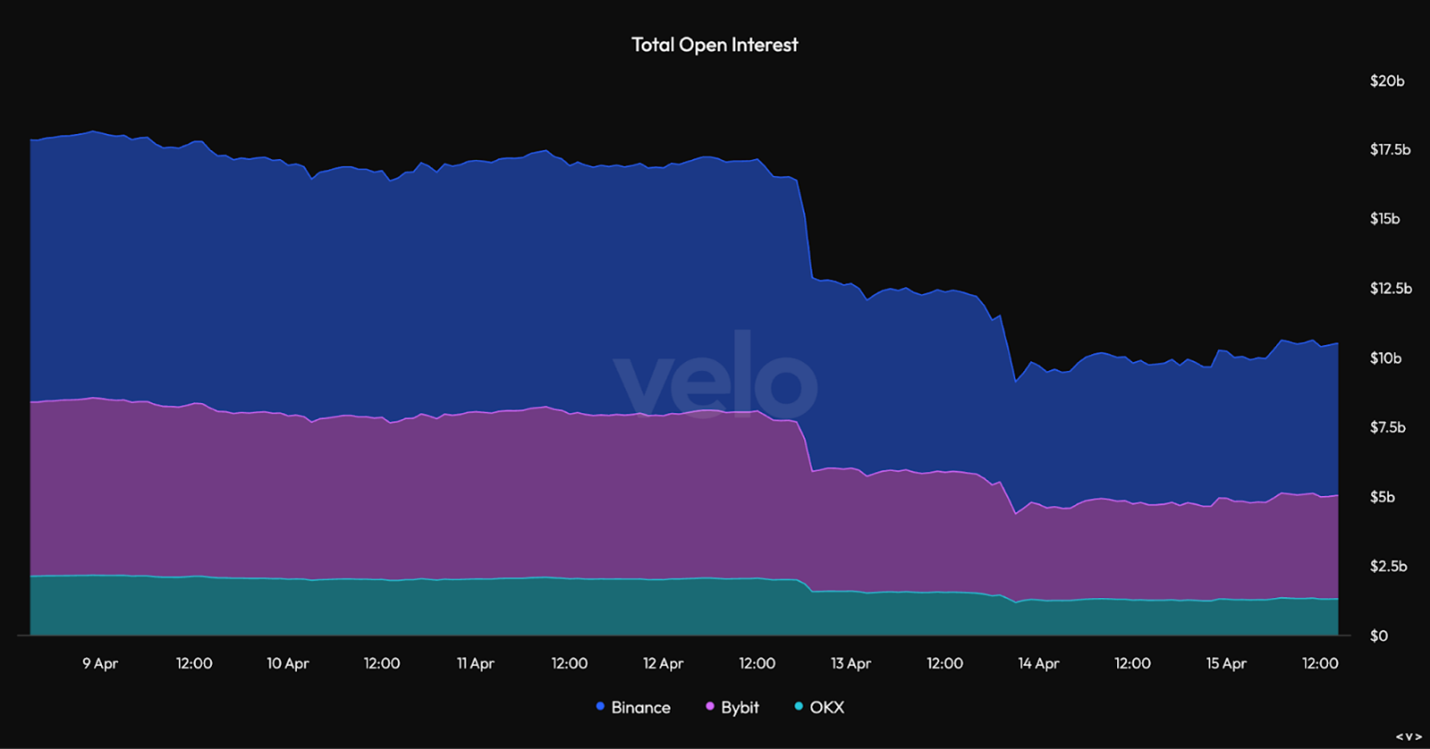

Digital asset markets experience over $1.5 billion in long liquidations

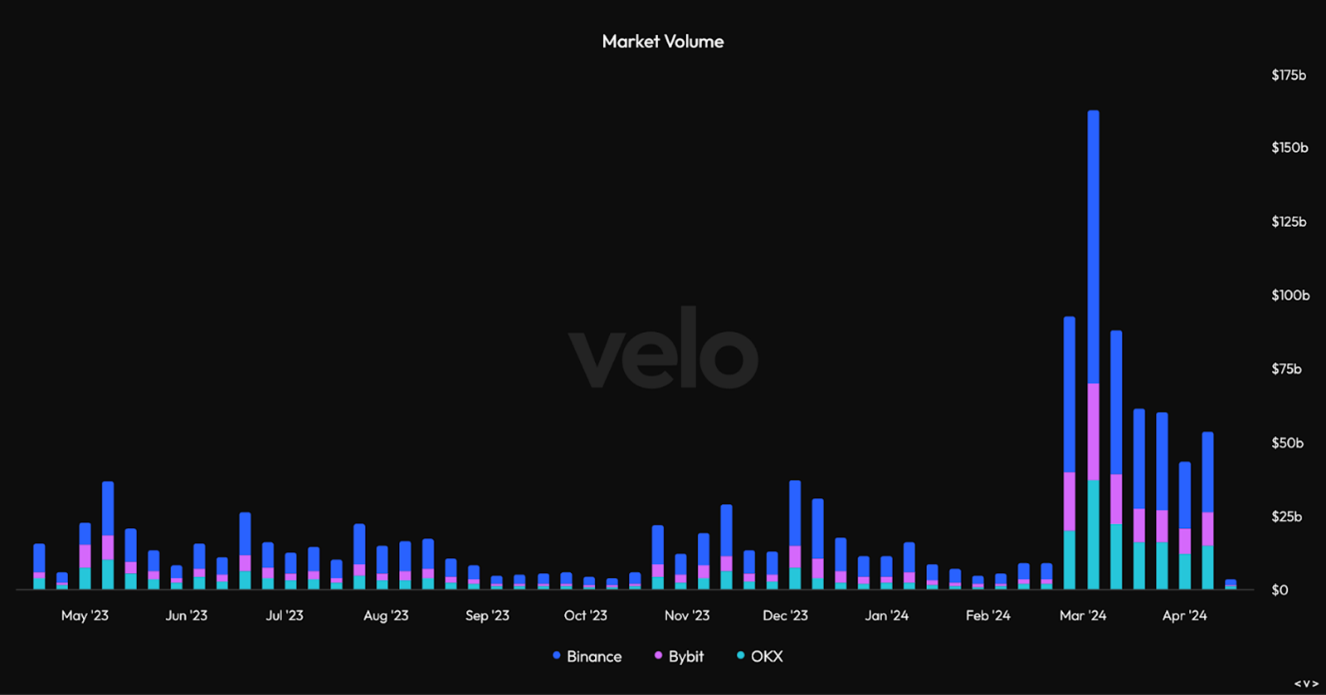

Last week, the markets experienced a significant liquidation event, with $1.5 billion in long positions being liquidated. In total, over $12 billion in open interest was wiped out, including approximately $6 billion from altcoins, as shown in the chart below:

This event marks the largest long liquidation since the cycle began in October and is one of the largest altcoin liquidation events ever recorded on Binance and Bybit.

Altcoins accounted for nearly half of the $1.5 billion in long liquidations, totalling $750 million. Of the remaining sum, Bitcoin represented approximately $525 million and Ethereum about $268.5 million.

