Bitcoin spot ETFs see over $2 billion in inflows as BTC trades above $69k

Weekly Market Update #46

Before diving into this week’s report, we want to invite you to join us this Friday in New York City for Crypto Investor Day — our second ever event. Sign-up here.

Major developments for the week:

Bitcoin Spot ETFs experienced a $2.12 billion inflow week

BlackRock entered discussions with global crypto exchanges to use the BUIDL token as collateral for futures trading.

Securitize launched a USDC conversion service for BlackRock's Digital Liquidity Fund.

Grayscale filed to convert its mixed crypto fund, including Bitcoin, Ether, and Solana, into an ETF.

Tether began exploring lending options to commodity trading companies.

Venmo users gained the ability to purchase crypto via Moonpay.

Vitalik Buterin shared an article discussing improvements to Ethereum's Proof-of-Stake mechanism.

HyperFND introduced the $HYPE token.

CelestiaOrg announced the Shwap upgrade.

RDNT Capital was exploited, resulting in over $50 million in user losses.

Last week inflows into the spot Bitcoin exchange-traded funds soared by over 580% this week.

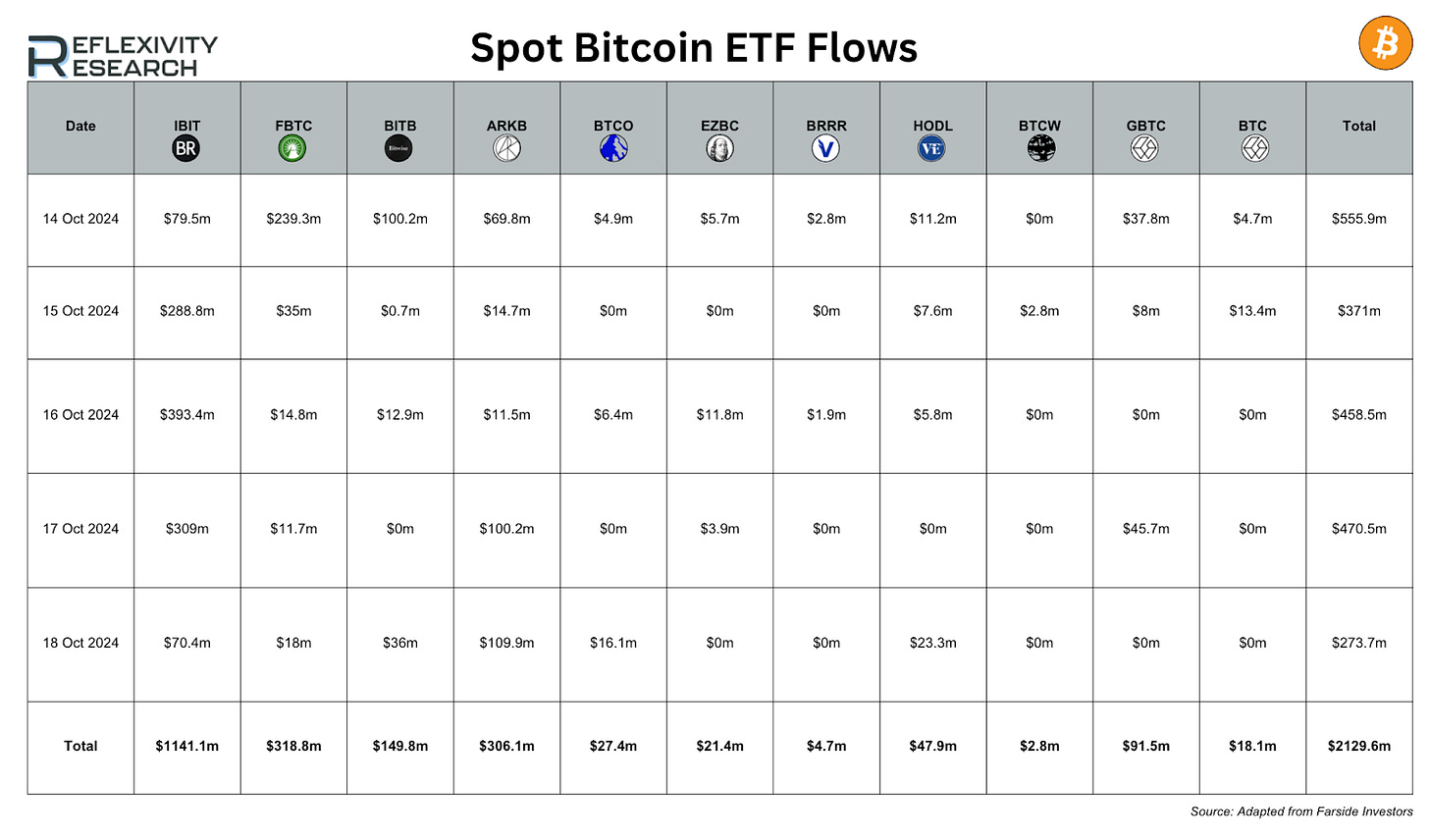

Over the past seven days, the 12 spot Bitcoin ETFs attracted $2.13 billion in inflows, following six consecutive days of positive investment. This is the first time since March 2024 that weekly inflows into Bitcoin ETFs have surpassed the $2 billion mark.

Total net inflows across all Bitcoin ETFs have reached a record $20.94 billion; a milestone that took gold ETFs years to achieve. Bitcoin ETFs achieved this feat in less than a year.

Weekly inflows peaked on October 14, with $555.86 million flowing into the ETFs. However, by October 18, the pace had slowed to $273.71 million, based on data from FarsideInvestors.

None of the funds experienced negative flows on the last trading day, with ARK 21Shares' ARKB leading the inflows at $109.86 million and maintaining a seven-day inflow streak. BlackRock's IBIT followed with $70.41 million, marking a five-day inflow streak. Bitwise's BITB attracted $35.96 million, while VanEck's HODL received $23.34 million. Fidelity's FBTC brought in $18.0 million, sustaining a six-day inflow streak, and Invesco's BTCO added $16.11 million. Meanwhile, Franklin Templeton's EZBC, WisdomTree's BTCW, Grayscale's GBTC and BTC, and Hashdex's DEFI reported no inflows.

