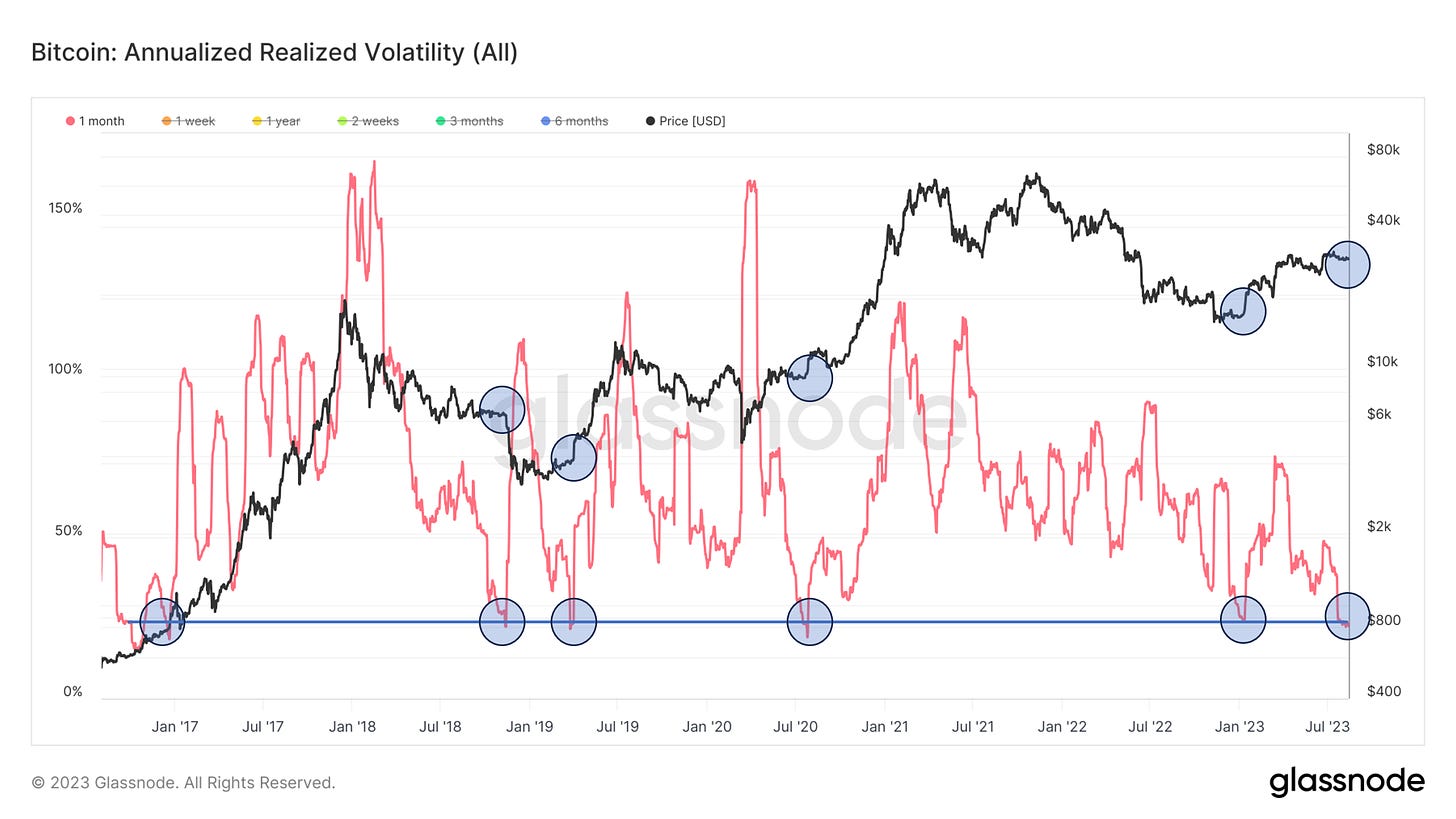

This month has been extremely boring for the Bitcoin and crypto market broadly with the initial wave of excitement around ETF filings that sparked Bitcoin’s move to $30K behind us. This is evident by looking at Bitcoin’s realized volatility, which is approaching levels that have historically preceded large price impulses over the last few years as highlighted below:

