Major developments for the week:

Last week Bitcoin ETF products saw net outflows of approximately $550 million

Vaneck introduces the first Bitcoin ETF on the Australian Securities Exchange

Deutsche Telekom, the parent company of T-Mobile, will begin mining Bitcoin

The Enforcement Division of the SEC has informed Consensys that it is concluding its investigation into Ethereum 2.0

Spot ETH ETF issuers disclose fees and seed investments in their latest amendment filings

ENA provides an update on tokenomics and generalised restaking

3iQ has filed to launch a Solana ETF in Canada

ENS Domains unveils plans for version 2

Arbitrum launches Layer Leap

Solana introduces zero-knowledge (ZK) compression

Last week Bitcoin ETF products saw net outflows of approximately $550 million

Throughout the week from 17th June to 21st June 2024, ETF flows exhibited a predominantly negative trend. Significant outflows were recorded in FBTC, which saw a total outflow of $271 million and GBTC, which lost $152.6 million. ARKB also experienced outflows amounting to $78.8 million. In contrast, IBIT and EZBC were the only ETFs with consistent positive inflows, accumulating $1.5 million and $1.9 million respectively Other ETFs such as BITB, HODL and BTCO faced outflows of $35.6 million, $7.5 million and $2 million, respectively. The overall net outflow for the week across all observed ETFs amounted to $544.1 million.

A full breakdown of the BTC holdings per respective ETF entity can be seen below:

Mt. Gox To Distribute Bitcoin, Bitcoin Cash Repayments in July 2024

In other important BTC related news, the Rehabilitation Trustee of Mt. Gox has been diligently preparing to initiate repayments in Bitcoin and Bitcoin Cash as stipulated in the Rehabilitation Plan. It is announced that these preparations are now complete and repayments will commence from the beginning of July 2024.

Repayments will be made to cryptocurrency exchanges with which the Rehabilitation Trustee has successfully exchanged and confirmed the necessary information. This process ensures adherence to financial regulations in each country and implements technical measures for secure repayments.

To ensure a safe and reliable repayment process, thorough preparations have been made, including discussions with cryptocurrency exchanges and compliance with relevant financial regulations.

Repayments will be initiated in the order of exchanges that have completed the required information exchange and confirmation. Creditors are kindly asked to be patient as these repayments proceed.

Spot ETH ETF issuers disclose fees and seed investments in their latest amendment filings

More details have also emerged as to the Ethereum Spot ETF. Bitwise disclosed a $2.5 million seed investment in the latest update to its S-1 form for its spot Ethereum ETF, as reported by Sarah Wynn from The Block. This update includes new details about the investment, with Bitwise Investment Manager, LLC set to purchase 100,000 shares at $25 each, totaling $2.5 million. Pantera Capital Management LP has expressed interest in buying up to $100 million in shares, though these are not binding commitments.

Bloomberg ETF analyst James Seyffart predicted that spot Ethereum ETF products might launch before July 4, contingent on SEC approval. Despite the SEC approving 19b-4 forms for eight Ethereum ETFs last month, the S-1 statements still need to become effective for trading to begin. Seyffart noted that the timeline for the launch is uncertain and depends on final SEC approval.

In other Ethereum related news, ConsenSys announced that the SEC's Enforcement Division has closed its investigation into Ethereum 2.0. As a result, the SEC will not bring charges alleging that sales of ETH are securities transactions. This is a significant step for the broader digital asset landscape following months of various legal scrutiny by the SEC.

