ETFs Turn Red, Robinhood Enters Prediction Markets, MetaMask Launches mUSD, and Plasma Partners with Binance Earn

Weekly Market Update #83

In partnership with DeFi Technologies Inc

Happy start to the week! Welcome back to the Reflexivity Weekly Market Update — your concise rundown of the biggest moves in crypto. If someone forwarded you this, you can Sign up here for free to get it straight to your inbox!

Today’s Market Update is in partnership with DeFi Technologies Inc. DeFi Technologies Inc. (Nasdaq: DEFT) (CBOE CA: DEFI) (GR: R9B) is a financial technology company bridging the gap between traditional capital markets and digital assets. As the first Nasdaq-listed digital asset manager of its kind, DeFi Technologies offers equity investors diversified exposure to over 70 crypto assets through its integrated and profitable ETF and trading business model.

Before jumping into last week’s action, check out some of the research published last week by the Reflexivity team:

-Bitlayer- First BitVM, Powering Bitcoin DeFi

-Dinero: Building the Back-end of Institutional Crypto Yield

Major Market Developments:

🏈 Robinhood × Kalshi launch football prediction markets

🐉 Valantis Labs acquires stakedHype for expansion

🤝 Plasma × Binance Earn partner on staking products

💵 MetaMask unveils mUSD stablecoin

🔀 Wormhole offers $120 M USDC to acquire Stargate

🗺️ KaitoAI shares roadmap and future plans

💸 SharpLink authorises $1.5 B stock buyback program

🪙 Verb Technology announces $780 M TON treasury allocation

📊 Kamino Finance introduces USD benchmark rate

🟡 Ethena approves BNB as collateral for USDe

📈 VanEck proposes JitoSOL ETF in new staking fund push

✅ Stargate DAO approves LayerZero acquisition

🏦 B Strategy to raise $1 B for a BNB treasury company

🌊 Galaxy, Jump & Multicoin seek $1 B to buy Solana

🇵🇭 Philippines proposes 10,000 BTC strategic reserve with 20-year lockup

Fear & Greed Index:

The Fear & Greed Index came in at 47 this week, landing squarely in the neutral zone. Sentiment has cooled from prior risk-on prints, showing that traders are hesitant to push heavily into either greed or fear. Historically, readings in the high-40s suggest markets are pausing to reassess - liquidity is present, but conviction is thin, leaving room for sharper moves if macro or crypto-specific catalysts emerge.

Note: The index ranges from 0 (extreme fear during capitulations and sell-offs) to 100 (extreme greed during euphoric, overbought conditions).

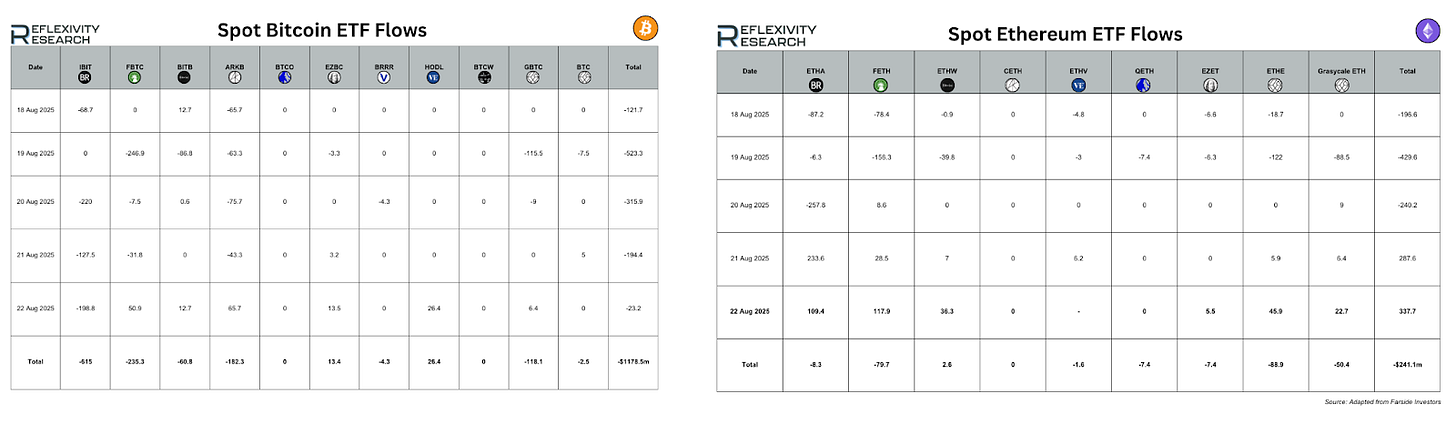

ETF Flows:

Bitcoin ETFs (18–22 Aug): Net - $1,178.5m. Selling was broad with IBIT - $615m, FBTC - $235m, ARKB - $182m, BITB - $61m and GBTC - $118m. Small offsets came from HODL + $26m and EZBC + $13m. The worst day was 19 Aug (- $523m) on large redemptions from FBTC, GBTC and BITB; Friday saw pockets of buying but still finished slightly negative (- $23m).

Ethereum ETFs (same window): Net - $241.1m. Outflows early in the week were partly reversed by strong inflows on Thu–Fri. ETHA ended roughly flat at - $8m after + $234m and + $109m late-week creations offset a - $258m drop on 20 Aug. FETH - $80m, ETHE - $89m, and Grayscale ETH - $50m were the main drags, while ETHW + $3m provided a small positive.

