ETF outflows continue; could adding staking help?

Weekly Market Update #64

Weekly Market Update

Before diving into this week’s round-up, be sure to check out some of our recently released research content:

Major developments for the week:

Spot Bitcoin and Ethereum ETFs: Net flows were -$921.4 million for Bitcoin ETFs and -$189.9 million for Ethereum ETFs

Coinbase is preparing to offer round-the-clock BTC and ETH futures trading for US customers

Ethena Labs has enabled the use of its USDe token as collateral on Deribit Exchange

Berachain has launched its Bepolia testnet to conduct Proof-of-Liquidity (PoL) testing

Lido Finance has unveiled its CSM V2

Franklin Templeton has become the largest asset manager yet to seek authorization for a Solana ETF

Telegram founder Pavel Durov has received temporary permission to leave France

Initia is doubling the token supply allocated to its Vested Interest Program

Stani Kulechov introduced Project Horizon, with community consensus ultimately rejecting the idea of a new token

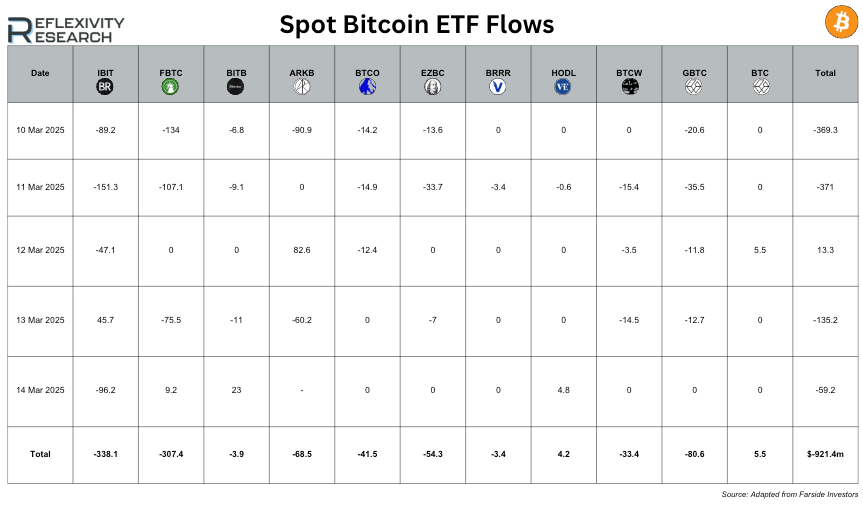

Over the five trading days from 10th to 14th March 2025, spot Bitcoin ETFs experienced significant net outflows totaling $921.4 million, reflecting continued investor withdrawals. The largest single-day outflow occurred on 11th March, with $371 million exiting various ETFs, led by $151.3 million from IBIT and $107.1 million from FBTC. IBIT and FBTC recorded the highest cumulative outflows, losing $338.1 million and $307.4 million, respectively, while GBTC also saw substantial redemptions of $80.6 million. ARKB contributed to the losses with $68.5 million in net outflows, while BTCO, EZBC, and BTCW experienced moderate withdrawals.

Despite the overall selling pressure, 12th March stood out as the only day of net inflows, with $13.3 million entering ETFs, primarily driven by a notable $82.6 million inflow into ARKB. However, this brief positive momentum was erased by continued sell-offs on subsequent days. The data indicates that institutional investors remain in a risk-off mode, with major Bitcoin ETFs seeing large redemptions despite some isolated inflows. The trend suggests persistent capital flight from Bitcoin ETFs, potentially driven by macroeconomic concerns, shifting investor sentiment, or profit-taking after prior rallies.

Moving on to Ethereum, over the five trading days from 10th to 14th March 2025, spot Ethereum ETFs saw net outflows of $189.9 million, indicating sustained investor withdrawals. The largest single-day outflow occurred on 13th March, with $73.6 million exiting Ethereum ETFs, primarily driven by $41.7 million in redemptions from ETHE and $15.1 million from ETHA.

Across the week, ETHA (-$63.3 million) and FETH (-$61.3 million) experienced the most significant cumulative outflows, while ETHE (-$46.5 million) also faced consistent selling pressure. Minor redemptions were observed in Grayscale ETH (-$12.6 million) and CETH (-$5.7 million), while QETH was the only ETF to record small net inflows (+$1.4 million).

