Before diving into this week’s round-up, be sure to check out some of our recently released research content:

Major developments for the week:

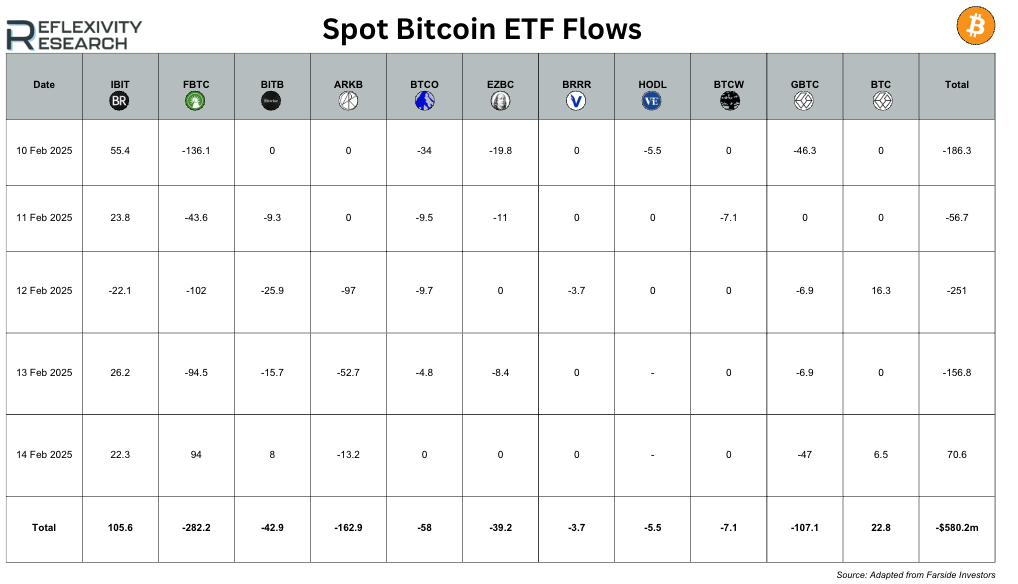

Spot Bitcoin and Ethereum ETFs: Net flows were $-580.2 million for Bitcoin ETFs and $-26.3 million for Ethereum ETFs

Hong Kong now accepts Bitcoin and Ethereum as proof of investment for visas

Lido proposed governance updates on staking rewards and treasury management

Tether conducted another large-scale issuance and movement

Arbitrum Bold launched on mainnet, enabling permissionless validation

Jupiter buybacks began on Monday, 17 February as part of its fee redistribution plan

OpenSea confirmed the launch of its $SEA token, prioritizing long-term users

21Shares filed for an Ethereum staking ETF to offer regulated staking rewards

Ethereum Foundation deployed 45,000 ETH (~$120M) into DeFi for yield generation

Kaito introduced $KAITO token, rewarding high-quality Web3 content

Pump.fun launched a mobile app for on-the-go memecoin trading

Regulatory & Policy Updates

Last week saw several notable developments on the regulatory front.

SEC Commissioner Outlines Priorities

To begin with, SEC Commissioner Hester Peirce published a statement outlining priorities for the agency’s newly formed Crypto Task Force. Key areas include evaluating which crypto assets qualify as securities, exploring registration routes for token offerings (such as Regulation A or crowdfunding exemptions), clarifying rules for broker-dealers and investment advisers handling crypto assets, and determining how crypto lending or staking programmes fit under securities laws. Peirce also advocated for clear guidelines on crypto ETFs and proposed a “cross-border sandbox” to encourage international cooperation on crypto innovation.

Exchange Licensing and Compliance

Several major U.S.-based exchanges secured new licences abroad, reflecting a broader move towards compliance. Kraken announced a new on-chain staking product for U.S. customers while also obtaining a Markets in Financial Instruments Directive (MiFID) licence in the EU, paving the way to offer regulated crypto derivatives in select European markets. Coinbase finalised its registration as a Virtual Asset Service Provider (VASP) in the UK, allowing it to provide both crypto and fiat services in Britain. In addition, a Coinbase affiliate filed to list Solana and Hedera futures contracts in the U.S., planning to launch these cash-settled products pending regulatory approval.

Global Notes

Other jurisdictions also made progress on crypto frameworks. Luxembourg enacted a new law, effective 6 February, implementing the EU’s latest crypto-asset regulations and creating a unified framework for issuing, trading, and servicing digital assets. Meanwhile, Hong Kong’s securities regulator reportedly approved additional crypto exchange licences as the city continues its push to become a leading crypto hub under its 2024 licensing regime. These developments underscore the global race to establish clear rules for the crypto industry.

Moving onto the ETF flows last week. Over this five‐day stretch, net flows across the listed spot Bitcoin ETFs totalled ‐$580.2 million, with only 14 February showing a notable influx (of around $70.6 million) after four consecutive days of outflows. A significant drag came from FBTC (down $282.2 million), while IBIT was one of the few to register a net positive across the period. The worst outflow day overall was 12 February at nearly ‐$251 million, driven largely by withdrawals from ARKB (‐$97 million), FBTC (‐$102 million) and BITB (‐$25.9 million). Though GBTC had a cumulative net outflow of about $107 million, it was partially offset by some late inflows on 14 February (alongside IBIT’s and FBTC’s gains), softening the full‐week negative balance but not enough to bring it into positive territory.

