Blackrock flips Grayscale in Bitcoin AUM

Weekly Market Update #32

Major developments for the week:

Bitcoin ETF products saw inflows of roughly $120 last week

Blackrock flips Grayscale as largest institutional custodian of Bitcoin

Mind Network Unveils the First Institutional Fully Homomorphic Encryption (FHE) Interface

Mt. Gox Bitcoin is on the move

ENS Domains proposes migration to Layer 2

The Solana community votes to allocate all priority fees to validators

PayPal launches its stablecoin on Solana

The Sei Foundation unveiled phase two of their airdrop

dYdX puts forth notes in relation to their Chain Protocol V5.0.0 software upgrade

dYdX unlocks 11.91% of its circulating supply on June 1st

Bitcoin ETF products saw inflows of roughly $120 million

This week, IBIT and FBTC recorded the highest total inflows so far, with $128.7 million and $171.1 million, respectively. In contrast, GBTC experienced a substantial net outflow, with a total volume of -$136.3 million. Despite the negative contribution from GBTC, the overall trading volume across all instruments amounted to $122.1 million.

In other Bitcoin-specific ETF news, BlackRock has officially surpassed Grayscale to become the largest institutional custodian of BTC.

Exact specifics of the top 3 ETF participants can be found in the table below;

ENS Domains proposes migration to Layer 2

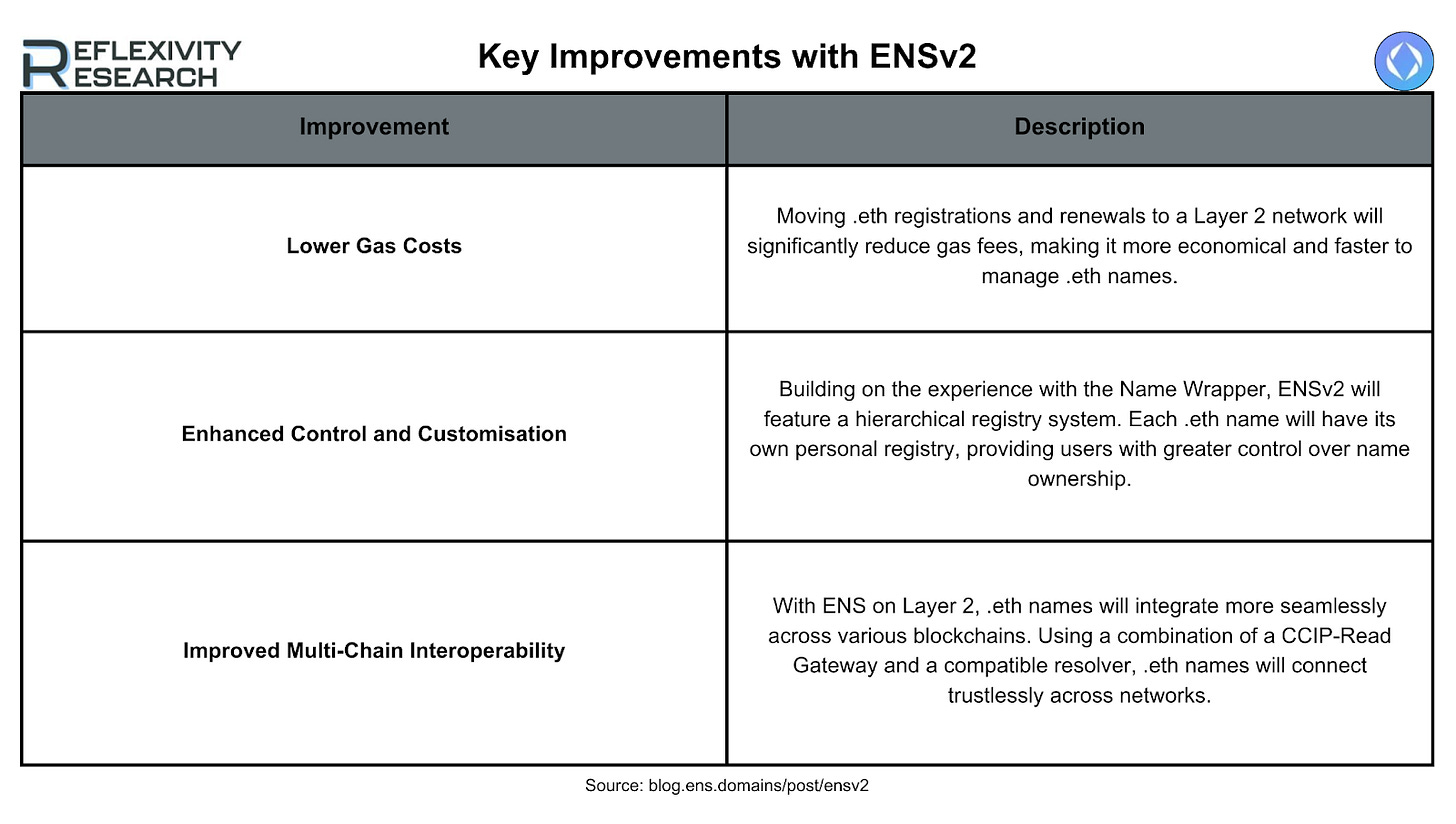