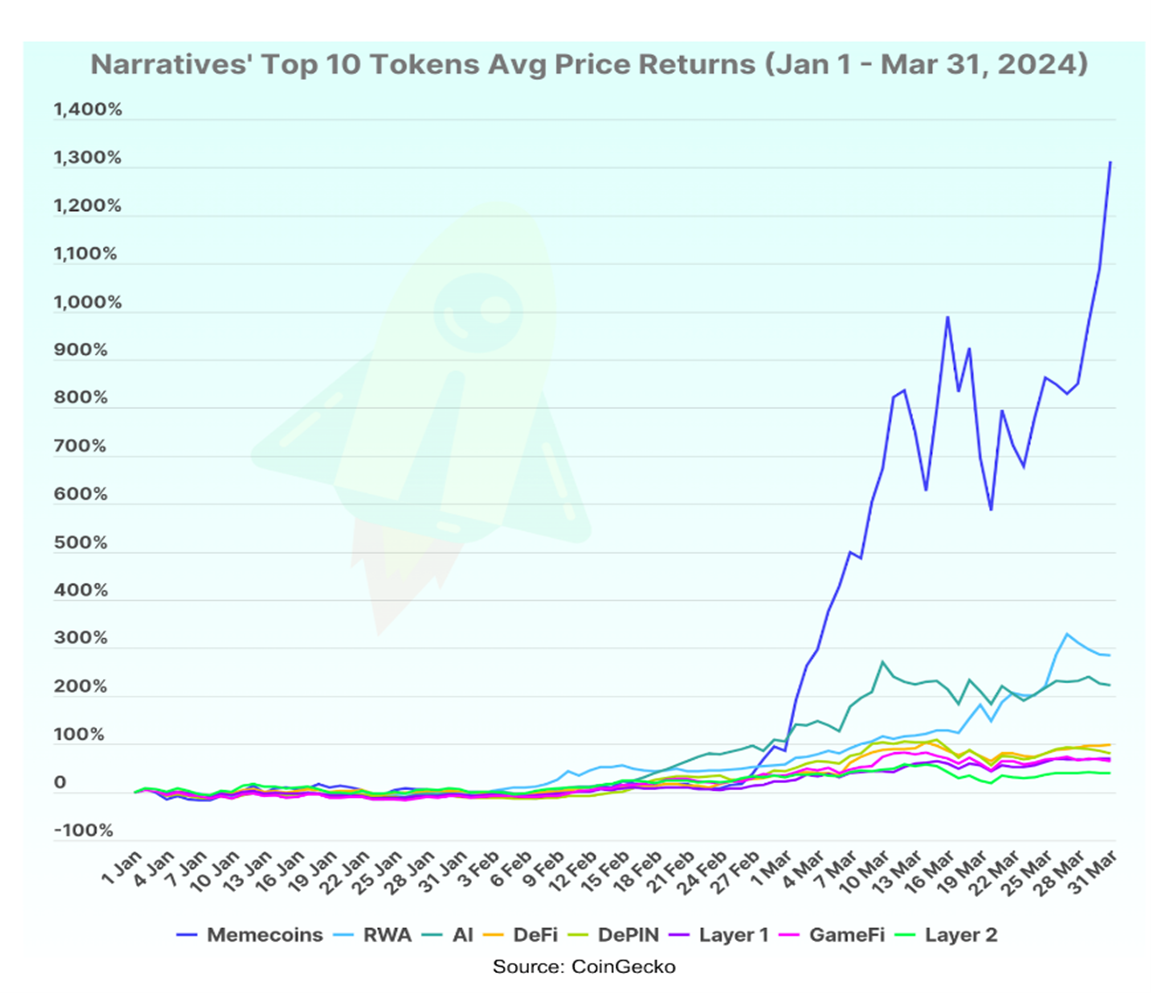

Leading memecoins have outperformed every other crypto subsector YTD

In recent months, meme coins have attracted considerable interest from a diverse range of market participants according to CoinGecko. Over the last year, open interest in memecoins has significantly increased, indicating a growing demand for exposure to this market niche.

In March of this year, trading volume for meme coins peaked at $163 billion, marking a substantial increase in activity:

This heightened interest in meme coins has led protocols and individuals to develop strategies that enhance the ecosystem's safety and transparency.

Within this context, Fantom emerged last week as an advocate for creating a secure environment for meme coin enthusiasts and investors. Andre Cronje's proposal addresses important risks such as token dumping, liquidity withdrawal and unregulated token control. The plan recommends direct proposal submissions, securing marketing funds in multi-signature wallets, allocating a significant portion of tokens to a liquidity pool and implementing transaction size limits. These measures aim to reduce the speculative tendencies in the sector and lay the groundwork for a more stable and reliable meme coin community.

