Before diving into this week’s overview, be sure to check out some of our recently released research content:

Major developments for the week:

Senator Cynthia Lummis expressed confidence that the Strategic Bitcoin Reserve bill could be passed within the first 100 days of Trump’s presidency

MicroStrategy acquired an additional $4.6 billion worth of Bitcoin

Marathon Digital Holdings (MARA) revealed plans for a private offering of $700 million in convertible senior notes aimed at purchasing Bitcoin

Elon Musk and Vivek Ramaswamy were announced as the leaders of a newly proposed ‘Department of Government Efficiency’ in Donald Trump’s upcoming administration

Monad began the phased rollout of its testnet

Coinbase and Robinhood listed PEPE on their platforms

The FBI confiscated electronics, including the phone of the CEO of Polymarket, as part of an ongoing investigation

Franklin Templeton expanded its $410 million money market fund to operate on the Ethereum blockchain

Ethena Labs’ proposal to introduce a fee-switch mechanism was approved, marking a significant overhaul in its protocol’s revenue-sharing model

MicroStrategy Completes $4.6 Billion Bitcoin Acquisition

In our last weekly update we discussed MicroStrategy’s plan to invest $42 billion in Bitcoin over the next three years, dividing the funds equally between debt and equity. It was just recently announced that MicroStrategy has completed its largest Bitcoin purchase to date, acquiring 51,780 BTC for approximately $4.6 billion. The transaction, carried out between 11 and 17 November 2024, was made at an average price of $88,627 per Bitcoin. This acquisition brings the company’s total Bitcoin holdings to 331,200 BTC, with an estimated value of $30 billion. The purchase was financed through the sale of approximately 13.6 million shares, consistent with MicroStrategy’s strategy of leveraging equity and debt offerings to fund its Bitcoin investments.

Similar to Microstrategy, MARA has unveiled plans for a $700 million private offering of convertible senior notes set to mature on 1 March 2030. The funds raised will be allocated towards acquiring Bitcoin and refinancing debt, including the repurchase of $200 million in notes due in 2026. These new notes will be convertible into either cash or MARA stock and will offer semi-annual interest payments beginning on 1 March 2025. This initiative aligns with Marathon's ongoing strategy to expand its Bitcoin holdings, which currently stand at 26,747 BTC.

Strategic Bitcoin Reserve Bill Update

Additional Bitcoin related news came from Senator Cynthia Lummis who has voiced confidence in advancing the Strategic Bitcoin Reserve bill early in President Trump's term.

Originally introduced by Lummis in July, the Bitcoin Act outlines the establishment of a decentralized network of vaults across the United States for securely storing Bitcoin reserves. The proposal includes key provisions such as:

The U.S. Treasury purchasing 200,000 BTC annually over five years, amassing a total of 1 million BTC.

A requirement to hold the reserves for at least 20 years.

Adoption of a proof-of-reserves system.

Consolidation of all Bitcoin currently held by the U.S. government.

The initiative aligns with President Trump's campaign pledge to create a national Bitcoin reserve.

Despite the enthusiasm, some individuals have raised doubts about the plan's feasibility, pointing to budgetary limitations and potential political hurdles. Nevertheless, the initiative is gaining momentum at the state level. For instance, Pennsylvania has recently proposed legislation allowing its treasury to allocate up to 10% of state funds into Bitcoin.

Memecoins Experience Continued Traction

Coinbase and Robinhood recently added the meme coin PEPE to their trading platforms, resulting in a significant price surge of over 50%. The price increase drove PEPE to a new all-time high, with its market capitalization surpassing $8 billion. As a result, PEPE now ranks as the third-largest meme coin by market capitalization, behind Shiba Inu and Dogecoin.

