Ether Flows Outpace BTC and Circle and Stripe Announce Their Own L1 Networks

Weekly Market Update #82

In partnership with DeFi Technologies Inc

Happy start to the week! Welcome back to the Reflexivity Weekly Market Update — your concise rundown of the biggest moves in crypto. If someone forwarded you this, you can Sign up here for free to get it straight to your inbox!

Today’s Market Update is in partnership with DeFi Technologies Inc. DeFi Technologies Inc. (Nasdaq: DEFT) (CBOE CA: DEFI) (GR: R9B) is a financial technology company bridging the gap between traditional capital markets and digital assets. As the first Nasdaq-listed digital asset manager of its kind, DeFi Technologies offers equity investors diversified exposure to over 70 crypto assets through its integrated and profitable ETF and trading business model.

Before jumping into last week’s action, check out some of the research published last week by the Reflexivity team:

-Bitlayer- First BitVM, Powering Bitcoin DeFi

-Dinero: Building the Back-end of Institutional Crypto Yield

Major Market Developments:

💰 CASK launches $360 M $IP token reserve with backing from a16z and other major investors

📈 Limitbreak debuts LBAMM market-making model on Hyperliquid

🔄 LayerZero to acquire Stargate and initiate token swap for STG holders

⚡ Stripe builds Tempo blockchain with Paradigm support

🪙 Circle unveils plans for its own L1, ARC, focused on stablecoins

💵 BMNR files to expand equity program by $20 B

🦄 Uniswap Foundation floats DUNI token proposal alongside fee switch discussion

⚖️ Do Kwon pleads guilty to U.S. fraud charges tied to $40 B collapse

🚀 Bullish raises $1.1 B in IPO, priced above expectations

📉 Gemini files for IPO despite $282 M losses amid rally

🏦 Federal Reserve shutters crypto bank supervision program in regulatory rollback

📊 Liminal Money introduces tokenized delta-neutral strategies

🎯 Theo Network launches points system to track ecosystem participation

Fear & Greed Index:

The Crypto Fear & Greed Index sits at 56 this week, reflecting a mild greed reading. Sentiment is tilted slightly risk-on, but not in overheated territory. Historically, mid-50s levels suggest cautious optimism but lack of excessive froth - investors are adding exposure, yet markets remain balanced.

Note: The index ranges from 0 (extreme fear during capitulations and sell-offs) to 100 (extreme greed during euphoric, overbought conditions).

ETF Flows:

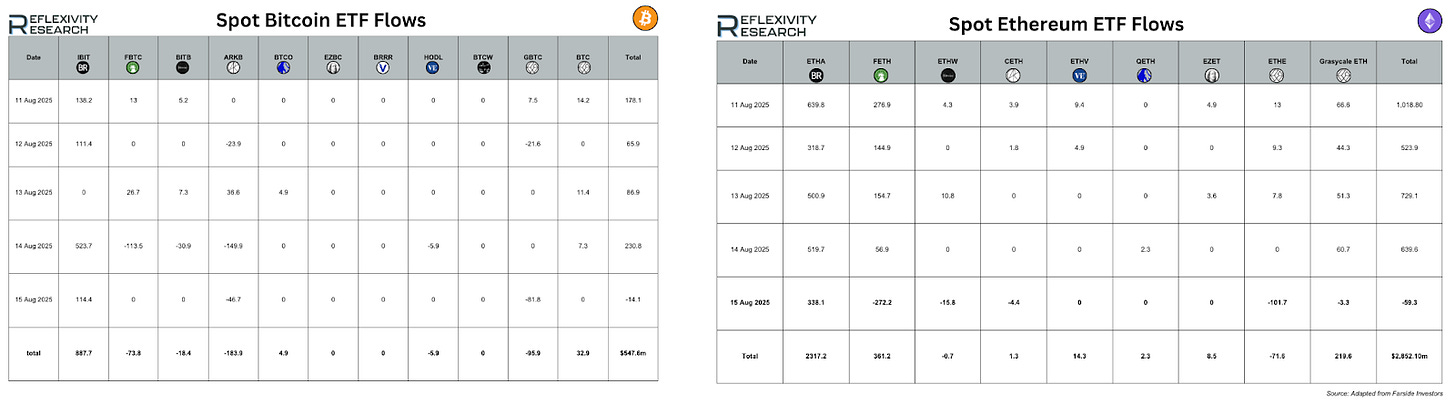

Spot-Bitcoin ETFs added $548 million over 11–15 Aug. IBIT did all the heavy lifting at +$888 million, while FBTC -$74 million, ARKB -$184 million, and GBTC -$96 million offset much of it; smaller moves included BTC +$33 million, BTCO +$5 million, and HODL -$6 million. Daily prints were mostly positive, peaking on 14 Aug at +$231 million and finishing slightly negative on 15 Aug (-$14 million).

Spot-Ethereum ETFs had a blockbuster week with +$2.85 billion. ETHA contributed +$2.32 billion, FETH +$361 million, and the Grayscale ETH fund +$220 million, while ETHE was the only notable drag at -$72 million. The first four sessions were strongly positive, highlighted by 11 Aug (+$1.02 billion) and 13 Aug (+$729 million), with a single pullback on 15 Aug (-$59 million).

