Bitwise Targets Avalanche, MetaMask Signals Token, Kraken Launches Platform

Weekly Market Update #87

This edition brought to you in partnership with Valour

Valour makes it easy for retail and institutional investors to invest in digital assets & decentralised finance, with Europe's largest selection of crypto ETPs.

Happy start to the week! Welcome back to the Reflexivity Weekly Market Update — your concise rundown of the biggest moves in crypto. If someone forwarded you this, you can sign up here for free to get it straight to your inbox!

Before jumping into last week’s action, check out some of the research published last week by the Reflexivity team:

-Bitlayer- First BitVM, Powering Bitcoin DeFi

-Dinero: Building the Back-end of Institutional Crypto Yield

Major Market Developments:

🏔️ Bitwise files for an Avalanche ETF

🏦 Openbank rolls out crypto trading for retail clients

🔵 Circle × Hyperliquid: USDC expansion and integrations

🧭 Aave publishes its v4 launch roadmap

🎁 0G Labs opens airdrop registration

🪙 Wormhole posts new tokenomics and a strategic reserve plan

🇰🇷 KRW1 stablecoin (BDACS) launches on Avalanche

🚀 Plasma sets mainnet beta & XPL TGE dates

🦊 MetaMask hints that a token is coming

🧨 Kraken Launch debuts token launch platform

📉 MetaMask integrating perp trading via Hyperliquid

💳 PayPal invests in Stable to push stablecoin payments

🏦 Plasma One: stablecoin-native neobank & card announced

🔁 LayerZero buys back 50M ZRO (5% of supply)

Fear & Greed Index:

The Crypto Fear & Greed Index is 43 this week, tipping into the fear side of neutral. That usually signals cautious positioning: traders are selective, liquidity is patchier, and price action tends to chop unless a clear catalyst arrives. It’s a risk-aware backdrop rather than capitulation, with room for swift swings on headlines.

Note: The index ranges from 0 (extreme fear during capitulations and sell-offs) to 100 (extreme greed during euphoric, overbought conditions).

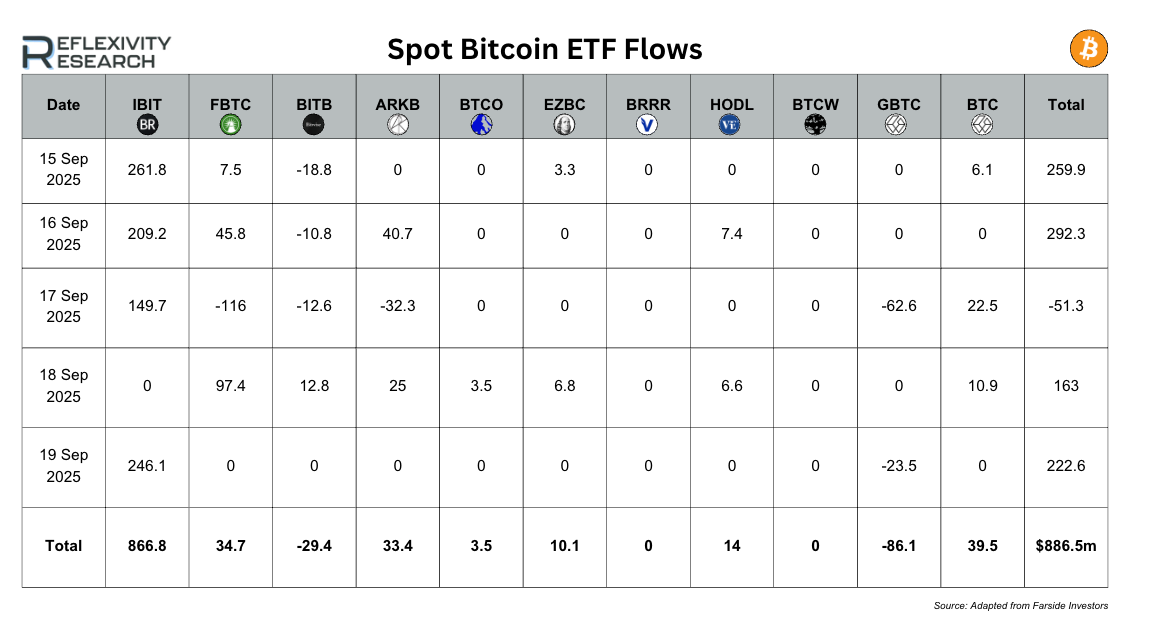

ETF Flows:

Bitcoin ETFs (15–19 Sep 2025, $ millions): Net +886.5. Four of five sessions were positive (Mon +259.9, Tue +292.3, Thu +163.0, Fri +222.6) with only Wednesday dipping (-51.3). Buying was led by IBIT +866.8, with added support from FBTC +34.7, ARKB +33.4, BITC/BTC +39.5, HODL +14.0, EZBC +10.1, and BTCO +3.5; offsets were GBTC -86.1 and BITB -29.4.

Ethereum ETFs (15–19 Sep 2025, $ millions): Net +557.0. Flows surged on Monday (+359.7) and Thursday (+213.1) and were mildly negative on the other two midweek days, ending with a small Friday gain (+47.8). The advance was powered by ETHA +513.1 and FETH +15.2, with help from ETHE +13.6, Grayscale ETH +18.0, ETHW +7.5, and EZET +3.5. Small drags came from CETH -4.0, ETHV -8.2, and QETH -1.7.