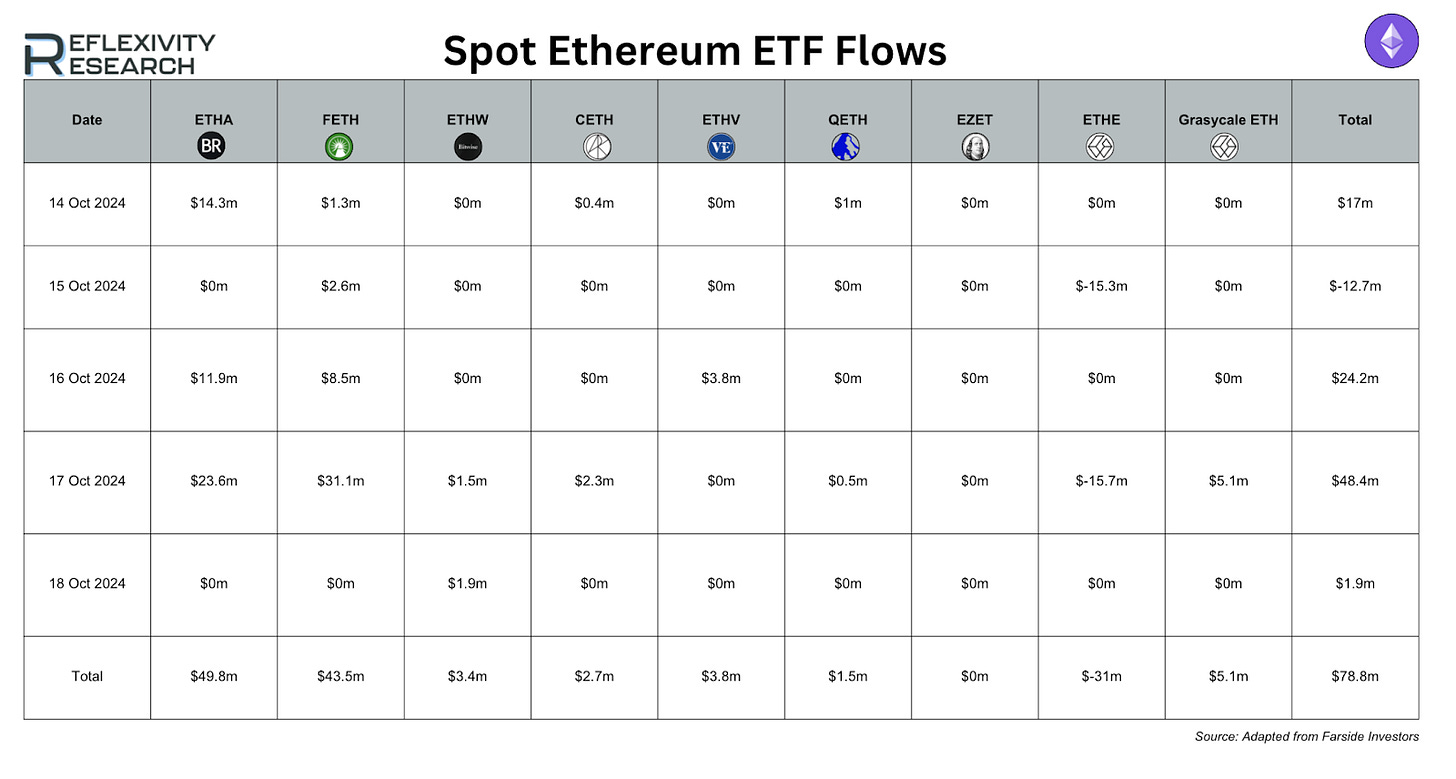

Between October 14 and October 18, 2024, Ethereum ETFs saw net inflows totaling $78.8 million, a significant surge compared to the previous week's inflows of just $1.9 million over the same number of trading days.

BlackRock entered discussions with global crypto exchanges to use the BUIDL token as collateral for futures trading

In other news last week, BlackRock announced that it is negotiating with leading crypto exchanges, including Binance, OKX, and Deribit, to use its BUIDL token as collateral for futures trading.

Furthermore Securitize, in partnership with Zero Hash, has introduced a USDC-to-USD conversion service for BlackRock's USD Institutional Digital Liquidity Fund. This integration enables eligible investors to subscribe to the BUIDL fund by converting USDC stablecoins into U.S. dollars, streamlining on-chain investments. BUIDL fund offers tokenized shares backed by secure assets such as U.S. Treasury bills, providing benefits like instant settlement and improved liquidity. The initiative aims to lower investment costs and simplify the subscription process for traditional financial institutions.

Grayscale also had an update last week in which it submitted a filing to the SEC to convert its Digital Large Cap Fund, which holds assets such as Bitcoin, Ethereum, Solana, XRP, and Avalanche, into an ETF. The fund manages around $524 million, with a major portion allocated to Bitcoin and Ethereum. This move comes after Grayscale’s successful conversions of its Bitcoin and Ethereum funds into ETFs earlier this year. If approved, the ETF will be listed on the NYSE, reflecting Grayscale’s ongoing efforts to expand its offerings and cater to growing investor interest in digital assets.

