Bitcoin Weekly Update #5

Several positive developments unveiled as trading activity continues to decline

Dear readers,

Hope you’re having a great week thus far. We’ve excited to share our latest weekly update:

Major Developments for the week:

Franklin Templeton ($1.5 trillion AUM) files for Bitcoin spot ETF

VISA announces integration of Solana for stablecoin payment pilot program

SEC delays multiple Bitcoin spot ETFs

Ark Invest files for an ETH spot ETF

Ripple acquires custodian Fortress

FASB approves marked to marked accounting rule for companies holding Bitcoin/crypto on their balance sheet

Coinbase to buy back debt, files for institutional lending service

Franklin Templeton Files for Bitcoin spot ETF

This morning $1.53 trillion asset manger Franklin Templeton has joined the race and filed for a Bitcoin spot ETF, which similar to other filings, would utilize Coinbase as their custodian of choice. The firm joins the likes of Blackrock, Fidelity, Ark Invest, Invesco, Galaxy Digital, and more. Between Blackrock, Fidelity, Invesco, and now Franklin Templeton, there is now a combined AUM of over $16 trillion across all of the asset managers that have filed for Bitcoin ETFs. These “blue-chip” traditional finance names have a material impact on the career risk of supporting or allocation to Bitcoin as an asset class.

SEC delays multiple Bitcoin spot ETFs, Ark Invest and Hashdex file for an ETH ETFs

Last week, to the surprise of few, the SEC’s decisions on several Bitcoin spot ETF applications were delayed once again. The table below, from head ETF analyst at Bloomberg, shows important dates to watch out for regarding major Bitcoin ETF applications. The next batch of deadlines comes in mid-October. Ultimately, the most important dates, which are the final deadlines, all come in Q1 of 2024; with the earliest (Ark Invest/21Shares) coming on January 10th.

In addition, another big development in the ETF world was Ark Invest filing for an Ethereum spot ETF in partnership with 21Shares. This morning it was revealed that Hashdex has filed for an ETH based mixed spot/futures ETF as well.

Grayscale’s GBTC (Grayscale Bitcoin Trust) can be seen as a decent proxy for the market’s expectations of ETF approval. Looking at its discount to NAV (net asset value), the discount is currently the lowest that it has been since December 2021 at 17%.

