Before diving into this week’s round-up, be sure to check out some of our recently released research reports:

Major developments for the week:

Last week, spot Bitcoin ETFs saw net outflows of $706.1 million, while Ethereum ETFs experienced net outflows of $99.1 million

The Eigen Foundation announced details of the S2 airdrop

CelestiaOrg unveiled its community roadmap

Arbitrum launched the Stylus platform

WisdomTree withdrew its ETH trust offering

Durov provided an update on his arrest situation

0xSonicLabs achieved a 720ms transaction finality

Last week, spot Bitcoin ETFs saw net outflows of $706.1million

The table outlines the flows of spot Bitcoin ETFs across multiple products from 2nd to 6th September 2024. The data reveals significant net outflows across most products, particularly for FBTC, which saw total outflows of $404.9 million, and GBTC, with $160.7 million in net outflows. Other notable outflows include BITB at $59.8 million, ARKB at $40.8 million, and HODL at $8.2 million. Only one platform, EZBC, recorded minimal inflows of $2.3 million. Overall, the week resulted in total net outflows of $706.1 million across all platforms. These outflows match the largest recorded outflow set in March of this year.

BTC cumulative returns by session continue to be led by the APAC region, while the US sessions maintain their trend of having the lowest returns among the respective trading sessions.

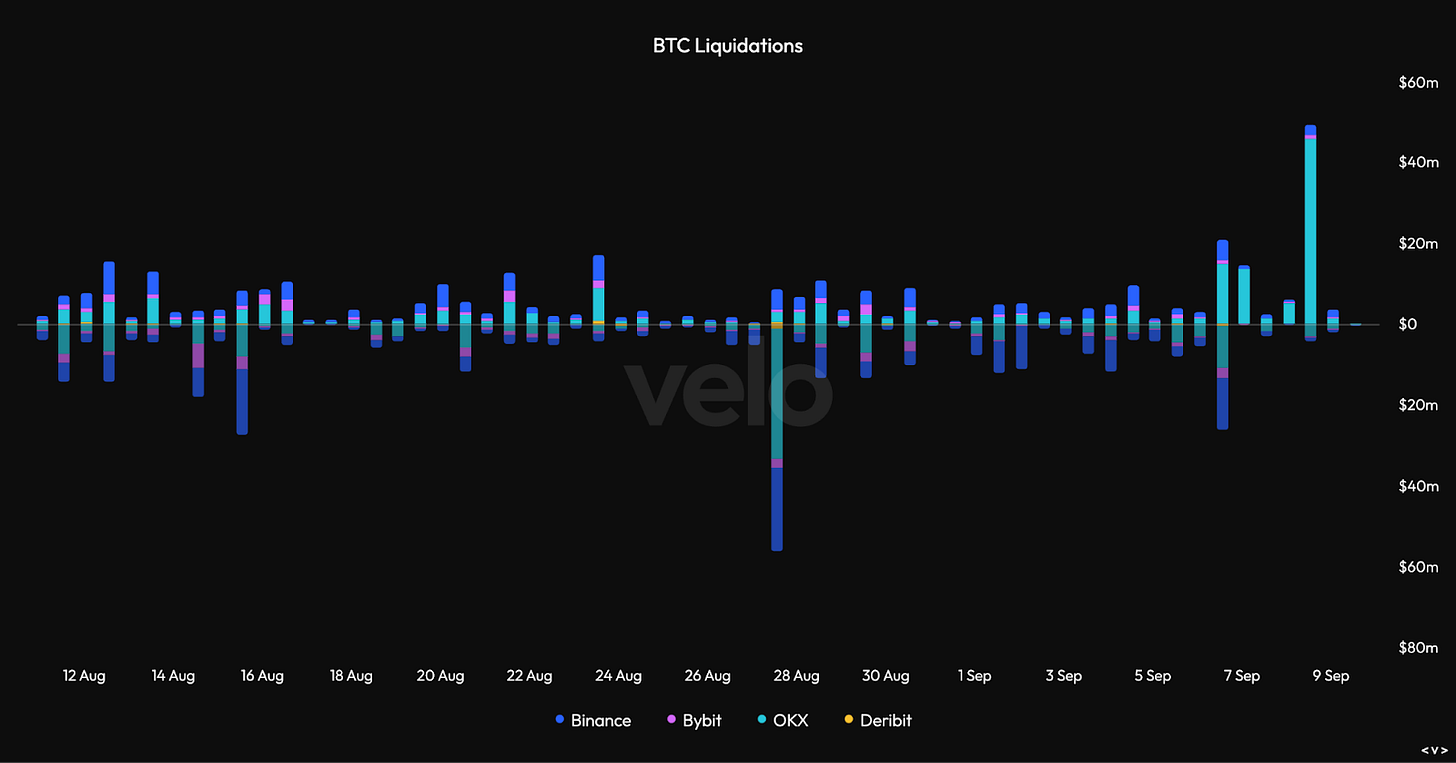

Additionally, the largest exchange short liquidation event of the month occurred on September 8th, with OKX accounting for $45 million out of the $48 million in BTC shorts liquidated.