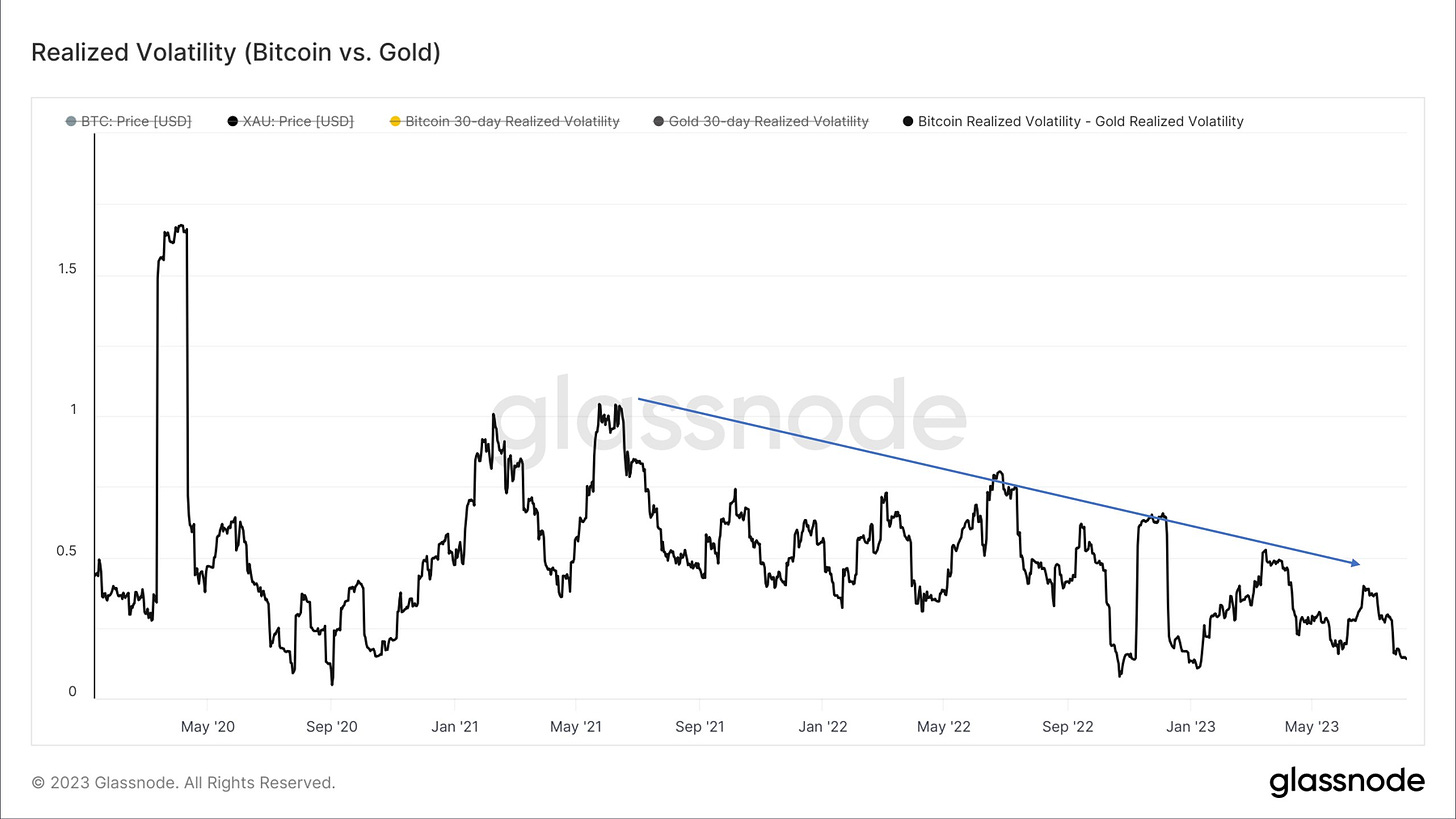

Bitcoin’s realized volatility has now been declining relatively to Gold’s realized volatility for over two years — which is a trend that is unlikely to continue forever, but puts to sleep any arguments that Bitcoin is too volatile to be a legitimate asset class.

