Key Takeaways:

Bitcoin ETF products saw net outflows of $887.6 million last week

MicroStrategy purchased an additional 9,245 Bitcoin for $623 million

BlackRock launched a digital asset fund and deposited $100 million in USDC on the Ethereum network

Fidelity has amended their Ethereum ETF application to include staking capabilities

Vitalik Buterin announced the introduction of a novel staking model named "Rainbow Staking."

Google is incorporating Ethereum Name Service (ENS) data into its search results via Etherscan integration

Coinbase Derivatives LLC has submitted certifications to the CFTC to list U.S. regulated futures for Dogecoin, Litecoin and Bitcoin Cash

Fully permissionless proposals and withdrawals have been activated on Optimism Sepolia

Sui revealed Pilotfish, an innovative auto scaling technology developed by Mysten Labs

Frax unveiled Part 1 of the Singularity Roadmap

The Avalanche Foundation is launching Phase 1 of the Memecoin Rush

Canto announced their parallel execution EVM “Cyclone Stack”

DYDX will undergo a $110.33 million unlock on April 1st, 2024

Bitcoin ETF products saw net outflows of $887.6 million last week

Last week, Bitcoin ETF products saw a significant net outflow of $887.6 million, with Grayscale's outflows surpassing $2 billion. In a noteworthy move, Michael Saylor acquired an additional 9,245 Bitcoin for $623 million, increasing Microstrategy's stake to over 1% of Bitcoin's total supply.

Blackrock Launches Tokenized Asset Fund

Ethereum also saw several major updates last week, the largest of which is highlighted by BlackRock's launch of their tokenized asset fund, "BUIDL." The tokenization of the Fund through BUIDL offers investors several benefits, including the facilitation of blockchain-based issuance and trading of ownership. This initiative not only broadens investor access to on-chain offerings but also guarantees instant and transparent settlements and supports cross-platform transfers. BNY Mellon's involvement is key to bridging digital and traditional markets, ensuring seamless interoperability for the Fund.

BUIDL is designed to keep a stable token value of $1, with daily accrued dividends paid out as new tokens directly to investors' wallets each month. By investing 100% of its assets in cash, U.S. Treasury bills and repurchase agreements, the Fund allows investors to earn yields on the blockchain. Moreover, it provides 24/7 transferability to other pre-approved investors and offers flexible custody options, empowering investors with the choice of how to manage their tokens.

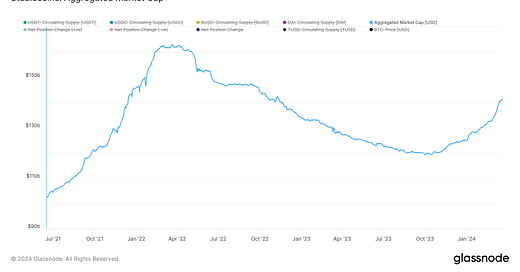

Stablecoin supplies have now risen more than over $20 billion in aggregate from their lows.

Avalanche Foundation is launches Memecoin Rush

In other news, the Avalanche Foundation has initiated the first phase of its $1 million liquidity mining incentive program, Memecoin Rush, which is planned to unfold in several stages. This program, following the success of the Foundation's earlier incentive initiatives, seeks to enhance liquidity and catalyse growth within Avalanche's community coin ecosystem.

The launch phase includes collaborations with two Avalanche-based projects, SteakHut and Trader Joe, with announcements of additional partnerships anticipated in the near future. These initial collaborations are designed to encourage trading and improve liquidity for selected community tokens.

Memecoin Rush extends the Avalanche Rush program, an established liquidity mining campaign that has been a key driver in the development of Avalanche's DeFi sector since 2021.

Coinbase Derivatives LLC has submitted certifications to the CFTC to list U.S. regulated futures for Dogecoin, Litecoin, and Bitcoin Cash

On a shorter note, Coinbase Derivatives LLC discreetly submitted certifications to the Commodity Futures Trading Commission (CFTC) for listing U.S. regulated futures for Dogecoin, Litecoin and Bitcoin Cash on March 7th. Remarkably, the filings went largely unnoticed.

Pending any objections from the CFTC, futures trading for these cryptocurrencies is scheduled to begin on April 1st, 2024.

Bitcoin spot trading volume on Coinbase has risen to daily values north of $2 billion, marking a record high.

DYDX will undergo a $110.33 million unlock on April 1st, 2024

Lastly, the primary unlock event this week features DYDX. Scheduled for April 1st, 2024, $DYDX plans to release 11.35% of its circulating supply. This comprises $61.19 million for investors, $33.7 million for founders, employees, advisors & consultants, and $15.45 million for future employees. $DYDX’s vesting schedule is estimated to reach completion by November 4th, 2026.

Note: The content in this weekly report has also been utilized in our weekly collaborative series with stock/crypto trading platform eToro.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make. The author of this report holds Ondo Finance’s token ONDO.

View 50+ free reports on our homepage: reflexivityresearch.com