Major developments for the week:

Bitcoin and Ethereum ETFs see largest uptick of inflows in several months

Frankendancer went live on the Solana mainnet

CelestiaOrg announced a $100 million fundraising effort

Sonic is set to launch in December 2024

Ethena Labs revealed USTb, backed by Blackrock and developed in collaboration with Securitize

Berachain introduced an RFB (Request for Broposal)

The Initia Foundation raised $2.5 million in less than two hours on echodotxyz

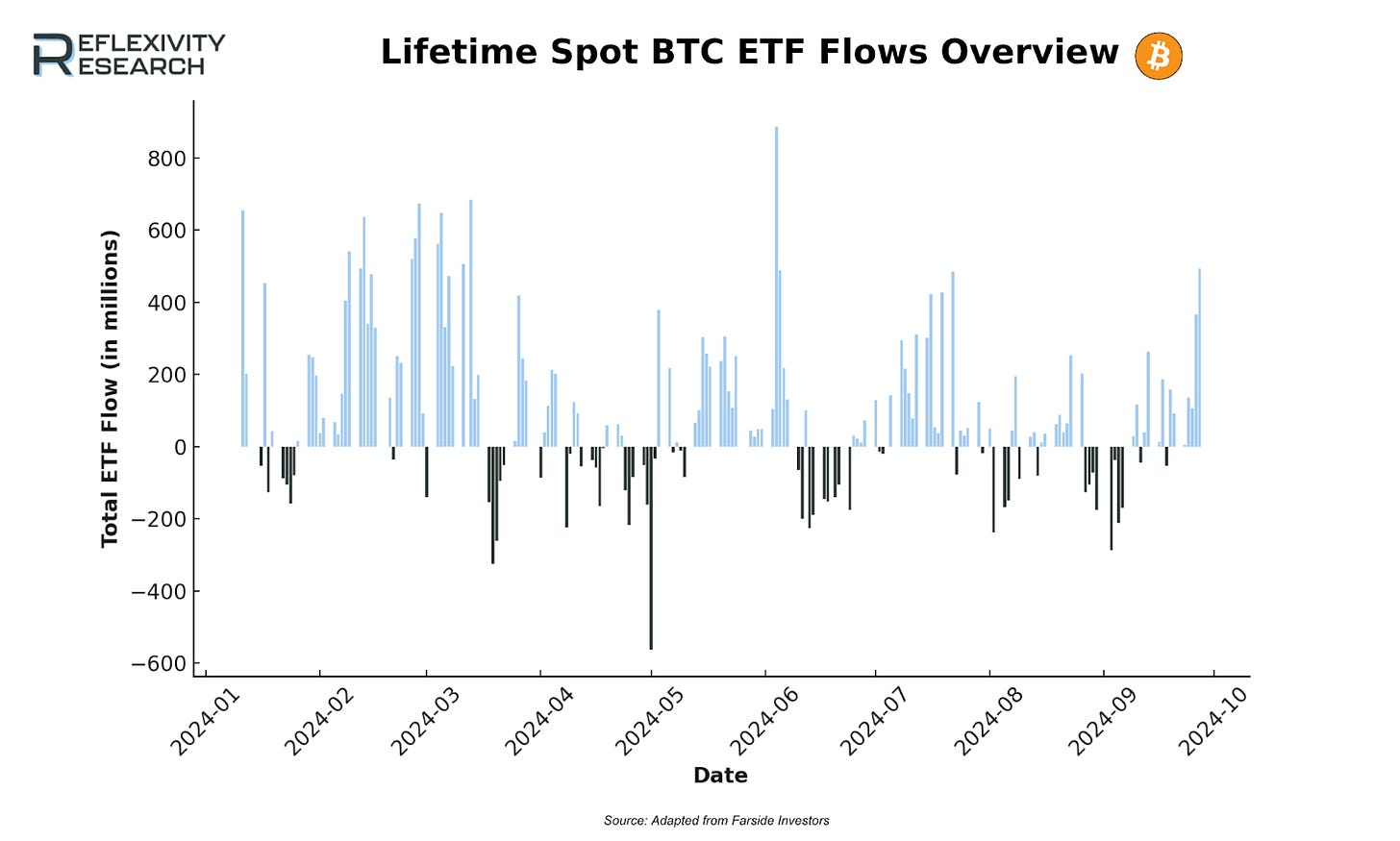

BTC sees renewed strength in ETF inflows

From early to mid-2024, BTC ETFs exhibited substantial volatility, with inflows surpassing $600 million on certain days, followed by outflows exceeding $200 million, reflecting cyclical market sentiment and active rebalancing. Throughout the year, frequent shifts between positive and negative flows were observed, with outflows dominating in March, May, and September, while inflows peaked periodically, often exceeding $400-600 million, particularly in February and May. Between April and August, both inflows and outflows were smaller in magnitude, indicating a potential period of consolidation or reduced market activity. May 2024 recorded one of the largest single-day outflows, with over $500 million withdrawn from BTC ETFs. However, in the final quarter of the year, there has been a renewed strength in positive inflows, particularly this month, which saw inflows exceeding 400 million, signalling a possible resurgence in market optimism.

