Crypto Goes Corporate: BTC Treasuries, Shopify x USDC, and Trump Media Moves

Weekly Market Update #74

In partnership with Elementus

Happy start to the week! Welcome back to the Reflexivity Weekly Market Update — your concise rundown of the biggest moves in crypto. If someone forwarded you this, you can Sign up here for free to get it straight to your inbox!

Today’s Market Update is in partnership with Elementus. Delivering preeminent on-chain intelligence, Elementus provides macro- and micro-level visibility for investment, compliance, and DeFi projects.

Illuminate the Blockchain: Elementus provides unparalleled visibility into blockchain data, empowering institutions to navigate the crypto ecosystem with confidence, clarity, and compliance.

Accelerate Investigations: Elementus's powerful query engine enables rapid tracing of on-chain activity-essential for law enforcement, regulators, and businesses combating fraud, hacks & illicit finance.

Unlock Market Intelligence: With Elementus, firms gain actionable insights into transaction patterns - transaction patterns to macro flows.

Before jumping into last week’s action, check out some of the research published last week by the Reflexivity team as well a special interview from our partners:

-Plasma and the Stablecoin Arms Race

- Beluga, a partner offering daily insights into the top token launches and projects, recently sat down with Trevor Koverko, Co-Founder of Sapien, to discuss his journey from playing hockey in the NHL to founding a company in Web3. Check it out here.

Major Market Developments:

💰 Plasma hits $1 B deposits ahead of XPL sale

🏗 Stripe snaps up wallet‑infra firm Privy

🐧 Pudgy Penguins × NASCAR merch tie‑in

🏦 Trump Media wins SEC green light for BTC treasury plan

🌎 Vietnam legalizes crypto; Brazil slaps 17.5 % tax

🎮 GameStop adds 4 710 BTC to treasury

🔀 1inch rolls out Pathfinder 2.0 for smarter swaps

🤖 Virtuals brings AI agents to Ethereum

🔐 Nillion launches Enterprise Cluster with telco heavyweights

💳 Coinbase One Card offers up to 4 % BTC back

🛒 Shopify enables USDC checkout via Coinbase & Stripe

🏢 First public company puts $HYPE on its balance‑sheet

⚖️ Argentina clears President Milei in LIBRA promo probe

🏗️ Ondo brings tokenized Treasuries to XRP Ledger

Fear & Greed Index:

Crypto sentiment sits almost dead‑centre at 51, squarely in the neutral zone. After last week’s mild risk‑off lull, the gauge’s slight uptick suggests traders are cautiously re‑adding exposure: enough optimism to stem outflows, but not yet the froth that precedes overheated rallies. In practice, a low‑50s reading often heralds range‑bound price action as markets await a decisive macro or regulatory catalyst.

Note: The index ranges from 0 (extreme fear during capitulations and sell-offs) to 100 (extreme greed during euphoric, overbought conditions).

ETF Flows:

From 9 to 13 June, spot-Bitcoin ETFs attracted roughly 1.37 billion dollars in new money. BlackRock’s IBIT did the heavy lifting with 1.12 billion, followed by modest support from Fidelity’s FBTC (80 million net despite a 197 million one-day exit on 12 June), Bitwise’s BITB (83 million) and a smattering of smaller creations across ARK/21Shares, Franklin and VanEck products; even Grayscale’s GBTC managed a 15 million inflow. The two busiest sessions were 10 June (about 431 million) and 9 June (about 386 million), easily outweighing the lone soft day on 12 June.

Spot-Ethereum ETFs also experienced strong demand, attracting approximately $ 528 million. BlackRock’s ETHA led with 381 million, Fidelity’s FETH added 79 million, and incremental buys in ETHW, plus a 41 million lift for the Grayscale trust filled out the total. Net creations ran for four straight days, peaking at roughly 240 million on 11 June, before a small 2 million pullback on 13 June. Taken together, the data show investors continuing to add both Bitcoin and Ether exposure, with Bitcoin vehicles still drawing more than double the fresh capital that flowed into their Ethereum counterparts.

