Major developments for the week:

Last week, spot Bitcoin ETFs saw net inflows of $506 million, while Ethereum ETFs experienced net outflows of $44.5 million.

Tether is introducing USDT on the Aptos blockchain.

The SEC has denied Cboe's 19b-4 filings for Solana ETFs.

Vitalik Buterin expressed optimism about $ETH in his recent posts.

Tether is launching a new stablecoin tied to the UAE Dirham.

Franklin Templeton is expanding its blockchain fund to include Avalanche.

Grayscale has announced the launch of an Avalanche Trust.

CZ has been released from prison and moved to a halfway house in Los Angeles.

Optimism has unveiled The SUNNYs, a new incentive program.

Telegram founder Pavel Durov has been arrested in France.

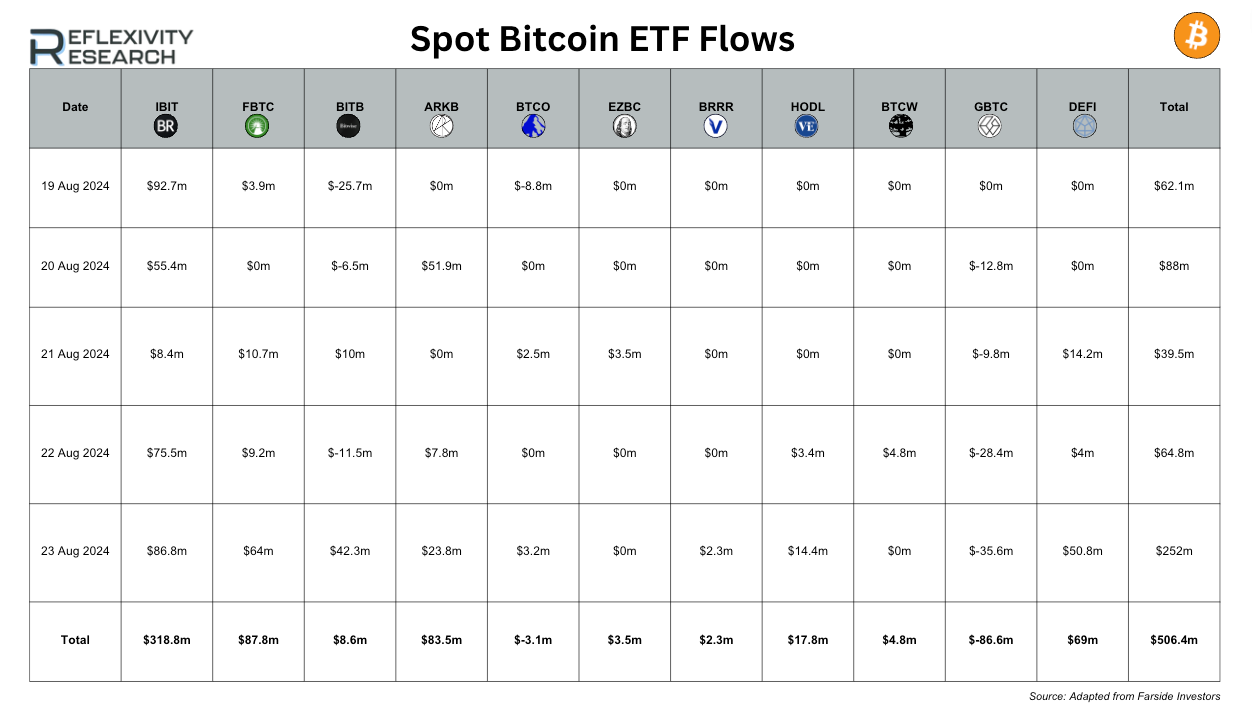

Last week, spot Bitcoin ETFs saw net inflows of $506 million

The data from the past week on Bitcoin ETF flows shows significant activity across various funds. On the 19th of August, the highest inflow was observed in the IBIT fund, with $92.7 million, while the BITB fund experienced an outflow of $25.7 million. Over the following days, we see a trend where the IBIT fund consistently attracts substantial inflows, totalling $318.8 million for the week, despite other funds like BTW and GBTC showing outflows of $86.6 million and $8.6 million respectively. Notably, ARKB and BRRR had minimal to no changes throughout the week. By the end of the week, total inflows amounted to $506.4 million, highlighting a stark contrast to the $32.4 million of inflows we saw the week prior.