Despite the broader sell-off, outflows in Ethereum ETFs were relatively smaller compared to Bitcoin ETFs, suggesting Ethereum investors might be holding up slightly better amid market uncertainties. However, the overall trend points to continued institutional de-risking, likely influenced by macroeconomic factors, regulatory concerns, or shifting investment strategies.

CBOE Submits Proposal Seeking to Enable Staking for ETH ETF

Another interesting Ethereum-related update came from The Chicago Board Options Exchange, which has submitted a proposal to the SEC seeking approval to integrate staking into Fidelity’s Ethereum Exchange-Traded Fund (ETF). If granted, this change would allow the fund to stake its Ether holdings, providing investors with the opportunity to earn staking rewards as part of their ETF investment.

Lido Finance’s Community Staking Module (CSM) V2: Strengthening Decentralization and Scalability

In other news, last week, Lido Finance introduced its vision for CSM V2, outlining key updates to enhance the decentralization and scalability of its Ethereum staking platform. The plan includes increasing the share of Lido’s staked ETH managed by permissionless community node operators to a double-digit percentage, boosting independent validator participation, and maintaining competitive staking rewards.

The proposed upgrades focus on reliability and incentive alignment. These include measures to prevent poor validator performance, enhance the accuracy of the performance oracle, integrate Ethereum’s triggerable withdrawals (EIP-7002), and refine reward formulas.

A notable concept is an introduction of “Entry Gates,” customized onboarding tracks for different categories of node operators, each with its own specific criteria or incentives. This would allow diverse operators to join and secure Lido’s network without compromising standards.

Overall, CSM V2 aims to make Lido more resilient and permissionless, expand its validator base, and safeguard network security while offering competitive yields.

Initia Doubling Supply for Vested Interest Program

Initia, a rollup-centric blockchain project, has revised its tokenomics to heavily favour community incentives, effectively doubling the token supply allocated to its Vested Interest Programme (VIP). According to the new plan, 50% of the total INIT token supply will be dedicated to VIP user rewards and fixed liquidity provision, a substantial increase in the share directed at ecosystem participants.

In practical terms, a large portion of tokens will be distributed over time as vested rewards to active users, developers, and “Minitia” rollup contributors, rather than insiders. The team and insiders will receive no unlocked staking rewards, and only 15% of tokens are earmarked for investors, underscoring Initia’s commitment to a community-first approach.

By boosting the VIP allocation, Initia aims to incentivise active participation and network growth.

Stani Kulechov’s Project Horizon

Project Horizon is an initiative led by Aave founder Stani Kulechov to bring RWA into DeFi through the Aave ecosystem. Under the plan proposed by Aave Labs, a regulated platform (a licensed instance of Aave) would allow institutions to use tokenized money market fund shares as collateral to borrow stablecoins such as USDC and Aave’s native GHO, thereby bridging traditional finance with on-chain liquidity.

A significant point of contention was the proposal to introduce a new “Horizon” token for this project. The Aave community pushed back on the idea, questioning the need for a separate token and voicing concerns about diluting the value and governance of the existing AAVE token. In response to this clear DAO consensus, Stani Kulechov confirmed that no new token would be created for Horizon, ensuring that AAVE remains the primary governance and utility token for any Horizon-related developments.

This outcome reaffirms Aave’s commitment to keeping its token ecosystem simple, even as it explores new RWA-powered products under Project Horizon.

Telegram Founder Durov Allowed to Leave France

The final piece of news this week is an update on the Telegram Founder, Pavel Durov. He has been under formal investigation in France for allegedly facilitating illegal activities on the platform, including suspected drug trafficking, money laundering, and other crimes. Since his arrest at a Paris airport in August 2024, Durov had been barred from leaving France and was required to post a €5 million bail while the probe continues.

In a recent development, a French judge temporarily eased Durov’s travel ban, allowing him to leave the country for a few weeks; he has reportedly departed to Dubai under this special permission. The case has attracted considerable attention due to Durov’s Russian origins amid the war in Ukraine, heightening tensions between France and Russia, and sparking debate over the balance between online free speech and law enforcement. While the ability to travel reflects a slight relaxation of his restrictions, Durov remains under scrutiny as the legal proceedings continue.

This report was brought to you by CoinMarketCap, the world’s most trusted source of crypto data, insights, and community.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky, and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose, and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.