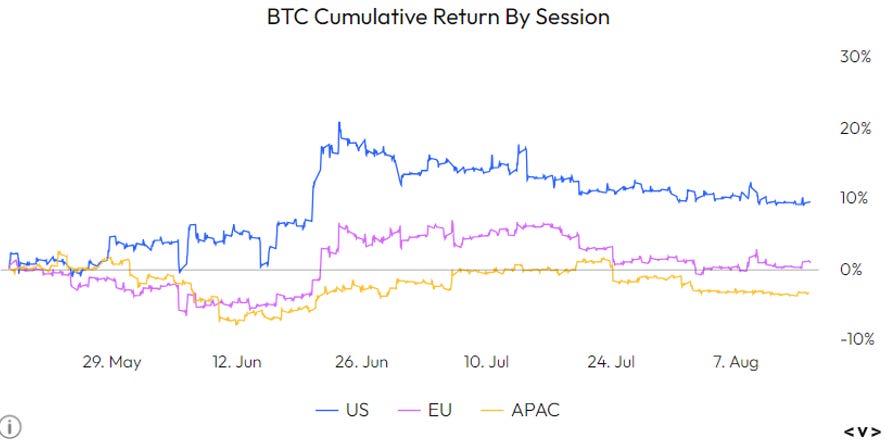

The decline in ETF hype for the time being is also evident by looking at the US trading hour premium, which ramped up after the initial Blackrock ETF announcement alongside CME futures open interest. This will be something to watch for the return of the ETF trade.