In other news this week, ENS Labs has proposed an expansion of the Ethereum Name Service to Layer 2, named "ENSv2," which entails a comprehensive rethinking of its architecture based on seven years of web3 naming experience. This proposal aims to enhance decentralisation and accommodate new use cases and integrations previously restricted by the Ethereum mainnet's limitations.

Since its inception in 2017, the Ethereum Name Service has evolved from a basic on-chain naming tool into a crucial part of the internet's infrastructure, with millions of .eth names registered and integrations with decentralised applications, wallets, top-level domains and browsers. Notable partnerships include Coinbase, GoDaddy, Uniswap, Farcaster and Box.

As Ethereum and Layer 2 solutions advance, providing faster transactions and lower gas costs, the Ethereum Name Service is at the forefront with innovations like Cross-Chain Interoperability Protocol-Read and the Ethereum Virtual Machine Gateway. The proposed move to Layer 2 aims to make the Ethereum Name Service more accessible and better suited to the needs of its growing community. The ENS Labs team is actively researching and evaluating the best Layer 2 options for this transition, with updates available in the governance forum.

The Sei Foundation unveiled phase two of their airdrop

Another interesting protocol specific piece of news this week came from SEI who announced phase two of their airdrop.

Since launching Sei's Pacific-1 Mainnet last August, over 100,000 addresses have secured the network, primarily used for NFT transactions. Sei v2, a highly performant and parallelized Ethereum Virtual Machine blockchain has also been introduced.

