Bitcoin continues to trade sideways as LayerZero’s releases their plan to address sybil activity

Weekly Market Update #29

Key Takeaways:

Bitcoin ETF products saw net inflows of $116.8 million last week

ARK 21SHARES is removing staking from their Spot Ethereum ETF application

Mastercard, JPMorgan, Visa, Wells Fargo and other leading US banks are experimenting with shared-ledger technology for settling tokenized assets

LayerZero’s released their plan to address sybil activity

Pudgy Penguins sells over 1 million toys through its various retail stores

1inch introduced fusion 2.0, which makes order settlements up to 35% cheaper and execution speeds 75% faster

Ethena released its 2024 roadmap

Lido released a proposal for Lido Alliance; an Ethereum-aligned ecosystem built around stETH

MakerDAO updates SubDAO details

ARB is set to unlock 3.49% of its circulating supply on the 16th of May

Bitcoin ETF products saw net inflows of $116.8 million last week

From May 6th to May 10th the Bitcoin ETFs experienced improved net inflows when compared to last week's $400 million in outflows. FBTC reported the highest total inflows, summing up to $111.3 million, with a peak of $99.2 million on May 6th. IBIT also saw notable inflows, amounting to $48.1 million throughout the week. ARKB experienced a cumulative inflow of $82.8 million during the same period.

On the other hand, GBTC faced outflows totaling $171.1 million, with the largest withdrawal of $103 million occurring on May 10th. Across all Bitcoin ETFs, the total net inflow for the week was $116.8 million. Despite GBTC’s outflows, we are perhaps beginning to see a change in trend of GBTC flows as indicated by the graph below:

In other ETF related news, more than a week has gone by since the launch of HongKong’s ETH and BTC ETFs.

The highest inflow was recorded on May 2nd, adding 174.73 BTC and the highest trading value of $9.76M. Net assets peaked on May 8th, reaching $270.77M alongside an inflow of 101.6 BTC.

Conversely, the ETF also witnessed notable outflows, with the most significant occurring on May 13th, when 519.5 BTC were withdrawn. This outflow corresponded to a lower total value traded of $4.25M and a decrease in total net assets to $219.70M, marking a decline from earlier in the period.

Similarly the ETH ETF experienced varying flows, with significant inflows of 1.56K ETH and 999.75 ETH on May 2nd and May 6th, respectively. These inflows corresponded with trading volumes of $653.44K and $1.80M and saw net assets rise to peaks of $54.87M by May 6.

Subsequent days marked a trend of outflows, notably on May 8th and May 9th, where 644.78 ETH and 536.88 ETH were withdrawn, contributing to a decline in total net assets to $48.35M and $51.51M respectively. The period concluded on May 13th with an outflow of 2.27K ETH, a trading volume of $726.97K and net assets reduced to $39.12M

Lido released a proposal for Lido Alliance; an Ethereum-aligned ecosystem built around stETH

Another interesting development occurred yesterday in which Steakhouse released a significant government proposal on the Lido DAO forums. This proposal was titled Lido Alliance: An Ethereum-Aligned Ecosystem. Below is an overview of some of the core topics touched upon within the proposal:

LayerZero’s released their plan to address sybil activity

Another significant update came from the LayerZero team last week in which they discussed their anti-sybil efforts for their highly coveted token airdrop.

Overview

LayerZero has recorded interactions from nearly 6 million unique wallet addresses over the past two years. They stated that identifying resilient users, who are likely to remain active or replicate previous activities, is critical for effective token distribution.

Addressing Sybil Activity

Identified Sybil activities within LayerZero include:

Operating multiple addresses for industrial farming

Creating "valueless" NFTs solely for cross-chain transfers

Using applications known for "Sybil farming" such as Merkly, L2Pass, and L2Marathon

Conducting minimal transactions to appear active

Self-identifying as a Sybil

Sybil users are encouraged to self-report within a 14-day window for a reduced allocation of 15%. The deadline for self-reporting is May 17th, 11:59:59 UTC.

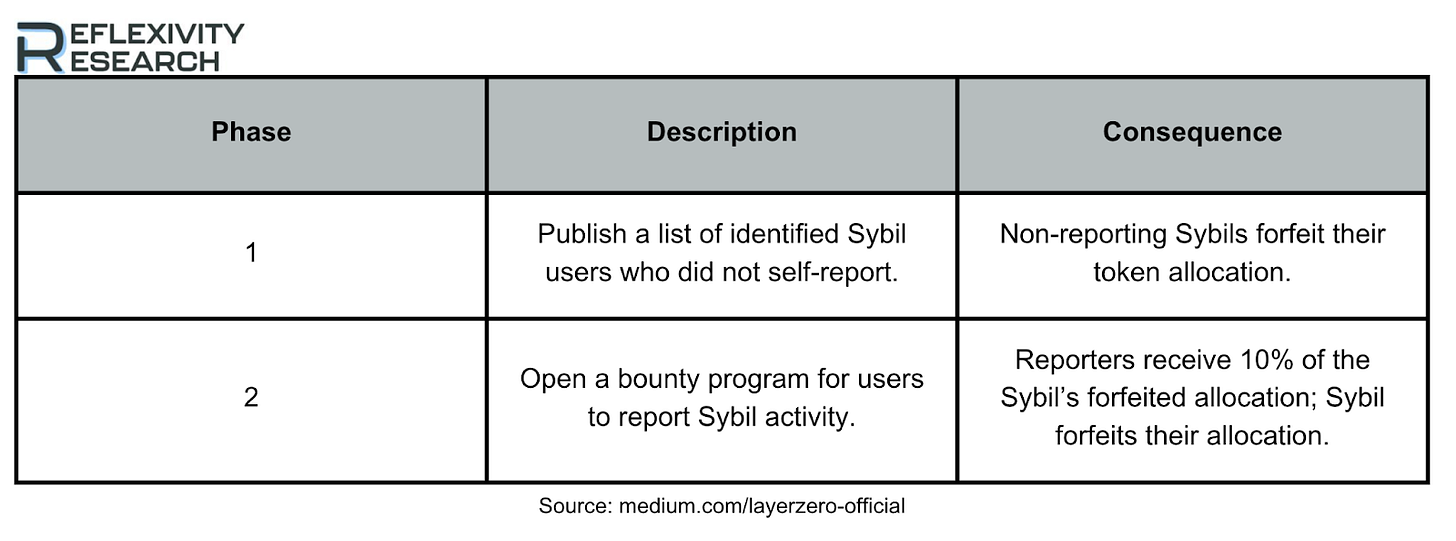

Failure to do so results in two outcomes:

Note: The content in this weekly report has also been utilized in our weekly collaborative series with stock/crypto trading platform eToro.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

View 50+ free reports on our homepage: reflexivityresearch.com