Bitcoin undergoes biggest leverage wipeout since FTX collapse

Weekly Market Update #52

Before diving into this week’s overview, be sure to check out some of our recently released content:

Major developments for the week:

Bitcoin Spot ETFs experienced a $2.7 billion inflow week

MicroStrategy acquired 21,550 BTC for $2.1 billion at an average price of $98,783 per Bitcoin.

Virgin Voyages became the first cruise line to accept Bitcoin.

Binance introduced on-chain yields through Babylon BTC staking.

The Czech Republic eliminated capital gains taxes on Bitcoin held for over three years.

Coinbase began allowing users to purchase cryptocurrency via Apple Pay.

Tether reported that, as of the start of Q4 2024, there were 109 million on-chain wallets holding USDT.

Former President Trump appointed pro-crypto advocate Paul Atkins as the new chair of the SEC.

Grayscale submitted an application for a Solana ETF to the NYSE.

Jupiter DAO approved a $860 million "Jupuary" airdrop.

SushiSwap proposed liquidating all their $SUSHI holdings.

Regulatory and Leadership Developments

President-elect Donald Trump has nominated Paul Atkins, a pro-cryptocurrency advocate, to serve as Chair of the SEC. Atkins, who held the role of SEC commissioner from 2002 to 2008 under President George W. Bush, is expected to adopt a more lenient regulatory stance than previous chair Gary Gensler. As CEO of Patomak Global Partners, a financial services and cryptocurrency advisory firm, Atkins’ selection signals Trump’s pro-crypto sentiment and could encourage greater innovation in the digital asset sector, pending Senate confirmation.

Institutional and Investment Highlights

Cumulative Bitcoin Spot ETF flows reached $2.7 billion last week. During the same period, MicroStrategy significantly expanded its Bitcoin holdings by purchasing 21,550 BTC between December 2 and December 8, 2024, at an average price of $98,783 per Bitcoin (including fees). This move, funded by issuing and selling approximately 5.4 million shares of common stock, brought the company’s total BTC holdings to 423,650, currently valued at around $42 billion.

Tax and Regulatory Changes

In Europe, the Czech Republic passed a tax reform, effective January 1, 2025, exempting Bitcoin from capital gains tax if held for more than three years. This measure, aligned with the EU’s Markets in Crypto-Assets (MiCA) framework, applies to personal holdings under CZK 100,000 (approximately $4,300) in annual Bitcoin income. Although it aims to foster a Bitcoin-friendly environment, questions remain about verifying holding periods and clarifying which digital assets qualify.