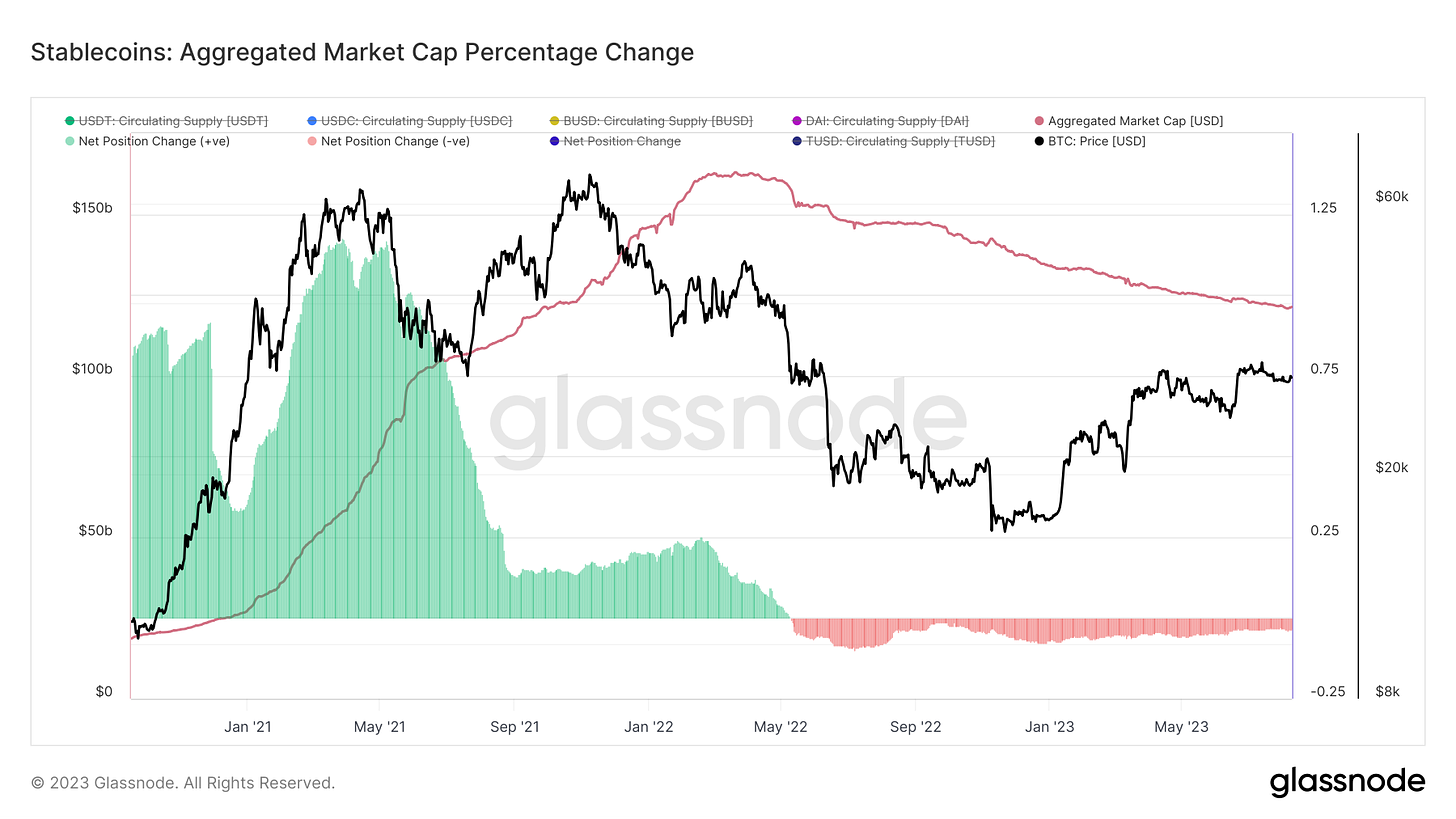

This lacks of volatility paired with crypto wide contagion and counter party risk has led to a decline in volume and liquidity across centralized exchanges, which can be shown by looking at bid/ask depth. Not only have we seen this decline in volatility on centralized exchanges but on-chain as well. One way to measure this is by looking at aggregated stablecoin supplies across USDC, USDT, BUSD, and DAI. Stablecoin supplies have been declining for over a year now, which is partially due to the declining interest in crypto for the reasons mentioned above as well as the ability to earn yield from treasuries as opposed to operating in DeFi. One metric that is worth following for a potential trend shift is the 90 day change, shown as the green/red oscillator at the bottom of the chart.