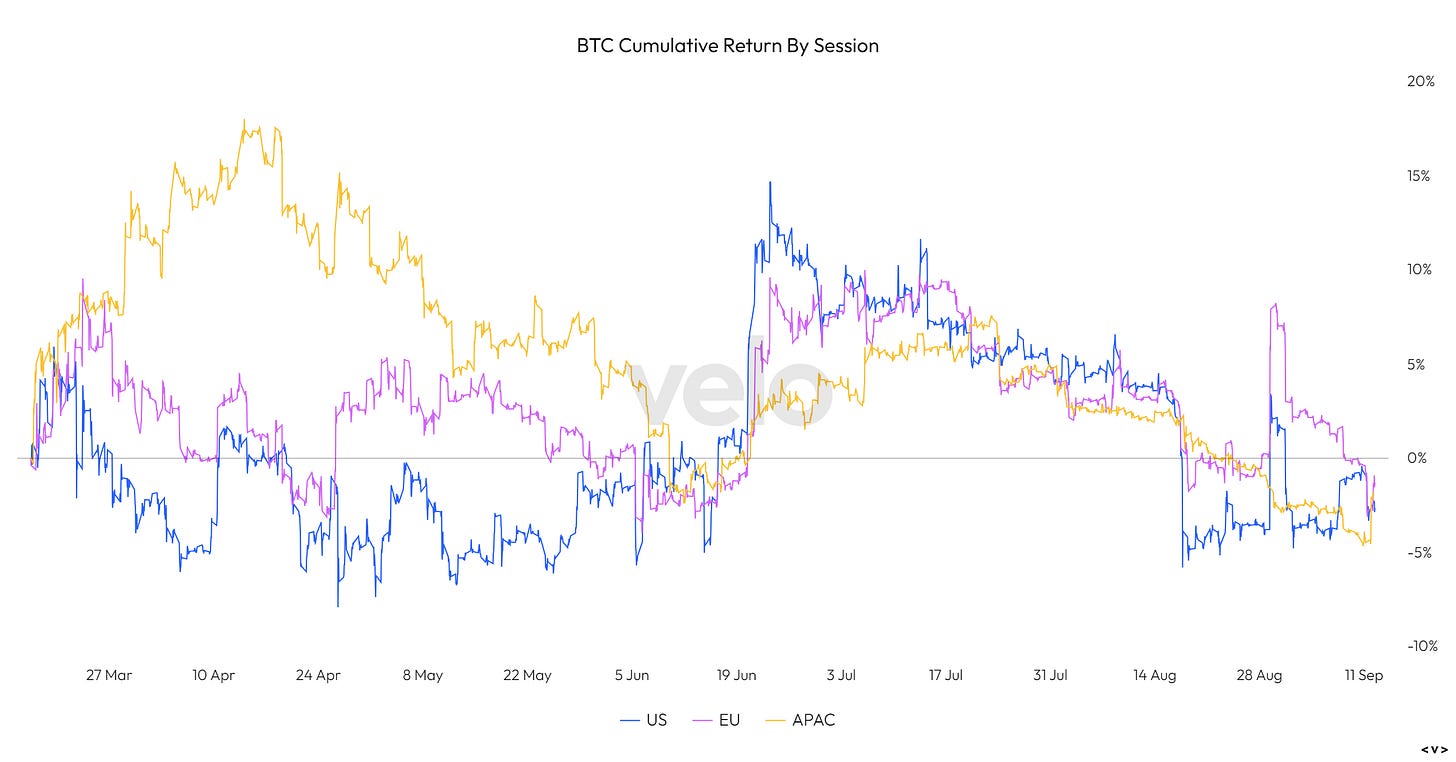

Meanwhile, the US trading hour premium that we saw erupt after the initial Blackrock spot ETF filing has continued to wane, showing that the initial cohort of flows that pushed BTC to $30K is still either expressing ETF views through GBTC or sitting on the sidelines for the time being.

VISA announces integration of Solana for stablecoin payment pilot program

One of the most exciting developments of this week was from VISA, announcing that they are going to be utilizing the Solana blockchain’s high transaction throughput for USDC-based cross-border stablecoin transactions. In the announcement, VISA stated that they are one of the first financial/payment institutions to integrate the Solana blockchain at scale. This is not VISA’s first time dabbling in crypto, as the payment giant previously ran a pilot program with crypto.com in 2021, utilizing Ethereum blockchain to enable stablecoin-tied payments made with crypto.com VISA cards. According to the head of crypto at VISA, “By leveraging stablecoins like USDC and global blockchain networks like Solana and Ethereum, we're helping to improve the speed of cross-border settlement and providing a modern option for our clients to easily send or receive funds from Visa’s treasury”.