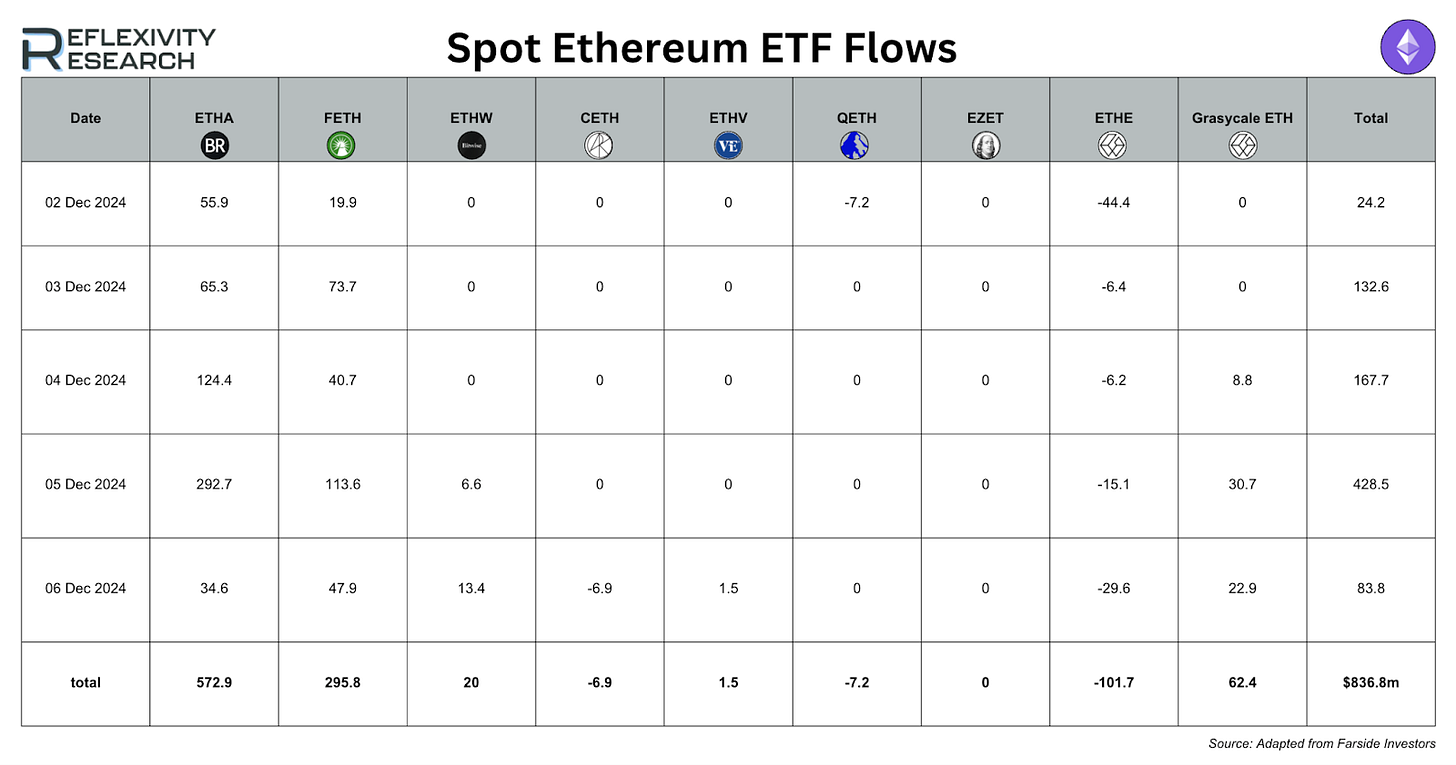

Last week, ETH saw net inflows of $836.8 million. This reflects a strong start to the month and a continuation of November’s strong performance as highlighted below

DeFi Governance Decisions

In other news last week, SushiSwap's governance has proposed a significant restructuring of its treasury management. The plan involves transferring assets from the DAO-controlled treasury to a new entity, Sushi Labs, which would oversee protocol development and operations. This move includes a request for a grant of 25 million SUSHI tokens (approximately $38.5 million) to Sushi Labs, along with assets from various sources such as the Arbitrum airdrop and business development funds.

The proposal has sparked considerable debate within the SushiSwap community. Concerns have been raised about transparency, potential centralization of power, and the fair allocation of project resources. Despite these issues, a signal vote concluded with over 62% approval for the restructuring.

It's important to note that this proposal does not involve liquidating all of SushiSwap's $SUSHI holdings. Instead, it focuses on reallocating treasury assets to Sushi Labs to enhance operational efficiency and accelerate protocol development.

Solana and Solana Ecosystem Developments

Solana also had a couple of notable developments last week. The first major development of the week came from Grayscale Investments which has filed with the U.S. Securities and Exchange Commission to convert its Grayscale Solana Trust into a spot ETF listed on the NYSE. If approved, this ETF would trade under the ticker symbol GSOL, offering investors direct exposure to SOL without the need to hold the cryptocurrency directly. The Grayscale Solana Trust currently manages approximately $134.2 million in assets, representing about 0.1% of all SOL in circulation. This move reflects Grayscale's ongoing efforts to expand its digital asset offerings and aligns with the growing institutional interest in Solana's ecosystem.