Last week, Spot Ethereum ETFs experienced net outflows of $99.1 million

The table displays the flows of spot Ethereum ETFs across various products from 2nd to 6th September 2024. Over the week, there were significant net outflows, with ETHE experiencing the largest outflow of $111 million, followed by moderate inflows in Grayscale ETH at $10.3 million. FETH showed a smaller inflow of $4.9 million, and ETHA had inflows of $4.7 million. Other products, such as ETHW, CETH, ETHV, QETH, and EZET, remained static with no recorded flows. In total, the week saw overall net outflows amounting to $91.1 million.

In other Ethereum-related news last week, WisdomTree has opted to withdraw its Ethereum Trust S-1 registration filing with the U.S. Securities and Exchange Commission, signalling a strategic shift for the asset manager. The filing, originally submitted on May 27, 2021, is now being retracted, with WisdomTree requesting that the fees be credited for future filings. This decision reflects a broader market trend, as VanEck recently shut down its Ethereum Strategy ETF due to low demand for such products.

This weekly update is brought to you by:

The EigenFoundation announced details of the S2 airdrop

In other news last week, EigenLayer announced the S2 airdrop. The Eigen Season 2 Stakedrop marks the second phase of token distribution by EigenLayer, aimed at rewarding key contributors and ecosystem participants. In this phase, approximately 86 million EIGEN tokens, representing 5% of the total supply, will be distributed.

Key Dates:

Snapshot Date: August 15, 2024

Claim Deadline: By September 17, 2024

Token Transferability: EIGEN tokens will become tradable starting September 30, 2024.

Participants can claim their tokens through the designated portal, with community members required to verify their social identity before receiving their tokens.

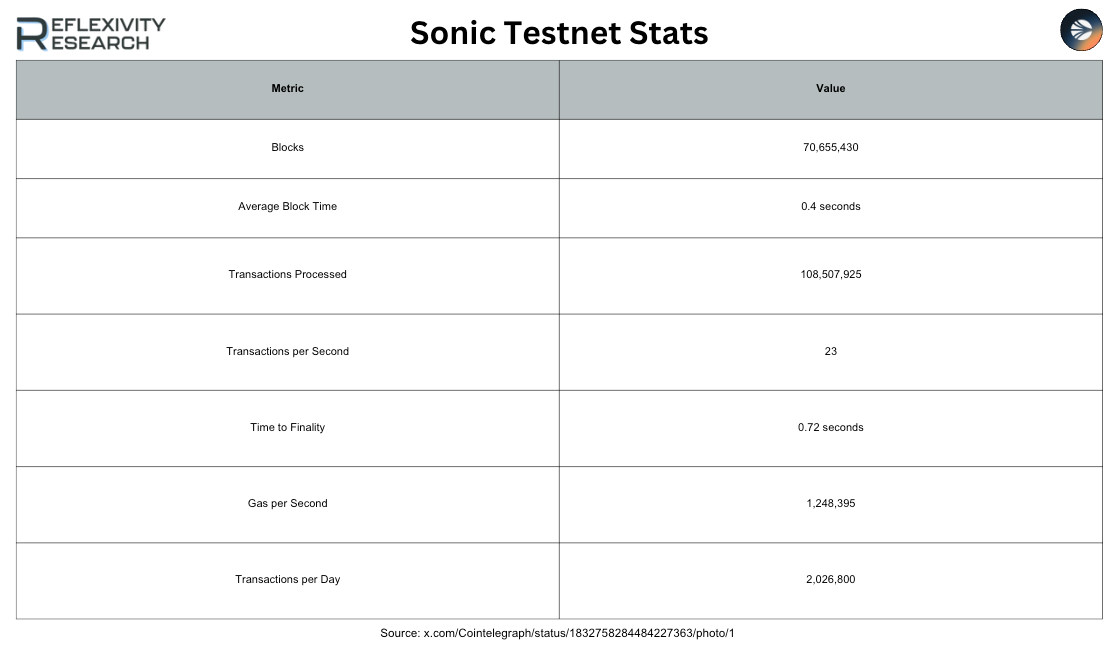

SonicLabs achieved a 720ms transaction finality

In other news, Sonic Blockchain has achieved an impressive transaction finality time of 720 milliseconds during its testnet phase, as reported on September 8, 2024. This milestone establishes Sonic as one of the fastest blockchain networks in development. Andre Cronje, the creator of Fantom, emphasized the significance of this achievement, highlighting its potential to improve blockchain efficiency and user experience.

Beyond its speed, Sonic Blockchain stands out for eliminating gas fees and offering attractive incentives for developers. This combination of rapid transaction finality and cost-effectiveness could make blockchain integration simpler, potentially driving more developers to adopt the Sonic platform and expanding its presence within the blockchain ecosystem.

Pavel Durov provided an update on his arrest situation

In final news this week, Durov, CEO of Telegram, has issued a public response following his arrest in France on August 24, 2024. He criticised the actions of the French authorities as "misguided," arguing that he should not be personally held accountable for illegal activities conducted by users on the platform. Durov stressed that if countries are dissatisfied, they should pursue legal action against the service itself rather than targeting a CEO based on outdated, pre-smartphone era laws.

Durov acknowledged that Telegram's rapid growth, now with 950 million users, has created moderation challenges, leading to some criminal activity on the platform. He committed to intensifying efforts to address these issues, declaring it his "personal mission" to improve moderation.

Currently, Durov is out on bail set at €5 million, required to report to authorities twice a week while remaining in France. His passports have been confiscated as investigations continue into allegations that Telegram facilitated illegal activities.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.