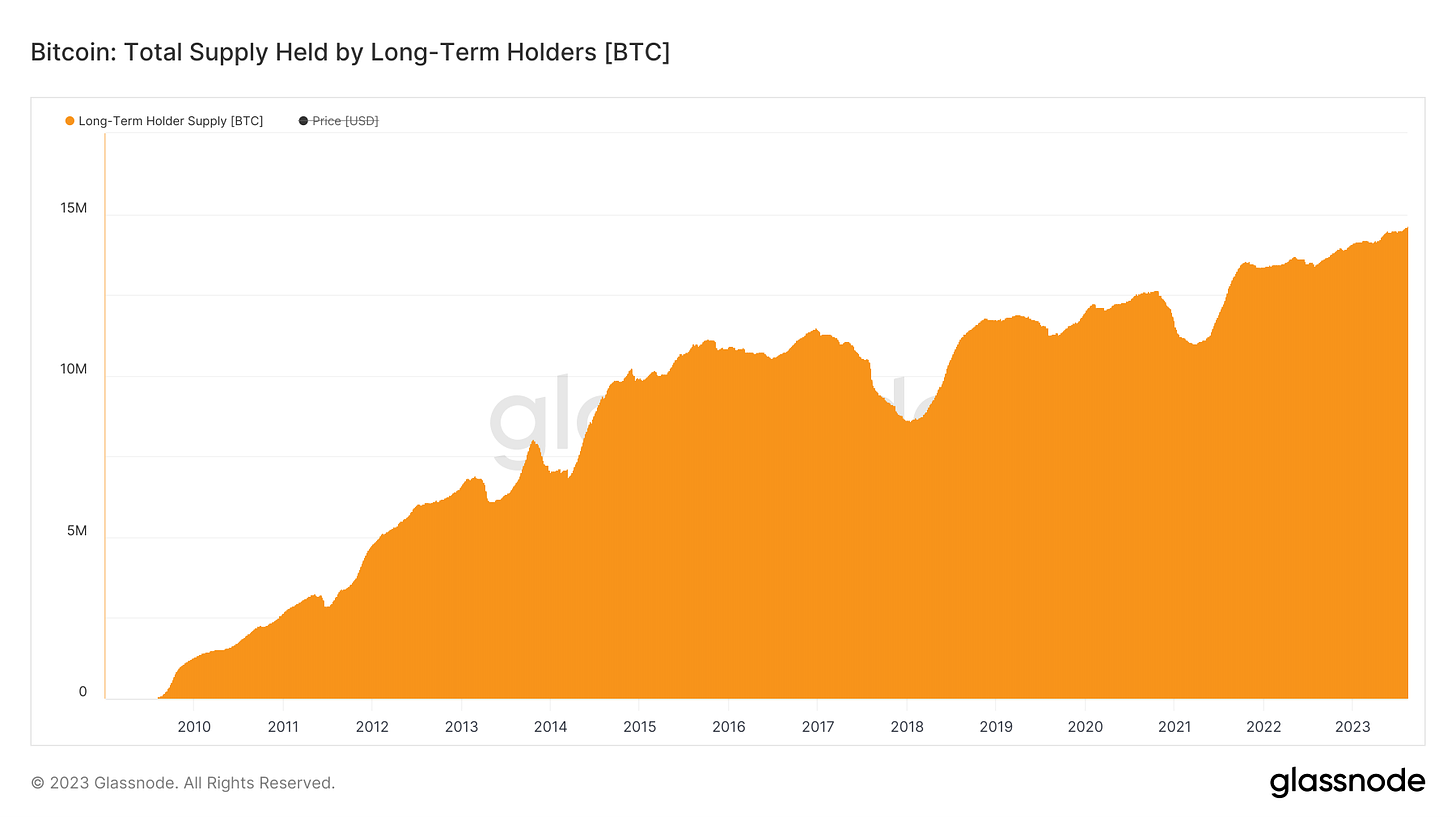

Meanwhile as volatility grinds near record lows, Bitcoin holders have shown unwavering belief in the asset class, with an all time high in the amount of Bitcoin held by long term holders outright as well as the percentage of overall circulating supply held by long term holders breaching 75%.