Spotlight 🔦

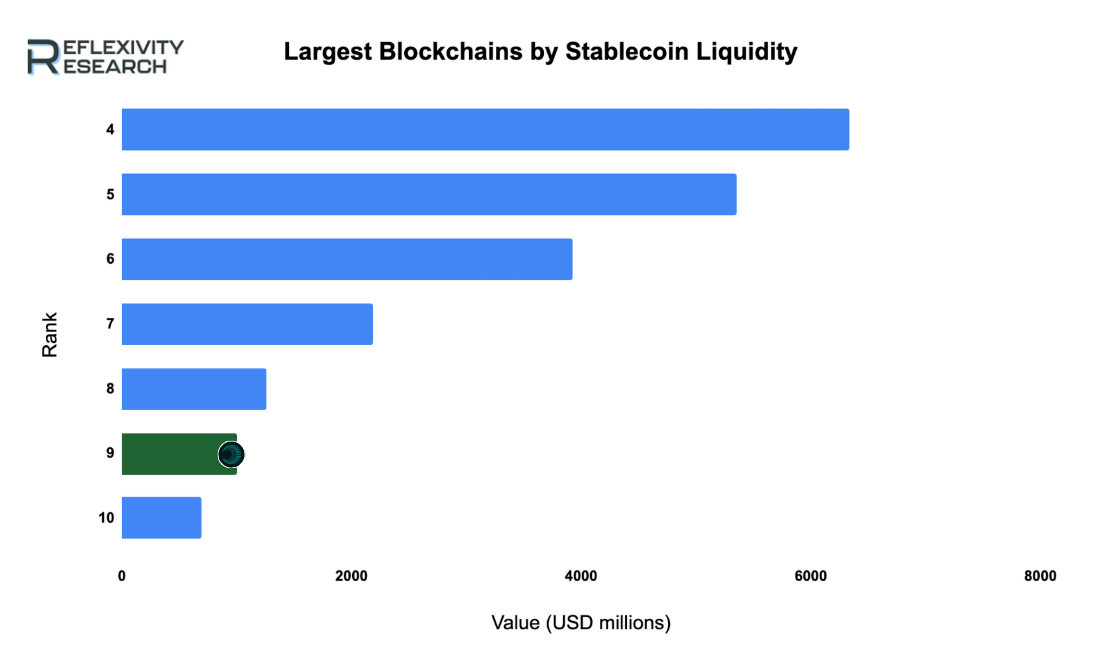

Plasma’s forthcoming stable‑coin chain is already awash in liquidity. After announcing its XPL public sale on 27 May, the team opened a deposit vault where users park stablecoins to earn sale rights. Demand blew past the initial $500 M limit, prompting an unannounced extension to $1 B, filled in half an hour. Crucially, these funds remain user-owned and bridge to Plasma’s mainnet beta, which will launch with $1B in USDT liquidity, instantly ranking 9th among all chains by stablecoin TVL. Only $50 M of XPL (10 % of supply) will actually be sold at a $500 M FDV; the oversized deposits simply weight allocations and throttle bots, ensuring broad grassroots participation. With a fee‑free stable‑coin design and billion‑dollar war‑chest committed before genesis, Plasma is set to test whether liquidity‑first bootstrapping can catapult a new L1 into the upper tier on day one.

Rapid Reflexivity: Quick Market Takes ⚡

Stripe ↔ Privy – Payments giant acquires embedded‑wallet provider Privy to streamline on‑chain identity for mainstream apps.

Pudgy Penguins on track – NFT brand partners with NASCAR to push crypto‑native mascots into motorsport merch.

Trump Media’s Bitcoin play – SEC clears the firm’s registration, green‑lighting a multibillion‑dollar capital raise earmarked for corporate BTC reserves.

Vietnam embraces crypto – New law formally recognizes “digital assets”; Brazil moves the opposite way, ending tax exemptions and imposing a flat 17.5 % levy on all crypto gains.

Virtuals to Ethereum – AI‑agent platform launches I.R.I.S. auditor on mainnet, bringing automated contract security to the L1.

GameStop stacks 4 710 BTC – Retailer diversifies treasury after $1.3 B debt raise.

Shopify × USDC – Merchants gain instant stablecoin checkout via Coinbase Base and Stripe rails, with cashback incentives.

1inch Pathfinder 2.0 – Smarter routing boosts swap rates by up to 6.5 % while trimming gas.

HYPE on a balance sheet – Tony G Co‑Investment becomes first public company to hold HyperLiquid’s token.

Nillion Enterprise Cluster – Deutsche Telekom, Alibaba Cloud and others test privacy‑preserving compute on decentralized nodes.

Ondo’s Treasuries on XRPL – Tokenized U.S. bonds debut on Ripple’s ledger for 24/7 mint‑and‑redeem.

Coinbase One Card – AmEx‑issued credit card offers 2–4 % BTC back to subscribers.

ADA‑for‑BTC proposal – Charles Hoskinson suggests swapping $100 M ADA into Bitcoin and Cardano‑native stables to jump‑start DeFi TVL.

AERO was the top gainer of the week, largely based on the news that Coinbase will fold Base‑chain DEXs (including Aerodrome) into its main app, suddenly putting the token in front of more than 10 million Coinbase users.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky, and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose, and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.