Spotlight 🔦

What’s New

Plasma Foundation has introduced Plasma One, a stablecoin-first neobank app paired with a payment card. It's built to make on-chain dollars feel like everyday money: hold stablecoins in-app, move funds instantly on-chain, and spend from the same balance at merchants.

How It Works (High-Level)

-One wallet, two contexts. Your on-chain stablecoin balance also acts as your spending account, eliminating the usual friction between DeFi and point-of-sale.

-Instant, transparent transfers. Stablecoin payments settle nearly instantly with clear fees, mirroring the real-time experience of modern fintech.

-Interoperable by design. Plasma One integrates with the broader Plasma stack—including the upcoming mainnet beta and XPL TGE—so balances can flow between savings, payments, and yield products without needing to off-ramp.

Why It Matters

-Connects DeFi to daily spending. Turns stablecoin balances into usable money for paying bills, buying goods, or reimbursing friends—no bank required.

-Streamlined UX for mainstream users. Abstracts away key management and gas fees behind a consumer-friendly interface, making crypto usable for more than just crypto-natives.

-Strengthens the ecosystem. Making stablecoins practical at checkout increases on-chain dollar demand and helps keep liquidity circulating within the Plasma economy.

What to Watch Next

Launch timing, supported stablecoins, regional availability, merchant coverage, and how seamlessly Plasma One connects with the rest of the Plasma product suite as mainnet beta goes live.

Rapid Reflexivity: Quick Market Takes ⚡

Bitwise → Avalanche ETF: Bitwise filed for an AVAX-focused ETF, pushing tokenized exposure to Avalanche into the U.S. fund pipeline.

Openbank retail crypto: Santander’s digital bank launched crypto trading for retail clients, widening mainstream access in Europe.

Circle × Hyperliquid: USDC is integrating across Hyperliquid’s stack, improving settlement and fiat rails for its on-chain venues.

Aave v4 roadmap: Aave shared its v4 launch plan, highlighting a slimmer core, new facilitators, and unified cross-chain markets.

0G Labs airdrop: 0G opened airdrop registration, signalling its network is nearing public distribution.

Wormhole tokenomics: Wormhole released updated token economics and will build a strategic reserve, aiming for long-term stability.

KRW1 on Avalanche: South Korea’s BDACS launched KRW1, the first KRW-backed stablecoin on Avalanche, expanding non-USD rails.

Plasma mainnet beta + XPL TGE: Plasma set dates for mainnet beta and the XPL token generation event, moving its stablecoin-native chain into launch mode.

MetaMask token hint: MetaMask signalled a token is “coming soon,” stoking expectations around wallet-driven incentives.

Kraken Launch: Kraken introduced its token launch platform, adding a regulated venue for new asset distributions.

MetaMask perps via Hyperliquid: Code updates show MetaMask integrating perpetuals trading through Hyperliquid, bringing derivatives into the wallet experience.

PayPal invests in Stable: PayPal-backed Stable to advance merchant stablecoin payments, reinforcing enterprise adoption.

LayerZero buys back ZRO: LayerZero executed a 50M ZRO buyback from early investors, equal to 5% of supply, tightening float and aligning incentives.

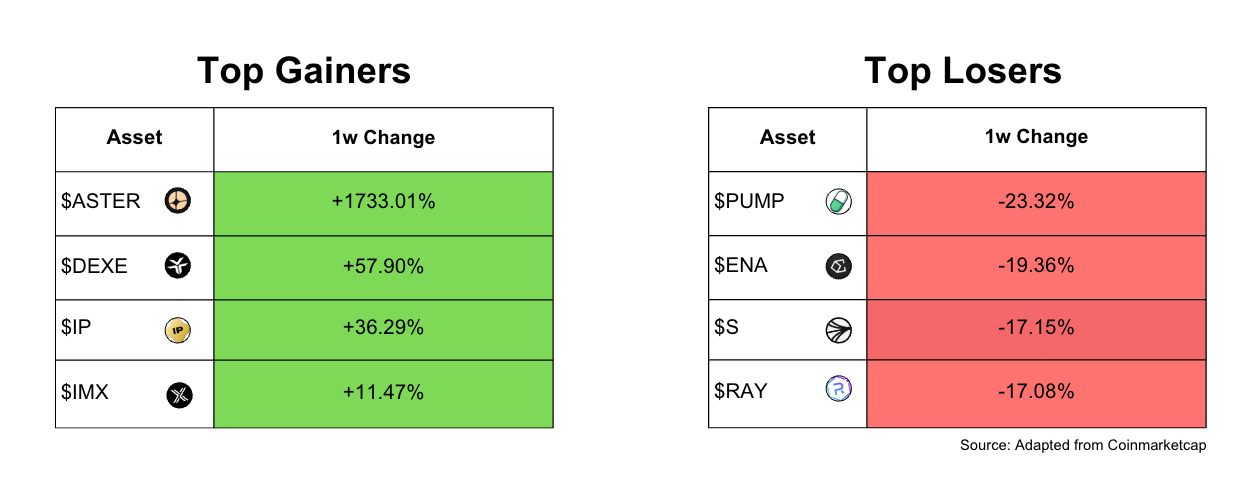

Aster was by far the biggest gainer of the last week due to a number of reasons:

Fresh TGE + airdrop mechanics: Very low float at launch + large airdrop claims created acute supply/demand imbalances.

Influencer spotlight: A high-profile shout-out (incl. CZ) pulled in speculators and volume.

Narrative fit: Branded as a high-velocity perp-DEX competitor (“the next Hyperliquid”), attracting momentum traders.

On-chain flows: Whale wallets rotated in; thin books + perps funding led to short squeezes.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky, and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose, and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.