Jerome Powell Spoke at Jackson Hole last Friday

In his address at the Jackson Hole Symposium, Federal Reserve Chair Jerome Powell articulated several pivotal aspects concerning the U.S. economy and its monetary strategy. He announced that "the time has come" for interest rate reductions, likely commencing in September, to bolster the labor market and ensure economic stability. Describing the economic growth as robust, Powell noted that inflation is nearing the Federal Reserve's 2% target. While acknowledging a slowdown in the labor market, he reassured that it should not precipitate further inflationary pressures. Powell also emphasized the importance of continuously reassessing monetary policy principles, a lesson underscored by the recent pandemic. Looking ahead, he remains confident about achieving price stability, albeit cautious about the future economic landscape.

Following Powell’s speech, Bitcoin subsequently rallied about 7%.

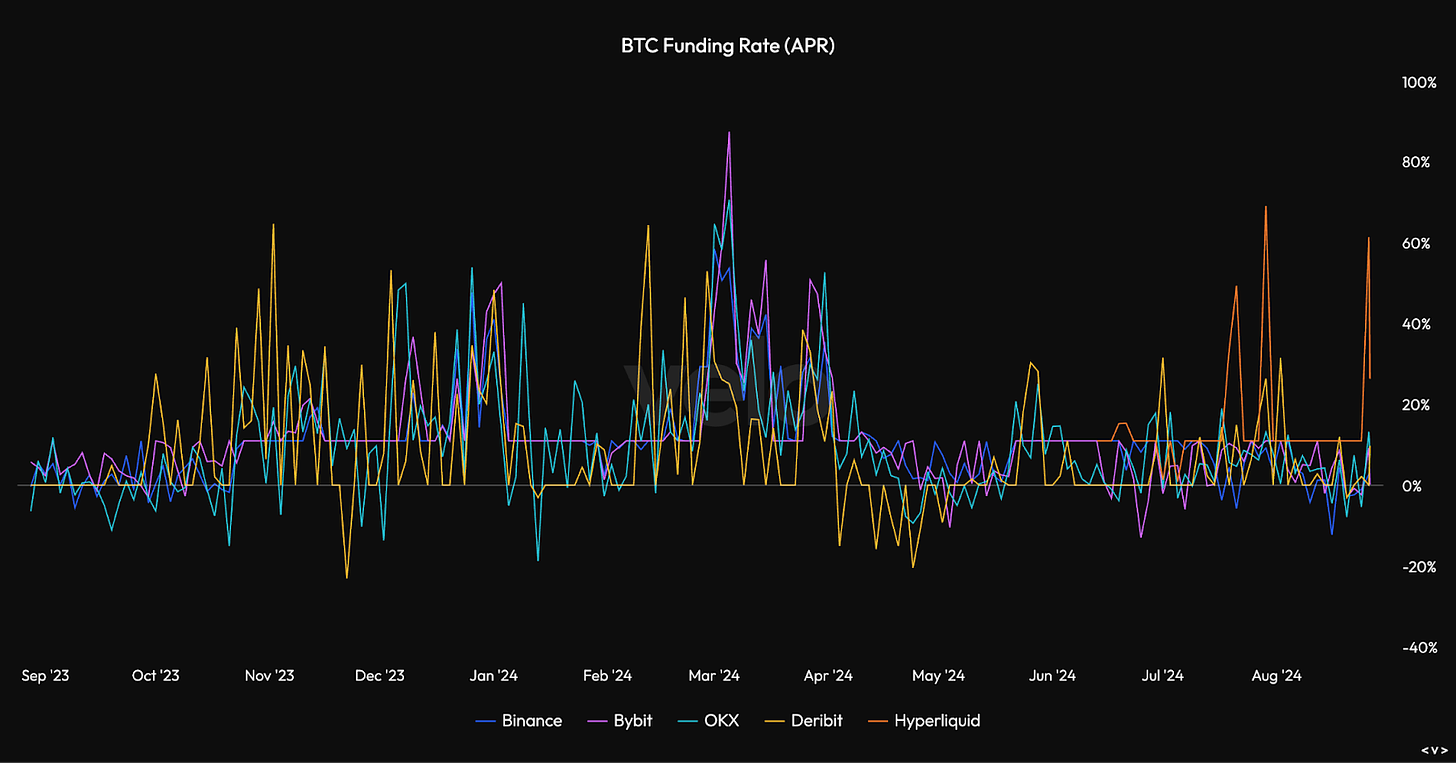

An interesting data point to consider is funding rates. Six months ago, while Bitcoin was trading at the same prices as today, funding rates were significantly higher, ranging from 25% to 50%. In contrast, today's funding rates are nearly flat. This may indicate a healthier market that is less leveraged and has greater potential for growth.

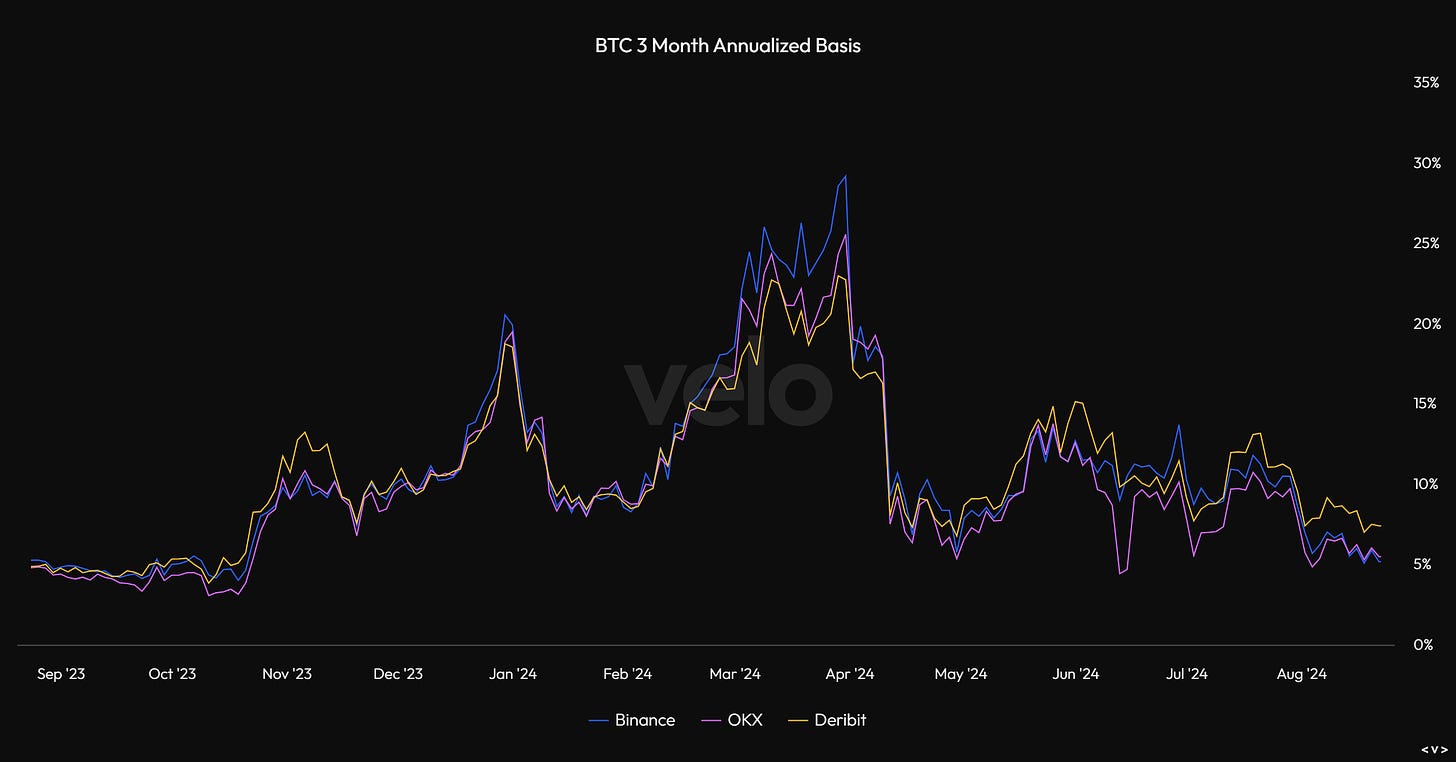

We can also look at Bitcoin’s 3 month annualized futures basis, the spread between spot and the 3 month quarterly futures contract. This also shows a similar picture to funding rates.