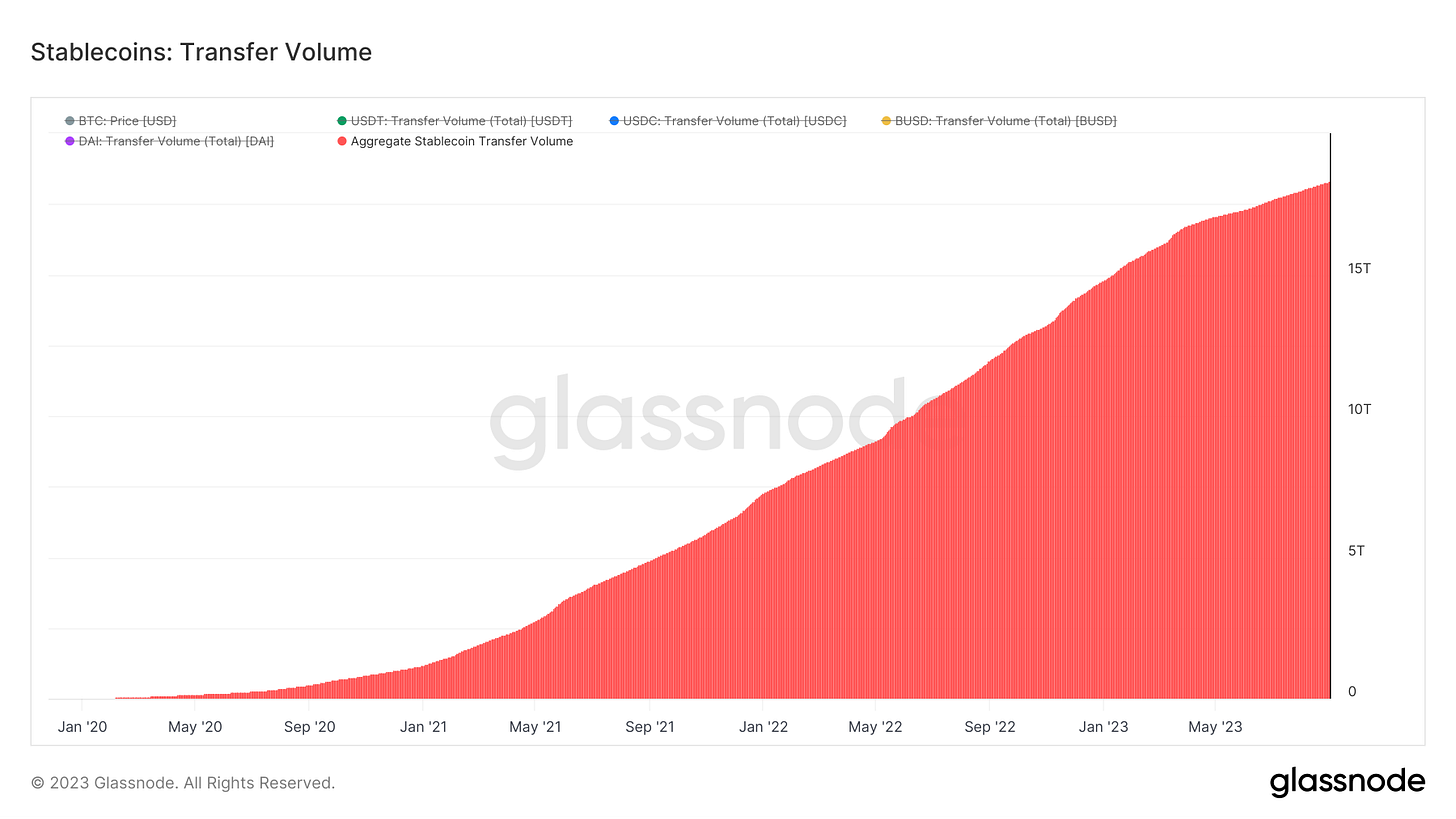

This move continues to solidify stablecoins as one of the clearest findings of product market fit for crypto, which have now crossed over $18 trillion in cumulative settlement on Ethereum alone. Stablecoins are used globally in regions of the world that don’t have access to banking/financial infrastucture and/or regions of the world that have rapidly devaluing native currencies. In addition, stablecoins are used for remittance payments, allowing individuals to bypass large fees that firms such as Western Union charge. Lastly, financial firms may utilize stablecoins for instant cross-border settlement as well as trading and/or market making in crypto.

FASB Approves Favorable Crypto Account Rule

Another major development for the crypto industry that went under the radar this week was the Financial Accounting Standards Board (FASB) approving a favorable crypto accounting law that allows firms to mark their holdings to current fair market value on their balance sheet. In a meeting last week, the FASB gave staff permission to draft up a final copy for the new standard, which is expected to be officiality voted on and approved by the end of this year and would go into effect after December 15, 2024. This move is one step closer to enabling broad adoption of Bitcoin and digital assets for corporations. Microstrategy’s Michael Saylor expressed his excitement about the announcement in the tweet below:

Coinbase buys back debt, files for institutional lending service

There were two interesting developments around Coinbase that were unveiled this week. Firstly, on September 5th the publicly traded exchange announced that it will commit up to $150 million to buying back its 3.625% senior notes due in 2031 at less than 70 cents on the dollar. In addition, the company filed for an institutional lending service, which aims to capitalize on the gaping hole left by previous failed crypto lending firms such as Genesis, BlockFi, Voyager, etc. This move potentially signals early signs of credit returning to the crypto market, which has been missing at scale for over a year after the widespread contagion and fallout throughout 2022.