Over the observed five‐day window, spot Ethereum ETFs collectively finished down by $26.3 million, driven mainly by substantial redemptions in ETHE (‐$56.5 million overall). The heaviest single‐day outflow occurred on 12 February (‐$40.9 million), with ETHE alone accounting for a $30.2 million draw that day, on top of a near ‐$22.5 million outflow on 10 February. Offsetting these losses somewhat were ETHA, which brought in a total of $24.6 million (notably $12.6 million on 11 February and $12 million on 13 February), and FETH, up $5.6 million. The cumulative result, however, remained negative after the week’s trading, largely due to ETHE’s outsized redemptions.

ETH Staking Filing

Asset manager 21Shares, in partnership with Cboe BZX Exchange, has filed for an Ethereum staking ETF, seeking approval to offer a spot Ether ETF that also harnesses Ethereum’s staking yields. According to reports on 13–14 February, Cboe submitted a rule-change request to the U.S. Securities and Exchange Commission, aiming to allow the 21Shares Ethereum ETF to stake a portion of its Ether holdings and pass the resulting rewards through to investors. If approved, this would be the first product of its kind in the United States, enabling investors to gain exposure to ETH’s price while earning around 5% annually via Ethereum’s proof-of-stake, all within a regulated ETF vehicle. In its filing, 21Shares argued that the product would benefit investors, with the staking process (including any slashing risks) transparently disclosed and managed.

ETH Pectra Upgrade

Ethereum’s core developers have confirmed the schedule for the next major network update, called Pectra. It will activate on the Holesky testnet on 24 February and on Sepolia on 5 March, with the mainnet hard fork slated for 8 April 2025. Pectra will double Ethereum’s data “blobspace” per block (from three to six), improving layer-2 data availability and reducing fees. It also introduces execution-layer enhancements that boost performance and increase the ETH burn rate, reinforcing Ethereum’s deflationary model.

Ethereum Foundation Utilize DeFi Protocols

For the final piece of Ethereum related news, the Ethereum Foundation (EF) made a notable shift in its treasury strategy this week by deploying a portion of its ETH holdings into decentralised finance protocols to earn yield. Blockchain data later confirmed by the Foundation showed 45,000 ETH, worth around $120 million, moving into Aave, Compound and Spark (MakerDAO’s lending dApp). Specifically, around 30,800 ETH went to Aave (split between Aave’s main market and an Aave pool for Lido stETH), 10,000 ETH to Spark, and 4,200 ETH to Compound. By supplying these funds, EF can earn roughly 1.5% annual yield on its ETH, translating to an estimated $1.5–$2 million per year. This is the first time the Ethereum Foundation has actively leveraged DeFi protocols to utilize its ETH, having previously held it or occasionally sold portions to fund operations.

OpenSea Announces Token

In other news: OpenSea, the largest NFT marketplace, is set to roll out its own native token, $SEA, as part of a significant platform overhaul. The OpenSea Foundation revealed the plan on 13 February via an official post on X. Although a specific launch date has not been announced, OpenSea confirmed that $SEA will be introduced in multiple jurisdictions, including the United States, a noteworthy point given previous regulatory scrutiny of token launches. Crucially, the allocation of $SEA will heavily favour long standing OpenSea users: the foundation explained that token distribution will be tied to historical engagement on the platform rather than recent trading activity. This implies an airdrop or reward scheme aimed at early and loyal OpenSea users, discouraging manipulation by those who have only recently become active.

Kaito Introduces $KAITO Token and Whitepaper

Token & Whitepaper Launch

The final update of this week comes from Kaito: an AI-driven Web3 research and information platform. Kaito has also unveiled its native token “KAITO”, accompanied by a detailed whitepaper explaining the project’s vision. Kaito’s platform focuses on the “attention economy” and “InfoFi”, with $KAITO central to incentivising and monetising user-generated content. According to the whitepaper, users who create high-quality social media content will be evaluated by Kaito’s AI algorithms, which measure novelty, engagement, and insightfulness. Content creators receive an “attention score” called “Yaps,” which later translates into $KAITO token allocations. In doing so, Kaito aims to tokenize valuable information sharing.

Key Takeaways from the Whitepaper

Reward & Attention Mechanism

The $KAITO token underpins Kaito’s reward system for content. Users earn Yaps for contributing valuable posts, and those points convert into $KAITO. This setup is designed to foster a meritocratic social platform, emphasising expertise and quality over mere engagement.Governance

$KAITO bestows governance rights, enabling token holders (especially the most active contributors) to vote on key platform decisions and future feature rollouts. This ensures the community remains aligned with Kaito’s development.Native Currency

Within Kaito’s ecosystem, $KAITO functions as a form of payment for various services, such as accessing advanced analytics or tipping other users. It also rewards active participants, creating a feedback loop that incentivizes ongoing engagement.

The whitepaper delves into Kaito’s AI models and outlines the tokenomics (though complete distribution details remain forthcoming). The team acknowledges the inherent challenges of measuring social capital, noting that some users may try to game the AI system by producing content intended to trick the algorithm. In response, Kaito plans to refine its models continuously to prevent manipulation.

This report was brought to you by CoinMarketCap, the world’s most trusted source of crypto data, insights and community.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.