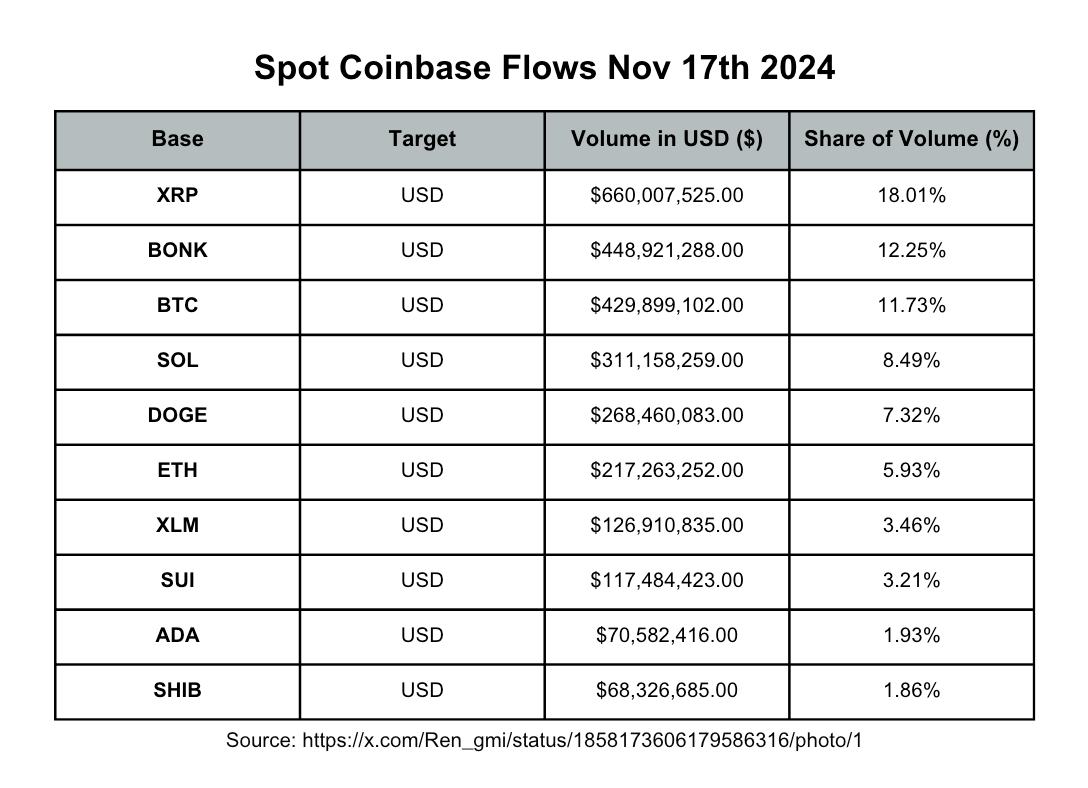

This surge in interest isn't limited to PEPE alone. Other meme coins also experienced remarkable activity on major exchanges. For example, Bonk recorded higher spot trading volumes than Bitcoin on Coinbase at one point.

Beyond Memecoins we also saw an improvement in ETH ETF flows last week. Between 4–8 November and 11–15 November, total flows surged from $154.7 million to $515.3 million, marking an improved net flow of $360.6 million.

Alongside this growth in flows, Ethereum received a significant boost with Franklin Templeton’s expansion of its $410 million OnChain U.S. Government Money Market Fund (FOBXX) to the Ethereum blockchain. This move furthers the company’s multi-chain strategy in the tokenized asset market. Launched in 2021, the fund was the first to leverage a public blockchain for transaction and ownership tracking. By integrating Ethereum, the leading platform in the tokenized treasury market with $1.6 billion in assets, Franklin Templeton seeks to enhance its digital asset offerings and provide investors with greater flexibility.

Monad Advances with Testnet Rollout

Another interesting development came from Monad which has initiated the phased rollout of its testnet following the successful performance of its devnet, which reached 10,000 transactions per second during testing. As an Ethereum-compatible Layer 1 blockchain, Monad aims to enhance throughput and scalability by designing a new Ethereum Virtual Machine from the ground up using a pipelined architecture. This innovative design enables more efficient processing and instant block finality while maintaining full compatibility with existing Ethereum smart contracts. The mainnet launch is anticipated later in 2024.

Ethena Labs Fee-Switch Proposal Approved

For the final update of the week, Ethena has approved Wintermute’s proposal to implement a fee-switch mechanism, introducing changes to the protocol’s revenue-sharing model. The mechanism allocates a portion of the protocol’s revenue to staked sENA holders, addressing prior misalignments where they did not benefit directly from revenue growth. Implementation details are being finalized, with activation planned by the end of November. The proposal also outlines measures to ensure transparency and community governance in revenue distribution.

This weekly round-up is brought to you by:

Unlock the Power of Seamless Crypto Liquidity

Whether you're an institutional counterparty or a high-net-worth individual, Stillman Digital provides the deep liquidity and best execution you need to navigate the digital asset market with confidence.

Here’s why top-tier clients choose Stillman Digital for their trading needs:

24/7 Deep Liquidity with Fast Settlement Times: Execute large trades with minimal slippage and industry-leading speed.

Flexible Access: Choose between trading in chat, API, or our intuitive GUI.

High-Touch Service: From onboarding to execution, we’re here to guide you every step of the way.

Elevate your trading strategy within 24 hours. Book a call to learn more.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.