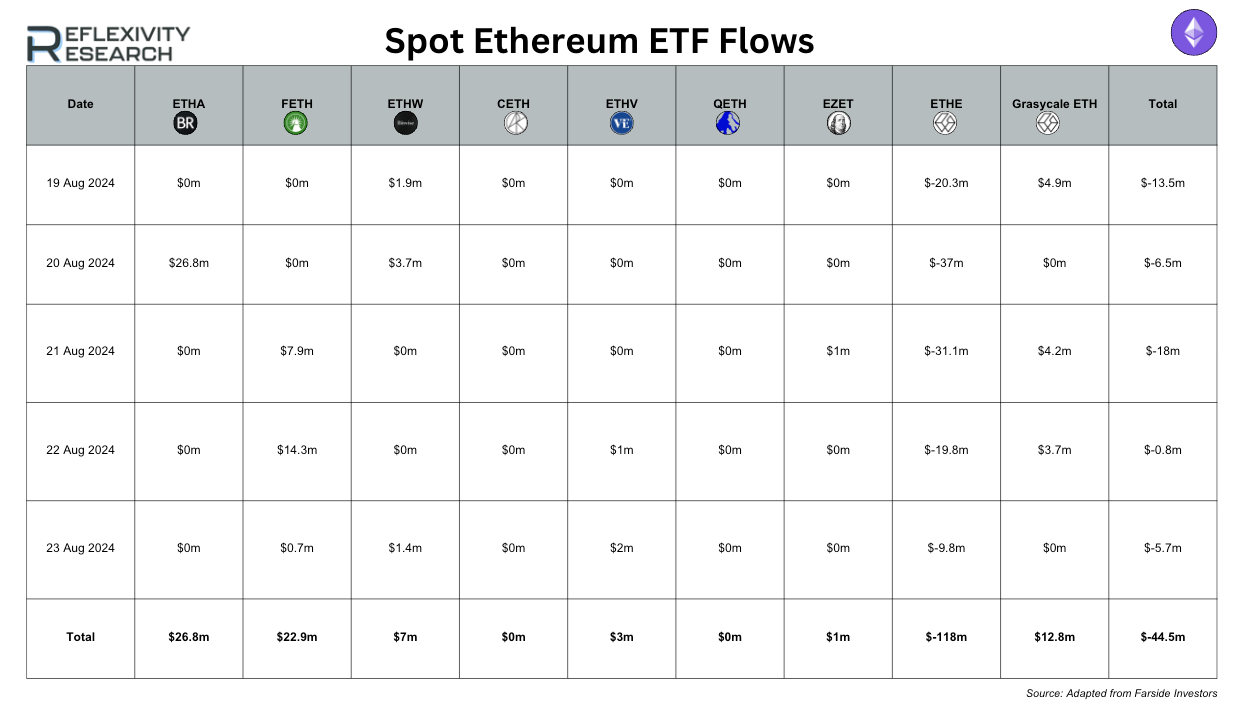

Ethereum ETFs experienced net outflows of $44.5 million

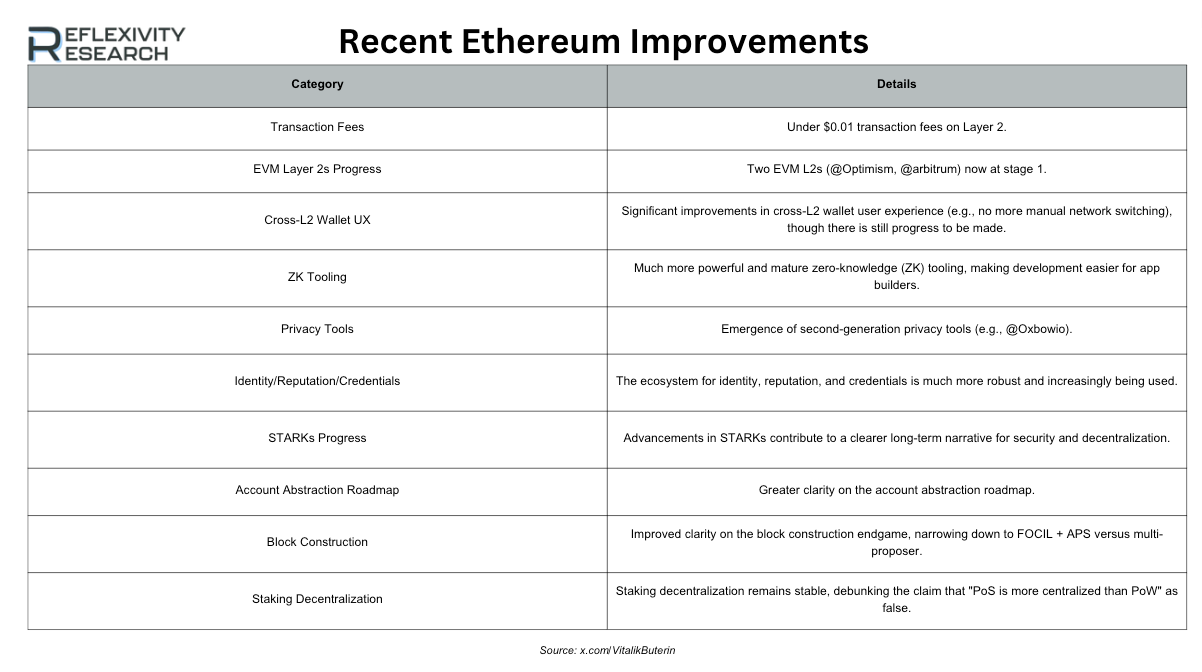

An interesting development for Ethereum came from Vitalik Buterin last week in which he took a more lighthearted approach on X, posting a humorous "bull post" featuring an image of a bull with the caption "Ethereum is good." This represented a notable shift from his usual philosophical commentary, likely in response to the community's desire for more attention on Ethereum's market trends. The post coincided with a spike in Ethereum's price, pushing it above $2,600. Buterin's post aimed to emphasize Ethereum's overall strengths, focusing on its ecosystem and future applications, even as it faces criticism for lagging behind rivals like Solana in terms of price performance.

Some additional recent Ethereum strengths that Vitalik noted are summarized in the table below;

Avalanche sees two significant developments

Last week, Avalanche made headlines with two significant developments. Franklin Templeton expanded its OnChain U.S. Government Money Market Fund (FOBXX) to the Avalanche blockchain, enhancing access to its tokenized fund and allowing investors to purchase shares through the Benji Investments app. This expansion follows previous integrations with Stellar, Polygon, and Arbitrum, as Franklin Templeton seeks to leverage Avalanche's capabilities to attract institutional interest and improve financial services in the blockchain space. Additionally, Grayscale Investments launched the Grayscale Avalanche Trust, enabling accredited investors to gain direct exposure to AVAX. The Trust, which opened for daily subscriptions on August 22, 2024, is part of Grayscale's broader strategy to expand its offerings within the crypto ecosystem, particularly in real-world asset tokenization.

Pavel Durov, Founder of TON was arrested

In the final news of this week, Pavel Durov, the founder and CEO of Telegram, was arrested at Le Bourget airport near Paris on August 24, 2024, after arriving from Azerbaijan. The arrest was made under a French warrant concerning allegations of inadequate moderation on Telegram, which has been linked to criminal activities. Although French authorities have not officially confirmed the arrest, reports suggest that Durov may face charges related to money laundering and other crimes. Durov, who holds dual citizenship in France and the UAE, is expected to appear in court soon.

In the aftermath of Durov's arrest, $TON faced significant market turbulence. The token's value fell by over 20%, erasing nearly $3 billion from its market capitalization. As of August 26th, Toncoin is trading around $5.67, reflecting a 14.80% decline over the past week. In response to these developments, TON updated its branding to symbolize resistance against censorship, while the community rallied strongly behind Durov.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.