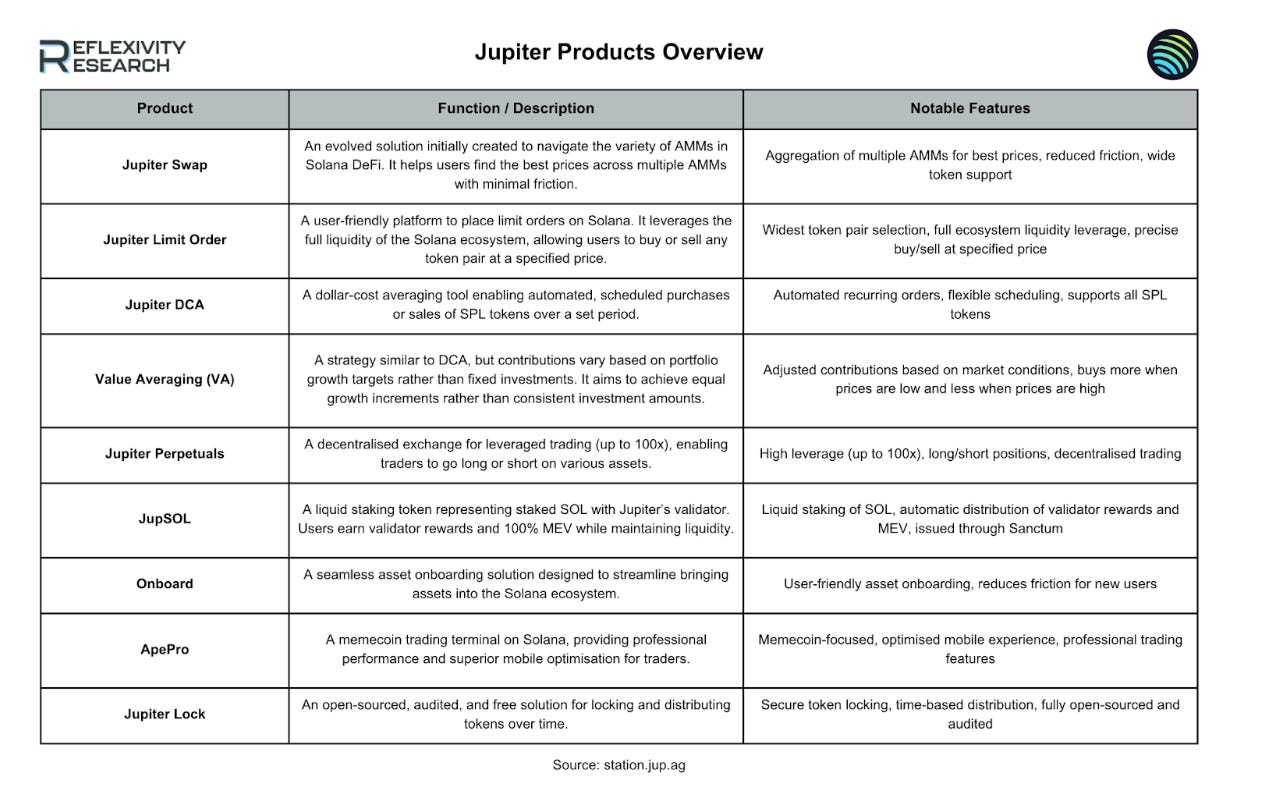

For the final update of the week, and in other news related to the Solana ecosystem, Jupiter DAO has approved a revised "Jupuary" airdrop worth $860 million. Since its launch in 2021, Jupiter has established itself as a major player in Solana's DeFi ecosystem, providing optimized token swaps and advanced trading features.

This airdrop follows the rejection of an earlier proposal to distribute 1.4 billion JUP tokens, worth approximately $1.6 billion, which failed to secure the required 70% approval threshold. The updated plan introduces safeguards to deter opportunistic actions and focuses on rewarding active and authentic platform users. Ongoing community discussions and voting will finalize the details to reach a consensus on the distribution process.

This weekly round-up is brought to you by:

Unlock the Power of Seamless Crypto Liquidity

Whether you're an institutional counterparty or a high-net-worth individual, Stillman Digital provides the deep liquidity and best execution you need to navigate the digital asset market with confidence.

Here’s why top-tier clients choose Stillman Digital for their trading needs:

24/7 Deep Liquidity with Fast Settlement Times: Execute large trades with minimal slippage and industry-leading speed.

Flexible Access: Choose between trading in chat, API, or our intuitive GUI.

High-Touch Service: From onboarding to execution, we’re here to guide you every step of the way.

Elevate your trading strategy within 24 hours. Book a call to learn more.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

I like how what’s in the headline is not discussed at all in the article 😂 a bit click-baity

So many activities