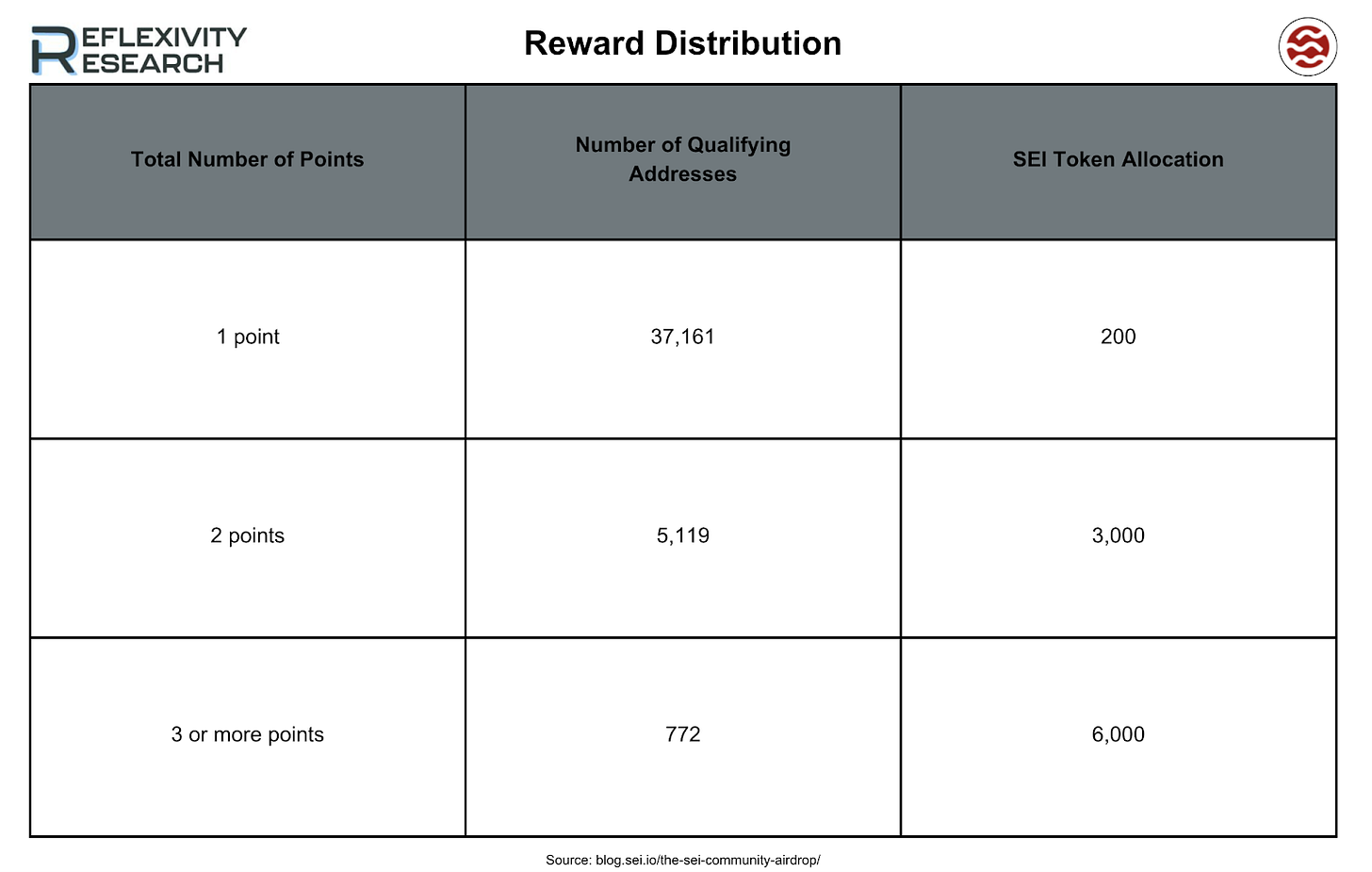

Airdrop number two distributes 27,421,200 SEI to 43,052 addresses, rewarding active users. Points for eligibility were based on staking, liquid staking and participation in top NFT collections. Exclusions apply to addresses with over 2,000,000 SEI, over 2,000,000 liquid staked SEI or over 150 NFTs from top collections. SEI Foundation affiliates are not eligible.

This airdrop targets genuine community members and is part of the total token supply set aside for airdrops. Phase 3 and token distribution will be announced on the official Sei Twitter account.

dYdX unlocked 11.91% of its circulating supply on June 1st

Lastly, dYdX unlocked 11.91% of its circulating supply this week, a $66.67 million equivalent. This unlock consists of $36.97 million for investors, $20.36 million for founders, employees, advisors and consultants in addition to $9.33 million for future employees.

Note: The content in this weekly report has also been utilized in our weekly collaborative series with stock/crypto trading platform eToro.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

View 50+ free reports on our homepage: reflexivityresearch.com