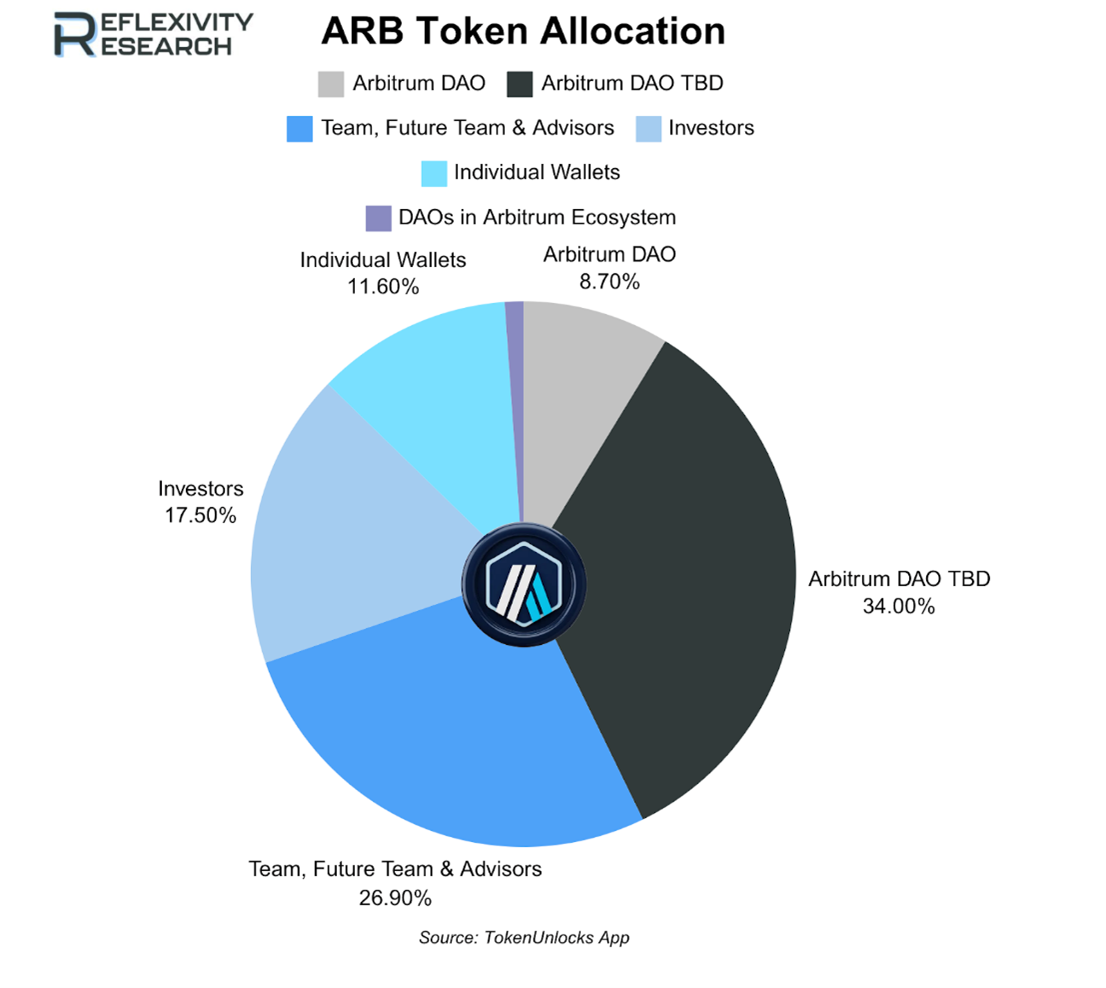

Arbitrum will undergo a $94.87 million unlock on April 16th, 2024

Lastly, the primary unlock event this week features ARB. Scheduled for April 16th, 2024, $ARB plans to release 3.49% of its circulating supply. This comprises $57.47 million for Team, Future Team & Advisors. It also comprises $37.4m for Investors. $ARB vesting schedule is estimated to reach completion by July 17th, 2027.