Shwap Upgrade Overview

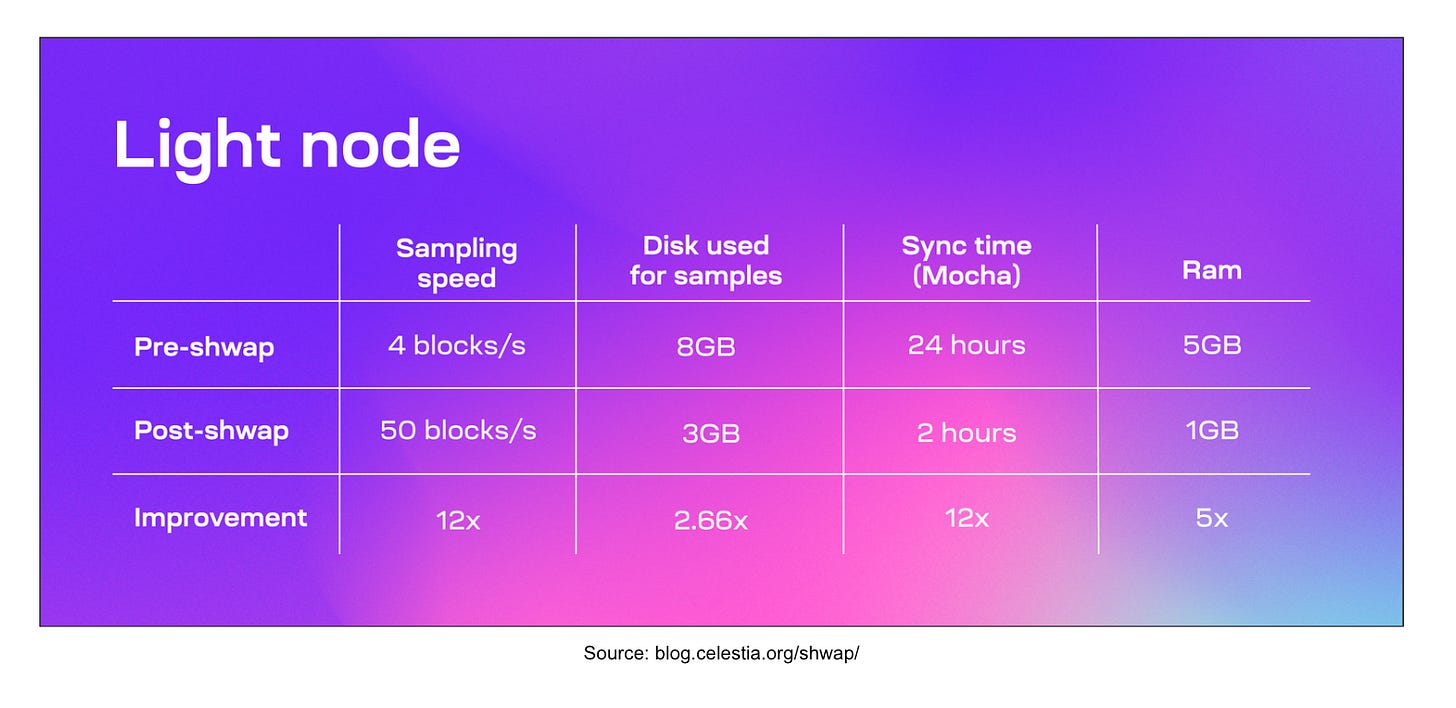

Last week Celestia's Mainnet Beta underwent its first upgrade, introducing a new set of features to enhance the consensus network. The data availability (DA) network received its first major update, called Shwap, now active on the Arabica and Mocha testnets with the release of celestia-node v0.18.2. Shwap improves DA sampling speeds by 12x and reduces storage requirements by 16.5x, enabling larger block sizes and smaller nodes.

Shwap introduces a new messaging framework and storage system designed to enhance data sampling efficiency. It reduces full node storage needs by 16.5x and offers a scalable foundation for larger blocks. Key improvements include:

New data square storage subsystem: Eliminates the need to store historical Merkle proofs and global indices, yielding a 16.5x improvement in storage efficiency.

Composable networking framework: Standardizes messaging for share exchanges without enforcing specific transport protocols.

O(1) data availability sampling (DAS): Accelerates DAS, reducing round-trips for light nodes from 7 to 1.

Shwap is a critical step towards the Celestia community's vision of 1GB block sizes. While Shwap lays the foundation for this scaling, further optimizations are required to reach the goal. With this solid infrastructure in place, the DA network will now focus on maintenance, security improvements, and performance optimizations, driving the project closer to its ultimate goal.

Hyper Foundation introduced the $HYPE token

This week’s final update comes from the Hyper Foundation, which announced the launch of the $HYPE token in preparation for the HyperEVM mainnet. The token will play a crucial role in the ecosystem, serving as a staking token for the HyperBFT proof-of-stake consensus and supporting financial operations on dApps deployed on HyperEVM. Eligible users can claim HYPE tokens during the Genesis Event and will also receive a commemorative Hypurr NFT by November 11, 2024. Designed to boost user engagement and strengthen network security, the token launch comes as daily transaction volumes on Hyperliquid’s DEX already exceed $1 billion.

Despite the point incentivization program ending at the start of October, activity has not declined as reflected by the chart above with TVL reaching news highs of $757 million.

This weekly round-up is brought to you by:

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.