Bitcoin trades around crucial $60,000 level as US and German governments sell seized supply

Weekly Market Update #36

Key Takeaways:

Last week Bitcoin ETF products saw net outflows of $37.3 million

US and German governments are both selling seized Bitcoin

VanEck and 21 Shares file for Solana ETFs

Pantera announced that they are raising more funds for a TON investment

Aave DAO posted a Lido Alliance proposal

Optimism announced Superfest

dYdX announced staking for their native token

Aptos Foundation introduced a proposal to deploy Aave V3 on Aptos Mainnet as part of Aave’s open governance process

Fantom Foundation announced airdrop details for Opera and Sonic users

Last week Bitcoin ETF products saw net outflows of approximately $37.3 million

From 24th to 28th June 2024, the US Bitcoin ETF market experienced a net outflow of -$37.3 million. IBIT led with the highest inflow of $82.4 million, while GBTC saw the largest outflow at -$155 million. Overall, significant inflows were observed in IBIT and ARKB ($42.8 million), while substantial outflows in GBTC and EZBC (-$17.3 million) impacted the total net flow.

A portion of these outflows can be attributed to governmental bodies selling seized BTC.

US Government Selling Seized Bitcoin: The US government transferred 3,940 BTC (approximately $240 million) to Coinbase Prime last week. This Bitcoin was confiscated from Banmeet Singh, a convicted narcotics trafficker and was forfeited at trial in January 2024. This sale is part of a broader strategy by the US government to liquidate seized cryptocurrencies. Notably, this follows previous large-scale transfers related to Silk Road seizures.

German Government Selling Seized Bitcoin: The German government is also liquidating Bitcoin that was seized from Movie2k, a now-defunct streaming site involved in illegal activities. This sale is in line with Germany's ongoing efforts to convert seized digital assets into fiat currency for public use.

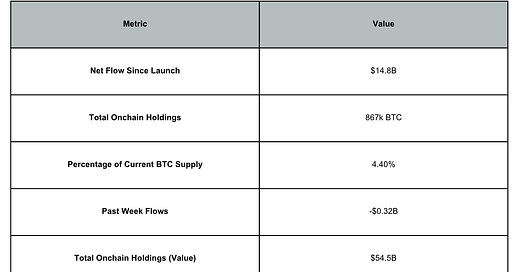

Overall since their launch, Bitcoin ETFs have accumulated a net flow of $14.8 billion. Currently, they hold a total of 867,000 BTC, which represents 4.40% of the current Bitcoin supply. The total on-chain holdings of these ETFs amount to $54.5 billion in value. Looking ahead, the projected Bitcoin supply absorption by these ETFs based on the last 14 days annualised is expected to decrease by 1.17%, indicating a potential reduction in their market influence.

dYdX introduces staking

In other news last week, dYdX introduced in-app staking, allowing users to stake and unstake $DYDX directly through the dYdX trading interface at dydx.trade and earn USDC staking rewards.

Previously, $DYDX holders had to use third-party wallets for staking, but now they can send $DYDX to the same wallet address used for trading on the dYdX Chain and stake their tokens seamlessly. According to Mintscan, staking $DYDX currently offers an approximate 14% APR, with USDC staking rewards automatically distributed to the wallet. This creates an ongoing cycle: stake $DYDX to earn $USDC, use $USDC for trading on dYdX, earn $DYDX trading rewards and repeat indefinitely.

Aave post a Lido Alliance Proposal

Another interesting protocol specific update came from Aave last week in which they released a Lido Alliance proposal.

This proposal recommends that the Aave DAO join the Lido Alliance and launch an Aave v3 instance centred on the Lido ecosystem.

Historically, Aave and Lido have experienced mutual growth, with stETH being a top collateral on Aave and leveraged staking being highly profitable for both Aave DAO and Lido users. The Lido Alliance aims to boost innovative uses of staked ETH and enhance the Lido ecosystem's growth. The proposal suggests that Aave support these efforts by creating a new Aave v3 ETH market tailored for Lido, specifically designed to support stETH leverage loopers, including only wstETH and wETH assets with E-Mode enabled. Lido has pledged incentives and ecosystem support to bootstrap liquidity and foster additional programs within the Lido Alliance. Detailed incentives from Lido will be provided prior to the Aave Improvement Proposal deployment.

Optimism Announces Superfest

The last update for this week comes from Optimism in which they announced their Superfest event.

Optimism Superfest is an event by the Optimism Collective, spotlighting advancements in Ethereum's Layer 2 scaling solutions.

Key highlights include:

OP Stack: An open-source, modular framework that simplifies the creation of Layer 2 chains, enhancing interoperability and ease of upgrades.

Superchain Vision: A network of interoperable Layer 2 chains designed to improve scalability and reduce transaction costs on Ethereum.

Funding and Incentives: $3.3 billion in OP tokens are allocated to support public goods and incentivize developers, fostering innovation and decentralisation.

Overall, Optimism Superfest underscores collective efforts to boost Ethereum's scalability and usability, promoting a decentralised blockchain ecosystem.

Note: The content in this weekly report has also been utilized in our weekly collaborative series with stock/crypto trading platform eToro.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

View 50+ free reports on our homepage: reflexivityresearch.com

"A portion of these outflows can be attributed to governmental bodies selling seized BTC." - This doesn't make sense. How can ETF outflows be attributed to govt selling SEIZED BTC on the free market? You do understand the govt holds these bitcoins in their own private wallets and then auction them, it has nothing to do with the ETF flows.