Bitcoin halving sits just 10 days out

Weekly Market Update #34

Key Takeaways:

Bitcoin ETF products saw net inflows of $484.5 million last week

Bitcoin halving is in 10 days, set for April 19th at 00:14 UTC

Goldman Sachs, Citadel, Citigroup and UBS have been included as authorised participants for BlackRock's spot Bitcoin ETF

A wallet holding $2 billion in bitcoin, previously seized by the DOJ, sent funds to Coinbase Prime last week according to Arkham Data

The FTX bankruptcy estate plans to start repaying creditors by the end of 2024

Fantom announces its canonical stablecoin $USDC.e

35.4% of the Ethena airdrop has been claimed

Ethena Labs incorporates Bitcoin as backing for USDe

Marc Zeller, the founder of the Aave Chan Initiative, has hinted that a preliminary vote on allocating fees to Aave stakers might occur as early as this week, in light of Aave's earnings

Governance almost unanimously approved the first part of the Frax Singularity Roadmap

Aptos will undergo a $330.65 million unlock on April 12th, 2024

Bitcoin ETF products saw net inflows of $484.5 million last week

Last week witnessed a net inflow of $484.5 million into Bitcoin ETF products, with BlackRock’s IBIT leading the charge, securing $811.2 million in net inflows. Additionally, BlackRock has considerably broadened the reach of its iShares Bitcoin Trust by welcoming five new authorised participants, increasing the total to nine. This expansion includes the entry of Wall Street giants Goldman Sachs, Citadel Securities, Citigroup and UBS, along with clearing house ABN AMRO, as revealed in a filing with the U.S. Securities and Exchange Commission. These firms join the existing roster of authorised participants: Jane Street Capital, JP Morgan, Macquarie and Virtu Americas. Authorised participants play a pivotal role in the ETF ecosystem, essential for ensuring liquidity by modulating the supply of shares to meet market demand.

Ethena Labs incorporates Bitcoin as backing for USDe

Ethena has garnered considerable attention over the past week, reaching a significant milestone on April 2nd. The significance of this day was marked by the ENA airdrop and the initiation of its second campaign.

This new phase signifies a strategic pivot from "Shards" to "Sats", introducing one of the protocol's boldest advancements yet; the adoption of BTC as a reserve asset.

This development paves the way for Ethena to tap into an additional ~$25 billion in open interest for delta-hedging purposes, effectively more than doubling the volume from ETH perpetual futures. This figure is exclusive of an extra $11 billion in open interest from the CME.

The alignment of BTC funding rates with those of ETH highlights a substantial, yet underexplored, avenue for yield generation within the cryptocurrency domain. Historically, BTC funding on major exchanges has averaged ~22% across roughly $25 billion of open interest. Given that half of this interest could translate into fee revenue from short positions, there's a prospect of generating approximately $2.75 billion in annual gross cash flow.

It is essential for the protocol to maintain scalability to meet market demands, and incorporating BTC perpetual futures significantly bolsters USDe's scalability potential.

The "Sats Campaign", designed to foster this growth, is set to run for five months, concluding on September 2nd or when the USDe supply hits $5 billion, whichever occurs first.

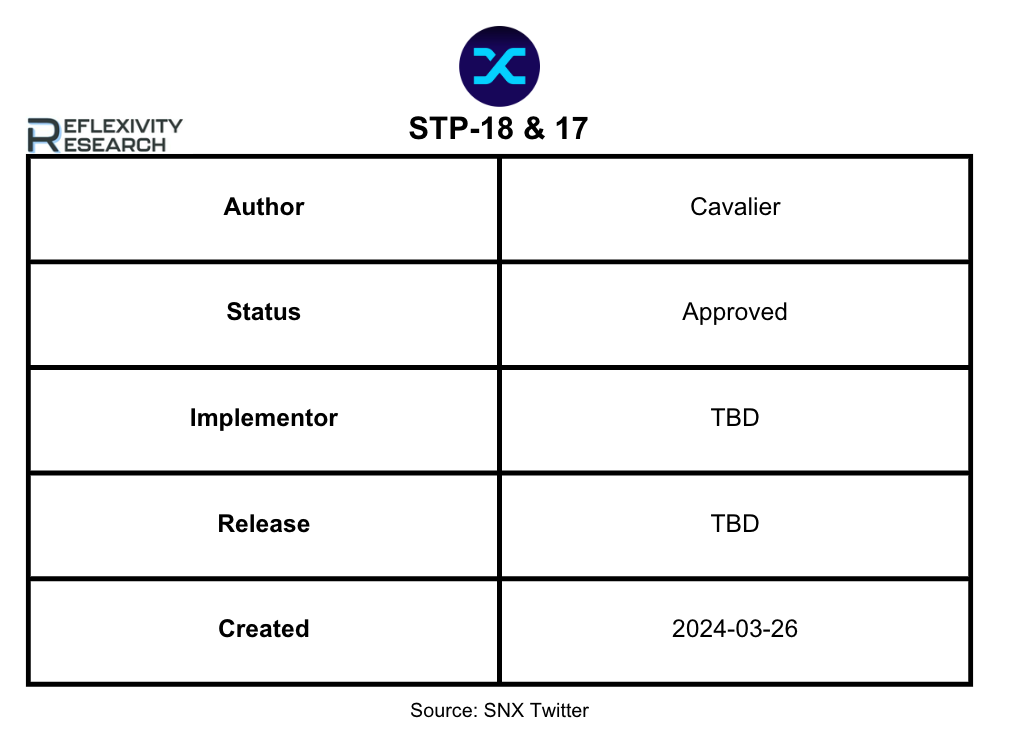

Synthetix will launch its perpetual contracts on Solana and Sui

Another interesting development last week came from Synthetix which is set to launch its perpetual contracts on both the Solana and Sui blockchains, following the approval of STP-18 "Solana Perps Working Group" and STP-17 "SUI Perps Working Group". These initiatives aim to broaden the protocol's reach by integrating its main offering, perpetual contracts, into these blockchains. The strategy involves creating specific infrastructure on each platform to replicate Synthetix Perps functionality, with Solana's vibrant community and Sui's advanced developer tooling being key factors in their selection. Funding has been allocated for development, deployment and management on both chains, with 430,000 SNX and 400,000 USDC earmarked for Solana over 12 months and 290,000 SNX for Sui. This expansion represents a strategic shift from focusing solely on EVM-compatible chains to adapting Synthetix's offerings for a broader blockchain ecosystem, potentially increasing user engagement and market penetration for perpetual contracts.

It will be interesting to monitor this expansion’s effects on the below metrics once they are operational:

Aave preliminary fee switch discussions

On a shorter note, Marc Zeller, founder of the Aave Chan Initiative, has hinted that a preliminary vote on allocating fees to Aave stakers might be on the horizon as early as this week. This comes in light of his discussion surrounding Aave’s treasury and profitability in which he notes the Aave treasury, consisting of Ethereum and stablecoins, now holds $50 million, covering 2.5 years of operational expenses. Additionally, the net profits of the DAO are at $50 million per year and are on an upward trajectory.

APTOS will undergo a $110.33 million unlock on April 12th, 2024

Lastly, the primary unlock event this week features APT. Scheduled for April 12th, 2024, $APT plans to release 6.23% of its circulating supply. This comprises $158.8 million for Core Contributors, $112.12 million for Investors, $42.73 million for Community and $17.75 million for Foundation. $APT’s vesting schedule is estimated to reach completion by October 9th, 2032.

Note: The content in this weekly report has also been utilized in our weekly collaborative series with stock/crypto trading platform eToro.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

View 50+ free reports on our homepage: reflexivityresearch.com