Spotlight 🔦- PlasmaFDN partners with Binance Earn

What launched: Binance On-Chain Yields introduced the Plasma USDT Locked Product on 20 Aug 2025. Users can lock USDT and earn (i) daily USDT rewards paid to their Spot account, plus (ii) an XPL airdrop distributed after XPL’s TGE. Total XPL allocated is 100,000,000 XPL (1% of supply). Subscriptions run from launch until post-TGE or sell-out, with allocations first-come, first-served and a 250,000,000 USDT product cap (Binance may adjust). Listing is not implied by participation.

How rewards work: Binance will take multiple daily snapshots of each user’s subscribed USDT and the total pool, then calculate the final XPL distribution from those historical snapshots - similar to its “HODLer Airdrop” method. Early redemption doesn’t erase already-accrued USDT rewards or past snapshots for XPL; redeemed USDT stops counting from that day forward. Rewards start accruing the day after subscription. Detailed limits, lock durations and resulting APRs are shown on the product’s subscribe page.

Why it matters: The integration gives Binance users one-click access to Plasma’s incentives without complex on-chain setup, creating a powerful distribution funnel for XPL and a broader audience for Plasma’s on-chain liquidity. As ever, Binance flags protocol and market risks, and notes Earn products are independent of listings - use is region-dependent and subject to terms.

Rapid Reflexivity: Quick Market Takes ⚡

Robinhood enters prediction markets – In partnership with Kalshi, Robinhood is launching football-focused prediction markets, signalling the broker’s first move into regulated event contracts and broadening retail engagement beyond equities and crypto.

Valantis Labs acquires StakedHype – The acquisition strengthens Valantis’ presence in Hyperliquid-native tooling, consolidating on-chain market-making infrastructure under its umbrella.

Plasma × Binance Earn – Plasma Foundation’s partnership with Binance Earn will route Binance users directly into Plasma yield products, potentially boosting retail inflows and institutional visibility.

MetaMask unveils mUSD – MetaMask introduced its own stablecoin, mUSD, embedding a native unit of account into the world’s most widely used crypto wallet - an aggressive step toward deeper financial services integration.

Kaito AI roadmap update – Kaito outlined its future focus on scaling AI-driven research and governance tools, aiming to position itself as the default data layer for Web3 intelligence.

Verb’s TON treasury strategy – Verb Technology expanded its TON treasury assets to $780 M, further institutionalising TON exposure and highlighting its growing role as a corporate reserve asset.

Ethena adds BNB – Ethena Labs approved BNB as the first non-ETH collateral backing USDe, marking a significant step toward multi-asset stablecoin collateralisation.

VanEck eyes JitoSOL ETF – VanEck has filed for a JitoSOL ETF, signalling institutional interest in liquid staking tokens and setting precedent for Solana staking products entering mainstream finance.

Stargate DAO approves LayerZero acquisition – Governance approval paves the way for Stargate to be folded into LayerZero’s stack, reducing fragmentation in cross-chain liquidity management.

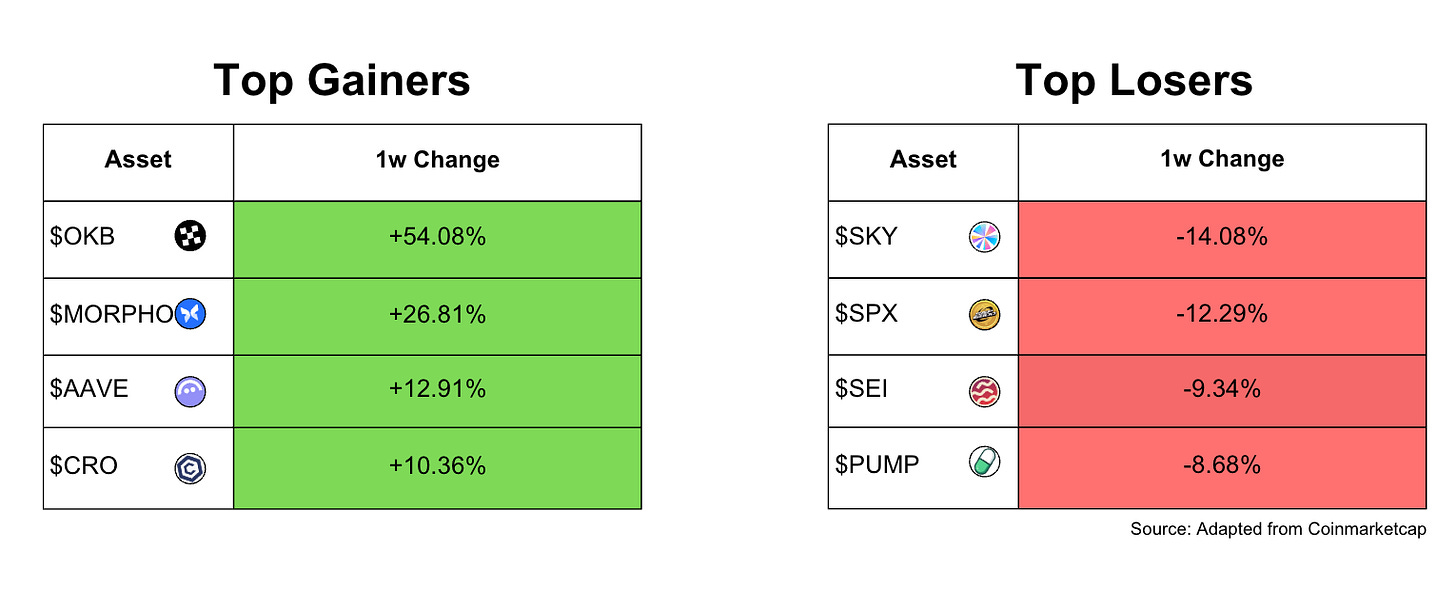

OKB was once again this week’s largest gainer. A key factor behind the recent gains was the platform’s burn of around 65 million OKB, which reduced supply and helped support the price.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky, and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose, and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.