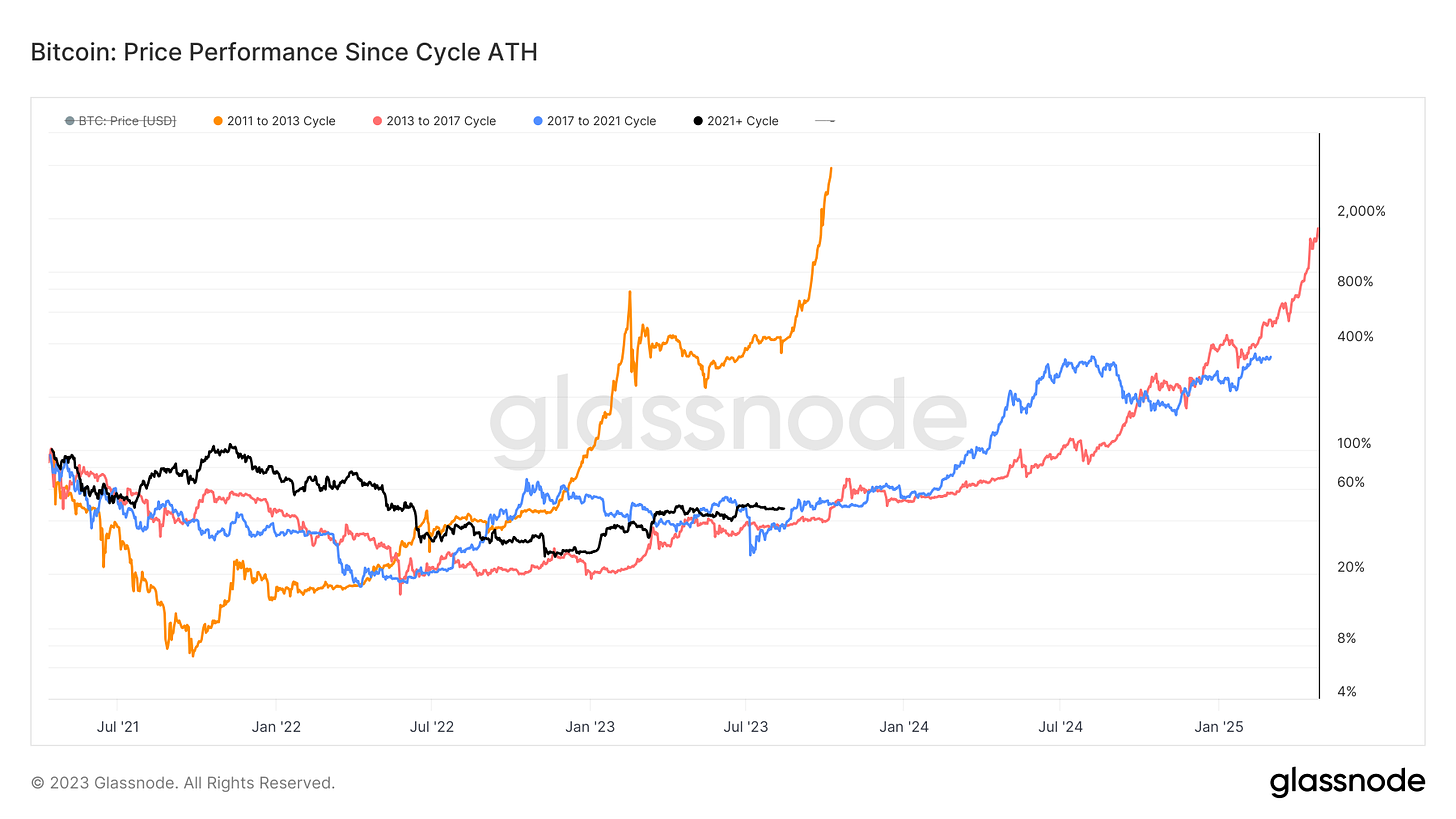

Zooming out, from a pure time perspective Bitcoin is trading very similarly to how it has during previous “4 year” market cycles. The chart below compares each epoch starting from their prior cycle all time high, with this current one being shown in black — which yes is slid back to April 2021 instead of November, which was a decision made due to the fact that all on-chain activity peaked in April of 21.

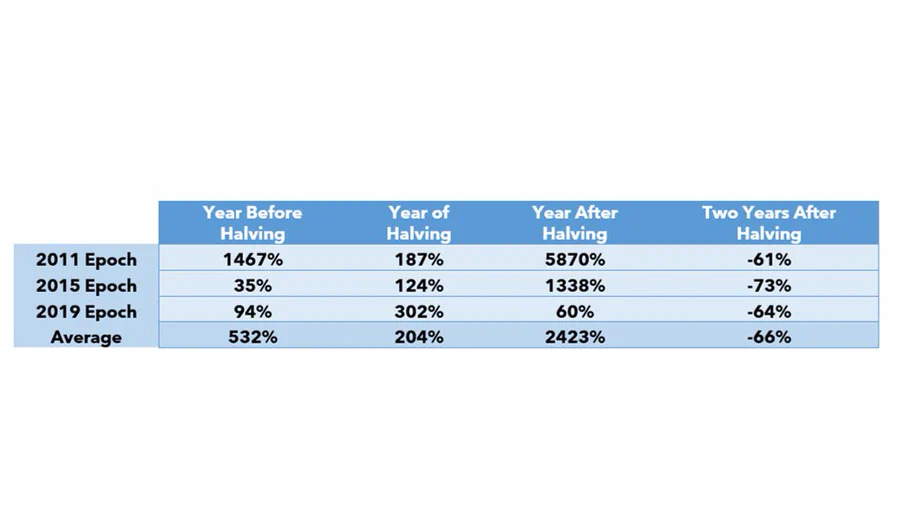

Looking at Bitcoin’s returns by year, we can see that every one of its down years have been two years after the halving (2014, 2018, 2022). While history doesn’t always repeat it often rhymes, and it appears this market cycle is off to following a similar pattern to prior ones.