The total BTC ETF flows for 2024 so far reveal a wide range of performance across different entities. IBIT leads with substantial inflows of $21,423 million, followed by FBTC at $9,986 million. Other ETFs like BITB, ARKB, and BTC show more moderate inflows, with totals of $2,145.3 million, $2,727.4 million, and $422.4 million, respectively. In contrast, GBTC experienced significant net outflows of -$20,090.2 million, illustrating their heavy redemptions throughout the year. Despite this, the total net flow across all entities remains positive, amounting to $18,804.5 million. Next we will look at the Ethereum Flows:

The Total ETH ETF Flows Over Time chart highlights significant volatility in ETH ETF flows, with large inflows and outflows occurring throughout July, August, and September 2024. For instance, on July 23, 2024, there was a strong inflow of $106.6 million, followed by consecutive days of negative flows, including a large outflow of -$162.7 million on July 26, 2024. This trend of alternating inflows and outflows continues into August and September, with substantial fluctuations, such as net outflows on certain days exceeding -$100 million, indicating variable investor behaviour. The Total ETH ETF Flows by Entity (Year-to-Date) chart shows ETHA leading with $1,654.6 million in net inflows, followed by FETH with $826.6 million, reflecting strong investor interest in these ETFs. However, ETHE has seen a significant net outflow of -$5,264.5 million. Other entities, such as ETHW and ETH, show moderate inflows, while EZET has smaller inflows of $46.3 million. Last week marked the highest net inflows for the first time in a couple of months, perhaps once again indicating a possible resurgence in market optimism for the final months of the year.

$EIGEN Token transfers go live today, September 30th 2024

Tuesday marks a crucial milestone for $EIGEN, as token transfers will become available.

The insights in this breakdown are informed by Kairo Research's analysis of the token’s supply and market dynamics.

Supply Overview:

At launch, EIGEN has a total supply of 1,673,646,668 tokens. The circulating supply at the start is primarily shaped by the first two stakedrops:

6.75% from the first stakedrop

5.2% from the second stakedrop

This puts the initial circulating supply at approximately 200,000,776 EIGEN (11.95%).

However, the actual float turns out to be quite different.

Why is the float lower?

During the first stakedrop, only 85.4% of tokens were claimed (about 95 million EIGEN). So far, for the second stakedrop, only 21.7% have been claimed (18.6 million EIGEN).

In total, the circulating supply is currently 114 million EIGEN. On top of that, 73 million EIGEN have already been restaked on EigenLayer.

This means the real float is around 40.43 million EIGEN. At the pre-market price of $3.84 (via HyperLiquid), this equals a market value of approximately $155 million, with an implied fully diluted valuation (FDV) of $6.42 billion.

With only 2.42% of the float in circulation, there is likely to be substantial volatility as the market finds its price.

Additional Factors:

Operator claims for the tokens will only be available after October 6th, which could be slowing down the claim process. Additionally, some participants may be delaying their claims for tax reasons, as the claim period ends on March 25th of next year.

Key Claimants:

According to Kairos Research, Analysis of Dune queries for the first two stakedrops reveals some of the largest claimants by wallet. Although the data didn’t perfectly match across both queries, Etherscan was used to verify the legitimacy of these claims.

It’s important to note that entity tags may not be fully accurate, as they are based on a combination of Arkham, Nansen, and wallet fund flow tracking. Due to the low float and the fact that many participants are restaking their tokens, these large wallets could significantly impact market conditions.

Token Unlock Schedule:

Unlocking of $EIGEN tokens will not begin until one year from this coming Tuesday. In the meantime, an additional 3% of the supply is still to be distributed from Stakedrop 2, along with 4% of the supply allocated to programmatic incentives within the first year.

As the remaining supply enters circulation, the platform is expected to introduce more features, such as slashing mechanisms, which will help both users and market participants better understand the drivers of demand for $EIGEN.

Frakendancer went live on Solana mainnet

In other news, Frankendancer, a validator client developed by Jump Crypto, has been successfully launched on the Solana mainnet to enhance network performance, redundancy, and scalability. By introducing a second independent validator client alongside the existing Agave client, it boosts the network's capacity while reducing costs. Optimising each layer for maximum efficiency, Frankendancer allows validator clients to operate at full capacity, significantly scaling Solana's bandwidth and hardware capabilities. In testnet environments, it has demonstrated the ability to process over 1 million transactions per second, showcasing remarkable improvements in transaction processing speeds and overall network resilience. Additionally, it serves as a prototype for Firedancer, which is expected to further improve Solana’s infrastructure upon full release.

CelestiaOrg announced a $100 million fundraising effort

Another interesting development last week came from the Celestia Foundation in which it announced $100 million in a funding round led by Bain Capital Crypto, bringing its total raised capital to $155 million. The funds will be used to advance Celestia's modular blockchain architecture, which separates the data consensus and execution layers to enhance scalability and flexibility. This investment will help accelerate Celestia's development, particularly in scaling data availability to 1-gigabyte blocks, potentially exceeding Visa’s transaction throughput. Following the announcement, the price of Celestia's native token, TIA, surged by 14%.

Ethena Labs announced UStb

For the final piece of news this week, Ethena Labs has introduced a new stablecoin called UStb, developed in partnership with BlackRock and Securitize. UStb is fully backed by BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) and operates similarly to a traditional stablecoin. The launch addresses concerns around Ethena’s existing stablecoin, USDe, particularly in environments with negative funding rates. UStb offers a distinct product with a different risk profile, allowing Ethena to dynamically manage its backing assets and improve resilience across varying market conditions.

This round-up is brought to you by:

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.