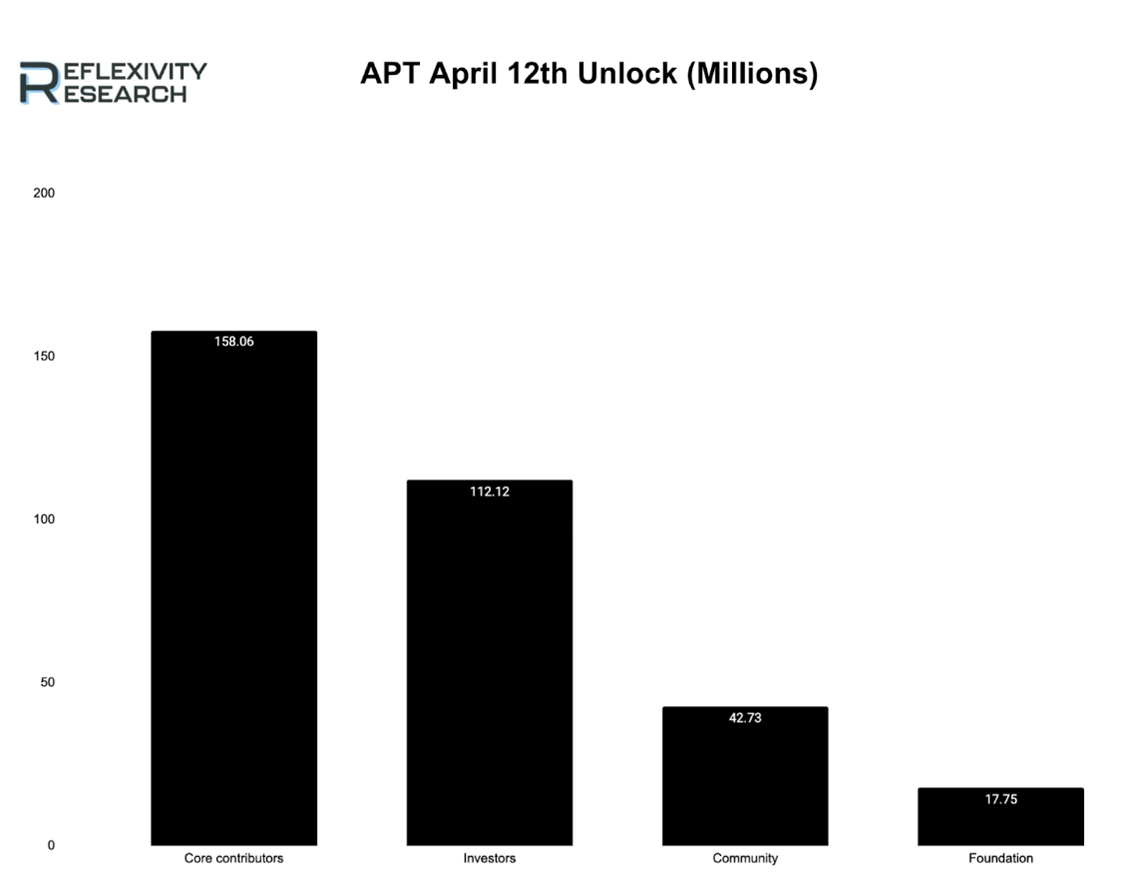

Lastly, the primary unlock event this week features APT. Scheduled for April 12th, 2024, $APT plans to release 6.23% of its circulating supply. This comprises $158.8 million for Core Contributors, $112.12 million for Investors, $42.73 million for Community and $17.75 million for Foundation. $APT’s vesting schedule is estimated to reach completion by October 9th, 2032.

Note: The content in this weekly report has also been utilized in our weekly collaborative series with stock/crypto trading platform eToro.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

View 50+ free reports on our homepage: reflexivityresearch.com