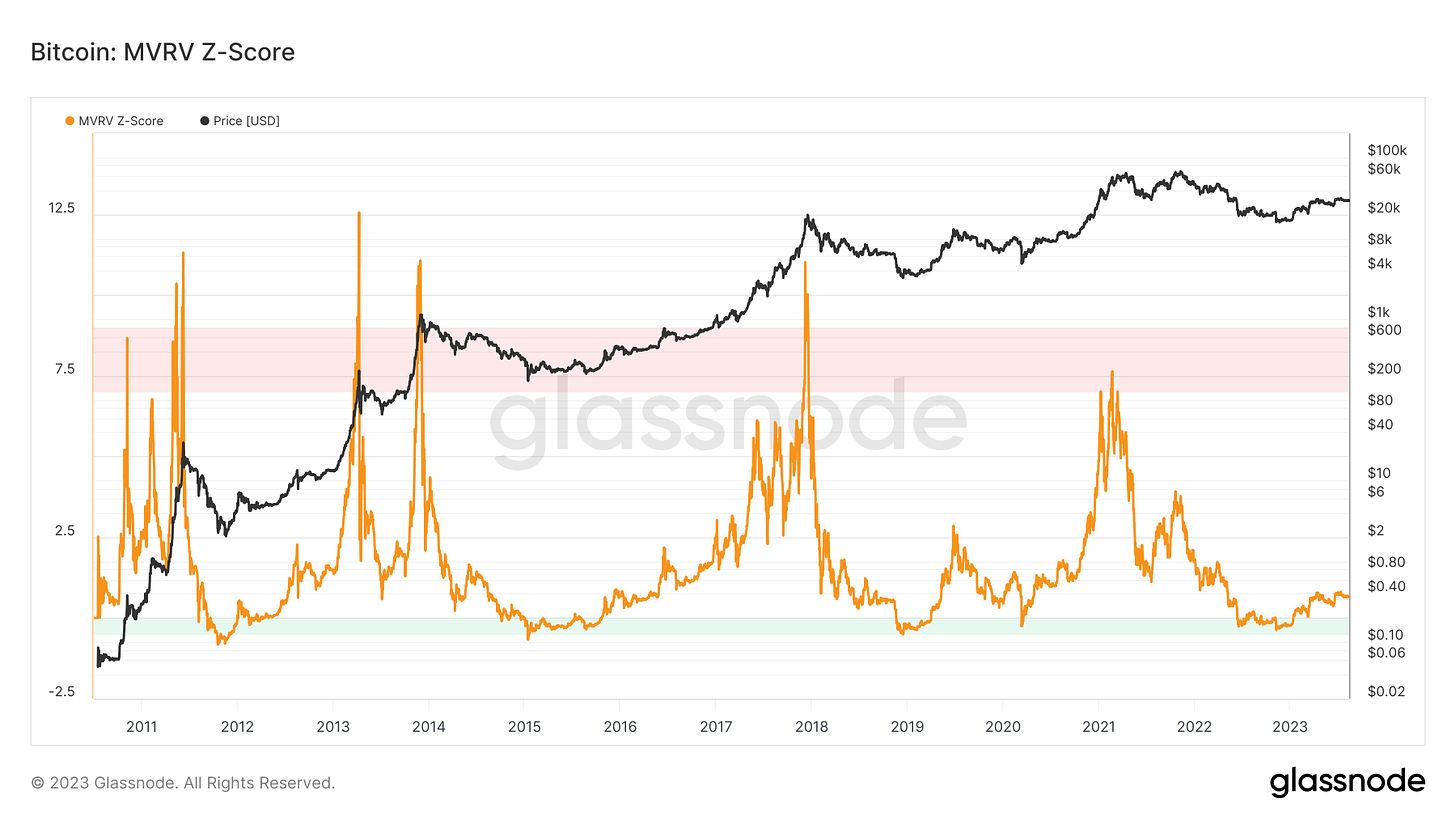

One of our favorite valuation metrics for high time frames is to look at MVRV ratio. This compares the current marginal trading price to realized price, which is the aggregated cost basis of the network based on when coins were last moved. The idea here is that whenever the marginal trading price is significantly above the cost basis of the market there is a high likelihood that investors will look to take profit on their Bitcoin holdings and whenever the current marginal trading price is below the cost basis of the network by definition the market is underwater in aggregate and it is likely a prudent time to allocate to BTC. So far we saw the latter prove to be true once again, and as it appears we have moved out of “deep value” Bitcoin is still trading in the lower bounds of valuation.

Another variant of realized price that paints the picture of HTF market dynamics is looking at the percentage drawdown of realized price from its prior all time high. As you can see this bear market’s drawdown was worse than both 2015/2018, meaning that even on a relative basis the amount of losses realized (capitulation) on-chain has been massive.

As Bitcoin trades sideways like a stablecoin nearing all time low volatility, with the halving on the horizon (~250 days out) and Bitcoin still trading in its lower bounds of valuation, beneath the surface holders are sitting tight for the coming years head. Until we get a significant catalyst to unleash volatility, we sit patiently.

Looking forward to sending out these recurring weekly updates from here on out. Appreciate your support and hope you get some value out of these. Have a great day.

very good! thanks Root

gud