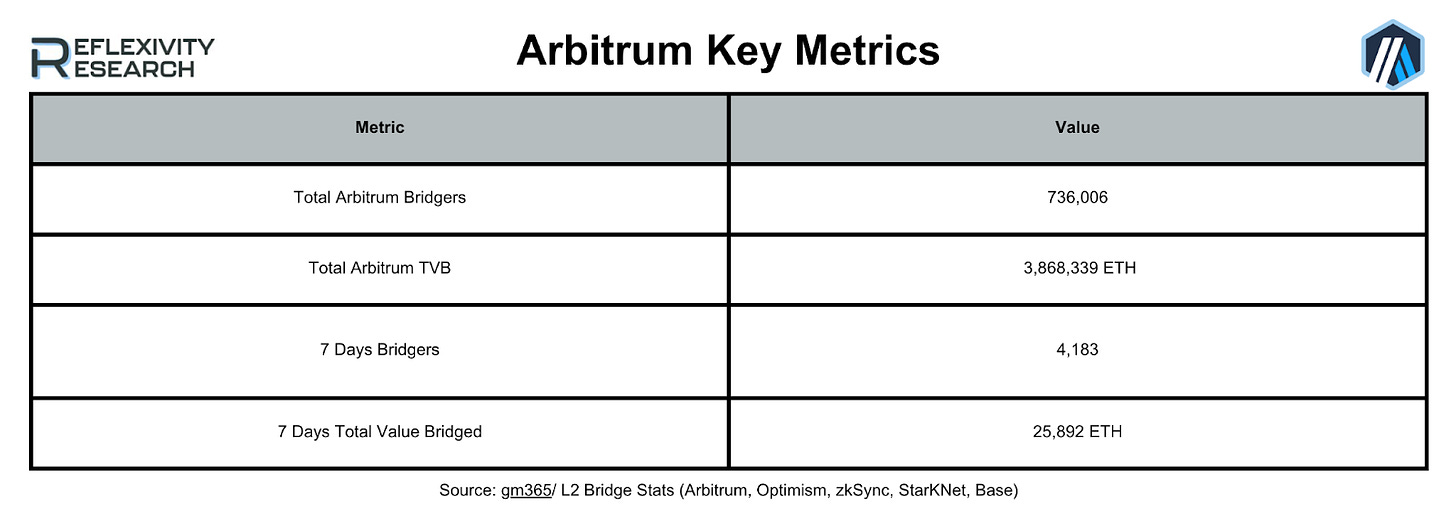

Arbitrum launches Layer Leap

In other protocol specific news last week, foresight News reported that Arbitrum has introduced its Layer Leap service, which enables direct bridging of funds from Ethereum L1 to the L3 Orbit chain, bypassing L2. Proof of Play and RARI Chain are among the first applications to adopt this service.

Layer Leap is a notable advancement in blockchain technology, simplifying the process of transferring funds across different layers. By allowing direct transfers from Ethereum L1 to the L3 Orbit chain, the service enhances efficiency and streamlines the process.

The adoption of Layer Leap by Proof of Play and RARI Chain highlights its potential to improve fund transfers within the blockchain industry.

In summary, Arbitrum's Layer Leap service improves the transfer process by bypassing L2, directly connecting Ethereum L1 to the L3 Orbit chain. The early adoption by prominent applications like Proof of Play and RARI Chain underscores its transformative potential in the blockchain sector.

Asset manager 3iQ is planning to introduce the first Solana product in North America to be traded on a traditional stock exchange

Another interesting development occurred this week for Solana which will be listed as an ETF in North America:

The proposed QSOL instrument would be accessible across all Canadian provinces and territories, except Quebec. It will provide investors with exposure to SOL's daily price movements in U.S. dollars and allow them to earn SOL staking yields.

Canada has pioneered the approval of crypto financial products, being the first to approve spot BTC ETFs in February 2021, followed by spot ETH ETFs two months later.

Although Americans have been able to trade Grayscale’s GSOL over-the-counter (OTC) since 2021, QSOL will be the first Solana product to trade on a formal stock exchange, the TSX. Unlike GSOL, QSOL aims to minimize extreme discounts and premiums through superior mechanisms.

ENSv2 Project Plan Announcement

For the last update of this week, the ENS team has unveiled a comprehensive plan for the next generation of the Ethereum Name Service (ENS). The detailed phases of the ENSv2 project, aimed at extending ENS to Layer 2, have been shared.

The ENSv2 Project Plan includes five phases, each thoroughly documented with a technical design document and FAQ. The team will provide regular updates on the project's progress and developments.

Below is a comprehensive overview of the ENSv2 project plan as it currently stands:

Note: The content in this weekly report has also been utilized in our weekly collaborative series with stock/crypto trading platform eToro.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

View 50+ free reports on our homepage: reflexivityresearch.com