Market Structure

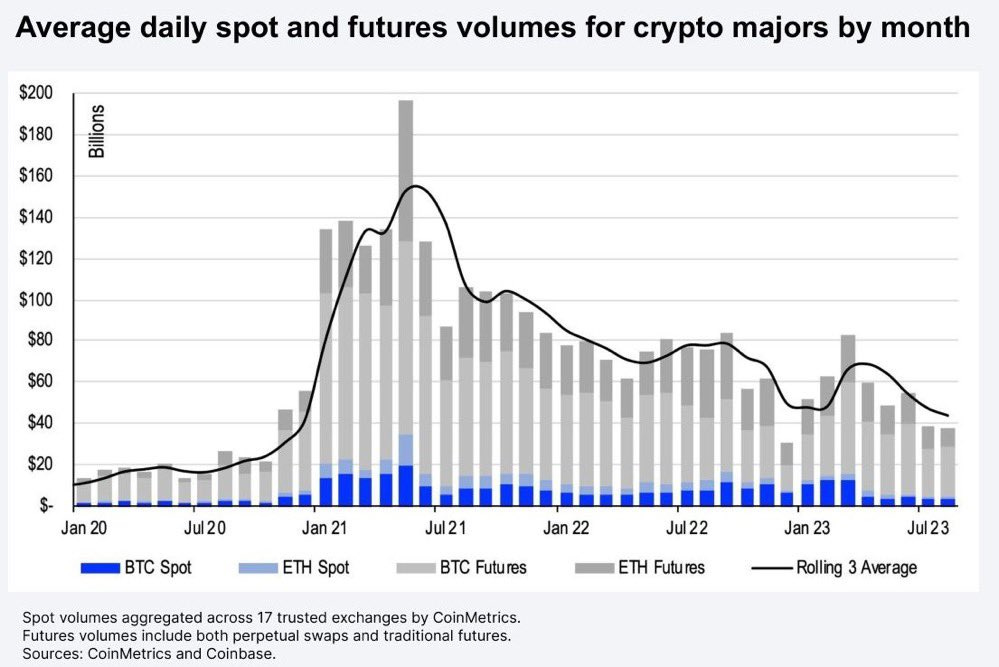

In terms of market structure, trading volume has declined again this week, a continuation of the market apathy and time capitulation that we described in recent reports.

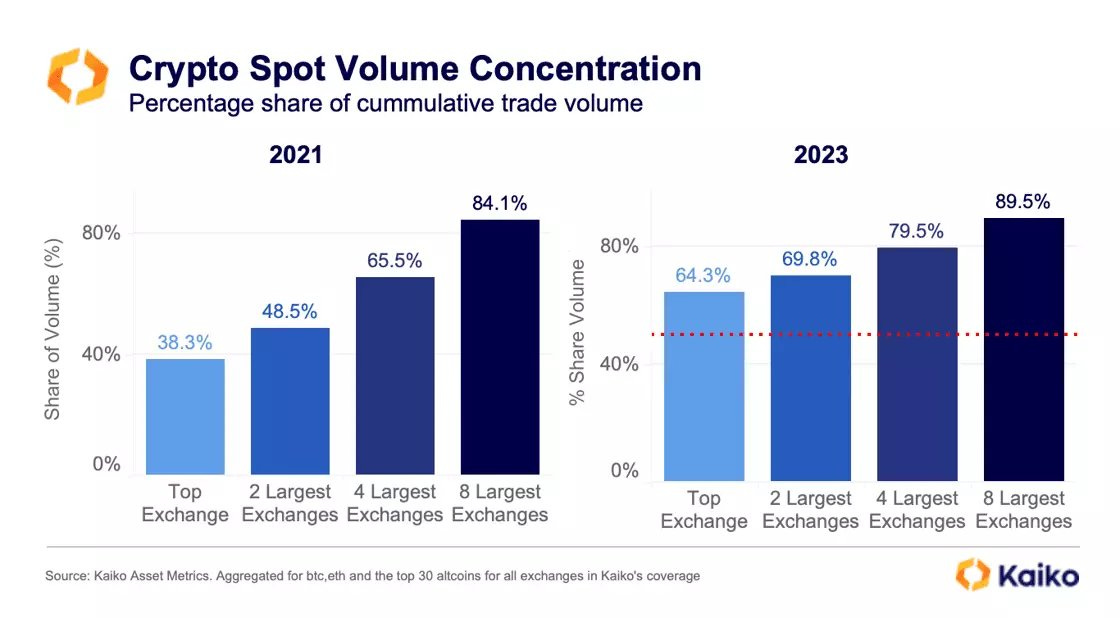

On that note, Kaiko data released an interesting report on volume and liquidity in crypto markets this week, with one of the most interesting findings throughout their report being the chart below. This shows the concentration of spot trading volume in the crypto market from 2021 to today. In 2021, the largest exchange globally (Binance) took up 38% of all global trading volume, compared to 64% today. Looking at the top 2, 4, and 8 largest exchanges all show the same trends of concentration. Why does this matter? The more volume concentrated into a few venues the higher amount of concentration risk for the industry should those few venues undergo any existential regulatory or security issues. For end users in any industry, more competition ensures constant innovation to stay ahead of other firms. However, the other argument would be that more competition in the exchange landscape fragments liquidity, meaning traders must execute across multiple venues to minimize price impact.

In conclusion, despite several positive developments/announcements this week across both Bitcoin/crypto, trading activity and price action continue to be lackluster. As we’ve said before, it’s safe to say the market is in a deep period of apathy. However, a lack of mainstream interest sparks opportunity for those who have stuck around and are still engaged in the space — and with the Bitcoin halving less than 250 days out and multiple Bitcoin ETF decisions to be made in Q1 2024, the ultimate light at the end of the tunnel may be closer than we may think.

We hope you enjoyed this week’s update and have a great week!

Some of us have been buying heavily.