Spotlight 🔦

The Hyperliquid ecosystem saw two notable developments last week.

Theo Network points go live:

The first of which came from Theo Network, which has introduced an on-chain points system to track and reward real user activity. Points create a simple, measurable way to recognize contributors before any governance decisions, and they tend to bootstrap early product usage without committing to token economics too soon. Expect points to concentrate around behaviours the team wants more of (building, testing, supporting launches), tightening the feedback loop between contributors and roadmap priorities.

Liminal introduces tokenised delta-neutral strategies. Liminal has unveiled tokenized, delta-neutral vaults that aim to deliver market-independent yield by offsetting long and short exposure. Wrapping these hedged positions into composable tokens lowers the barrier to professional strategies (carry/funding/basis), making them plug-and-play across DeFi. The draw is cleaner risk budgeting for treasuries and users who want yield without taking a directional punt. Though, as ever, basis/funding, liquidity, and smart-contract risks still need watching.

Rapid Reflexivity: Quick Market Takes ⚡

Tokenized reserves scale up – CASK’s $360 M $IP reserve, backed by a16z, highlights institutional appetite for IP-linked assets and extends tokenization into new verticals.

Corporate blockchains proliferate – Stripe’s “Tempo” chain and Circle’s ARC L1 show fintechs moving from rails providers to full-stack blockchain operators, each aiming to control stablecoin flows.

Equity program expansion – BMNR’s $20 B equity program enlargement signals continued TradFi capital deployment into crypto-adjacent strategies.

Uniswap governance pivots – Proposal for a DUNI token and fee switch marks a potential structural change in how Uniswap redistributes protocol revenue.

Legal reckoning – Do Kwon’s guilty plea in the $40 B collapse closes a major chapter in crypto fraud cases, adding to precedent for aggressive U.S. prosecution.

Exchange IPO wave – Bullish raises $1.1 B above range while Gemini files for a Nasdaq listing despite a $282 M loss, underscoring strong equity-market demand for crypto exchanges.

Regulatory pullback – The U.S. Fed shutting its crypto bank supervision program suggests a shift toward lighter federal oversight, pushing responsibility back to market actors.

New DeFi strategies – Liminal Money debuts tokenized delta-neutral vaults, packaging complex hedging into accessible products for yield seekers.

Points meta persists – Theo Network’s points release follows a broader trend of gamified user incentives ahead of governance token launches.

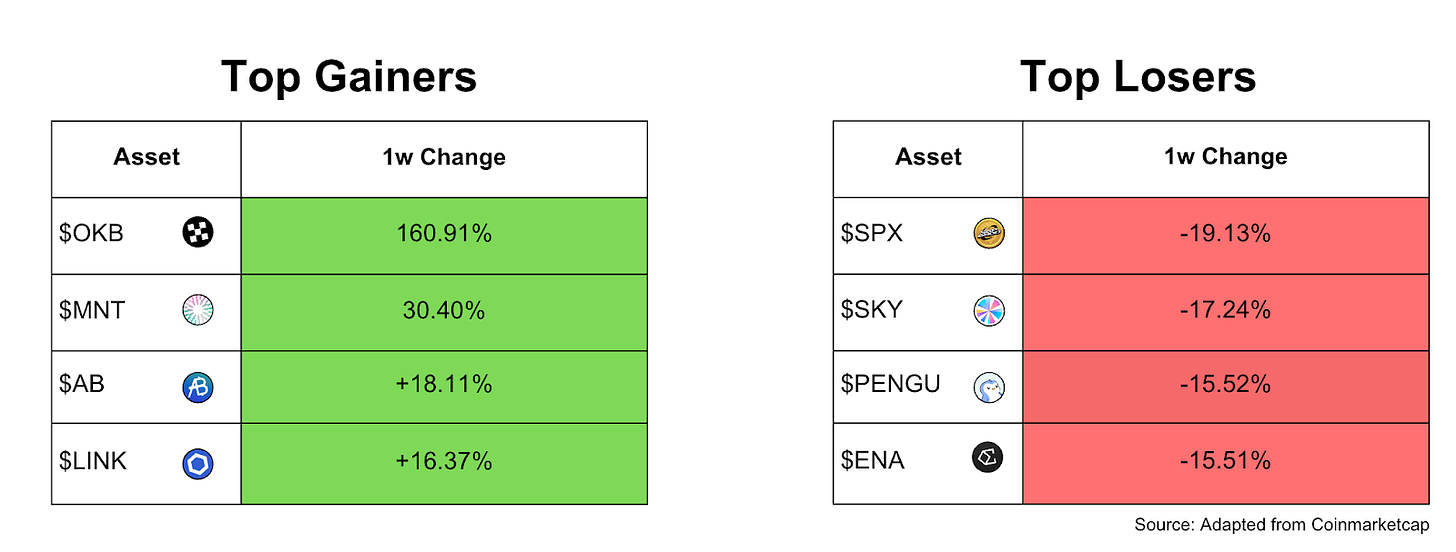

OKB’s price surged 160% this week following OKX’s announcement of a one-off burn of more than 65 million tokens, reducing the total fixed supply to 21 million.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky, and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose, and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.